TIDMHMB

PRESS INFORMATION9 June 2009

HAMBLEDON MINING PLC

(AIM:HMB)

Final results

(All references to "GBP" are to the British pound and "ounces" are to troy ounces)

Hambledon Mining plc ("Hambledon" or the "Group" or the "Company"), the AIM-listed mining and exploration company developing precious metal deposits in Kazakhstan, announces its results for the year ended 31 December 2008.

Highlights

-- 11,939 ounces of gold and 21,644 ounces of silver produced during 2008.

-- Upgrade to the crusher completed in 2009.

-- Crushing circuit is now operating well.

-- Process plant now capable of achieving 33 per cent. greater throughput

than planned.

-- Underground mine study completed and underground permitting process

started.

The annual general meeting of the Company will be held at the offices of Fairfax I.S. PLC at 46 Berkeley Square, Mayfair, London W1J 5AT on Friday 17 July at 2.30 p.m.

Enquiries

Hambledon Mining plc

Charles Zorab Telephone: + 44 (0) 207 233 1462

Fairfax I.S. PLC

Ewan Leggat Telephone: +44 (0) 207 598 5638

Chairman's statement

I am pleased to announce our financial results for the twelve months to 31 December 2008.

Review of 2008 and 2009 to date

Sekisovskoye

Production in 2008 suffered from a number of significant disruptions. A boiler explosion in February put the plant out of action for three months while a new boiler was installed and new safety procedures put in place. Subsequently, a number of problems, mainly concerning the crushing circuit, continued to hinder our efforts to increase production towards design levels. As a result, production levels during 2008 were far lower than planned. However, I am pleased to report that following the installation of new equipment earlier this year, the plant can now operate at a throughput some 33 per cent. above the originally anticipated level.

Having achieved this improvement in performance, our task is now to ensure that the many advantages of Sekisovskoye - including the simple metallurgy, proximity to infrastructure and availability of a skilled, low cost workforce - are translated into financial benefits.

Ognevka

The combination of low metallurgical recoveries and the very severe drop in metal prices caused us to abandon our initial plan to treat the small quantity of copper-gold-silver bearing clinkers that were on-site at the time of acquisition. We have carried out test work into the possibility of treating the large quantities of existing tailings to produce a saleable feldspar concentrate, and other uses for this process plant are being considered, but for the present, the plant has been placed on care and maintenance.

Outlook

Although the major causes of bottlenecks in production have been resolved, we still have many things to achieve. Our process plant has proven to be capable of operating satisfactorily at 33 per cent. higher throughput rates than initially planned, but it remains to be demonstrated that this can be done on a consistent basis. Metallurgical recoveries have recently risen close to the anticipated level, but we need to achieve this over a longer time-frame. The Group's mining team is working to increase mine production to cater for the increased milling capacity, but equipment failures and long time-lines for the procurement of spares have impeded us. We have reviewed and augmented the list of spares which we carry on site, but there is further work to be done to improve general efficiency. The geological model on which our resource estimate is based, and the associated open pit mine plan, show that the stripping ratio will fall and the ore grade will increase as the pit deepens. These factors, combined with the greater efficiencies now becoming apparent, should enable us to reach higher levels of production from the open pit over the next few years.

We have employed an underground mine manager to oversee the permitting processes for the start of underground mining. Although this project is behind schedule, we need to ensure we have sufficient cash resources before the equipment is ordered. Work on securing the necessary permits has already started, and we see no reason why mining work should not commence in the next twelve months.

We have studied various opportunities for expansion of the Group, either using the Ognevka facility or additional gold opportunities which could stand-alone or provide additional feed for our plant at Sekisovskoye. The legal process whereby we may apply for suitable licences is slow, but we have already held preliminary discussions with the appropriate authorities.

We have spent considerable time and effort in making the business a more efficient and productive operation. This has been at times frustrating, none more so than for you as shareholders, but I believe we are at last about to see the rewards of our labour.

I thank all shareholders for their considerable patience and the management and staff for their efforts over the year.

George Eccles

8 June 2009

Review of operations

Sekisovskoye

Mining Operations

Open pit

Mining operations at the Sekisovskoye open pit progressed well during 2008. With the commencement of processing in December 2007, the focus of the mining operation was to provide a steady supply of ore to the processing plant while also continuing the construction of the tailings storage facilities with the waste material mined from the pit.

