(OTCBB: TDCB) - Robert D. Heuchan, President and CEO of Third

Century Bancorp, the holding company of Mutual Savings Bank,

announced net income of $60,000 for the quarter ended March 31,

2013, or $0.05 per share. This compares with net income of $113,000

for the quarter ended March 31, 2012, or $0.09 per share.

The decrease of $53,000 in net income for the first quarter of

2013 as compared to the first quarter of 2012 was primarily due to

a $68,000 gain on sale of real estate owned recorded during the

first quarter of 2012. This was offset by a decrease of $37,000 or

3.35% in non-interest expenses which totaled $1.1 million for the

quarters ended March 31, 2013 and 2012. The Bank continues to

improve its operating efficiencies resulting in lower operating

costs.

The provision for loan losses decreased $22,000 to $9,000 from

$31,000. Management considers factors such as delinquency trends,

portfolio composition, past loss experience and other factors such

as general economic conditions. For the quarter ended March 31,

2013, Mutual Savings Bank charged-off loans, net of recoveries, of

$64,000 compared to $598,000 for the quarter ended March 31, 2012,

which represents a decrease in the level of charge offs of

$534,000, or 89.22%. At March 31, 2013, non-performing assets

totaled $6.4 million, or 5.15% of total assets, and included $5.7

million of non-performing loans. At December 31, 2012,

non-performing assets totaled $6.9 million, or 5.40% of total

assets, and included $6.2 million of non-performing loans. The

decrease in non-performing loans was a result of increased

collection and loan monitoring efforts. Loans are considered

non-performing when one or more of the following occur: borrowers

fail to make scheduled payments causing loans to become delinquent

by 90 days or more; borrowers default on original loan terms and

the Bank restructures such loans; or, Management classifies loans

as “substandard” in regards to full repayment according to loan

agreements.

Total assets decreased $2.7 million to $125.1 million at March

31, 2013 from $127.8 million at December 31, 2012, a decrease

of 2.13%. The decrease in assets was primarily due to the repayment

of $2.0 million in Federal Home Loan Bank advances which matured

during the first quarter of 2013.

Deposits decreased $864,000 to $89.9 million at March 31, 2013

from $90.8 million at December 31, 2012. Demand deposits increased

$252,000 or 1.62% to $15.8 million at March 31, 2013. Savings, NOW

and money market savings deposits decreased $754,000 or 1.59%, to

$46.6 million and time deposits decreased $361,000 or 1.29% to

$27.5 million at March 31, 2013.

Federal Home Loan Bank advances and other borrowings decreased

$2.0 million or 9.30% to $19.5 million at March 31, 2013 from $21.5

million at December 31, 2012. At March 31, 2013 the weighted

average rate of all Federal Home Loan Bank advances was 2.11%

compared to 2.22% at December 31, 2012 and the weighted average

maturity was 3.77 years at March 31, 2013 compared with 3.1 years

at December 31, 2012.

Stockholders’ equity increased $60,000 to $15.3 million at March

31, 2013 from $15.2 million at December 31, 2012. Equity as a

percentage of assets decreased 0.15% to 12.23% at March 31, 2013

compared to 12.38% at December 31, 2012. The Company previously

announced that the Board of Directors has suspended quarterly

dividend payments until the Company achieves an acceptable and

sustained level of earnings performance.

Founded in 1890, Mutual Savings Bank is a full-service financial

institution based in Johnson County, Indiana. In addition to its

main office at 80 East Jefferson Street, Franklin, Indiana, the

bank operates branches in Franklin at 1124 North Main Street and

the Franklin United Methodist Community, as well as in Edinburgh,

Nineveh and Trafalgar, Indiana.

Selected Consolidated Financial

Data

At March 31, At December 31,

2013 2012 Selected

Consolidated Financial Condition Data:

(In Thousands)

Assets $ 125,059 $ 127,786 Loans receivable-net 97,052 96,964 Cash

and cash equivalents 9,679 13,363 Interest-earning time deposits

5,456 4,465 Investment securities 5,791 5,863 Deposits 89,957

90,821 FHLB advances and other borrowings 19,500 21,500

Stockholders’ equity-net 15,292 15,232

For the

Three Months Ended March 31, 2013

2012 (Dollars In Thousands, Except Share

Data) Selected Consolidated Earnings Data: Total

interest income $ 1,210 $ 1,316 Total interest expense

181 215 Net interest

income 1,029 1,101 Provision of losses on loans

9 31 Net interest

income after provision for losses on loans 1,020 1,070 Total other

income 175 252 General, administrative and other expenses 1,095

1,132 Income tax expense

40

77 Net income

60

113 Earnings per share basic $ 0.05 $

0.09 Earnings per share diluted $ 0.05 $ 0.09

Selected

Financial Ratios and Other Data: Interest rate spread during

period 3.22 % 3.65 % Net yield on interest-earning assets 3.41 3.84

Return on average assets 0.19 0.38 Return on average equity 1.57

2.97 Equity to assets 12.23 12.38

Average interest-earning assets to average

interest-bearing liabilities

131.71 125.52 Non-performing assets to total assets 5.15 6.89

Allowance for loan losses to total loans outstanding 2.21 2.60

Allowance for loan losses to non-performing loans 38.61 33.47

Net charge-offs (recoveries) to average

total loans outstanding

0.07 0.02 General, administrative and other expense to average

assets 0.87 0.94 Effective income tax rate 40.00 40.53

Number of full service offices 6 6 Tangible book value per share $

12.00 $ 10.78 Market closing price at end of quarter $ 2.25 $ 2.25

Price as a percentage of tangible book value 18.75 % 20.88 %

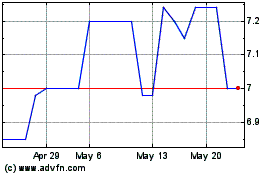

Third Century Bancorp (PK) (USOTC:TDCB)

Historical Stock Chart

From Jan 2025 to Feb 2025

Third Century Bancorp (PK) (USOTC:TDCB)

Historical Stock Chart

From Feb 2024 to Feb 2025