false

0000856984

0000856984

2025-02-18

2025-02-18

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of report (date of earliest event reported): February 18, 2025

QHSLab,

Inc.

(Exact

Name of Registrant as Specified in its Charter)

0-19041

(Commission

File No.)

| Nevada |

|

30-1104301 |

(State

of

Incorporation) |

|

(I.R.S.

Employer

Identification

No.) |

901

Northpoint Parkway Suite 302 West Palm Beach

FL

33407 |

|

33407 |

| (Address

of Principal Executive Offices) |

|

(ZIP

Code) |

Registrant’s

telephone number, including area code: (929) 379-6503

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c) |

Securities

registered pursuant to Section 12(g) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock, $0.0001 par value |

|

USAQ |

|

N/A |

Item

7.01 Regulation FD Disclosure.

On

February 18, 2025 QHSLab, Inc. (the “Company,” OTCQB: USAQ), issued a press release announcing its unaudited financial results

for the fourth quarter and fiscal year 2024, including record revenue growth and a net profit for the year. The full text of this press

release is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

The

information in this Current Report on Form 8-K (including the exhibit) is furnished pursuant to Item 7.01 and shall not be deemed to

be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”),

or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference into any filing by the Company

under the Exchange Act or the Securities Act of 1933, as amended, regardless of any general incorporation language in such filing, unless

expressly incorporated by specific reference in such filing. This Current Report on Form 8-K will not be deemed an admission as to the

materiality of any information in the Report that is required to be disclosed solely by Regulation FD.

We

do not have, and expressly disclaim, any obligation to release publicly any updates or any changes in our expectations or any change

in events, conditions, or circumstances on which any forward-looking statement is based.

We

use, and will continue to use, our website (https://usaqcorp.com), press releases, and various social media channels, including our Twitter

account (https://twitter.com/qhslabinc), LinkedIn account (https://www.linkedin.com/company/65407282/), Facebook account

(https://www.facebook.com/QHSLabs) and Instagram account (https://www.instagram.com/qhslabs/) as additional means of disclosing

public information to investors, the media and others interested in the Company. It is possible that certain information we post on our

website, disseminate in press releases and on social media could be deemed to be material information, and we encourage investors, the

media and others interested in the Company to review the business and financial information that we post on our website, disseminate

in press releases and on the social media channels identified above, as such information could be deemed to be material information.

Item

9.01 FINANCIAL STATEMENTS AND EXHIBITS

(d)

Exhibits.

The

exhibits listed in the following Exhibit Index are filed as part of this Current Report on Form 8-K.

SIGNATURES

Pursuant

to the requirements of Section 12 of the Securities Exchange Act of 1934, the Registrant has duly caused this current report to be signed

on its behalf by the undersigned, thereunto duly authorized.

| Date:

February 18, 2025 |

|

| |

|

|

| QHSLab,

Inc. |

|

| |

|

|

| |

/s/

Troy Grogan |

|

| Name: |

Troy

Grogan |

|

| Title: |

CEO

and Chairman |

|

Exhibit

99.1

QHSLab,

Inc. Reports Record Revenue Growth and Positive Net Income in Preliminary Q4 and FY 2024 Financial Results

| ● | Four

consecutive quarters of year-over-year revenue growth underscore continued business momentum. |

| | | |

| ● | Revenue

surges 98% in Q4 2024 compared to Q4 2023, marking a milestone year for QHSLab. |

| | | |

| ● | Operational

efficiencies and strategic execution drive first profitable year. |

WEST

PALM BEACH, FL, February 18, 2025 (GLOBE NEWSWIRE) — QHSLab Inc. (the “Company”) (OTCQB: USAQ), a digital health

company advancing personalized medicine through innovative population health screening and point of care diagnostic tools in primary

care, today announced its preliminary, unaudited financial results for the fourth quarter and fiscal year ended December 31, 2024.

For

the full year 2024, the Company recorded record revenue growth, substantial gross margin improvements, its first-ever year of profitability

on a GAAP basis and positive cash flow from operations, which enabled it to repay a portion of its outstanding debt strengthening its

balance sheet.

Financial

Highlights:

| ● | Fourth

Quarter 2024 Preliminary Financial Results: |

| ● | Revenue

surged 98% year-over-year to $625,981, compared to $315,020 in Q4 2023, marking four consecutive

quarters of year-over-year revenue growth. |

| | | |

| ● | Gross

profit increased 117% to $412,154, with gross margin expanding to 65.8%, up from 60.3% in

the prior-year quarter. |

| | | |

| ● | Net

income for Q4 2024 of $40,838, a significant improvement from a net loss of $86,627 in Q4

2023. |

| ● | Full-Year

2024 Preliminary Financial Results: |

| ● | Revenue

grew 51% year-over-year, reaching $2.1 million compared to $1.4 million for the full-year

2023. |

| | | |

| ● | Gross

margin improved to 63.7%, reflecting an enhanced product mix and increased operational efficiencies. |

| | | |

| ● | The

Company recorded net income of $69,188 for 2024, compared to a net loss of $468,362 in 2023,

underscoring QHSLab’s strong financial momentum and commitment to profitable operations. |

| | | |

| ● | Positive

Cash Flow Generation: The Company reported net positive cash flow of $105,586, driven by