Mining operations were suspended from mid February 2008 until the end of April 2008 as a result of the plant shut down following the boiler accident. There was a sufficient stockpile of ore for the process operation so this did not impact gold production after the restart.

The construction of the second stage tailings storage facility with the installation of the plastic lining was completed in August. This will have sufficient capacity until around the end of 2009. Construction of the third stage, with capacity for around 1½ years of tailings, commenced in late 2008 and is expected to be completed in July 2009. Construction of the final and largest stage will commence after the completion of the third stage in late 2009.

A second Atlas Copco L7 blasthole drilling rig was purchased and commissioned in May 2008. This machine was required to allow mining of the high volume of waste material planned to be mined in 2008 and 2009. In addition, we purchased a Hitachi Zaxis ZX200 fitted with a Montabert 900 rock breaker in June. While the main task of this machine is to break the oversize ore generated from mining operations to a size that can be fed to the jaw crusher, it will also be used for small scale trenching operations.

Analysis of the mining operations at Sekisovskoye shows that the costs associated with the operation of the mining fleet are lower than initially projected, helped by the devaluation of the Kazakh tenge in January 2009.

The characteristics of the pit design are such that the requirement for waste stripping is currently at its highest, so the mine fleet cannot easily provide the increased tonnage that the upgraded process plant can now treat. The shortfall will be made up with lower grade marginal ore that will nevertheless provide a useful contribution to profits. In future years, this stripping requirement will fall, enabling a greater tonnage of ore to be mined. The ore grade is also expected to rise slightly with depth, giving a further boost to annual gold production.

Underground

The Company has started to develop the required documentation to be presented to the Kazakhstan regulatory authorities for approval to commence underground mining. This involves our team of planning engineers and geologists converting the current design into a format acceptable to the local authorities. We currently expect to commence mine development with the construction of a surface decline from within the existing open pit to intersect the old exploration level at an elevation of 320 (120 metres below surface).

Discussions have been ongoing with suppliers to source the required underground equipment to start development of the surface decline. Previously indicated lead times of 9 to 12 months for the supply of this equipment appear to have been significantly reduced.

The Company is working on a development schedule that will proceed in stages to suit the approvals system operating in Kazakhstan and will use more Russian and Chinese equipment. The likely up-front investment for the first stage, including working capital, will be just US$3 million, which we anticipate financing from internally generated cashflow.

Processing operations

Processing operations were carried out from January 2008 until mid February when the eluate boiler in the gold recovery circuit suffered catastrophic failure. The process plant was immediately shut down while we carried out investigations and repairs.

The processing plant restarted operations in late April 2008 following the installation and commissioning of a new boiler and heat exchanger. Initial throughput was affected by the spring rains on the clay-like material that had been mined from near-surface ore-zones, which hampered the material's flow through the conveyor systems and tended to clog the sizing screens of the crushing plant. In winter, when temperatures frequently reach -40 C, freezing of the natural moisture in the ore caused further blockages and the widely fluctuating temperatures of spring and autumn caused freezing of rain-soaked dust to further slow down production. We attempted to modify the circuit to resolve these issues but were only partially successful until in late 2008 we decided to carry out a major upgrade of the crushing plant. Equipment was ordered and arrived on site in early 2009. In February 2009 we suspended the plant's operations for a period so that all the new crusher equipment could be installed. Commissioning problems encountered in the start-up of the equipment in February and early

March were quickly resolved and the crushing circuit is now operating well, with production consistently over 200 tonnes per hour, more than sufficient to supply the process plant with the required feed.

The failure of the crushing plant to produce sufficient quantities of material at an appropriate size limited milling operations throughout 2008. However, since the crusher upgrade in February 2009, we have gradually increased the tonnage feed through the process plant to the point where it is now able to operate satisfactorily at 140 tonnes per hour, some 33 per cent. above the design capacity, making possible an annual throughput of in excess of 1 million tonnes. Output will now be limited by the amount and grade of ore that the mine can supply.

