Wolters Kluwer 2014 Half-Year Report

30 July 2014 - 4:03PM

Wolters Kluwer, a global leader in

professional information services , today released

its 2014 half-year results.

Highlights

- Full-year 2014 guidance reiterated.

- First-half revenues up 2% in constant

currencies and up 1% organically.

- Leading, growing positions (47% of total revenues) on average

grew 6% organically.

- Digital revenues (68% of total) grew 5% organically, more than

offsetting print decline.

- Digital and services revenues now account for 81% of total

revenues (HY 2013: 78%)

- First-half adjusted operating profit margin declined,

as expected, due to restructuring costs.

- Restructuring costs of €19 million in first half; continue to

expect €25-30 million for full year.

- First half diluted adjusted EPS €0.63, up 1% at

constant currencies.

- Adjusted free cash flow €136 million, up 1% at constant

currencies.

- Net-debt-to-EBITDA of 2.6x, following dividend and

acquisition payments in second quarter.

- Acquisition of Datacert in April builds on our leading

growth position in Corporate Legal Services.

- Announcing renewal of €600 million multi-currency

credit facility.

Interim Report of the Executive Board

Nancy McKinstry, CEO and Chairman of the Executive

Board, commented: "In the first half of the year, we

continued to build on and invest in our leading, growing positions

and digital solutions, and these areas delivered sustained organic

growth. Trends in Europe are still quite varied, but we are

encouraged by recent performance of digital products in this

region. Our planned restructuring program is well underway and we

remain confident of achieving the guidance we set out at the start

of the year."

Key Figures 2014 Half-Year

|

Six months ended June 30 (in millions of euros,

unless otherwise stated) |

2014 |

2013 |

D |

D CC |

D OG |

| Business

performance - benchmark figures |

|

|

|

|

|

| Revenues |

1,716 |

1,742 |

-1% |

+2% |

+1% |

| Adjusted operating

profit |

313 |

334 |

-6% |

-3% |

-4% |

| Adjusted operating

profit margin (%) |

18.2% |

19.2% |

|

|

|

| Adjusted net

profit |

190 |

197 |

-4% |

+1% |

|

| Diluted adjusted EPS

(€) |

0.63 |

0.66 |

-4% |

+1% |

|

| Adjusted free cash

flow |

136 |

140 |

-3% |

+1% |

|

| Net

debt |

2,227 |

2,276 |

-2% |

|

|

| IFRS

results1 |

|

|

|

|

|

| Revenues |

1,716 |

1,742 |

-1% |

|

|

| Operating profit |

214 |

285 |

-25% |

|

|

| Profit for the

period2 |

200 |

164 |

+23% |

|

|

| Diluted EPS

(€)2 |

0.67 |

0.55 |

+23% |

|

|

| Net cash

from operating activities |

188 |

199 |

-6% |

|

|

D - % Change; D CC - % Change constant currencies (EUR/USD

1.33); D OG - % Organic growth. Benchmark and IFRS figures are for

continuing operations unless otherwise noted. Benchmark figures are

performance measures used by management. See Note 5 of this Interim

Financial Report for a reconcilation from IFRS to benchmark

figures. 1) International Financial Reporting Standards as adopted

by the European Union. 2) Includes discontinued operations in

2013.

Full-Year 2014 Outlook

We reiterate the full-year guidance set out in February this

year. Our full-year 2014 margin guidance includes anticipated

restructuring costs of €25-€30 million, of which €19 million

occurred in the first half. The table below provides our 2014

guidance.

|

Performance

indicators |

2014 Guidance |

| Adjusted operating profit

margin |

20.5%-21.5% |

| Adjusted free cash

flow |

>=

€475 million |

| Return on invested

capital |

>=

8% |

|

Diluted adjusted EPS |

Low single-digit growth |

Guidance for adjusted free cash flow and diluted adjusted EPS is

in constant currencies (EUR/USD 1.33).

