TIDMALTN

ALTYNGOLD PLC

Unaudited Interim Results -- six months to 30 June 2022

AltynGold Plc ("AltynGold" or the "Company"), the gold mining

and development company, announces its unaudited results for the

six months to 30 June 2022.

The Company had a successful 6 months with milling of ore

exceeding 300kt generating an increase in profits to US$11.6m (2021

US$9.3m). The principal KPI's saw an increase from the prior

period, the Company is continuing to grow and develop in line with

its medium-term plan.

The Company's aim is to develop the mine at Sekisovskoye moving

from its current level of processing to 1mt of ore in a phased

development. The current plan is to move to 650ktpa in the current

period and progressively move up to 850ktpa in the medium term.

The management are currently finalising the funding with the

bank to invest in the processing plant to move the capability to

1mtpa.

In previous periods the Company has been developing the mine

site, investing in equipment and making use of subcontractors in

order to develop the mine and extract ore for processing. The move

to increase the involvement of the subcontractors has streamlined

the process of ore extraction and also accelerated the mines

capital development, the costs of the latter are reflected in the

additions to mining properties in the current period.

In line with its mine developments the Company is aware of its

social and environmental responsibilities, particularly in relation

to climate change and carbon reduction. Currently in Kazakhstan

there are three levels of categorisation for companies based on

their carbon emissions. AltynGold is in the lowest level of

category, and closely monitors its emissions, reporting to the

relevant government bodies on a regular basis. The Company will

continue to look at the development of its social and environmental

policies as it evolves.

Highlights:

Mine development

-- Transport declines No.1 and No. 2 have both been developed to the horizon

100masl from 150masl in the prior period.

-- Development of the mine tunneling amounted to 2,992 linear metres,

(H12021: 3,131 linear metres).

-- Exploration drilling amounted to 11,040 linear metres, (2021: 8,200m).

-- Ore was mined in the period principally from ore bodies 3.8 and 11 at

horizons between 164masl to 117 masl.

-- An extension for the licence at Teren-Sai has been applied for in July

2022 to continue exploration works for a further three years.

Production

-- The milled ore was 306,599t (H1 2021: 262,744t), in the current period,

an increase of 17%.

-- Average processed gold grade in the period was 2.06g/t (H1 2021:

1.88g/t).

-- Gold recovery averaged 83.44% during the 6 month period (H1 2021:

82.18%).

-- H1 2022 gold production from Sekisovskoye was 16,965oz, compared with H1

2021 of 13,066oz

-- H1 2022 gold sold was 17,542oz, compared with H1 2021 of 12,560oz

Financial

-- The turnover has increased to US$32m (H1 2021: US$23m). The gold price

achieved averaged US$1,830oz during the period (H1 2021: US$1,832oz).

-- The Company made a gross profit of US$17m (H1 2021: gross profit of

US$14m), with a net profit before taxation of US$11.6m (H1 2021: loss of

US$9.3m).

-- The total cash cost of production was US$884oz (H1 2021: US$766oz).

-- Adjusted EBITDA achieved was US$16.6m (H1: 2021: US$13.4m).

-- A loan in principal has been agreed with Bank Center Credit for an

additional US$40m to fund the Company's capital program.

Aidar Assaubayev, CEO of AltynGold plc commented:

'The Company is moving forward in its plan to increase its

production capability to 1mtpa and has agreed an in principal loan

with Bank Center Credit in order to assist in this process. The

current results are very encouraging and demonstrate the strong

economics of our business'.

For further information please contact:

AltynGold plc

For further information please contact:

Rajinder Basra, CFO +44 (0) 203 432 3198

Email: info@altyn.uk

Information on the Company

AltynGold plc (LSE:ALTN) is an exploration and development

company, which is listed on the main market segment of the London

Stock Exchange. The information contained within this announcement

is deemed by the Company to constitute inside information as

stipulated under the Market Abuse Regulations (EU) No.

596/2014.

