ALTIN cuts leverage at end 2008

17 December 2008 - 6:00PM

UK Regulatory

ALTIN cuts leverage at end 2008

Baar, 17 December 2008 - ALTIN AG (SIX Swiss Exchange: ALT, LSE: AIA) , the Swiss alternative investment company,

today announces that the company will have no leverage in its portfolio as of 2 January 2009.

In order to adjust to a more difficult market environment, ALTIN's investment manager has decided to reduce the

leverage in the portfolio to zero. This measure will be effective as of 2 January 2009.

For further information on ALTIN, please contact:

Jean Keller David Hothersall

Investor Relations Manager Kinlan Communications

Tel. +41 41 760 60 62 Tel. +44 20 7638 3435

jean.keller@altin.ch davidh@kinlan.net

Note to Editors

About ALTIN AG

ALTIN AG was launched in December 1996. It has been listed on the Swiss Stock Exchange since its inception and on

the London Stock Exchange since 2001. It has one of the longest track records as a listed fund of hedge funds in the

world. ALTIN is a multi-strategy fund invested in over 40 hedge funds across a variety of investment strategies and has

one of the longest track records in the world as a listed fund of hedge funds. ALTIN's aim is to generate an absolute

compound annual return in USD terms, with a lower volatility than equity markets.

ALTIN's investment manager is 3A (Alternative Asset Advisors), a specialist alternative investment manager, and part

of the SYZ & CO Group.

www.altin.ch

About 3A

3A (Alternative Asset Advisors), is the alternative division of the SYZ & CO Group and one of Europe's leading

specialists in the field. 3A is the investment manager for a number of funds of hedge funds, including London and

Zurich-listed ALTIN and the 3A Alternative Funds Luxembourg SICAV, which offers a number of single-strategy and

multi-strategy funds of hedge funds. Following a highly disciplined analysis and due diligence process, 3A selects the

best hedge funds worldwide to build tailor-made multi-manager portfolios, funds of hedge funds or structured products.

3A manages over USD 3.9 billion in hedge fund assets. Additionally, 3A provides alternative research and due

diligence services on USD 7 billion in alternative investments.

www.3-a.ch

About SYZ & CO

The Swiss banking group SYZ & CO is exclusively dedicated to asset management through three strongly interconnected

business lines: high-level private banking (Banque SYZ & CO SA), an award-winning family of investment funds (OYSTER

Funds), and alternative investments, through 3A (Alternative Asset Advisors) , one of the acknowledged alternative

management specialists in Europe.

SYZ & CO manages CHF 26 billion in assets with a staff of 350 people. In addition to the Bank's headquarters in

Geneva, the Group also has offices in Switzerland in Zurich, Lugano and Locarno, as well as in Milan, Rome, London,

Luxembourg, Vienna, Nassau and Hong Kong.

www.syzbank.ch

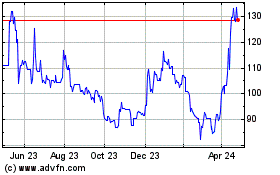

Altyngold (LSE:ALTN)

Historical Stock Chart

From Jun 2024 to Jul 2024

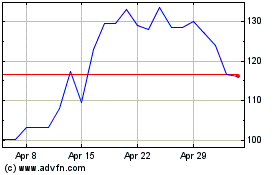

Altyngold (LSE:ALTN)

Historical Stock Chart

From Jul 2023 to Jul 2024