TIDMAURR

RNS Number : 0933V

Aurrigo International PLC

29 November 2023

THIS ANNOUNCEMENT AND THE INFORMATION CONTAINED HEREIN IS

RESTRICTED AND IS NOT FOR PUBLICATION, RELEASE OR DISTRIBUTION,

DIRECTLY OR INDIRECTLY, IN WHOLE OR IN PART, IN, INTO OR FROM THE

UNITED STATES OF AMERICA, ITS TERRITORIES AND POSSESSIONS, ANY

STATE OF THE UNITED STATES OR THE DISTRICT OF COLUMBIA

(COLLECTIVELY, THE "UNITED STATES"), AUSTRALIA, CANADA, JAPAN, THE

REPUBLIC OF SOUTH AFRICA OR ANY OTHER JURISDICTION IN WHICH SUCH

PUBLICATION, RELEASE OR DISTRIBUTION WOULD BE UNLAWFUL.

THE COMMUNICATION OF THIS ANNOUNCEMENT AND ANY OTHER DOCUMENTS

OR MATERIALS RELATING TO THE RETAIL OFFER AS A FINANCIAL PROMOTION

IS ONLY BEING MADE TO, AND MAY ONLY BE ACTED UPON BY, THOSE PERSONS

IN THE UNITED KINGDOM FALLING WITHIN ARTICLE 43 OF THE FINANCIAL

SERVICES AND MARKETS ACT 2000 (FINANCIAL PROMOTION) ORDER 2005, AS

AMED (WHICH INCLUDES AN EXISTING MEMBER OF AURRIGO INTERNATIONAL

PLC). ANY INVESTMENT OR INVESTMENT ACTIVITY TO WHICH THIS

ANNOUNCEMENT RELATES IS AVAILABLE ONLY TO SUCH PERSONS AND WILL BE

ENGAGED IN ONLY WITH SUCH PERSONS.

29 November 2023

Aurrigo International plc

("Aurrigo" or the "Company")

Result of Retail Offer

Further to the announcement made by the Company on 16 November

2023, Aurrigo International plc (AIM: AURR), a leading

international provider of transport technology solutions, announces

that it has raised gross proceeds of GBP176,255 pursuant to its

retail offer via the BookBuild Platform from existing retail

shareholders ("Retail Offer"). Subject to the Retail Offer becoming

unconditional, a total of 176,255 new ordinary shares of GBP0.002

each ("Retail Offer Shares") will be issued at 100 pence per Retail

Offer Share ("Issue Price"). In addition, the Company has raised

GBP100,000 by way of a direct subscription for 100,000 new Ordinary

Shares ("Subscription Shares" and together with the Retail Offer

Shares the "New Ordinary Shares") at the Issue Price (the

"Subscription").

Consequently, an application has been made to the London Stock

Exchange for the admission of, in aggregate, 276,255 New Ordinary

Shares to trading on AIM ("Admission"). Admission and dealings in

the New Ordinary Shares are expected to take place at 8.00 a.m. on

or around 1 December 2023.

The Retail Offer and Subscription is conditional (amongst other

things) upon Admission and completion of the Placing announced on

15 November 2023, which is expected to take place at 8.00 a.m. on

or around 1 December 2023.

The New Ordinary Shares, when issued, will be fully paid and

will rank pari passu in all respects with the existing Ordinary

Shares, including the right to receive all dividends and other

distributions declared, made or paid after the date of issue.

Following Admission, the Company's enlarged issued ordinary

share capital will be 45,782,922. This figure may be used by

shareholders in the Company as the denominator for the calculations

by which they will determine if they are required to notify their

interest in, or a change in their interest in, the share capital of

the Company under the FCA's Disclosure Guidance and Transparency

Rules.

For further enquiries:

Aurrigo International plc Via Instinctif

David Keene, Chief Executive Officer

Graham Keene, Director of Corporate Development

Ian Grubb, Chief Financial Officer

Singer Capital Markets (Nominated Adviser,

Sole Broker and Retail Offer Coordinator)

Phil Davies, Rick Thompson, Jalini Kalaravy +44 (0)20 7496 3000

Instinctif Partners (Financial Communications) +44 (0)20 7457 2020

Rozi Morris, Tim McCall, Isadora Pegler aurrigo@instinctif.com

Important Notices

The content of this announcement has been prepared by, and is

the sole responsibility of, the Company.