The current annualised production rate is around 30,000 ounces per year, but the average from the open pit is expected to average over 40,000 ounces per year over the pit life, while combined open pit and underground production is expected to reach around 100,000 ounces per year.

Gold recovery in the leaching circuit during 2008 at 73 per cent. was lower than budgeted. The principal cause of this was the failure to achieve the planned performance in the gravity and intensive leaching circuit. During the February 2009 plant shut down the manufacturer overhauled and upgraded the Falcon gravity concentrator. As a result, gold recovery is much improved and there are indications that this will tend to increase with increasing ore grade, as is expected as the pit deepens. We are therefore on track to achieve the predicted recovery of 92 per cent. over the life of the pit.

All other areas of the processing plant are functioning according to the design parameters.

Production statistics

Mining

Ore mined 587,514 t

=--------------------------------

Gold grade 1.24 g/t

=--------------------------------

Silver grade 2.34 g/t

=--------------------------------

Contained gold 23,422 oz

=--------------------------------

Contained silver 44,200 oz

=--------------------------------

Waste mined 1,507,212 t

=--------------------------------

Processing

Crushing 417,990 t

=-----------------------------------

Milling 392,485 t

=-----------------------------------

Gold grade 1.37 g/t

=-----------------------------------

Silver grade 2.58 g/t

=-----------------------------------

Gold recovery 75.1 per cent.

=-----------------------------------

Silver recovery 69.7 per cent.

=-----------------------------------

Gold poured 11,939 oz

=-----------------------------------

Silver poured 21,644 oz

=-----------------------------------

The above statistics are for the year ended 31 December 2008.

Ognevka

The Ognevka processing facility restarted in early December 2007 and operated through to the middle of 2008. During this time, copper / gold and silver concentrate and a separate carbon concentrate were produced but at a lower grade than is acceptable in current market conditions. With the collapse in the copper price in late 2008, following a review of the economics of the operation, management halted operations. In light of this suspension, it was decided to make an impairment provision in the consolidated financial statements of GBP1.7 million against the assets of the business.

The company undertook metallurgical testwork to determine the viability of reprocessing the tailings of the pegmatite material which were produced from previous operations at Ognevka until the late 1990's. There currently exists approximately 9.7 million tonnes of tailings in the storage facility containing potentially economic quantities of lithium, beryllium and feldspar. The testwork demonstrated that it is technically feasible to extract a feldspar concentrate as well as a concentrate containing lithium and beryllium. However, in the current recessionary conditions prices would be inadequate.

There are a number of other potential uses of the Ognevka facility in treating many types of primary base and precious metal ores, and these are currently being examined.

Exploration

The priority given to resolving production issues at Sekisovskoye restrained exploration activity in 2008 but a limited amount of exploration was carried out at Tserkovka. Though no significant discoveries were made, we plan to undertake bulk sampling of the surface exposure of its ore zones. By extracting and processing a total of 2,200 tonnes of ore at an expected grade of 2.45 grammes per tonne, we will determine the grade more accurately than is possible from sampling in this highly variable deposit. Former Soviet assessments showed higher grades and tonnes. If the bulk sampling exercise proves successful, further exploration will be carried out. In accordance with the terms of the subsoil use licence 30 per cent. of the 29 square kilometres of licensed territory at Tserkovka has been relinquished.

At Sekisovskoye, once we have established the initial underground decline, we plan to drill 183 holes totaling 24,000 metres from the 320m, 240m and 120m levels in order to upgrade the reliability of the resource estimate and as part of the project approval process. Test-mining will take place on orebody 11 from level 240m up to level 400m.

Our geologists have been researching other potential deposits which might be available in Kazakhstan, either by taking new licences from government or by contract with existing owners. Several potential targets have been identified and initial discussions have been held with the appropriate authorities. For the present, the government of Kazakhstan has suspended such negotiations generally, although we expect them to restart later this year.

Risks, uncertainties and performance indicators

The main risks and uncertainties facing the Sekisovskoye operation include the following:

1 The risk of production being affected by failures of vital equipment.

2 The risk of failing to mine the tonnes and grades of ore predicted by the geological model.

3 The risk of failing to obtain the metallurgical recoveries predicted by test-work.

4 The risk of operating costs being significantly different from those predicted.

5 The risk of operations being affected by events outside the control of the Company such as major infrastructure failures or political upheaval.