This report will be available on our website at

www.altyngold.uk

H1 2022 Review

Mine developments

H1 2022 Operational Overview -- Sekisovskoye

Ore H1 2022 H1 2021

Ore mined tons 277,398 266,607

Gold grade g/t 2.06 1.85

Silver grade g/t 1.69 1.80

Mineral processing H1 2022 H1 2021

Milling tons 306,599 262,774

Gold grade g/t 2.06 1.88

Silver grade g/t 1.69 1.83

Gold recovery % 83.44% 82.18%

Silver recovery % 72.34% 73.19%

Gold produced ounces 16,965 13,066

Silver produced ounces 11,306 11,315

The principal development milestones achieved in the period

were:

-- Tunnelling and decline development of 2,992 linear metres, in the similar

period last year it was 3131 metres.

-- Exploration drilling was carried out and amounted to11,039m (2021: 8,200

linear metres).

The declines have now been developed to 100masl. The ore bodies

currently being developed are ore bodies 3, 8 and 11 which, are

expected to continue to be mined into the second half of the year.

The principal ore body that is ready for extraction after those

noted above will be ore body 10 above which is above 100masl and is

readily accessible.

The principal capital expenditure relating to plant to extract

ore at the Sekisovskoye mine is now in place; the ongoing capital

expenditure will relate to the development of the processing plant

to increase the capability of ore processing and further

development of the mine declines.

The gold grade has increased from 1.88g/t to 2.06g/t and is in

line with that budgeted for the period. Further increases are

expected as the ore bodies are developed.

H1 2022 -- Teren-Sai

In the current period the Company has been concentrating on the

finalising its plans for future development of the site, with

proposals being sent into the government department in July 2022,

these are currently being reviewed. The initial exploration phase

requested is three years, but the Company is anticipating a move to

production within this period once more detailed studies have been

carried out on the approach to develop the site and define the ore

bodies.

As part of the review of Teren-Sai the Company has narrowed its

search parameters of the 288km(2) site, and reduced the areas of

interest, to concentrate on those areas showing significant

potential. Areas that are no longer of significance are to be

returned to the government for alternative use.

H1 2022 Financial Review

The Company has reported a gross profit of US$17m for H1 2022,

against US$14m for H1 2021, with turnover of US$32m (H1 2021

US$23m).

The results are in line with budget, with 306.5kt of ore milled,

the Company is expecting to process up to 650,000t for the year.

The average gold price achieved was similar to the prior period at

of US$1,830 (H1 2021 US$1,832).

Sekisovskoye produced 16,965oz of gold in H1 2022 (H1 2021:

13,066oz). Gold sold during the period amounted to 17,542oz (H2

2021: 12,560oz).

The operating cash cost of production (cost of sales excluding

depreciation and provisions) for the period was US$730/oz (H1 2021

US$546/oz). The total cash cost was US$884/oz as compared to

US$766/oz in H1 2021. These are in line with the expected costs for

the period.

Administrative costs have been contained and were US$2.7m which

is similar to the prior period. Inflationary pressures are

increasing in both Kazakhstan and the UK, and the management will

be monitoring the position closely to ensure that action is taken

to minimise any significant increase in costs to the Company. The

Company has benefited in the current period from the strength of

the US Dollar, (which is the currency in which revenues are

received) against the Kazakh, at the 31December 2021 it was 432

Kazakh Tenge, and the dollar has averaged 448 Kazakh Tenge in the

six month period. The current rate in September is one US$ to 485

Kazakh Tenge.

In terms of finance costs these are similar to the prior period;

with no new loans in the period; the finance cost was US$1.7m in

both periods. Interest and loan commitments were paid as they

arose, and plans are in place to repay the bond of US$10m in

December 2022.

The significant change in the financial position of the Company

relates to the movement in advance payments made to the contractor

who is responsible for the capital development and ore extraction

services. As the development has progressed and production growing,

the payments have increased in the period. The current contract

runs until April 2023. A monthly drawdown and reconciliation

against monies advanced is done on a monthly basis as the mine

development continues. The Company generated an EBITDA of US$16.6m

(2021: US$13.4m), but a substantial amount of this was absorbed in

the period by the capex development prepayments as noted above.

