Immediate Acquisition PLC Update: proposed acquisition of Fiinu Holdings Ltd (0515P)

16 June 2022 - 3:14AM

UK Regulatory

TIDMIME

RNS Number : 0515P

Immediate Acquisition PLC

15 June 2022

This announcement is for information purposes only and does not

constitute or contain any invitation, solicitation, recommendation,

offer or advice to any person to subscribe for, otherwise acquire

or dispose of any securities in Immediate Acquisition Plc or any

other entity in any jurisdiction. Neither this announcement nor the

fact of its distribution shall form the basis of, or be relied on

in connection with, any investment decision in Immediate

Acquisition Plc.

The information contained within this announcement is deemed by

the Company to constitute inside information stipulated under the

Market Abuse Regulation (EU) No. 596/2014 which forms part of

English law by virtue of the European Union (Withdrawal) Act 2018,

as amended. Upon the publication of this announcement via the

Regulatory Information Service, this inside information is now

considered to be in the public domain.

15 June 2022

Immediate Acquisition Plc

("IME" or "the Group" or "the Company")

Update on the proposed acquisition of Fiinu Holdings Ltd

The Directors of Immediate Acquisition Plc (AIM: IME) are

pleased to announce that, further to the close of the accelerated

bookbuild ("ABB") and temporary suspension of trading announcement

earlier today, the Company has now entered into the Sale and

Purchase Agreements for the proposed acquisition of Fiinu Holdings

Ltd ("Proposed Acquisition"), which constitutes a reverse takeover

under the AIM Rules. In addition it has entered into the Placing

and Loan Facility Agreement together with the Relationship and Lock

in Agreements. Details of all these agreements will be included in

the Admission Document, together with a Notice of a General Meeting

which is to be convened to approve, inter alia, the Proposed

Acquisition, the Rule 9 waiver of the City Code on Takeovers and

Mergers, the Placing and the proposed change of name.

Loan Facility Agreement

The Company has entered into a GBP2.49 million loan facility

agreement (the "Loan Facility") with Dewscope Limited, a company

controlled by Mark Horrocks, a non-executive director of the

Company. The Loan Facility is for two years, unsecured and will

attract interest at 12.5% on amounts drawn (paid monthly in

arrears). In addition, there is a 2% arrangement fee and a 3%

drawdown fee on each tranche (with a minimum tranche size of

GBP250,000). The Loan Facility will be utilised to provide

additional working capital for the Enlarged Group.

The Loan Facility is a related party transaction for the

purposes of the AIM Rules. The Company's independent directors,

being Tim Hipperson and Simon Leathers, having consulted with the

Company's nominated adviser SPARK Advisory Partners Limited,

consider that the terms of the Loan Facility are fair and

reasonable insofar as the Company's shareholders are concerned.

In addition, the Company sold its entire shareholding in

Audioboom Group plc shares yesterday for a consideration of

approximately GBP0.95 million in cash.

The Admission Document, Notice of General Meeting and Form of

Proxy are expected to be published and posted to shareholders

today.

Further announcements will be made as appropriate.

For further information please contact:

Immediate Acquisition Plc Tel: +44 (0) 203 515 0233

Tim Hipperson, Non-executive Chairman

Simon Leathers, Non-executive Director

SPARK Advisory Partners Limited (Nomad) Tel: +44 (0) 203 368 3550

Mark Brady

Neil Baldwin

SP Angel Corporate Finance LLP (Broker) Tel: +44 (0) 207 470 0470

Matthew Johnson

Abigail Wayne

Buchanan Communications Tel: +44 (0) 207 466 5000

Chris Lane / Kim van Beeck

Expected Timetable of Principal Events

Publication of the Admission Document 15 June 2022

Latest time and date for receipt of CREST 29 June 2022

voting intentions

Latest time and date for receipt of Forms 10.00 a.m. on 29 June

of Proxy 2022

Time and date of the General Meeting 10.00 a.m. on 1 July

2022

Expected date for change of name to become Anticipated within

effective five Business

Days of the General

Meeting

Expected date of confirmation of Banking anticipated within

Licence to Fiinu by FCA & PRA five Business

Days of the date of

the General

Meeting

Expected completion of Acquisition of Fiinu, anticipated to be

issue of the New Ordinary 8.00 a.m. on or

Shares, re-admission of the Enlarged Issued about the Business

Share Capital and Day following

commencement of dealings on AIM confirmation of the

Banking

Licence

Expected date for New Ordinary Shares to anticipated to be

be credited to CREST accounts 8.00 a.m. on or

about the Business

Day following

confirmation of the

Banking

Licence

Despatch of definitive certificates for within 14 days of

New Ordinary Shares Admission

All of the above timings refer to UK time. All future times

and/or dates referred to above are subject to change at the

discretion of the Company and SPARK.

Any changes to the above dates and times will be communicated by

the Company via RIS announcements.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCMZGMVNKFGZZM

(END) Dow Jones Newswires

June 15, 2022 13:14 ET (17:14 GMT)

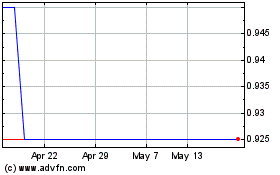

Fiinu (LSE:BANK)

Historical Stock Chart

From Nov 2024 to Dec 2024

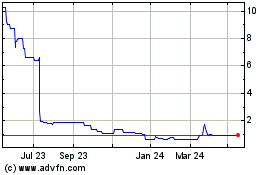

Fiinu (LSE:BANK)

Historical Stock Chart

From Dec 2023 to Dec 2024