6 Gold and silver prices.

Risks one to four are reducing at Sekisovskoye as, over time, the operation's performance is monitored against plan. An analysis of equipment performance has been carried out and defects rectified and critical spares identified and procured. The implementation of a detailed costing system has allowed the monitoring and assessment of costs to be undertaken. The grade of ore mined is constantly compared to the geological model and differences investigated.

The key performance indicators used to monitor the performance of the operations are:

1 Tonnes and grade of ore mined.

2 Tonnes processed.

3 Metallurgical recovery.

4 Gold and silver produced.

5 Cost per unit of production.

6 Safety of the Group's employees.

Key performance indicators one to four are set out in the tables of production statistics.

The Ognevka plant is currently on care and maintenance due to the current low world metal prices. It is not possible to predict if and when economic conditions will be sufficiently favourable for it to be reopened.

The Group is monitoring the environmental impact of its operations in compliance with an agreed monitoring programme.

Employee safety is of paramount concern to the Group and the board of directors receives regular updates on safety matters.

Going concern

The Group's business activities, together with the factors likely to affect its future development, performance and position are set out in the Chairman's statement and review of operations and exploration above. The major risks and uncertainties which could impact on the Group's ability to generate cash in the next 12 months are its level of production and gold prices.

Mining operations at Sekisovskoye is the Group's only source of revenue. The Directors believe that production at or above the levels achieved from April 2009 and up to the date of this report are sustainable following the major improvements made to the processing operations and measures to guard against significant production interruptions introduced in the first quarter of 2009 as discussed in the review of operations and exploration.

The Group's forecasts and projections based on the assumption that the current level of production at Sekisovskoye can be sustained and on the prevailing outlook for the gold price and taking into account of reasonably likely changes in the level of production and gold prices show that the Group will now be cash generative for the foreseeable future and its borrowings can be repaid before it falls due at the end of 2009. The Directors believe that the Group's low level of gearing relative to the value of its assets would put it in a strong position, were any additional funding to be required.

Accordingly, at the time of approving the consolidated financial statements, the Directors have a reasonable expectation that the Group has adequate resources to continue in operational existence for the foreseeable future. For this reason the Directors continue to adopt the going concern basis in preparing the financial statements.

Mineral resources

Resource statement

This mineral resource estimate for the Sekisovskoye deposit has been prepared under the JORC Code. Mining operations commenced in mid 2006. Ore has been mined during 2007 and 2008. The following resource table reflects the depletion of the resource due to open pit mining activities.

The underground resource is unchanged since the update reported in September 2006.

Location Resource Tonnes Au g/t Contained Ag g/t Contained Au g/t Cut-off

Category (millions) Metal Metal

Au oz * Ag oz *

=-------------------------------------------------------------------------------------------

Open pit Indicated 8.91 1.8 521,999 3.0 859,360 0.5

area

=-------------------------------------------------------------------------------------------

Inferred (b) 6.06 1.8 350,700 2.0 389,667

=-------------------------------------------------------------------------------------------

Underground Indicated 2.21 5.1 362,371 6.2 440,529 2.0

=-------------------------------------------------------------------------------------------

Inferred (b) 7.16 5.2 1,197,036 7.1 1,634,415

=-------------------------------------------------------------------------------------------

Marginal Indicated 3.40 0.7 76,519 1.4 153,037 0.5

underground

(a)

=-------------------------------------------------------------------------------------------

Inferred 0.96 0.6 18,519 1.2 37,038

=-------------------------------------------------------------------------------------------

Totals Indicated 14.52 2.0 960,889 3.1 1,452,926

=-------------------------------------------------------------------------------------------

Inferred 14.18 3.4 1,566,255 4.5 2,061,120

=-------------------------------------------------------------------------------------------

Total Indicated & 28.70 2.7 2,527,144 3.8 3,514,046

Inferred

=-------------------------------------------------------------------------------------------

*Troy oz = 31.10348 grams

(a)underground low grade material associated with high grade gold zones.

(b)includes resources that have been defined beyond the current limits of the grade model.