As of 30 June 2022, the Company had cash balances of US$1.1m. A

loan in principal has been agreed with Bank Center Credit in

Kazakhstan, there are sufficient projected funds from this and from

current trading to meet the Company's medium term plans. This

includes the repayment of the US$10m bonds that are due for

repayment in December 2022.

Aidar Assaubayev

Chief Executive Officer

26 September 2022

Directors Responsibility Statement and Report on Principal Risks

and Uncertainties

Responsibility statement

The Board confirms to the best of their knowledge, that the

condensed set of financial statements have been prepared in

accordance with the UK-adopted International Accounting Standard

34, 'Interim Financial Reporting' and the Disclosure Guidance and

Transparency Rules sourcebook of the United Kingdom's Financial

Conduct Authority.

The interim management report includes a fair review of the

information required by:

DTR 4.2.7R of the Disclosure and Transparency Rules, being an

indication of important events that have occurred during the first

six months of the financial year and their impact on the condensed

set of financial statements; and a description of the principal

risks and uncertainties for the remaining six months of the year;

and

DTR 4.2.8R of the Disclosures and Transparency Rules, being

related party transactions that have taken place in the first six

months of the current financial year and that have materially

affected the financial position or performance of the entity during

the period; and any changes in the related party transactions

described in the last annual report that could do so.

The Company's management has analysed the risks and

uncertainties and has in place control systems that monitor daily

the performance of the business via key performance indicators.

Certain factors are beyond the control of the Company such as the

fluctuations in the price of gold and possible political upheaval.

However, the Company is aware of these factors and tries to

mitigate these as far as possible. In relation to the gold price

the Company is pushing to achieve a lower cost base in order to

minimise possible downward pressure of gold prices on

profitability. In addition, it maintains close relationships with

the Kazakhstan authorities in order to minimise bureaucratic delays

and problems.

Risks and uncertainties identified by the Company are set out on

page 9 and 10 of the 2021 Annual Report and Accounts and are

reviewed on an ongoing basis. There have been no significant

changes in the first half of 2022 to the principal risks and

uncertainties as set out in the 2020 Annual Report and Accounts and

these are as follows:

-- Fiscal changes in Kazakhstan

-- No access to capital

-- Commodity price risk

-- Currency risk

-- Reliance on operating in one country

-- Reliant on one operating mine

-- Technical difficulties associated with developing the underground mines

at Sekisovskoye and Teren-Sai

-- Failure to achieve production estimates

-- COVID -19 uncertainties

-- Health, safety and environment

The Directors do not expect any changes in the principal risks

for the remaining six months of the financial year.

Aidar Assaubayev

Chief Executive Officer

26 September 2022

ALTYNGOLD PLC

Consolidated statement of profit or loss -- six months to 30 June 2022

Six months Six months

ended 30 June ended 30 June

2022 2021

Unaudited Unaudited

US$'000 US$'000

Revenue 32,095 23,009

Cost of sales (15,137) (9,037)

Gross profit 16,958 13,972

Administrative expenses (2,714) (2,757)

Operating profit 14,244 11,215

Foreign exchange (954) (278)

Finance expense (1,734) (1,676)

Profit before taxation 11,556 9,261

Taxation (689) (510)

Profit attributable to equity shareholders 10,867 8,751

Profit per ordinary share Note

Basic and diluted (US cent) 3 39.76c 32.03c

ALTYNGOLD PLC

Consolidated statement of profit or loss and other comprehensive income

Six months Six months

ended 30 June ended 30 June

2022 2021

unaudited unaudited

(restated)

US$'000 US$'000

Profit for the period 10,867 8,751

Currency translation differences arising on

translations of foreign operations items

which will or may be reclassified to profit

or loss (2,506) (1,493)

Total comprehensive profit for the period 8,361

attributable to equity shareholders 7,258

ALTYNGOLD PLC

Consolidated statement of financial position

Six months Six months

ended 30 June ended 30 June

2022 2021

Notes (unaudited) (audited)