The Retail Offer is only open to investors in the United Kingdom

who fall within Article 43 of the Financial Services and Markets

Act 2000 (Financial Promotion) Order 2005, as amended (which

includes an existing member of the Company).

This announcement and the information contained herein is

restricted and is not for publication, release or distribution,

directly or indirectly, in whole or in part, in or into or from the

United States (including its territories and possessions, any state

of the United States and the District of Columbia (the "United

States" or "US")), Australia, Canada, Japan, the Republic of South

Africa or any other jurisdiction where to do so might constitute a

violation of the relevant laws or regulations of such

jurisdiction.

The Retail Offer Shares have not been and will not be registered

under the US Securities Act of 1933, as amended (the "US Securities

Act") or under the applicable state securities laws of the United

States and may not be offered or sold directly or indirectly in or

into the United States or to or for the account or benefit of any

US person (within the meaning of Regulation S under the US

Securities Act) (a "US Person"). No public offering of the Retail

Offer Shares is being made in the United States. The Retail Offer

Shares are being offered and sold outside the United States in

"offshore transactions", as defined in, and in compliance with,

Regulation S under the US Securities Act. In addition, the Company

has not been, and will not be, registered under the US Investment

Company Act of 1940, as amended.

This announcement does not constitute an offer to sell or issue

or a solicitation of an offer to buy or subscribe for Retail Offer

Shares in the United States, Australia, Canada, Japan, the Republic

of South Africa or any other jurisdiction in which such offer or

solicitation is or may be unlawful. No public offer of the

securities referred to herein is being made in any such

jurisdiction.

The distribution of this announcement may be restricted by law

in certain jurisdictions and persons into whose possession any

document or other information referred to herein comes should

inform themselves about and observe any such restriction. Any

failure to comply with these restrictions may constitute a

violation of the securities laws of any such jurisdiction.

Singer Capital Markets Securities Limited ("Singer"), which is

authorised and regulated in the United Kingdom by the FCA is acting

exclusively for the Company and no-one else in connection with the

transactions and arrangements described in this announcement and

will not regard any other person (whether or not a recipient of

this announcement) as a client in relation to the transactions and

arrangements described in this announcement. Singer is not

responsible to anyone other than the Company for providing the

protections afforded to clients of Singer or for providing advice

in connection with the contents of this announcement, or the

transactions and arrangements described in this announcement.

The value of Ordinary Shares and the income from them is not

guaranteed and can fall as well as rise due to stock market

movements. When you sell your investment, you may get back less

than you originally invested. Figures refer to past performance and

past performance is not a reliable indicator of future results.

Returns may increase or decrease as a result of currency

fluctuations.

Certain statements in this announcement are forward-looking

statements which are based on the Company's expectations,

intentions and projections regarding its future performance,

anticipated events or trends and other matters that are not

historical facts. These forward-looking statements, which may use

words such as "aim", "anticipate", "believe", "intend", "estimate",

"expect" and words of similar meaning, include all matters that are

not historical facts. These forward-looking statements involve

risks, assumptions and uncertainties that could cause the actual

results of operations, financial condition, liquidity and dividend

policy and the development of the industries in which the Company's

businesses operate to differ materially from the impression created

by the forward-looking statements. These statements are not

guarantees of future performance and are subject to known and

unknown risks, uncertainties and other factors that could cause

actual results to differ materially from those expressed or implied

by such forward-looking statements. Given those risks and

uncertainties, prospective investors are cautioned not to place

undue reliance on forward-looking statements.

These forward-looking statements speak only as at the date of

this announcement and cannot be relied upon as a guide to future

performance. The Company and Singer expressly disclaim any

obligation or undertaking to update or revise any forward-looking

statements contained herein to reflect actual results or any change

in the assumptions, conditions or circumstances on which any such

statements are based unless required to do so by the Financial

Conduct Authority, London Stock Exchange plc or applicable law.

