Wolters Kluwer, a global leader in

professional information services , today released

its scheduled 2014 first-quarter trading update.

Highlights

- Full-year 2014 guidance affirmed.

- First-quarter revenues up +2% in

constant currencies and up +2% organically.

- First quarter benefitted from a favorable comparison to the

prior year.

- Leading, high growth businesses continue to drive

performance.

- Digital subscriptions saw good organic growth; transactional

and cyclical revenues declined.

- First-quarter adjusted operating margin declined, as

expected, due to planned restructuring costs.

- First-quarter adjusted free cash flow declined in

constant currencies, as expected, partly due to higher paid

financing costs.

- Net-debt-to-EBITDA 2.2 (March 31, 2014) in line with

year-end 2013 and better than target of 2.5.

- Year-to-date acquisition spending, net of cash

acquired, was €170 million including Datacert.

Nancy McKinstry, CEO and Chairman of the Executive

Board, commented: "Our leading, high growth businesses and

digital products again drove positive organic revenue performance

in the first quarter, more than compensating for expected decline

in print formats and certain transactional and cyclical revenue

streams. We sustained organic investment in new products and

geographic expansion, and, as announced previously, stepped up

restructuring in order to drive further efficiencies, particularly

in Europe. The acquisition of Datacert last month will help further

transform our portfolio. We remain confident of achieving the

guidance we set out at the start of this year."

First Quarter Developments

First-quarter revenues declined 1% overall due to the strength

of the Euro against the U.S. Dollar and other currencies. In

constant currencies, revenues rose +2%, driven mainly by organic

growth which benefitted from a favorable comparison to the prior

year (first quarter 2013: -1%). The effect of 2013 acquisitions

(mainly Prosoft in Tax & Accounting) was broadly offset by the

impact of last year's divestitures (mainly in Legal &

Regulatory). Recurring revenues saw good organic growth in the

quarter, despite further decline in print subscriptions. Books,

transactional and other non-recurring revenues declined. The

first-quarter adjusted operating margin declined compared to a year

ago, due to increased restructuring costs, lower transactional

revenues as well as the effect of last year's disposals and

currency.

In Legal & Regulatory, Corporate Legal Services (CLS)

achieved positive organic growth, with growth in digital

subscriptions partly offset by slower transaction volumes due to

decelerating trends in M&A volumes, commercial lending activity

and UCC filings compared to a year ago. Legal & Regulatory

publishing operations saw organic revenue decline, as expected, in

both Europe and North America. While digital revenues grew, this

was offset by trends in print subscriptions and books (including

U.S. legal education). The divisional adjusted operating margin

declined, as expected. As indicated in February 2014, we have

transferred certain European tax publishing assets into the Legal

& Regulatory division (a net transfer of approximately €33

million revenue in 2014) in order to drive further scale economies.

For the full year, we continue to expect Corporate Legal Services

to achieve positive organic growth, although momentum in CLS

transactional revenues is expected to be slower this year. In our

Legal & Regulatory publishing operations, we anticipate organic

revenue decline due to continued economic uncertainty in Europe,

weakness in print formats, and lower U.S. law school enrollments.

Continued softness in revenue combined with higher restructuring,

the effect of dilutive disposals and the transfer of tax publishing

assets is expected to lead to a lower margin in 2014.

Tax & Accounting saw positive organic growth in the first

quarter, with software products (over 60% of divisional revenues)

performing well around the world, while other product lines,

including print, partly offset this performance. Prosoft in Brazil

continues to perform well. The first quarter adjusted operating

profit margin declined, as expected, due to planned restructuring

initiatives. For the full year, we continue to expect the

division's software businesses to achieve good organic growth,

partly offset by trends in other product areas. As before, we

anticipate margin contraction due to increased restructuring which

will be weighted towards the first half.

Health achieved strong organic growth in the first quarter,

benefitting from an easy comparable in the first quarter of 2013.

Clinical Solutions achieved double-digit organic growth, with

UpToDate, Pharmacy OneSource, Provation, and Health Language

driving this performance. Medical Research posted improved organic

growth, with growth in digital revenues including online journal

advertising outweighing expected print decline. Professional &

Education revenues declined in the seasonally small first quarter.

For the full year, we continue to expect another strong year for

Clinical Solutions. Market conditions for print journals and books

are expected to remain weak. The positive effect from the ongoing

mix shift towards Clinical Solutions should benefit margins despite

continued investment in new digital product development and global

expansion.

Financial & Compliance Services first quarter revenues were

lower on organic basis due to declines in our Originations and

Transport units. Finance, Risk & Compliance saw positive

organic growth driven by strong performance from FRSGlobal and

FinArch products. In Audit, TeamMate internal audit software had a

strong start to the year which more than compensated for the

expected revenue attrition from the rationalisation of the Axentis

platform. We expect full year results to be back-end loaded,

supported by positive organic growth in our Finance, Risk &

Compliance and Audit units. First half performance is expected to

be impacted by lower mortgage refinancing volumes.

Cash Flow, Acquisitions, Divestitures, and Net

Debt Cash conversion was broadly stable compared to a year

ago. Adjusted free cash flow declined in constant currencies, as

expected, due mainly to higher paid financing costs resulting from

double coupon payments due to the maturing Eurobond in January

2014. We continue to expect at least €475 million adjusted free

cash flow at constant currencies for the full year. Twelve months

rolling net-debt-to-EBITDA was 2.2 at the end of the first quarter,

stable compared to 2.2 reported for year-end 2013, and better than

our target of 2.5.