US$'000 US$'000

Non-current assets

Intangible assets 5 12,576 13,016

Property, plant and equipment 6 34,130 33,163

Other receivables 7 10,348 5,996

Deferred tax asset 6,936 4,026

Restricted cash 35 13

64,025 56,214

Current assets

Inventories 10,775 8,522

Trade and other receivables 7 21,536 12,874

Cash and cash equivalents 1,148 3,478

33,459 24,874

Total assets 97,484 81,088

Current liabilities

Trade and other payables (6,030) (6,111)

Provisions (250) (186)

Borrowings 10 (19,374) (3,238)

(25,654) (9,535)

Net current assets 7,805 15,339

Non-current liabilities

Other financial liabilities &

payables (450) (388)

Provisions (5,488) (5,082)

Borrowings 10 (5,366) (23,490)

(11,304) (28,960)

Total liabilities (36,958) (38,495)

Net assets 60,526 42,593

Equity

Called-up share capital (4,267) (4,267)

Share premium (152,839) (152,839)

Merger reserve 282 282

Other reserve - (333)

Currency translation reserve 56,958 54,452

Accumulated loss 39,340 60,112

Total equity (60,526) (42,593)

The financial information was approved and authorised for issue

by the Board of Directors on 26 September 2022 and was signed on

its behalf by:

Aidar Assaubayev -- Chief Executive Officer

ALTYNGOLD PLC

Consolidated statement of changes of equity

Share

Currency based

Share Share Merger translation payment Other Accumulated

capital premium reserve reserve reserve reserves losses Total

Unaudited US$'000 US$'000 US'000 US$'000 US$'000 US$'000 US$'000 US$'000

At 1 January 2022 4,267 152,839 (282) (51,412) - - (50,207) 55,205

Profit for the

period - - - - - - 10,867 10,867

Exchange

differences on

translating

foreign

operations - - - (5,546) - - (5,546)

Total

comprehensive

income for the

period - - - (5,546) - - 10,867 5,321

At 30 June 2022 4,267 152,839 (282) (56,958) - - (39,340) 60,526

Unaudited US$'000 US$'000 US'000 US$'000 US$'000 US$'000 US$'000 US$'000

At 1 January 2021 4,267 152,839 (282) (52,959) - 333 (68,863) 35,335

Profit for the

period - - - - - - 8,751 8,751

Exchange

differences on

translating

foreign

operations - - - (1,493) - - (1,493)

Total

comprehensive

income for the

period - - - (1,493) - - 8,751 7,258

At 30 June 2021 4,267 152,839 (282) (54,452) - 333 (60,112) 42,593

Audited US$'000 US$'000 US'000 US$'000 US$'000 US$'000 US$'000 US$'000

At 1 January 2021 4,267 152,839 (282) (52,959) - 333 (68,863) 35,335

Profit for the

year - - - - - - 18,323 18,323

Exchange

differences on

translating

foreign

operations - - - 1,547 - - 1,547

Total

comprehensive

income - - - 1,547 - - 18,323 19,870

Transfer to

reserves - - 2 - - (333) 333 -

At 31 December

2021 4,267 152,839 (282) (51,412) - - (50,207) 55,205

ALTYNGOLD PLC

Consolidated statement of cash flows

Six months ended Six months ended

30 June 2022 30 June 2021

(unaudited) (unaudited)

Note US$'000 US$'000

Net cash inflow from operating

activities 8 13,622 1,819

Investing activities

Purchase of property, plant and

equipment *(11,805) *(2,133)

Acquisition of intangible assets (189) (375)

Net cash used in investing

activities (11,994) (2,508)

Financing activities

Loans received - 4,641

Loans repaid (2,668) (6,518)

Interest paid (1,282) (1,120)

Net cash flow decrease from

financing activities (3,950) (2,997)

Decrease in cash and cash

equivalents (2,322) (3,686)

Cash and cash equivalents at the

beginning of the period 3,598 7,154

Effect of exchange rate

fluctuations on cash held (128) 10

Cash and cash equivalents at end

of the period 1,148 3,478

* Cash paid to purchase property, plant and equipment represents

additions of US4.9m (2021 :US$4.2m) (note 6) plus the cash amounts

paid as a result of the net increase in prepayments/payables of

US$6.9m from the prior year.(2021 a net decrease in

prepayments/payables of $2.1m).

