UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of January 2024

Commission File Number: 001-13184

TECK RESOURCES LIMITED

(Exact name of registrant as specified in its

charter)

Suite 3300 – 550 Burrard Street

Vancouver, British Columbia V6C 0B3

(Address of principal executive offices)

Indicate by check mark whether

the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☐ Form

40-F ☒

EXHIBIT INDEX

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned,

thereunto duly authorized.

| |

Teck Resources Limited |

|

| |

(Registrant) |

|

| |

|

|

|

| |

|

|

|

| Date: January 4, 2024 |

By: |

/s/ Amanda R. Robinson |

|

| |

|

Amanda R. Robinson |

|

| |

|

Corporate Secretary |

|

EXHIBIT 99.1

| For Immediate Release |

Date: January 3, 2024 |

24-2-TR |

|

Teck

Provides Update on QB and Q4 2023 Steelmaking Coal Sales and Pricing

Vancouver, B.C. – Teck Resources Limited (TSX: TECK.A and TECK.B,

NYSE: TECK) (“Teck”) today provided unaudited 2023 production volumes for Quebrada Blanca (“QB”) operations, an

update on the QB2 project, and unaudited fourth quarter steelmaking coal sales volumes and realized prices.

“We are pleased that QB is now operating near design throughput capacity

with strong recoveries, positioning Teck for significantly increased copper production in 2024,” said Jonathan Price, President

and CEO. “We had strong fourth quarter performance in our steelmaking coal operations, with improvements in plant performance leading

to an increase in production, and sales volumes of 6.1 million tonnes near the top end of our guidance.”

QB Operations

2023 unaudited contained copper production volumes from QB, excluding copper

cathode, totaled 56,200 tonnes, below the bottom end of our guidance range of 80,000 tonnes for 2023 due to reliability and consistency

issues in the fourth quarter. Fourth quarter production was 35,000 tonnes.

During the second half of 2023, each of the operations at QB, including

mine operations, crushing, grinding, flotation, tailings, desalination and concentrate handling, all operated at or above design capacity.

Our focus in the fourth quarter was on achieving reliable and consistent operations. This took longer than expected to achieve and, as

a result, production did not meet forecast. However, by the end of December, QB was operating near design throughput capacity, and this

has continued into 2024. Recoveries have generally been in line with expectations and head grades remain within expected levels.

QB2 Project

The construction of the molybdenum plant was substantially completed in

December, and commissioning has commenced. Ramp-up of the molybdenum plant is expected to be completed by the end of the second quarter

of 2024. Construction of the port offshore facilities is progressing to plan and is expected to be completed by the end of the first quarter

of 2024. The last jetty pile was completed in December, representing a major milestone in the port construction. Our previously disclosed

QB2 project capital cost guidance is unchanged at US$8.6-$8.8 billion.

Steelmaking Coal Sales and Pricing

Our fourth quarter steelmaking coal sales were 6.1 million tonnes, near

the top end of our previously disclosed guidance of 5.8 – 6.2 million tonnes. The realized steelmaking coal price in the fourth

quarter

averaged US$270 per tonne. We expect to report positive steelmaking coal

provisional pricing adjustments of $89 million in the fourth quarter.

2023 Production and 2024 Guidance

Teck is expecting to provide full 2023 production results and 2024 guidance

in a separate news release on January 16, 2024. Our fourth quarter and annual 2023 financial results are scheduled for release on February

21, 2024.

Forward-Looking Statements

This press release contains certain forward-looking statements

within the meaning of the United States Private Securities Litigation Reform Act of 1995 and forward-looking information as defined in

the Securities Act (Ontario). Forward-looking statements and information can be identified by the use of words such as "expects",

"intends", "is expected", "potential" or variations of such words and phrases or statements that certain

actions, events or results "may", "could", "should", "would", "might" or "will"

be taken, occur, or be achieved. Forward-looking statements include statements regarding: our expectations for and timing of the completion

and commissioning of the QB2 molybdenum plant and port offshore facilities, QB2 capital cost guidance, and expected steelmaking coal provisional

pricing adjustments.

The forward-looking statements in this press release are

based on assumptions that QB2 construction and commissioning continues in accordance with our plans; among other matters. Assumptions

regarding QB include current project assumptions, including estimates of future construction capital at QB2 are based on a CLP/USD rate

range of 800 — 850, as well as there being no further unexpected material and negative impact to the various contractors, suppliers

and subcontractors for the QB2 project that would impair their ability to provide goods and services as anticipated during commissioning

and ramp-up activities. The foregoing list of assumptions is not exhaustive. Forward-looking statements involve known and unknown risks,

uncertainties, and other factors, which may cause the actual results, performance, or achievements to be materially different from any

future results. Factors that may cause actual results to vary include, but are not limited to, government action, unanticipated construction,

commissioning or operational difficulties (including failure of plant, equipment or processes to operate in accordance with specifications

or expectations, cost escalation, unavailability of materials and equipment, industrial disturbances or other job action, adverse weather

conditions, unanticipated events related to health, safety and environmental matters). QB2 costs, commissioning and commercial production

are also dependent on, among other matters, our continued ability to advance commissioning and ramp-up as currently anticipated. QB2 costs

may also be affected by claims and other proceedings that might be brought against us relating to costs and impacts of the COVID-19 pandemic;

and other risk factors as detailed from time to time in Teck's reports filed with Canadian securities administrators and the U.S. Securities

and Exchange Commission.

Certain

of these risks are described in more detail in the annual information form of Teck and in its public filings with Canadian securities

administrators and the U.S. Securities and Exchange Commission. Teck does not assume the obligation to revise or update these forward-looking

statements after the date of this document or to revise them to reflect the occurrence of future unanticipated events, except as may be

required under applicable securities laws.

About Teck

As one of Canada’s leading mining companies, Teck is committed to

responsible mining and mineral development with major business units focused on copper, zinc, and steelmaking

coal. Copper, zinc, and high-quality steelmaking coal are required for the transition to a low-carbon world. Headquartered in Vancouver,

Canada, Teck’s shares are listed on the Toronto Stock Exchange under the symbols TECK.A and TECK.B and the New York Stock Exchange

under the symbol TECK. Learn more about Teck at www.teck.com or

follow @TeckResources.

Investor Contact:

Fraser Phillips

Senior Vice President, Investor Relations & Strategic Analysis

604.699.4621

fraser.phillips@teck.com

Teck Media Contact

Chris Stannell

Public Relations Manager

604.699.4368

chris.stannell@teck.com

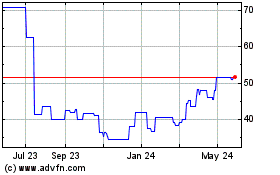

Teck Resources (PK) (USOTC:TCKRF)

Historical Stock Chart

From Nov 2024 to Dec 2024

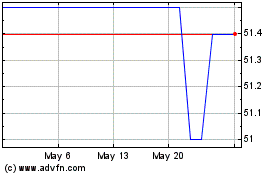

Teck Resources (PK) (USOTC:TCKRF)

Historical Stock Chart

From Dec 2023 to Dec 2024