UPDATE: Macau February Gambling Revenue Up 48% At Record MOP19.86 Billion

01 March 2011 - 10:07PM

Dow Jones News

Gambling revenue in Macau leapt 48% in February from a year

earlier, government statistics issued Tuesday show, as mainland

Chinese visitors to the territory helped push revenue to another

record high.

Gambling revenue rose to MOP19.86 billion (US$2.47 billion)

during the month, from MOP13.45 billion a year earlier, according

to data from Macau's Gaming Inspection and Coordination Bureau. The

total for February surpassed the previous monthly record of

MOP18.88 billion, hit in December 2010.

The record revenue haul came despite Beijing and Macau officials

urging the city to diversify its economy away from the lucrative

casino business, efforts by the local government to tame the

industry's growth, and investor concerns China's tightening

measures could negatively impact gambling revenue in the city, the

only place in China where casino gambling is legal.

However, Credit Suisse analyst Gabriel Chan said further

tightening by Beijing is unlikely to be a problem for Macau's

casino operators over the next few months.

"I don't think China's tightening measures will have any

meaningful impact on Macau's gambling revenue for the next three to

six months as it will take time for China to absorb its excess

liquidity," he said. "Plus, in the initial tightening cycles, VIPs

tend to take even more money out of China as they seek better

returns on their assets."

Macau's gambling revenue has made a dramatic recovery since the

end of 2009, as the city came roaring back from the global economic

downturn, a swine flu outbreak and China visa restrictions in the

first half of 2009.

Revenue growth in February was faster than the 33% rise recorded

in January, but slower than the 58% surge for all of 2010.

CLSA analyst Aaron Fischer said the investment house is

maintaining its estimate of a 30% increase in gambling revenue this

year despite the higher-than-expected growth rates in the first two

months of the year because of a high comparison base effect in the

second half and the possibility of "some form of tightening on the

VIP side."

He said consensus growth estimates are closer to 20%-25%.

Among Macau's six casino license-holders, tycoon Stanley Ho's

SJM Holdings Ltd. (0880.HK) continued to lead the market with a 32%

share, followed by Sands China Ltd. (1928.HK) with 18%, according

to a person familiar with the matter. Both operators' shares were

steady from the previous month.

Melco Crown Entertainment Ltd. (MPEL), co-chaired by James

Packer and Lawrence Ho, and Wynn Resorts Ltd. (WYNN) unit Wynn

Macau Ltd. (1128.HK) each increased their market shares by around

one percentage point to 15%, the person said.

MGM Macau, a joint venture between Pansy Ho and MGM Resorts

International (MGM), was in fifth position with a market share of

11%, about one percentage point higher than in January, the person

said, adding Galaxy Entertainment Ltd.'s (0027.HK) share fell to 9%

from 13% last month after having an unlucky month.

Shares of Macau casino operators rose sharply in Hong Kong

following the latest data.

Galaxy Entertainment, controlled by Hong Kong tycoon Lui Che

Woo, and SJM Holdings led the gains, rising 11.2% to HK$11.16 and

8.2% to HK$12.40, respectively.

In a report Monday, Bank of America Merrill Lynch analyst Billy

Ng wrote that the recent correction in Macau gambling operators'

shares, particularly those of Galaxy and SJM, provided a good entry

point for investors.

He said shares of SJM and Galaxy were both down about 20% from

their peaks in the middle of January.

-By Kate O'Keeffe, Dow Jones Newswires; 852-2802-7002;

kathryn.okeeffe@dowjones.com

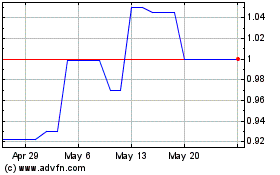

Wynn Macau (PK) (USOTC:WYNMF)

Historical Stock Chart

From Feb 2025 to Mar 2025

Wynn Macau (PK) (USOTC:WYNMF)

Historical Stock Chart

From Mar 2024 to Mar 2025