Form 8-K - Current report

18 September 2024 - 6:20AM

Edgar (US Regulatory)

false

0001848416

A1

0001848416

2024-09-17

2024-09-17

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d)

of

the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): September 17, 2024

VERANO

HOLDINGS CORP.

(Exact

Name of Registrant as Specified in its Charter)

| British

Columbia |

|

000-56342 |

|

98-1583243 |

(State

or Other Jurisdiction

of

Incorporation) |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification

No.)

|

224

W Hill Street, Suite 400,

Chicago,

Illinois 60610

(Address

of Principal Executive Offices) (Zip Code)

(312)

265-0730

(Registrant’s

Telephone Number, Including Area Code)

N/A

(Former

Name or Former Address, if Changed Since Last Report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| |

☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

|

| |

☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

|

| |

☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

|

| |

☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol |

|

Name

of each exchange on which registered |

| N/A |

|

N/A |

|

N/A |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

8.01 Other Events

Amended

Court Filings Made in Litigation

On

September 17, 2024, Verano Holdings Corp. (the “Company”) filed an Amended Response to Civil Claim (the “Amended

Response”) and an Amended Counterclaim (the “Amended Counterclaim”) with the Supreme Court of British Columbia,

Canada (the “Court”) in regard to litigation matters before the Court with Goodness Growth Holdings, Inc., now named

Vireo Growth, Inc. (“Vireo”). The amended filings were made primarily in response to communications recently disclosed

by Vireo in response to document production requests made by the Company in the litigation (the “Newly Discovered Communications”).

The Newly Discovered Communications have been in the possession of Vireo and its advisors but were unknown to the Company until provided

piecemeal by Vireo over 16 to 20 months after the commencement of the litigation.

Litigation

Background and Status

The

litigation matters arose from an Arrangement Agreement (the “Arrangement Agreement”) entered into by the Company and

Vireo on January 31, 2022, pursuant to which the Company would acquire Vireo, subject to the terms and conditions of the Arrangement

Agreement, by means of a stock-for-stock transaction (the “Arrangement”). Based on the Company’s belief that

there were multiple breaches by Vireo, Vireo’s Board of Directors (the “Vireo Board”) failure to reaffirm its

recommendation of the Arrangement and the occurrence of various material adverse events, the Company exercised four of its separate termination

rights set forth in the Arrangement Agreement on October 13, 2022 and demanded the payment of the $14.875 million termination fee and

the $3.0 million transaction expense payment owed to the Company under the terms of the Arrangement Agreement. Vireo filed suit against

the Company with the Court on October 21, 2022, alleging unspecified damages for wrongful termination and disputing it owed the termination

fee or expense payment. On November 14, 2022, the Company filed a response to Vireo’s allegations and a counterclaim against Vireo

seeking the termination fee and the expense payment.

On

May 2, 2024, Vireo filed a Notice of Application for Summary Trial seeking damages of $860.9 million and requesting that the Court decide

the case on a summary determination expedited basis, claiming urgency due to Vireo’s distressed financial condition and danger

of receivership. On June 20, 2024, the Company announced that it filed a Notice of Application with the Court seeking (a) a preliminary

order from the Court that summary determination is not suitable for this case and would not assist in the efficient resolution of the

proceedings, and (b) the inadmissibility and exclusion from evidence of Vireo’s expert report on purported damages on the grounds

that the expert report does not comply with the Court’s rules and common law admissibility requirements as to expert qualifications

and expert evidence regarding assumptions, support, methodology and other content deficiencies.

Currently,

an in-person preliminary hearing on the suitability of summary determination is scheduled with the Court for October 16-17, 2024. The

preliminary hearing will not address the merits of the litigation matters and it is unknown whether on a preliminary basis the Court

will decide the suitability of summary determination. The Court may, in its discretion, determine not to make a preliminary decision

on the suitability of summary determination and postpone a decision until a further hearing, which is currently unscheduled.

Basis

for Amended Filings

In

the Amended Response, among other amendments, the Company added defenses arising from the Newly Discovered Communications that Vireo

willfully and intentionally breached the Arrangement Agreement by (a) withholding from the Company correspondence from various litigation

counsel for Vireo shareholders alleging federal securities violations by Vireo, inadequate disclosures in Vireo’s preliminary proxy

statement and public filings, stale and outdated fairness opinions and other inadequacies with the fairness opinions on which the Vireo

Board relied, (b) withholding correspondence from a Vireo shareholder soliciting opposition to the Arrangement, and (c) refusing to give

fair and reasonable consideration to the Company’s comments and concerns, which raised the very same risks and inadequacies that

the Newly Discovered Correspondence raised regarding Vireo’s proxy statement disclosures, the Vireo Board process and litigation

exposure. Vireo repeatedly told the Company such comments and concerns were unreasonable and without merit notwithstanding Vireo’s

possession of the Newly Discovered Communications at such time. Other Newly Discovered Communications included that Vireo had genuine

and legitimate concerns that Vireo’s shareholders would no longer approve the Arrangement and that the Vireo Board should reaffirm

its recommendation of the Arrangement as requested by the Company.

In

the Amended Counterclaim, among other amendments, the Company added additional claims for damages against Vireo based on Vireo’s

willful breaches of the Arrangement Agreement, and Vireo’s breaches of good faith and the duty of honest performance. The damages

amounts are not specified at this time.

Summary

Description Only

The

description of the Amended Response and the Amended Counterclaim is a general summary only and is not complete. The complete Amended

Response and the Amended Counterclaim will be available on the Court’s website at https://justice.gov.bc.ca/cso/index.do.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

Dated:

September 17, 2024

| |

By: |

/s/

Laura Marie Kalesnik |

| |

Name: |

Laure

Marie Kalesnik |

| |

Title: |

Chief

Legal Officer, General Counsel & Secretary |

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

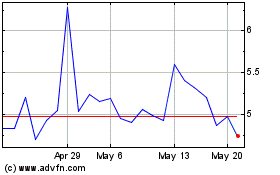

Verano (QX) (USOTC:VRNOF)

Historical Stock Chart

From Oct 2024 to Nov 2024

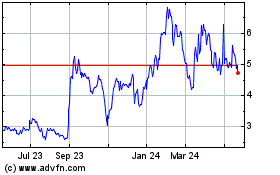

Verano (QX) (USOTC:VRNOF)

Historical Stock Chart

From Nov 2023 to Nov 2024