Subsequent to the first quarter, we announced the completion of

our acquisition of the 62% of Datacert (Third Coast Holdings) we

did not already own. The event triggered a non-cash book profit of

approximately $100 million (approximately €73 million) on Wolters

Kluwer's prior minority investment, subject to accounting

adjustments. This is excluded from adjusted results. Including

Datacert, net acquisition spending including earnouts for earlier

acquisitions and net of cash acquired, was approximately €170

million in the year to date. Following approval at the Annual

General Meeting, a dividend of €0.70 per share will be paid in cash

on May 13, 2014.

Full-Year 2014 Outlook

We reaffirm our full-year 2014 guidance. Our 2014 margin

guidance includes expected restructuring costs of approximately

€25-30 million (2013: €10-15 million) which will fall mainly in the

Legal & Regulatory and Tax & Accounting divisions and will

be weighted towards the first half.

|

Performance

indicators |

2014 Guidance |

| Adjusted

operating profit margin |

20.5%-21.5% |

| Adjusted free

cash flow |

>=

€475 million |

| Return on

invested capital |

>= 8% |

|

Diluted adjusted EPS |

Low single-digit growth |

|

Guidance for adjusted free cash flow and diluted adjusted EPS is in

constant currencies (EUR/USD 1.33). |

Our guidance is based on constant exchange rates. Wolters Kluwer

generates more than half of its adjusted operating profit in North

America. As a rule of thumb, based on our 2013 currency profile, a

1 U.S. cent move in the average EUR/USD exchange rate for the year

causes an opposite 1.0 euro-cent change in diluted adjusted

EPS.

Starting with 2014 figures, Wolters Kluwer is adopting more

standard terminology for its benchmark figures. See our website

www.wolterskluwer.com for more details.

About Wolters Kluwer Wolters Kluwer is a global

leader in professional information services. Professionals in the

areas of legal, business, tax, accounting, finance, audit, risk,

compliance and healthcare rely on Wolters Kluwer's market leading

information-enabled tools and software solutions to manage their

business efficiently, deliver results to their clients, and succeed

in an ever more dynamic world.

Wolters Kluwer reported 2013 annual revenues of €3.6 billion.

The group serves customers in over 150 countries, and employs over

19,000 people worldwide. The company is headquartered in Alphen aan

den Rijn, the Netherlands.

Wolters Kluwer shares are listed on NYSE Euronext Amsterdam

(WKL) and are included in the AEX and Euronext 100 indices. Wolters

Kluwer has a sponsored Level 1 American Depositary Receipt program.

The ADRs are traded on the over-the-counter market in the U.S.

(WTKWY).

For more information about our products and organization, visit

www.wolterskluwer.com, follow @Wolters_Kluwer on Twitter, like us

on Facebook, follow us on LinkedIn, or follow WoltersKluwerComms on

YouTube.

|

Financial Calendar |

|

| May 13,

2014 |

Dividend payment

date |

| May 20,

2014 |

ADR dividend

payment date |

| July 30,

2014 |

Half-Year 2014

Results |

| November 5,

2014 |

Third-Quarter

2014 Trading Update |

| February 18,

2015 |

Full-Year 2014

Results |

|

Media |

Investors/Analysts |

| Caroline

Wouters |

Meg Geldens |

| Corporate

Communications |

Investor

Relations |

| t + 31 (0)172

641 459 |

t + 31 (0)172

641 407 |

|

press@wolterskluwer.com |

ir@wolterskluwer.com |

Forward-looking Statements This report contains

forward-looking statements. These statements may be identified by

words such as "expect", "should", "could", "shall" and similar

expressions. Wolters Kluwer cautions that such forward-looking

statements are qualified by certain risks and uncertainties that

could cause actual results and events to differ materially from

what is contemplated by the forward-looking statements. Factors

which could cause actual results to differ from these

forward-looking statements may include, without limitation, general

economic conditions; conditions in the markets in which Wolters

Kluwer is engaged; behavior of customers, suppliers, and

competitors; technological developments; the implementation and

execution of new ICT systems or outsourcing; and legal, tax, and

regulatory rules affecting Wolters Kluwer's businesses, as well as

risks related to mergers, acquisitions, and divestments. In

addition, financial risks such as currency movements, interest rate

fluctuations, liquidity, and credit risks could influence future

results. The foregoing list of factors should not be construed as

exhaustive. Wolters Kluwer disclaims any intention or obligation to

publicly update or revise any forward-looking statements, whether

as a result of new information, future events or otherwise.

PDF version of Press Release

http://hugin.info/130682/R/1783238/610625.pdf

HUG#1783238

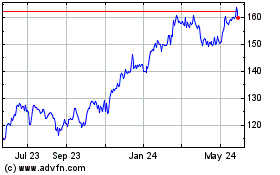

Wolters Kluwer (PK) (USOTC:WTKWY)

Historical Stock Chart

From Jan 2025 to Feb 2025

Wolters Kluwer (PK) (USOTC:WTKWY)

Historical Stock Chart

From Feb 2024 to Feb 2025