Note: "Inferred" resources cannot be used for ore reserves until they have been upgraded.

Reserve estimate

This ore reserve estimate of the Sekisovskoye deposit has been prepared under the JORC Code.

Location Reserve Tonnes Au g/t Contained Ag g/t Contained Au

Category (millions) Metal Metal g/t Cut-off

Au oz * Ag oz *

=------------------------------------------------------------------------------------

Open Probable 3.54 1.61 183,447 2.52 286,500 0.5

pit

area

=------------------------------------------------------------------------------------

Underground Probable 1.77 4.4 247,908 7.4 421,556 2.0

=------------------------------------------------------------------------------------

Total 431,355 708,056

=------------------------------------------------------------------------------------

*Troy oz = 31.10348 grams

The Sekisovskoye open pit ore reserve model is based on the ordinary kriging of the mineral resource model using a 0.5 grams per tonne cut-off, taking into consideration the expected dilution and losses. Whittle optimisations resulted in a pit shell containing 7.25 million tonnes of ore representing a conversion of 76 per cent. of the indicated resource to probable reserve in this area. However, development of this pit shell would have resulted in the loss of the existing underground infrastructure and made the process of bringing the underground operation into production much more difficult and on a much longer timeframe. It has therefore been decided to leave the existing 320 level intact and access this level from a decline developed from outside the pit limit. This will allow the western ore bodies to be mined from underground concurrently with the open pit and other ore zones below the pit bottom at the 340 level, which might otherwise have been included in the open pit mine plan, to be mined from underground.

The resultant reserve estimate is calculated by applying mining costs, mining dilution (4 per cent.) and recoveries (97.5 per cent.) to that portion of the Indicated Resource falling entirely within the optimised open pit design. The area of this open pit reserve is contained within the mineral resource as reported above.

The Sekisovskoye underground ore reserve has been determined from the mine design work carried out as a part of the evaluation on the development of the underground project using a 2.0 gram per tonne cut-off. The General Resource Estimate covered both the open pit resource and underground resource. Mine designs were therefore required for both the open pit and the underground areas.

The underground reserve estimate is calculated by applying mining costs, mining dilution (8 per cent.) and recoveries (96 per cent.) to that portion of the Indicated Resource falling entirely within the stope design. The area of this underground reserve is contained within the underground mineral resource as reported above.

Reconciliation

Mining of ore is carried out following the completion of grade control drilling. This is carried out using the Atlas Copco L7 CR drill rigs. The resulting assays are modeled using Datamine software to produce a Grade Control model. This Grade Control Model is reconciled back to the JORC model prior to mining to determine the accuracy of the original model. A reconciliation of the comparison of the Grade Control Model to the JORC model reveals the following.

Model Type Tonnes Au g/t Au oz * Ag Ag oz * Au g/t Cut-off

g/t

=--------------------------------------------------------------------------

Grade - actual ** 751,200 1.52 37,710 - - 0.5

=--------------------------------------------------------------------------

JORC - depleted 644,600 1.48 30,672 2.98 30,721 0.5

=--------------------------------------------------------------------------

*Troy oz = 31.10348 grams

** The in situ grade control model result is based on vertical rotary drill-hole sample data, for 2007 to end December 2008, and grade model blocks are 2.5m3 using a bulk density of 2.83.'Nearest Neighbour' grade interpolation was used for assigning grades to the model blocks.

The above grade control results are based on 23,000 samples, so statistically the results are significant. Overall, the JORC model shows a reasonably good spatial correlation with the grade control resource model and, as expected, "actual" tonnes and grade are higher than the JORC resource.

The actual grade for Silver is not given in the above table as the Company does not assay silver.

Glossary of technical terms

Grade The tenor or concentration by weight of

a metal in a mineral deposit or ore

=---------------------------------------------------------------------

Indicated Resource A category of Mineral Resource of higher

confidence than an Inferred

Resource, the estimation of

which is prescribed by the

JORC Code. This is the minimum level

of resource classification

required for Ore Reserve estimation

under the JORC Code.

=---------------------------------------------------------------------

Inferred Resource A category of Mineral Resource the estimation

of which is prescribed by the JORC

Code. Inferred Resources cannot be used as

a basis for Ore Reserve estimation.