ALTYNGOLD PLC

Notes to the consolidated financial information

1. Basis of preparation

General

AltynGold Plc (the "Company") is a Company incorporated in

England and Wales under the Companies Act 2006. The address of its

registered office, and place of business of the Company and its

subsidiaries is set out within the Company information at the end

of this interim report.

The Company is registered and domiciled in England and Wales,

whose shares are publicly traded on the London Stock Exchange. The

interim financial results for the period ended 30 June 2022 are

unaudited. The financial information contained within this report

does not constitute statutory accounts as defined by Section 434(3)

of the Companies Act 2006.

This interim financial information of the Company and its

subsidiaries ("the Group") for the six months ended 30 June 2022

have been prepared, in accordance with the UK-adopted International

Accounting Standard 34, 'Interim Financial Reporting' and the

Disclosure Guidance and Transparency Rules sourcebook of the United

Kingdom's Financial Conduct Authority, and on a basis consistent

with the accounting policies set out in the Group's consolidated

annual financial statements for the year ended 31 December 2021. It

has not been audited, does not include all of the information

required for full annual financial statements, and should be read

in conjunction with the Group's consolidated annual financial

statements for the year ended 31 December 2021 , which has been

prepared in accordance with both "international accounting

standards in conformity with the requirements of the Companies Act

2006" and "international financial reporting standards adopted

pursuant to Regulation (EC) No 1606/2002 as it applies in the

European Union".

These interim financial statements do not comprise statutory

accounts within the meaning of section 434 of the Companies Act

2006. Statutory accounts for the year ended 31 December 2021 were

approved by the board of directors on 24 June 2022 and delivered to

the Registrar of Companies. The report of the auditors on those

accounts was qualified in relation to not obtaining sufficient

audit evidence in relation to a prepayment at the year end. Further

details are available on page 37 of the annual report.

The financial statements have not been reviewed.

The financial information is presented in US Dollars and has

been prepared under the historical cost convention. On 31 December

2021, IFRS as adopted by the European Union at that date was

brought into UK law and became UK adopted international accounting

standards, with future changes being subject to endorsement by the

UK Endorsement Board.

The same accounting policies, presentation and method of

computation together with critical accounting estimates,

assumptions and judgements are followed in this consolidated

financial information as were applied in the Group's latest annual

financial statements except that in the current financial year, the

Group has adopted a number of revised Standards and

Interpretations. However, none of these have had a material impact

on the Group. In addition, the IASB has issued a number of IFRS and

IFRIC amendments or interpretations since the last annual report

was published. It is not expected that any of these will have a

material impact on the Group.

Going concern

Turnover and profitability have continued to grow as the Group

expands production. The Company has made significant payments to

facilitate the capital development of the mine at Sekisovskoye and

for ore extraction services for which the contract runs to April

2023. These prepayments will be offset as production and capital

development continues during the year.

At the period end the Group had cash resources of US$1.1m (31

December 2021: US$3.6m). The Board have reviewed the Group's cash

flow forecasts for the period to December 2023. The forecasts are

based on the current approved budgets taking into account any

adjustments from current trading. The principal capital costs and

to a large extent the mining costs of ore extraction have now been

made and the Directors are of the opinion that the current cash

balances and cash generated from operations will be sufficient for

the Group to meet its cash flow requirements. In addition, the

Group are in the final stages of agreeing a US$40m loan facility

for further capital development.

The Board have considered at the period end possible stress case

scenarios that they consider may likely impact the Group's

operations, financial position and forecasts, such as factors

impacting the production and possible falls in gold prices. From

the analysis undertaken the Board have concluded that the Group

will be able to continue to trade based on its existing resources.

