APQ Global Limited Book Value Report (3517X)

20 December 2023 - 4:00AM

UK Regulatory

TIDMAPQ

RNS Number : 3517X

APQ Global Limited

19 December 2023

APQ Global Limited

("APQ Global" or the "Company")

Book value report

APQ Global is a company incorporated in Guernsey (company

registration number 62008) which is listed on The International

Stock Exchange and admitted to trading on AIM.

The Company hereby announces that as at the close of business on

30(th) November 2023, the unaudited book value per Ordinary Share

was 06.93 US Dollar cents, equivalent to 05.48 Pounds Sterling

pence.

- End -

Enquiries:

ir@apqglobal.com

IMPORTANT INFORMATION

Important Notice:

*The term 'book value' herein includes the assets of APQ Global

and its subsidiaries net of any liabilities. The figure in this

announcement is an estimate and is based on unaudited estimated

valuations in accordance with the Company's valuation policy as

stated in the Company's AIM Admission Document. The Group has

measured its private investments in accordance with IFRS 9

Financial Instruments. In September 2017, APQ Global Ltd issued

4,018 units of GBP5,000 nominal 3.5 per cent convertible unsecured

loan stock 2024 ("CULS") to raise GBP20.09 million. In January

2018, APQ Global Ltd issued a further 1,982 CULS units at a price

of GBP5,150 per GBP5,000 nominal to raise GBP10.21 million. Under

IFRS, the CULS is a financial instrument and has been accounted for

under IAS 32 Financial Instruments: Presentation and IFRS 9 (as

effective for periods beginning on or after 1st January 2018).

Therefore, the fair value of the CULS liability component has been

calculated, with the difference between this and the fair value of

the compound financial instrument as a whole being taken to equity.

Following completion of the buy back and cancellation of CULS in

April 2023, there are currently 5,920 units of CULS outstanding.

Additionally, on January 28th, 2020, the Group issued 1,000,000

Warrants and 268,000 Convertible Preference Shares (CPS). In

October 2021, the Group entered into an agreement to repurchase the

entire amount of CPS and cancel all of the warrants outstanding.

Under IFRS, the Warrants and the CPS were also Financial

Instruments and were accounted for per the above guidance. This

figure also includes the amounts awarded in accordance with the

Company's Share-Based compensation scheme as adopted by the board

on 19th April 2017 and accounted for in accordance with IFRS 2.

Shares awarded under the scheme vest quarterly across 5 years. As

of 30(th) November 2023, the total shares issued under the scheme

amounted to 504,983.

Estimated results, performance or achievements may differ

materially from any actual results, performance or achievements. No

person has authority to give any representations or warranties

(express or implied) as to, or in relation to, the accuracy,

reliability or completeness of the information in this release, and

all liability therefore is expressly disclaimed. Accordingly, none

of the Company, the Corporate Services Provider or any of its/their

respective members, directors, officers, agents, employees or

advisers take any responsibility for, or will accept any liability

whether direct or indirect, express or implied, contractual,

tortious, statutory or otherwise, in respect of, the accuracy or

completeness of the information or for any loss, howsoever arising,

from the use of this release. Except as required by applicable law,

the Company expressly disclaims any obligations to update or revise

the above estimates to reflect any change in expectations, new

information, subsequent events or otherwise.

Notes to Editors

APQ Global Limited

APQ Global (ticker: APQ LN) is an investment company

incorporated in Guernsey. The Company focuses its investment

activities globally (in Asia, Latin America, Eastern Europe, the

Middle East, Africa and the Channel Islands, particularly).

The objective of the Company is to steadily grow its earnings to

seek to deliver attractive returns and capital growth through a

combination of building growing businesses as well as earning

revenue from income generating operating activities in capital

markets [1] . APQ Global run a well-diversified and liquid

portfolio, take strategic stakes in selected businesses and plan to

take operational control of companies through the acquisition of

minority and majority stakes in companies with a focus on emerging

markets.

(1) Where we refer to revenue from income generating operating

activities this relates to the revenue of our investee

companies.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCZKLFFXLLEFBV

(END) Dow Jones Newswires

December 19, 2023 12:00 ET (17:00 GMT)

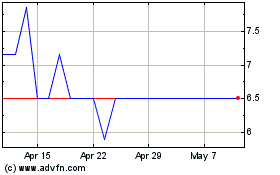

Apq Global (LSE:APQ)

Historical Stock Chart

From Nov 2024 to Dec 2024

Apq Global (LSE:APQ)

Historical Stock Chart

From Dec 2023 to Dec 2024