Our guidance is based on constant exchange rates. Wolters Kluwer

generates more than half of its revenue and adjusted operating

profit in North America. As a rule of thumb, based on our 2013

currency profile, a 1 U.S. cent move in the average EUR/USD

exchange rate for the year causes an opposite 1.0 euro-cent change

in adjusted diluted EPS.

Our guidance assumes no significant change in the scope of

operations. We may make further disposals which could be dilutive

to margins and earnings in the near term. Additional information

underlying our guidance is provided in the table below.

|

Additional information |

|

| Adjusted net financing

costs1 |

Approximately €100 million |

| Benchmark effective tax

rate |

27.5%-28.0% |

|

Cash conversion ratio |

Approximately 95% |

1) In constant currencies (EUR/USD 1.33).

About Wolters Kluwer Wolters Kluwer is a

global leader in professional information services. Professionals

in the areas of legal, business, tax, accounting, finance, audit,

risk, compliance and healthcare rely on Wolters Kluwer's market

leading information-enabled tools and software solutions to manage

their business efficiently, deliver results to their clients, and

succeed in an ever more dynamic world.

Wolters Kluwer reported 2013 annual revenues of €3.6 billion.

The group serves customers in over 150 countries, and employs over

19,000 people worldwide. The company is headquartered in Alphen aan

den Rijn, the Netherlands.

Wolters Kluwer shares are listed on NYSE Euronext Amsterdam

(WKL) and are included in the AEX and Euronext 100 indices. Wolters

Kluwer has a sponsored Level 1 American Depositary Receipt program.

The ADRs are traded on the over-the-counter market in the U.S.

(WTKWY).

For more information about our products and organization, visit

www.wolterskluwer.com, follow @Wolters_Kluwer on Twitter, or search

for Wolters Kluwer videos on YouTube.

Calendar

| November 5, 2014 |

Third-Quarter 2014 Trading

Update |

| February 18,

2015 |

Full-Year 2014

Results |

|

Media |

Investors/Analysts |

| Caroline Wouters |

Meg Geldens |

| Corporate

Communications |

Investor Relations |

| t + 31 (0)172 641 459 |

t + 31 (0)172 641 407 |

|

press@wolterskluwer.com |

ir@wolterskluwer.com |

Forward-looking Statements This report contains

forward-looking statements. These statements may be identified by

words such as "expect", "should", "could", "shall" and similar

expressions. Wolters Kluwer cautions that such forward-looking

statements are qualified by certain risks and uncertainties that

could cause actual results and events to differ materially from

what is contemplated by the forward-looking statements. Factors

which could cause actual results to differ from these

forward-looking statements may include, without limitation, general

economic conditions; conditions in the markets in which Wolters

Kluwer is engaged; behavior of customers, suppliers, and

competitors; technological developments; the implementation and

execution of new ICT systems or outsourcing; and legal, tax, and

regulatory rules affecting Wolters Kluwer's businesses, as well as

risks related to mergers, acquisitions, and divestments. In

addition, financial risks such as currency movements, interest rate

fluctuations, liquidity, and credit risks could influence future

results. The foregoing list of factors should not be construed as

exhaustive. Wolters Kluwer disclaims any intention or obligation to

publicly update or revise any forward-looking statements, whether

as a result of new information, future events or otherwise.

The full press release on the 2014 Half-Year Results is

available here:

Wolters Kluwer 2014 Half-Year Report

http://hugin.info/130682/R/1842711/641442.pdf

HUG#1842711

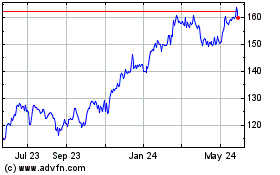

Wolters Kluwer (PK) (USOTC:WTKWY)

Historical Stock Chart

From Jan 2025 to Feb 2025

Wolters Kluwer (PK) (USOTC:WTKWY)

Historical Stock Chart

From Feb 2024 to Feb 2025