=---------------------------------------------------------------------

JORC Code Australasian Code for the Reporting

of Exploration Results, Mineral

Resources and Ore Reserves (Joint

Ore Reserves Committee). See

www.jorc.org/main.php

=---------------------------------------------------------------------

Kriging A class of methods of estimating mathematically

the distribution of a metal in three

dimensions within the earth, together

with the confidence of the estimate

=---------------------------------------------------------------------

Mineral Resource An estimated tonnage and grade

of mineralisation in the

ground determined as prescribed by the JORC Code

=---------------------------------------------------------------------

Ore Reserve That part of a Mineral Resource which

can be demonstrated to be worked

profitably when all modifying factors

are taken into account.

=---------------------------------------------------------------------

Tonne A metric tonne of 1000 kilograms

=---------------------------------------------------------------------

Qualified persons

The resource estimates has been prepared by Roger Rhodes BSc, MSc, MIMMM, independent geological consultant with Computer Resource Services. He has over 35 years of relevant experience and is a qualified person for the purpose of reporting resources under the JORC Code and the AIM rules.

The reserve estimate has been prepared by Neil Stevenson, FAusIMM. He is a full-time Director of the Company and has sufficient experience which is relevant to the style of mining that is planned and is a qualified person for the purpose of reporting resources under the JORC Code and the AIM rules.

Group income statement

year ended 31 December 2008

2008 2007

Notes GBP000 GBP000

Revenue 5,553 -

Cost of sales (7,727 ) -

Gross loss (2,174 ) -

Administrative expenses (3,154 ) (4,150 )

Other operating expenses:

Impairment of intangible assets - (227 )

Impairment of TOO Ognevka (1,679 ) -

Operating loss (7,007 ) (4,377 )

Investment revenues 42 222

Other gains and losses 3 (42 )

Finance costs (101 ) (186 )

Loss before taxation (7,063 ) (4,383 )

Taxation 3 (561 ) -

Loss attributable to equity shareholders (7,624 ) (4,383 )

Loss per ordinary share

Basic 5 (1.65 )p (1.04 )p

Diluted 5 (1.65 )p (1.04 )p

All results are derived from continuing activities.

Group statement of recognised income and expense

year ended 31 December 2008

2008 2007

GBP000 GBP000

Currency translation differences on foreign

currency net investments 4,751 (15 )

Net profit / (loss) recognised directly in equity 4,751 (15 )

Loss for the year (7,624 ) (4,383 )

Total recognised expense for the year attributable

to equity shareholders (2,873 ) (4,398 )

Group balance sheet

31 December 2008

2008 2007

GBP000 GBP000

Non-current assets

Intangible assets - -

Property, plant and equipment 20,361 17,424

Current assets

Inventories 3,393 2,395

Trade and other receivables 1,638 822

Cash and cash equivalents 536 3,176

5,567 6,393

Total assets 25,928 23,817

Current liabilities

Trade and other payables (1,626 ) (723 )

Provisions (161 ) (117 )

Borrowings (356 ) -

(2,143 ) (840 )

Net current assets 3,424 5,553

Non-current liabilities

Trade and payables (629 ) (453 )

Deferred taxation (561 ) -

Provisions (1,004 ) (774 )

(2,194 ) (1,227 )

Total liabilities (4,337 ) (2,067 )

Net assets 21,591 21,750

Equity

Called - up share capital 469 448

Share premium 31,317 28,707

Merger reserve (148 ) (148 )

Other reserves 170 87

Currency translation reserve 3,629 (1,122 )

Accumulated losses (13,846 ) (6,222 )

Total equity 21,591 21,750

Group cash flow statement

Year ended 31 December 2008

2008 2007

Note GBP000 GBP000

Net cash outflow from operating activities (3,895 ) (5,387 )

Investing activities

Interest received 42 222

Proceeds on disposal of property 61 -

plant and equipment

Purchase of intangible exploration assets - (75 )

Purchase of property, plant and equipment (2,123 ) (7,705 )

Net cash used in investing activities (2,020 ) (7,558 )

Financing activities

Proceeds on issue of shares 2,631 12,099

Interest paid - (18 )

New bank loans 356 -

Repayment of related party loan - (290 )

