Talon International, Inc. Reports 2014 First Quarter Financial

Results

12 Percent Increase in Revenue Driven by Strong Trim Sales

LOS ANGELES, CA--(Marketwired - May 12, 2014) - Talon

International, Inc. (OTCQB: TALN), a leading global supplier of

zippers, apparel fasteners, trim and stretch technology products,

reported financial results for the first quarter ended March 31,

2014.

Highlights

- Sales in Q1 2014 were $11.3 million -- an 11.9% increase over

Q1 2013.

- Trim sales rise 28.1% over same sales in Q1 2013.

- Q1 2014 Gross profit of $3.7 million -- an increase of 17.6%

over Q1 2013.

Financial Results

"Once again we are pleased to see continued growth and

improvement throughout our business, even during our historically

slowest quarter of the year," said Lonnie Schnell, Talon's Chief

Executive Officer. "We saw solid performance across our

product lines, especially in Trim, as our positions with core

customers continued to grow and we concentrated on adding new

global brand nominations to our marquee list of customers. We ended

the first quarter strongly, achieving profitability strictly from

operations," Schnell continued.

Total sales for the quarter ended March 31, 2014 were $11.3

million reflecting an 11.9% year-over-year increase compared to the

first quarter of 2013. Zipper sales were $5.8 million for the

quarter, virtually even with zipper sales in the same period in

2013. Zipper sales reflected some softness in sales within

mass merchandizing brand customers, but this was mostly offset by

increased sales within our strategically focused specialty retail

brand customers. Trim sales of $5.5 million in the first quarter of

2014 reflected a strong increase of 28.1% from the first quarter of

2013, as specialty customers continued to grow their core programs

with the Company at an increased rate. Sales for the quarter

included $5,945 of Tekfit patented stretchable waistbands, a slight

decline from Q1 2013, but evidenced the continuation of test

marketing programs with several major retailers who are considering

the adoption of this product into their core product

categories.

Gross profit for the three months ended March 31, 2014 was $3.7

million or 32.9% of sales, as compared to $3.2 million for the

first quarter of 2013; an increase of 17.6%. The gross profit

increase for the quarter as compared to the same period in 2013 was

principally attributable to greater overall sales volumes in the

Trim segment and improved product mix of sales to specialty

retailers as opposed to discount mass merchandisers, partially

offset by higher manufacturing support, freight and duty costs.

Operating expenses for the three months ended March 31, 2014

were $3.6 million, reflecting an increase of $0.6 million as

compared to the same period in 2013. Sales and marketing expenses

totaled $1.4 million for the first quarter of 2014, an increase of

$152,000 as compared to the same period in 2013 mainly due to

higher compensation costs associated with the higher sales volumes.

General and administrative expenses for the first quarter of 2014

totaled $2.2 million, or 19.1% of sales, compared to general and

administrative expenses in the prior year of $1.7 million. The

$474,000 increase in general and administrative expenses for the

first quarter of 2014 is mainly attributed to a one-time receipt in

2013 of $350,000 from a settlement in a legal dispute regarding

intellectual property rights, in addition to higher net

compensation costs of $120,000.

"We again achieved net profitability in the first quarter (which

is historically a loss quarter) of 2014, as a result of our

double-digit revenue growth and keen focus on costs. We were

profitable in the first quarter of 2013 as well, but that was aided

by a one-time litigation settlement. In 2014, our

profitability in the first quarter is strictly attributed to

operations," noted Schnell. "We expect to carry this sales and

earnings momentum into the second quarter, traditionally our

strongest quarter of the year, as well as throughout the full year

of 2014."

Net income for the quarter ended March 31, 2014 was $17,000 as

compared to $280,000 for the same period in 2013. Net income

per share applicable to common shareholders for the three months

ended March 31, 2014 was $0.00 per diluted share as compared to a

net loss per share applicable to common shareholders of $0.03 per

diluted share for the same period in 2013; including $0.04 net loss

per share previously allocated to the preferred shares which are

now fully redeemed.

Forward Looking Statements

This release contains forward-looking statements made in

reliance upon the safe harbor provisions of the Private Securities

Litigation Reform Act of 1995. Forward-looking statements include,

but are not limited to, the Company's views on market growth,

changing trends in apparel retailing, new product introductions,

and the Company's ability to execute on its sales strategies, and

are generally identified by phrases such as "thinks,"

"anticipates," "believes," "estimates," "expects," "intends,"

"plans," and similar words. Forward-looking statements are not

guarantees of future performance and are inherently subject to

uncertainties and other factors which could cause actual results to

differ materially from the forward-looking statement. These

statements are based upon, among other things, assumptions made by,

and information currently available to, management, including

management's own knowledge and assessment of the Company's

industry, competition and capital requirements. These and other

risks are more fully described in the Company's filings with the

Securities and Exchange Commission including the Company's most

recently filed Annual Report on Form 10-K and Quarterly Report on

Form 10-Q, which should be read in conjunction herewith for a

further discussion of important factors that could cause actual

results to differ materially from those in the forward-looking

statements. The Company undertakes no obligation to publicly update

or revise any forward-looking statements, whether as a result of

new information, future events or otherwise.