The information in this announcement is for background purposes

only and does not purport to be full or complete. None of Singer or

any of their respective affiliates, accepts any responsibility or

liability whatsoever for, or makes any representation or warranty,

express or implied, as to this announcement, including the truth,

accuracy or completeness of the information in this announcement

(or whether any information has been omitted from the announcement)

or any other information relating to the Company or associated

companies, whether written, oral or in a visual or electronic form,

and howsoever transmitted or made available or for any loss

howsoever arising from any use of the announcement or its contents

or otherwise arising in connection therewith. Singer and their

respective affiliates, accordingly disclaim all and any liability

whether arising in tort, contract or otherwise which they might

otherwise be found to have in respect of this announcement or its

contents or otherwise arising in connection therewith.

Any indication in this announcement of the price at which the

Ordinary Share have been bought or sold in the past cannot be

relied upon as a guide to future performance. Persons needing

advice should consult an independent financial adviser. No

statement in this announcement is intended to be a profit forecast

and no statement in this announcement should be interpreted to mean

that earnings or target dividend per share of the Company for the

current or future financial years would necessarily match or exceed

the historical published earnings or dividends per share of the

Company.

Neither the content of the Company's website (or any other

website) nor the content of any website accessible from hyperlinks

on the Company's website (or any other website) is incorporated

into or forms part of this announcement. The Retail Offer Shares to

be issued or sold pursuant to the Retail Offer will not be admitted

to trading on any stock exchange other than the AIM market of

London Stock Exchange plc.

Information to Distributors

UK Product Governance Requirements

Solely for the purposes of the product governance requirements

of Chapter 3 of the FCA Handbook Product Intervention and Product

Governance Sourcebook (the "UK MiFIR Product Governance

Requirements"), and disclaiming all and any liability, whether

arising in tort, contract or otherwise, which any "manufacture"

(for the purposes of the UK MiFIR Product Governance Requirements)

may otherwise have with respect thereto, the Retail Offer Shares

have been subject to a product approval process, which has

determined that the Retail Offer Shares are: (i) compatible with an

end target market of retail investors and investors who meet the

criteria of professional clients and eligible counterparties, each

as defined in paragraphs 3.5 and 3.6 of COBS; and (ii) eligible for

distribution through all permitted distribution channels (the

"Target Market Assessment"). Notwithstanding the Target Market

Assessment, distributors should note that: the price of the Retail

Offer Shares may decline and investors could lose all or part of

their investment; the Retail Offer Shares offer no guaranteed

income and no capital protection; and an investment in the Retail

Offer Shares is compatible only with investors who do not need a

guaranteed income or capital protection, who (either alone or in

conjunction with an appropriate financial or other adviser) are

capable of evaluating the merits and risks of such an investment

and who have sufficient resources to be able to bear any losses

that may result therefrom. The Target Market Assessment is without

prejudice to any contractual, legal or regulatory selling

restrictions in relation to the Retail Offer.

For the avoidance of doubt, the Target Market Assessment does

not constitute: (a) an assessment of suitability or appropriateness

for the purposes of Chapters 9A or 10A respectively of COBS; or (b)

a recommendation to any investor or group of investors to invest

in, or purchase, or take any other action whatsoever with respect

to the Retail Offer Shares. Each distributor is responsible for

undertaking its own target market assessment in respect of the

Retail Offer Shares and determining appropriate distribution

channels.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ROIFEWFFUEDSELF

(END) Dow Jones Newswires

November 29, 2023 07:00 ET (12:00 GMT)

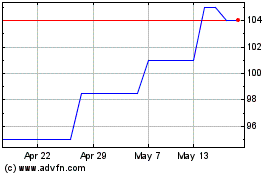

Aurrigo (LSE:AURR)

Historical Stock Chart

From Dec 2024 to Jan 2025

Aurrigo (LSE:AURR)

Historical Stock Chart

From Jan 2024 to Jan 2025