The stress tests included a drop in the gold price of 10% from the

current gold price and budgeted production by 10%, in both

scenarios and combination of both together it was concluded that

the Group had sufficient cash reserves to continue to operate. The

Board therefore considers it appropriate to adopt the going concern

basis of accounting in preparing these financial statements.

2. Segmental information

Operating segments are reported in a manner consistent with the

internal reporting provided to the chief operating decision maker.

The chief operating decision maker, who is responsible for

allocating resources and assessing performance of the operating

segments and making strategic decision, has been identified as the

Board of Directors.

The Board of Directors consider there to be two operating

segments, the exploration and development of mineral resources at

Sekisovskoye and at Teren-Sai, both based in one geographical

segment, being Kazakhstan. All sales were made in Kazakhstan from

the mine at Sekisovskoye. However, in relation to Teren-Sai as

there is discrete financial information available and the assets

account for greater than 10% of the combined total assets of all

segments it is a separate operating segment.

Teren-Sai is an exploration asset, details of the carrying value

of the asset are shown in note 5.

3. Profit per ordinary share

Basic profit per share is calculated by dividing the profit

attributable to ordinary shareholders by the weighted average

number of ordinary shares outstanding during the period. The

weighted average number of ordinary shares and retained profit for

the financial period for calculating the basic loss per share for

the period are as follows:

Six months Six months

ended 30 ended 30

June 2022 June 2021

(unaudited) (unaudited)

The basic weighted average number of ordinary

shares in issue during the period 27,332,933 27,332,933

The profit for the period attributable to equity

shareholders (US$'000s) 10,867 8,751

4. Alternative performance measures

The Directors have presented the alternative performance

measures adjusted EBITDA , operating cash cost and total cash cost

as they monitor these performance measures at a consolidated level

and the Directors believe it is relevant in measuring the Group's

performance.

A reconciliation of the alternative performance measures is

shown below.

Adjusted EBITDA, operating cash cost and total cash cost are not

defined performance measures in IFRS. The Group's definition of

adjusted EBITDA may not be comparable with similar titled

performance measures as disclosed by other entities.

Six months Six months

ended 30 June ended 30 June

2022 2021

(unaudited) (unaudited)

Adjusted EBITDA US$000's US $000's

Profit before taxation 11,556 9,261

Adjusted for

Finance expense 1,734 1,676

Depreciation of tangible fixed assets 2,339 2,167

Foreign currency translation 954 278

Adjusted EBITDA 16,583 13,382

Operating cash cost US$ US$

Cost of sales 15,137 9,037

Adjusted for

Depreciation of tangible fixed assets (2,339) (2,167)

12,798 6,870

Gold sold in the period per oz 17,542 12,560

Operating cash cost per oz 729 546

Total cash cost

Cost of sales 15,137 9,037

Adjusted for

Administrative expenses 2,714 2,757

Depreciation of tangible fixed assets (2,339) (2,167)

15,512 9,627

Gold sold in the period per oz 17,542 12,560

Total cash cost per oz 884 766

Exploration and

5. Intangible Teren-Sai evaluation

assets geological data costs US$'000

Cost

1 January 2021 9,026 8,650 17,676

Additions - 830 830

Amortisation

capitalised - 585 585

Currency

translation

adjustment (225) (240) (465)

December 2021 8,801 9,825 18,626

Amortisation

capitalised - 276 276

Additions - 190 190

Currency

translation

adjustment (632) (715) (1,347)

30 June 2022 8,169 9,576 17,745

Accumulated

amortisation

1 January 2021 4,662 165 4,827

Charge for the

period 585 - 585

Currency

translation

adjustment (125) (7) (132)

31 December 2021 5,122 158 5,280

Charge for the

period 276 - 276

Currency

translation

adjustment (375) (12) (387)

30 June 2022 5,023 146 5,169

Net books

values

30 June 2022 3,146 9,430 12,576

31 December 2021 3,679 9,667 13,346

The intangible assets relate to the historic geological

information pertaining to the Teren-Sai ore fields. The ore fields

are located in close proximity to the current open pit and

underground mining operations of Sekisovskoye.