Conference Call

Talon International will hold a conference call on Monday, May

12, 2014, to discuss its first quarter financial results for 2014.

Talon's CEO Lonnie D. Schnell will host the call starting at 4:30

P.M. Eastern Time. A question and answer session will follow the

presentation.

To participate, dial the appropriate number 5-10 minutes prior

to the start time, request the Talon International conference call

and provide the conference ID.

Date: Monday, May 12, 2014 Time: 4:30 p.m. Eastern Time (1:30

p.m. Pacific Time) Domestic callers: 1-877-300-8521 International

callers: 1-412-317-6026 Conference ID#: TALON

A replay of the call will be available after 7:30 p.m. Eastern

Time on the same day and until June 12, 2014. The toll-free replay

call-in number is 1-877-870-5176 for domestic callers and

1-858-384-5517 for international. Pin number 10043114.

About Talon International, Inc.

Talon International, Inc. is a major supplier of custom zippers,

complete trim solutions and stretch technology products to

manufacturers of fashion apparel, specialty retailers, mass

merchandisers, brand licensees and major retailers worldwide. Talon

develops, manufactures and distributes custom zippers exclusively

under its Talon® brand ("The World's Original Zipper Since 1893");

designs, develops, manufactures, and distributes complete apparel

trim solutions and products; and provides stretch technology for

specialty waistbands all under its trademark and world renowned

brands, Talon®, and TekFit® to major apparel brands and retailers.

Leading retailers worldwide recognize and use Talon products

including Abercrombie and Fitch, Polo Ralph Lauren, Kohl's, J.C.

Penney, Fat Face, Victoria's Secret, Wal-Mart, Tom Tailor,

Phillips-Van Heusen, Juicy Couture, and many others. The company is

headquartered in the greater Los Angeles area, and has offices and

facilities throughout the United States, United Kingdom, Hong Kong,

China, Taiwan, India, Indonesia and Bangladesh.

| |

| |

| TALON INTERNATIONAL, INC. |

| |

| CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE

INCOME |

| (Unaudited) |

| |

| |

|

Three Months Ended |

|

| March 31, |

| |

|

2014 |

|

2013 |

|

| Net sales |

|

$ |

11,343,118 |

|

$ |

10,139,750 |

|

| Cost of goods sold |

|

|

7,608,162 |

|

|

6,963,672 |

|

| |

Gross profit |

|

|

3,734,956 |

|

|

3,176,078 |

|

| Sales and marketing expenses |

|

|

1,415,690 |

|

|

1,263,992 |

|

| General and administrative expenses |

|

|

2,177,071 |

|

|

1,703,209 |

|

| |

Total operating expenses |

|

|

3,592,761 |

|

|

2,967,201 |

|

| |

|

|

|

|

|

|

|

| Income from operations |

|

|

142,195 |

|

|

208,877 |

|

| Interest expense, net |

|

|

111,271 |

|

|

772 |

|

| Income before provision for income taxes |

|

|

30,924 |

|

|

208,105 |

|

| Provision for (benefit from) income taxes, net |

|

|

13,659 |

|

|

(72,248 |

) |

| Net income |

|

$ |

17,265 |

|

$ |

280,353 |

|

| |

|

|

|

|

|

|

|

| Series B Preferred Stock liquidation preference

increase |

|

|

- |

|

|

(899,221 |

) |

| Net Income (loss) applicable to Common

Stockholders |

|

$ |

17,265 |

|

$ |

(618,868 |

) |

| |

|

|

|

|

|

|

|

| Per share amounts: |

|

|

|

|

|

|

|

| Net income |

|

$ |

0.00 |

|

$ |

0.01 |

|

| Net income applicable to Preferred Stockholders |

|

|

0.00 |

|

|

(0.04 |

) |

| Basic and diluted net income (loss) applicable to

Common Stockholders |

|

$ |

0.00 |

|

$ |

(0.03 |

) |

| Weighted average number of common shares outstanding -

Basic |

|

|

91,804,752 |

|

|

24,412,044 |

|

| Weighted average number of common shares outstanding -

Diluted |

|

|

93,431,832 |

|

|

24,412,044 |

|

| Net income |

|

$ |

17,265 |

|

$ |

280,353 |

|

| Other comprehensive income (loss) from foreign currency

translation |

|

|

1,092 |

|

|

(1,291 |

) |

| Total comprehensive income |

|

$ |

18,357 |

|

$ |

279,062 |

|

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| TALON INTERNATIONAL, INC. |