$247,317 in cash flow from operations, reflecting strong business performance. This was partially

offset by a $141,731 net cash outflow from financing activities, which includes debt repayments

and other financial obligations. |

| | | |

| ● | Continued

Debt Reduction: The Company repaid $298,531 in loans, further strengthening its balance sheet

and reducing financial liabilities, reinforcing its commitment to long-term financial stability. |

Management

Commentary:

“These

outstanding financial results reflect the continued execution of our strategic initiatives and the growing adoption of our digital medicine

solutions,” said Troy Grogan, President and CEO of QHSLab. “We are thrilled to report 98% revenue growth compared to Q4

2023, despite the fourth quarter historically being a lower performing quarter for healthcare companies due to the seasonal impact

of patient volume. This growth demonstrates the strength of our business model and the resilience of our operations. Our improved gross

margin and profitability highlight the effectiveness of our operational efficiencies and commitment to achieving and sustaining profitability.

As we increase the number of physicians using QHSLab, our financial performance should continue to improve.”

Audit

Status and Future Outlook:

The

Company is currently finalizing its independent year-end audit in preparation for filing its Annual Report on Form 10-K prior to the

2024 SEC reporting deadline. While these financial results remain unaudited and are subject to change, management is confident in the

reported numbers and expects only minor adjustments, if any.

“We

look forward to sharing our fully audited results in the coming weeks and remain committed to delivering strong financial performance

and value to our shareholders,” added Troy Grogan. “With our continued expansion and operational efficiencies, we are excited

about the future of QHSLab as we build on this momentum into 2025.”

For

more information about QHSLab and our healthcare solutions, please visit www.qhslab.com.

About

QHSLab, Inc.

QHSLab,

Inc. (OTCQB: USAQ) is a medical device company providing digital healthcare solutions and point-of-care-diagnostic tests to primary care

physicians. Digital healthcare allows doctors to assess patient responses quickly and effectively using advanced artificial intelligence

algorithms. Digital healthcare can also remotely monitor patients’ vital signs and evaluate the effects of prescribed medicines

and treatments on patients’ health through real-time data transferred from patient to doctor. QHSLab, Inc. also markets and sells

point-of-care, rapid-response diagnostic tests used in the primary care practice. QHSLab, Inc.’s products and services are designed

to help physicians improve patient monitoring and medical care while also increasing their revenues.

Forward-Looking

Statements

Certain

matters discussed in this press release are ‘forward-looking statements’ intended to qualify for the safe harbor from liability

established by the Private Securities Litigation Reform Act of 1995. In particular, the Company’s statements regarding trends in

the marketplace, future revenues, future products, and potential future results and acquisitions are examples of such forward-looking

statements. Forward-looking statements are generally identified by words such as ‘may,’ ‘could,’ ‘believes,’

‘estimates,’ ‘targets,’ ‘expects,’ or ‘intends,’ and other similar words that express

risks and uncertainties. These statements are subject to numerous risks and uncertainties, including, but not limited to, the timing

of the introduction of new products, the inherent discrepancy in actual results from estimates, projections, and forecasts made by management,

regulatory delays, changes in government funding and budgets, and other factors, including general economic conditions, not within the

Company’s control. The factors discussed herein and expressed from time to time in the Company’s filings with the Securities

and Exchange Commission could cause actual results and developments to be materially different from those expressed in or implied by

such statements. The forward-looking statements are made only as of the date of this press release. The Company undertakes no obligation

to publicly update such forward-looking statements to reflect subsequent events or circumstances.

Investor

Relations Contact:

Brett

Maas, Managing Principal, Hayden IR, LLC

brett@haydenir.com

646-536-7331

https://twitter.com/QHSLabInc

v3.25.0.1

Cover

|

Feb. 18, 2025 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Feb. 18, 2025

|

| Entity File Number |

0-19041

|

| Entity Registrant Name |

QHSLab,

Inc.

|

| Entity Central Index Key |

0000856984

|

| Entity Tax Identification Number |

30-1104301

|

| Entity Incorporation, State or Country Code |

NV

|

| Entity Address, Address Line One |

901

Northpoint Parkway

|

| Entity Address, Address Line Two |

Suite 302

|

| Entity Address, City or Town |

West Palm Beach

|

| Entity Address, State or Province |

FL

|

| Entity Address, Postal Zip Code |

33407

|

| City Area Code |

(929)

|

| Local Phone Number |

379-6503

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common

Stock, $0.0001 par value

|

| Trading Symbol |

USAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

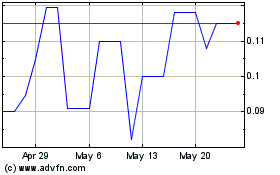

QHSLab (QB) (USOTC:USAQ)

Historical Stock Chart

From Jan 2025 to Feb 2025

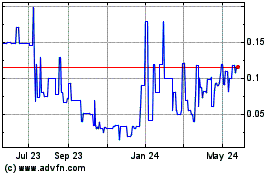

QHSLab (QB) (USOTC:USAQ)

Historical Stock Chart

From Feb 2024 to Feb 2025