Net cash inflow from financing activities 2,987 11,791

Decrease in cash and cash equivalents (2,928 ) (1,154 )

Cash and cash equivalents 3,176 4,352

at beginning of the year

Effect of foreign exchange rates changes 288 (22 )

Cash and cash equivalents at end of the year 536 3,176

Notes

1General information

Hambledon Mining plc (the "Company") is a company incorporated in England and Wales. The address of the registered office is Daws House, 33-35 Daws Lane, London, NW7 4SD. The principal activities and place of business of the Company and its subsidiaries ("the Group") are set out in the chairman's statement and the review of operations above.

2Basis of preparation of financial information

The financial information set out above, which was approved by the Board on 5 June 2009, has been compiled in accordance with International Financial Reporting Standards ("IFRS"), but does not contain sufficient information to comply with IFRS. The Company expects to distribute its full financial statements that comply with IFRS in June 2009. As set out in the review of operations, the board of directors assessed the ability of the Group to continue as a going concern, and consequently the financial statements of the Group have been prepared on a going concern basis.

The financial information set out above does not constitute the Company's statutory accounts for the year ended 31 December 2008 for the purpose of Section 240 of the Companies Act 1985 which comply with IFRS, but is extracted from those accounts. The Company's statutory accounts for the year ended 31 December 2008 will be filed with the Registrar of Companies following the Company's annual general meeting. The independent auditors' report on those accounts was unqualified and did not contain any statement under Section 237(2) or (3) of the Companies Act 1985. The Company's statutory accounts for the year ended 31 December 2007 have been filed with the Registrar of Companies. The independent auditors' report on those accounts was unqualified and did not contain any statement under Section 237(2) or (3) of the Companies Act 1985.

The financial statements have been prepared under the historical cost convention except for the treatment of share based payments.

3Taxation

An analysis of the taxation charge is as follows:

2008 2007

GBP000 GBP000

Current taxation - -

Deferred taxation 561 -

561 -

4Dividend

The Directors do not recommend the payment of a dividend (2007 - nil).

5Basic and diluted loss per share

The calculation of basic and diluted earnings per share is based on the retained loss for the financial year.

The weighted average number of ordinary shares for calculating the basic loss per share and diluted loss per share after adjusting for the effects of all dilutive potential ordinary shares are as follows:

2008 2007

Basic and diluted 461,031,025 422,403,465

6Annual general meeting

The annual general meeting of the Company will be held at the offices of Fairfax I.S. PLC at 46 Berkeley Square, Mayfair, London W1J 5AT on Friday 17 July at 2.30 pm.

Company Information

Directors George William O'Neale Eccles

Non-executive chairman

Nicholas John Bridgen

Chief executive

Neil Stevenson

Technical director

Christopher James Thomas

Non-executive director

Baurzhan Yerkeyev

Executive director

Secretary William Roy Morgan B. Sc. ACA

Registered office Daws House

33-35 Daws Lane

London NW7 4SD

Telephone +44 (0) 870 111 8778

Web www.hambledon-mining.com

Kazakhstan office 4th floor

83 Protozanova Street

Ust Kamenigorsk

Kazakhstan

Telephone: +7 (0) 72331 27928

Fax: +7 (0) 72331 27933

Nominated advisor and Fairfax I.S. PLC

broker 46 Berkeley Square

Mayfair

London W1J 5AT

Telephone: +44 (0) 207 598 5368

Investor relations Charles Zorab

Telephone: +44 (0) 207 233 1462

Registrars Neville Registrars

18 Laurel Lane

Halesowen

West Midlands B63 3DA.

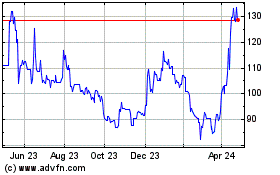

Altyngold (LSE:ALTN)

Historical Stock Chart

From Jun 2024 to Jul 2024

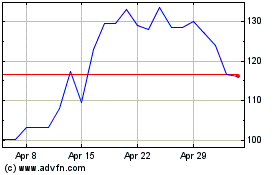

Altyngold (LSE:ALTN)

Historical Stock Chart

From Jul 2023 to Jul 2024