|

| |

|

| CONSOLIDATED BALANCE SHEETS |

|

| |

|

| |

|

March 31, 2014 |

|

|

December 31, 2013 |

|

| |

|

(Unaudited) |

|

|

|

|

| Assets |

|

|

|

|

|

|

|

|

| Current assets: |

|

|

|

|

|

|

|

|

| |

Cash and cash equivalents |

|

$ |

1,822,387 |

|

|

$ |

3,779,508 |

|

| |

Accounts receivable, net |

|

|

4,080,811 |

|

|

|

3,576,925 |

|

| |

Inventories, net |

|

|

701,224 |

|

|

|

800,240 |

|

| |

Prepaid expenses and other current assets |

|

|

1,212,099 |

|

|

|

973,836 |

|

| Total current assets |

|

|

7,816,521 |

|

|

|

9,130,509 |

|

| |

|

|

|

|

|

|

|

|

| Property and equipment, net |

|

|

575,295 |

|

|

|

614,592 |

|

| Intangible assets, net |

|

|

4,263,839 |

|

|

|

4,267,110 |

|

| Deferred income tax assets, net |

|

|

6,076,185 |

|

|

|

6,050,402 |

|

| Other assets |

|

|

437,507 |

|

|

|

460,226 |

|

| Total assets |

|

$ |

19,169,347 |

|

|

$ |

20,522,839 |

|

| |

|

|

|

|

|

|

|

|

| Liabilities and Stockholders' Equity |

|

|

|

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

|

|

|

| |

Accounts payable |

|

$ |

7,177,330 |

|

|

$ |

7,158,938 |

|

| |

Accrued expenses |

|

|

1,960,246 |

|

|

|

2,880,764 |

|

| |

Revolving credit loan |

|

|

1,000,000 |

|

|

|

1,000,000 |

|

| |

Current portion of term loan payable |

|

|

1,666,667 |

|

|

|

1,666,667 |

|

| Total current liabilities |

|

|

11,804,243 |

|

|

|

12,706,369 |

|

| |

|

|

|

|

|

|

|

|

| Term loan payable, net of current portion |

|

|

2,916,667 |

|

|

|

3,333,333 |

|

| Deferred income tax liabilities |

|

|

20,995 |

|

|

|

30,388 |

|

| Other liabilities |

|

|

16,417 |

|

|

|

22,169 |

|

| Total liabilities |

|

|

14,758,322 |

|

|

|

16,092,259 |

|

| |

|

|

|

|

|

|

|

|

| Stockholders' Equity: |

|

|

|

|

|

|

|

|

| |

Common Stock, $0.001 par value, 300,000,000 shares authorized;

92,267,831 and 91,342,215 shares issued and outstanding at March

31, 2014 and December 31, 2013, respectively |

|

|

92,268 |

|

|

|

91,342 |

|

| |

Additional paid-in capital |

|

|

64,007,793 |

|

|

|

64,046,631 |

|

| |

Accumulated deficit |

|

|

(59,804,913 |

) |

|

|

(59,822,178 |

) |

| |

Accumulated other comprehensive income |

|

|

115,877 |

|

|

|

114,785 |

|

| Total stockholders' equity |

|

|

4,411,025 |

|

|

|

4,430,580 |

|

| Total liabilities and stockholders' equity |

|

$ |

19,169,347 |

|

|

$ |

20,522,839 |

|

| |

|

|

|

|

|

|

|

|

Contact: Casey Stegman Stonegate, Inc. Tel: 972-850-2001

casey@stonegateinc.com

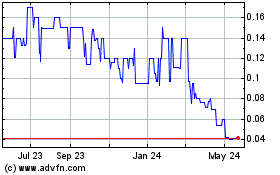

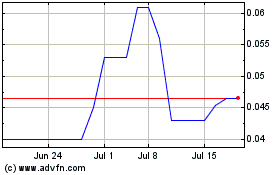

Talon (PK) (USOTC:TALN)

Historical Stock Chart

From Nov 2024 to Dec 2024

Talon (PK) (USOTC:TALN)

Historical Stock Chart

From Dec 2023 to Dec 2024