The Company is in the final stages of the renewal of the

licence, an updated and revised application was submitted to the

relevant authorities in July 2022 for an extension to the

exploration licence. The licence is for three years and will

commence on the date the licence is signed, which is expected to be

in Q4 2022. During the period of licence renewal, the company can

continue its exploration activities.

6. Property, plant and equipment

Mining Freehold Plant, Assets under Total

properties land Equipment construction

fixtures

and and

buildings fittings

US$000 US$000 US$000 US$000 US$000

Cost

1 January 2021 13,264 24,050 21,102 1,973 60,389

Additions 3,356 197 2,800 2,187 8,540

Disposals - - (659) - (659)

Transfers - 1, 1,441 - (1,441) -

Transfer -

inventories - - - 170 170

Currency

translation

adjustment (611) (654) (464) (67) (1,796)

31 December

2021 16,009 25,034 22,779 2,822 66,644

Additions 2,076 43 742 2,022 4,883

Disposals - - (54) - (54)

Transfers - - 645 (6531) -

Transfer to

inventories - 1,383 - (500) (500)

Currency

translation

adjustment (1,697) (1,797) (1,689) (342) (5,525)

30 June 2022 16,388 23,280 22,423 3,357 65,448

Accumulated

depreciation

1 January 2021 2,869 11,371 14,057 - 28,297

Charge for the

period 699 2,188 1,599 - 4,486

Disposals - (2) (659) - (661)

Currency

translation

adjustment (218) (238) (372) - (828)

31 December

2021 3.350 13,319 14,625 - 31,294

Charge for the

period 401 1,088 850 - 2,339

Currency

translation

adjustment (254) (985) (1,076) - (2,315)

30 June 2022 3,497 13,422 14,399 - 31,318

Carrying amount

30 June 2022 12,891 9,858 8,024 3,357 34,130

31 December

2021 12,659 11,715 8,154 2,822 35,350

7. Trade and other receivables

Non-current

30 June 31 December

2022 2021

(unaudited) (audited)

US$000's US $000's

VAT recoverable 1,277 1,375

Prepayments- advances to suppliers 9,071 2,550

10,348 3,925

The amount recoverable in relation to Value Added Tax is

expected to be recovered by offset against VAT payable in future

periods.

The advances to suppliers relate to mining services for capital

development of the mine at Sekisovskoye.

Current

30 June 31 December

2022 2021

(unaudited) (audited)

US$000's US $000's

Trade receivables 902 -

VAT recoverable 5,428 5,054

Prepayments - advances to suppliers 11,322 14,500

Prepayments - other 3,929 -

Other receivables 96 2,917

Other receivables/prepayments -- provision (141) (941)

21,536 21,530

The prepayment of advances to suppliers relates to payments for

mining services for the extraction of ore.

8. Notes to the cash flow statement

Six months Six months

ended 30 June ended 30 June

2022 2021

(unaudited) (unaudited)

US$000's US $000's

Profit before taxation 11,556 9,261

Adjusted for

Finance expense 1,734 1,676

Depreciation of tangible fixed assets 2,339 2,167

Increase in inventories (1,809) (2,689)

Increase in trade receivables (1,310) (7,641)

Increase/(decrease) in trade and other

payables 158 (1,233)

Foreign currency translation 954 278

Cash inflow from operations 13,622 1,819

Income taxes - -

13,622 1,819

9. Related party transactions

Remuneration of key management personnel

The remuneration of the Directors, who are the key management

personnel of the Group, is set out below in aggregate for each of

the categories specified in IAS 24 - "Related Party Disclosures".

The total amount remaining unpaid with respect to remuneration of

key management personnel amounted to US$114,000 (31 December 2021

US$122,000).

Six months Six months

ended 30 Ended 30

June 2022 June 2021

US$000 US$000

Short term employee benefits 138 66

Social security costs 9 2

147 68

During the period, the following transactions were connected

with Company's in which the Assaubayev family have a controlling

interest:

-- An amount is owing to Asia Mining Group of US$77,816, (31 December 2021:

US$83,850) and is included within trade payables.

