Tonogold Resources, Inc. Releases 43-101 Technical Report on the Mineral Mountain Gold Project, Goldstrike Mining District, Utah

08 March 2010 - 5:20PM

Tonogold Resources, Inc. (Pink Sheets:TNGL) announces the

completion of the 43-101 technical report for the Mineral Mountain

project, Goldstrike Mining District, southwest Utah, prepared by

Puchski GeoConsultants, Inc. This 43-101 technical report is now

available at www.tonogold.com.

The Mineral Mountain gold project is 30 miles northwest of St.

George, Utah and consists of 197 mining claims covering 3,940 acres

on BLM land. It is just west of the Goldstrike Mine which, until

recently, produced 280,000 ounces of gold and 197,000 ounces of

silver. There are 93 historic drill holes concentrated in the

western portion of the property, and the resource is open

ended.

Highlights:

An inferred mineral resource, in the center of a the

drilled area at Mineral Mountain, consists of 41,144 ounces of gold

in 3.4 million tons grading 0.012 ounces per ton (opt).

The inferred resource extends from the surface to a depth of 450

feet, the limit of drilling.

The main host rock is the gently-dipping Eocene Claron

Formation, consisting of sandstones and conglomerates with

additional mineralization in the underlying Paleozoic

limestones.

Mineralized drill holes in these three open-ended directions are

not drilled at close enough spacings to calculate a resource.

Other exploration and development targets within Tonogold's

claim block include the Black Canyon area one mile east of Mineral

Mountain, where one hole intersected >0.01 opt gold

mineralization from 55 feet to 135 feet in the Claron Formation.

This area of limited drilling has immediate potential for

expansion.

Only a small portion of the Mineral Mountain property has been

drilled. Grab samples taken by Tonogold geologists in outlying

areas range up to 0.92 opt and may indicate future targets for

exploration and drilling.

Recommendations in the 43-101 Report

A first phase of drilling is designed to validate known

mineralization inside the volume of the existing inferred resource

in the Main Zone. Five confirmation holes (HQ core) to

500-foot depths in the main zone are recommended. Estimated

cost is $188,000.

A second phase of drilling is designed to connect mineralized

areas north and south of the Main Zone. Twenty reverse

circulation holes to 600 foot depths are recommended. These

second phase holes should also be deep enough to test for gold

mineralization in the underlying carbonate rocks. Estimated

cost is $334,000.

A third stage of drilling, contingent upon success in the first

two programs, would focus on those areas farther south and east

along the strike of the mineralization under shallow cover.

Donald G. Strachan, the Vice President of Exploration,

commented: "The technical report upholds Mineral Mountain as a

valid target for near-term resource development. Additional

drilling along the east-west trend of the mineralization on obvious

near-surface gold targets could define additional resources that

may tie into the Mineral Mountain drilling."

Tonogold Resources, Inc. is a minerals exploration company based

in La Jolla, California. For more information on the Company visit

their website www.tonogold.com.

Cautionary Note to U.S. Investors - All mineral resources have

been estimated in accordance with the definition standards on

mineral resources and mineral reserves of the Canadian Institute of

Mining, Metallurgy and Petroleum referred to in National Instrument

43-101, commonly referred to as NI 43-101 as required by Canadian

Securities Administrators. U.S. reporting requirements for

disclosure of mineral properties are governed by the United States

Securities and Exchange Commission (SEC) Industry Guide 7. Canadian

and Guide 7 standards are substantially different. The SEC permits

mining companies, in their filings with the SEC, to disclose only

those mineral deposits that a company can economically and legally

extract or produce. SEC guidelines strictly prohibit terms that are

not defined in Industry Guide 7, such as "resources," "geologic

resources," "proven," "probable," "measured," "indicated," and

"inferred," from being included in Issuer's reports and

registration statements filed with the SEC. U.S. investors should

be aware that the Company has no "reserves" as defined by Guide 7

and are cautioned not to assume that any part or all of mineral

resources will ever be confirmed or converted into Guide 7

compliant "reserves." Disclosure of "contained ounces" in a

resource is permitted disclosure under Canadian regulations;

however, the SEC normally only permits issuers to report

mineralization that does not constitute Guide 7 compliant

"reserves" by SEC standards as in-place tonnage and grade without

reference to unit measures.

Safe Harbor Statement Under the Private Securities Litigation

Reform Act of 1995

This press release contains certain forward-looking information

about Tonogold Resources, Inc. ("Tonogold") which is intended to be

covered by the safe harbor for "forward-looking statements"

provided by the Private Securities Litigation Reform Act of

1995. Forward-looking statements are statements that are not

historical facts. Words such as "expect(s)," "feel(s),"

"believe(s)," "will," "may," "anticipate(s)," and similar

expressions are intended to identify forward-looking

statements. These statements include, but are not limited to,

financial projections and estimates and their underlying

assumptions; statements regarding plans, objectives and

expectations with respect to future operations, products and

services; and statements regarding future performance. Such

statements are subject to certain risks and uncertainties, many of

which are difficult to predict and generally beyond the control of

Tonogold Resources, Inc., that could cause actual results to differ

materially from those expressed in, or implied or projected by, the

forward-looking information and statements. These risks and

uncertainties include: our lack of operating revenue and

earnings history, our need for additional capital to pursue our

business strategy, the grade and quantity of minerals in our

projects may not be economic, we do not have fee title to our

properties, but derive our rights through leases and the Mining

Law, we are a non-reporting company and as such do not make

periodic filings with the Securities and Exchange Commission, we

trade on the Pink Sheets and there can be no assurances that a

liquid market will develop in our securities, mining is subject to

extensive environmental regulations and can create substantial

environmental liabilities, gold and silver are commodities which

have substantial price fluctuations, a drop in gold and/or silver

prices could adversely affect future profitability and/or capital

raising efforts, and mining can be dangerous and present

operational hazards for employees and contractors. Readers

are cautioned not to place undue reliance on these forward-looking

statements. Tonogold does not undertake any obligation to

republish revised forward-looking statements to reflect events or

circumstances after the date hereof or to reflect the occurrence of

unanticipated events.

CONTACT: Tonogold Resources, Inc.

Jeff Janda

Jerry Samaras

858-456-1273

jeff@tonogold.com

www.tonogold.com

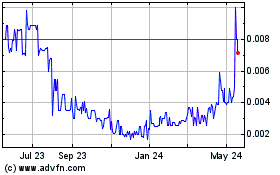

Tonogold Resources (PK) (USOTC:TNGL)

Historical Stock Chart

From Dec 2024 to Jan 2025

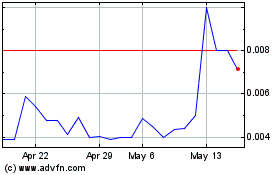

Tonogold Resources (PK) (USOTC:TNGL)

Historical Stock Chart

From Jan 2024 to Jan 2025