NetworkNewsWire

Editorial Coverage: A recently released report projects

that revenue from the global mobile games market will reach $40.6

billion in 2017, which is an increase of more than $10 billion from

2015 (http://nnw.fm/d8LBZ). Mobile gaming is unarguably the

hottest, fastest-growing sector within the gaming market, and

traditional gaming companies are jumping in with big M&A

action, buying up smaller creative players in order to develop

expertise and market share in the mobile games arena. Looking

forward to 2018 and beyond, continued mobile games acquisition

fervor could benefit up-and-coming companies like

Tapinator, Inc. (TAPM) (TAPM

Profile), as giants in the

space like Tencent Holdings Limited

(TCEHY), Microsoft Corp.

(MSFT), Take-Two Interactive Software, Inc.

(TTWO), Zynga Inc.

(ZNGA) and others continue their significant

M&A activity within the mobile games space.

Tapinator (TAPM) is a developer and

publisher of mobile games on the iOS, Google Play and Amazon

platforms with many assets and advantages in place to attract the

M&A interest of bigger companies. Tapinator’s portfolio

encompasses more than 300 mobile gaming titles that have,

collectively, amassed more than 450 million player downloads. As of

Q3 2017, Tapinator’s expansive number of engaged users equated to

11.7 million monthly active players. Additionally, the company

possesses three very strong franchise games (“Video Poker Classic,”

“Dice Mage” and “Solitaire Dash”), and it has an exciting pipeline

of Full-Featured Games scheduled to launch now through Q2 of 2018.

It's also notable that TAPM’s Full-Featured Games bookings

increased by 255 percent for the nine-month period ended Sept. 30,

2017.

Furthermore, Tapinator recently announced (http://nnw.fm/krl2P) that “Virtual Mom: Happy Family

3D,” one of the recent games released through its Rapid-Launch

Games division—collaboratively developed and published with TapSim

Game Studio—has become one of Google Play’s Top 100 games in the

United States. This game enables players to simulate some of the

endless tasks associated with motherhood. As of Nov. 28, “Virtual

Mom” had logged more than 600,000 downloads since its Nov. 8 launch

and had locked in the No. 5 slot for the “Adventure Games” category

within the Google Play U.S. Games Charts. “Virtual Mom” has further

experienced impressive performance on an international level,

becoming the No. 34 top game in Brazil, the No. 102 top game in

China and the No. 97 top game in Russia.

"The global success of ‘Virtual Mom: Happy Family’ is a great

indication of the universal nature of motherhood. It represents a

fun, entertaining way for both moms and non-moms alike to get a

small virtual taste of the incredible hard work performed by

mothers around the globe on a daily basis,” Tapinator CEO Ilya

Nikolayev said, as quoted in the press release. “The game's rise is

also a testament to the importance of 'Girl Gamers' as an audience

within the mobile gaming ecosystem. Given the title's initial

success, we intend to continue to improve the game, release

additional content and potentially expand upon our 'Happy Family'

game series.”

Another recent announcement (http://nnw.fm/kuhL5) details Tapinator’s recent

partnership with the Germany-based Robot Cake Games, through which

TAPM has acquired the rights to publish “ColorFill,” a unique

puzzle game designed to attract the fans of games like Sudoku and

Minesweeper. Through this partnership, Tapinator has received the

publication rights for additional future Robot Cake games, as well,

for a period of at least one year. “ColorFill,” the first to be

released under the Tapinator banner through this partnership, has

been soft launched in Canada and Australia and is slated for

worldwide release on Dec. 7.

Additional Tapinator titles hitting the scene during Q1 and Q2

2018 include “Divide & Conquer” and “Fusion

Heroes. The company also recently released two new full-featured

games: “Big Sport Fishing 2017” and “Dice

Mage 2.” with “Big Sport Fishing 2017”

amassing more than 520,000 player downloads within the first week

of its global release and with “Big Sport Fishing”

and “Dice Mage 2” both being singled out as “New

Games We Love” on the Apple iOS platform (http://nnw.fm/Xy3V5).

Tapinator has been lauded as “One to

Watch” in the mobile games market, receiving considerable

attention with its hundreds of thousands of daily downloads on the

iOS, Google Play and Amazon platforms. The company’s business

strategy involves creating segment-leading full-featured games,

like “ROCKY™” and “Solitaire Dash,”

that result in long-term player retention and that produce

attractive ROIs.

The company continues generating enticing and predictable

returns through consumer app store transactions and the sale of

branded advertisements, with its diversified revenue resources

including 51 percent from in-game advertising and 49 percent from

consumer purchases made through app stores. Advertisements placed

within Tapinator’s games are strategically limited to only appear

between game levels, which aids in fostering player retention. Game

participants are further induced to participate in viewing video

ads on a rewards basis.

Through its Full-Featured games model, Tapinator is creating

sustainable, franchise-like games that each have the potential to

bring in $100 million or more in revenues and which boast product

lifespans of at least five years. TAPM employs a set of proprietary

dynamic development and marketing processes factored on gaming

category, approximated player retention and predicted player

profitability.

Headquartered in New York, Tapinator has product development

teams in the U.S., Germany, Pakistan, Indonesia, Russia and Canada.

Among its current endeavors, the company is actively exploring

virtual reality and augmented reality opportunities and has

exploratorily released various prototype virtual reality games to

gather data before pursuing a more significant product in this

category. Tapinator additionally intends to pursue publishing

transactions that leverage its network, platform relationships and

operational expertise, and management is delving into significant

opportunities to expand the company’s gaming IP to new platforms

like Steam and to leading messaging apps.