-- Loan amounts due by the Group to Amrita Investments Limited a company

controlled by the Assaubayev family total US$12,000 (31 December 2021

US$12,000).

-- The group made sales to Altyn Group Qazaqstan of US$122,000 the amount is

included with in receivables at the period end.

10 . Borrowings

Six months Year ended

ended 30 June 31 December

2022 2021

(unaudited) (audited)

US$000's US $000's

Current loans and borrowings

Bonds 9,891 9,723

Bank loans 5,354 5,298

Related party loans 12 12

Other borrowings - 54

15,257 15,087

Due one-two years

Bonds - -

Bank loans 3,049 3,546

3,049 3,546

Due two-five years

Bank loans 6,434 8,675

6,434 8,675

Total non-current loans and borrowings 9,483 12,221

Bond Listed on Astana International Exchange

The total number of bonds at the period end amounted to US$10m

at a coupon rate of 9%, the bonds are repayable in December 2022.

At the period end the carrying value approximates to their fair

value.

Bank loans

The bank loans are repayable in instalments and bear interest at

6%-7% on the US$ denominated loans and at 15.5% on the Kazakh

denominated loans.

The bank loans are secured over the assets of the Group.

11. Reserves

A description and purpose of reserves is given below:

Reserve Description and purpose

Amount of the contributions made by shareholders

Share capital in return for the issue of shares.

Share premium Amount subscribed for share capital in excess of

nominal value.

Merger Reserve Reserve created on application of merger

accounting under a previous GAAP.

Currency translation reserve Gains/losses arising on re-translating the net

assets of overseas operations into US Dollars.

Accumulated losses Cumulative net gains and losses recognised in

the consolidated statement of financial

position.

12. Events after the balance sheet date

In July 2022 the Company agreed in principal a US$40m loan from

Bank Center Credit in Kazakhstan, the loan facility is expected to

be signed and details agreed during Q4 2022.

An extension for the licence at Teren-Sai has been applied for

in July 2022 to continue exploration works for a further three

years.

ALTYNGOLD PLC

Company information

Directors Kanat Assaubayev Chairman

Aidar Assaubayev Chief executive officer

Sanzhar Assaubayev Executive director

Ashar Qureshi Non-executive director

Andrew Terry Non-executive director

Maryam Buribayeva Non-executive director

Victor Shkolnik Non-executive director

Secretary Rajinder Basra

Registered office and Company number: 05048549

number

28 Eccleston Square

London

SW1V 1NZ

Telephone: +44 208 932

2455

Company website www.altyngold.uk

Kazakhstan office 10 Novostroyevskaya

Sekisovskoye Village

Kazakhstan

Telephone: +7 (0) 72331

27927

Fax: +7 (0) 72331 27933

Auditor BDO LLP,

55 Baker Street,

London W1U 7EU

Registrars Neville Registrars

Neville House

Steelpark Road

Halesowen

West Midlands B62 8HD

Telephone: +44 (0) 121

585 1131

Bankers NatWest Bank plc

London City Commercial

Business Centre

7th Floor, 280

Bishopsgate

London

EC2M 4RB

LTG Bank AG

Herrengasse 12

FL-9490, Vaduz

Principal of

Liechtenstein

View source version on businesswire.com:

https://www.businesswire.com/news/home/20220925005040/en/

CONTACT:

AltynGold Plc

SOURCE: AltynGold Plc

Copyright Business Wire 2022

(END) Dow Jones Newswires

September 26, 2022 02:00 ET (06:00 GMT)

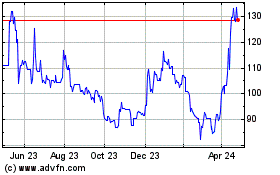

Altyngold (LSE:ALTN)

Historical Stock Chart

From Apr 2024 to May 2024

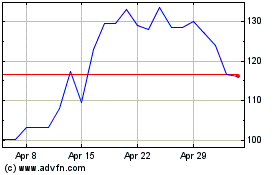

Altyngold (LSE:ALTN)

Historical Stock Chart

From May 2023 to May 2024