Lagardere Warns Of EUR900 Million Impairment Losses On Market Jitters

07 February 2012 - 7:35PM

Dow Jones News

French media-to-defense conglomerate Lagardere SCA (MMB.FR)

Tuesday warned of potential impairment losses of EUR900 million on

Canal Plus shares and some of its assets due to market volatility

as it reported a drop in fourth-quarter revenue.

Revenue in the three months to Dec. 31 fell 9.1% to EUR1.95

billion from EUR2.15 billion a year earlier, while full-year

revenue dropped 3.9% to EUR7.66 billion from EUR7.97 billion a year

earlier.

Lagardere confirmed its target for recurring earnings before

interest and taxes for its media division in 2011 of a decline of

about 5% to 12% on a constant exchange rate basis compared to

2010.

"In 2011, the weak environment in global economy and in stock

markets on the one hand, and the performances for the second half

2011 and prospects of the Unlimited branch on the other hand, are

likely to give rise to significant impairment losses," the company

warned.

"On the top of that, impairment losses on Canal+ France shares

will be added. Overall, the impairment losses, which are mainly

related to these two assets, may amount to around EUR900 million,"

it said.

Eight years ago, Lagardere's current Chief Executive Arnaud

Lagardere inherited control of a conglomerate with business

interests as diverse as automobiles and television stations.

Lagardere pledged to prune the businesses into a pure media group

built around four pillars: book publishing, media in France, travel

retail and sports marketing.

Time is ticking however, as the asset sales are taking time to

materialize and Lagardere's EUR1 billion bet on building a global

sports-marketing business continues to worry investors. In 2011,

the sports marketing business recorded sales of EUR454 million, up

14.5%, due to the acquisition of U.S.-based agency Best and the

consolidation of Lagardere Racing Paris.

Lagardere plans to sell minority stakes in non-core businesses,

notably a 7.5% stake in European Aeronautic Defence & Space Co.

(EAD.FR), parent company of aircraft maker Airbus, and a 20%

interest in Canal Plus France, a pay-TV business controlled by

Vivendi SA (VIV.FR). Analysts say the combined non-core stakes

could be valued at as much as EUR3 billion.

-By Geraldine Amiel and Max Colchester, Dow Jones Newswires; +33

1 40171767; geraldine.amiel@dowjones.com

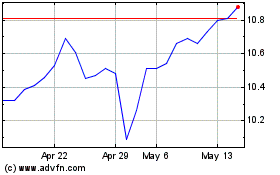

Vivendi (PK) (USOTC:VIVHY)

Historical Stock Chart

From Jun 2024 to Jul 2024

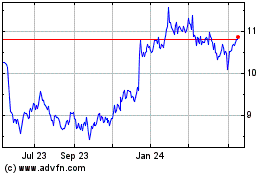

Vivendi (PK) (USOTC:VIVHY)

Historical Stock Chart

From Jul 2023 to Jul 2024