All of these attributes, achievements and pursuits make

Tapinator an attractive potential M&A target for larger players

seeking a piece of the mobile gaming pie—and such companies have

been in plentiful supply.

Companies like Tencent Holdings Limited

(TCEHY) have made significant acquisitions in the

mobile games space in recent years, such as the much-publicized

2016 majority stake acquisition of SuperCell to the tune of $8.6

billion. Microsoft (MSFT) is

certainly no stranger to big acquisitions, and near the end of 2014

the tech giant finalized its acquisition of Mojang, the creator of

“Minecraft,” for $2.5 billion. In February 2017,

Take-Two Interactive (TTWO) made its

move into the mobile gaming space with a $275.9 million acquisition

of Social Point, while even more recently—in early November

2017—gaming giant Zynga (ZNGA) announced it

had entered into an agreement to acquire the mobile card game

studio belonging to Peak Games for $100 million.

These are just a few examples of big players sitting up, taking

notice and taking action to cash in on the red-hot mobile games

market. As 2018 draws nearer and mobile games continue to firmly

establish a stronghold as the fastest-growing sector within the

gaming space, continued acquisition action could spell good news

for micro-cap companies like Tapinator.

For more information on Tapinator, visit

Tapinator, Inc.

(OTCQB: TAPM)

About NetworkNewsWire

NetworkNewsWire (NNW) is an information service that provides

(1) access to our news aggregation and syndication servers, (2)

NetworkNewsBreaks that summarize corporate news and

information, (3) enhanced press release services, (4) social media

distribution and optimization services, and (5) a full array of

corporate communication solutions. As a multifaceted financial news

and content distribution company with an extensive team of

contributing journalists and writers, NNW is uniquely positioned to

best serve private and public companies that desire to reach a wide

audience of investors, consumers, journalists and the general

public. NNW has an ever-growing distribution network of more than

5,000 key syndication outlets across the country. By cutting

through the overload of information in today’s market, NNW brings

its clients unparalleled visibility, recognition and brand

awareness. NNW is where news, content and information converge.

NetworkNewsWire (NNW)

New York, New York

www.NetworkNewsWire.com

212.418.1217 Office

Editor@NetworkNewsWire.com

Please see full terms of use and disclaimers on the

NetworkNewsWire website applicable to all content provided by NNW,

wherever published or re-published: http://NNW.fm/Disclaimer

DISCLAIMER: NetworkNewsWire (NNW) is the source of the Article

and content set forth above. References to any issuer other than

the profiled issuer are intended solely to identify industry

participants and do not constitute an endorsement of any issuer and

do not constitute a comparison to the profiled issuer. The

commentary, views and opinions expressed in this release by NNW are

solely those of NNW. Readers of this Article and content agree that

they cannot and will not seek to hold liable NNW for any investment

decisions by their readers or subscribers. NNW are a news

dissemination and financial marketing solutions provider and are

NOT registered broker-dealers/analysts/investment advisers, hold no

investment licenses and may NOT sell, offer to sell or offer to buy

any security.

The Article and content related to the profiled company

represent the personal and subjective views of the Author, and are

subject to change at any time without notice. The information

provided in the Article and the content has been obtained from

sources which the Author believes to be reliable. However, the

Author has not independently verified or otherwise investigated all

such information. None of the Author, NNW, or any of their

respective affiliates, guarantee the accuracy or completeness of

any such information. This Article and content are not, and should

not be regarded as investment advice or as a recommendation

regarding any particular security or course of action; readers are

strongly urged to speak with their own investment advisor and

review all of the profiled issuer’s filings made with the

Securities and Exchange Commission before making any investment

decisions and should understand the risks associated with an

investment in the profiled issuer’s securities, including, but not

limited to, the complete loss of your investment.

NNW HOLDS NO SHARES OF ANY COMPANY NAMED IN THIS RELEASE.

This release contains “forward-looking statements” within the

meaning of Section 27A of the Securities Act of 1933, as amended,

and Section 21E the Securities Exchange Act of 1934, as amended and

such forward-looking statements are made pursuant to the safe

harbor provisions of the Private Securities Litigation Reform Act

of 1995. “Forward-looking statements” describe future expectations,

plans, results, or strategies and are generally preceded by words

such as “may”, “future”, “plan” or “planned”, “will” or “should”,

“expected,” “anticipates”, “draft”, “eventually” or “projected”.

You are cautioned that such statements are subject to a multitude

of risks and uncertainties that could cause future circumstances,

events, or results to differ materially from those projected in the

forward-looking statements, including the risks that actual results

may differ materially from those projected in the forward-looking

statements as a result of various factors, and other risks

identified in a company’s annual report on Form 10-K or 10-KSB and

other filings made by such company with the Securities and Exchange

Commission. You should consider these factors in evaluating the

forward-looking statements included herein, and not place undue

reliance on such statements. The forward-looking statements in this

release are made as of the date hereof and NNW undertake no

obligation to update such statements.

Source:

NetworkNewsWire

Contact:

NetworkNewsWire (NNW)

New York, New York

www.NetworkNewsWire.com

212.418.1217 Office

Editor@NetworkNewsWire.com

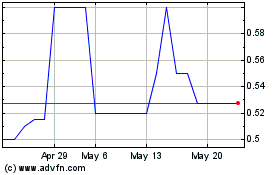

Tapinator (PK) (USOTC:TAPM)

Historical Stock Chart

From Oct 2024 to Nov 2024

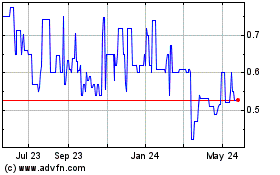

Tapinator (PK) (USOTC:TAPM)

Historical Stock Chart

From Nov 2023 to Nov 2024