TIDMBANK

RNS Number : 9911S

Fiinu PLC

15 March 2023

15 March 2023

Fiinu Plc

("Fiinu", the "Company" or the "Group")

Fundraising, Issue of Equity, Related Party Transactions and

TVR

Fiinu (AIM: BANK), a fintech company including the fully owned

Fiinu Bank Limited, creator of the Plugin Overdraft(R), announces

that it has conditionally raised up to GBP6.49 million, before

costs, ("Fundraising") in new equity funding ("New Ordinary

Shares") subject, inter alia, to admission of the New Ordinary

Shares to trading on the AIM Market of the London Stock Exchange

("Admission").

This Fundraising is split into three components:

-- An immediate subscription ("Subscription") of 3,846,155 New

Ordinary Shares at an issue price of 13 pence per New Ordinary

Share to new and existing shareholders to raise approximately

GBP0.5 million;

-- The proposed conversion of the existing GBP2.49 million loan

facility with Dewscope Limited ("Dewscope") ("Dewscope Loan"), of

which GBP1.99 million remains undrawn, into up to 19,153,847 New

Ordinary Shares, at a price of 13 pence per New Ordinary Share.

This conversion, which is by way of a further agreement with

Dewscope entered into on 14 March 2023, is expected to occur in

tranches following draw down, at the Company's option, between now

and the end of June 2023; and

-- GBP3.5 million draw down from a new three year share

subscription facility agreement ("Subscription Facility"), with GEM

Global Yield LLC SCS and GEM Yield Bahamas Limited (together

"GEM"), which has a total maximum draw down potential of up to

GBP40.0 million, at a price per New Ordinary Share determined on

the date of subscription, but with a condition in respect of this

initial GBP3.5 million draw down that the issue price must not fall

below 10p per New Ordinary Share, therefore the maximum number of

New Ordinary Shares that could be issued to GEM pursuant to the

initial draw down is 35,000,000. It is expected that this issue of

New Ordinary Shares to GEM and Admission, will take place in early

May 2023.

The New Ordinary Shares issued in respect of the Subscription

and conversion of the Dewscope Loan will be issued with new

three-year warrants ("Warrants") that are exercisable at 20 pence

per share into new ordinary shares in the Company at the ratio of 1

Warrant for every 19 New Ordinary Shares issued by the Company

(making a total of up to 1,210,526 Warrants). These Warrants

expire, unless exercised, three years after being issued, will not

be admitted to trading on AIM (although the underlying ordinary

shares upon exercise shall be) and may be re-priced in certain

circumstances during the three-year period.

In consideration of entering into the Subscription Facility, the

Company has issued 17 million warrants to GEM ("GEM Warrants") with

an expiry date of 15 March 2026, that are exchangeable into new

ordinary shares with an exercise price of 20 pence per share. The

GEM Warrants (which will not be admitted to trading on AIM,

although the underlying ordinary shares upon exercise shall be) are

transferable at GEM's option and may be re-priced in certain

circumstances during the three-year period.

Further details of all these arrangements are set out below.

This Fundraising, which forms part of the Company's anticipated

further funding requirements announced on 26 January 2023, will be

drawn down between now and the end of June 2023, subject to

Admission. All the New Ordinary Shares issued will rank pari passu

with existing shares (save for the Warrants and GEM Warrants above)

and will rank as qualifying CET1 regulatory capital. Further

announcements will be made as New Ordinary Shares are issued and

Admission occurs.

The proposed Fundraising and regulatory capital plan has been

shared with the Prudential Regulation Authority ("PRA"([1]) ).

Commenting on the Fundraising, Chris Sweeney, CEO of Fiinu,

said:

"As we progress through the next phase of our mobilisation plan,

this initial tranche of the overall funding requirement previously

outlined, further de-risks the business as it executes on its plans

for its subsidiary, Fiinu Bank Limited, to become a fully licenced

bank which is anticipated to take place in summer 2023, subject to

regulatory approval and funding. We are thankful to Dewscope, GEM

and to all our investors for their continued support."

Further Information on the Subscription

The Company has agreed to issue 3,846,155 New Ordinary Shares at

an issue price of 13 pence per New Ordinary Share to new and

existing shareholders to raise approximately GBP0.5 million. The

New Ordinary Shares, will be issued with 1 Warrant for every 19 New

Ordinary Shares issued by the Company with an exercise price of 20p

per new ordinary share. These Warrants (approximately 202,429)

expire, unless exercised, three years after being issued and will

not be admitted to trading on AIM (although the underlying ordinary

shares upon exercise shall be).

In respect of the Warrants, on the first anniversary of the

Subscription, if the share price of the Company is less than 90% of

the exercise price of 20 pence, the original exercise price can be

adjusted to a figure equating to 110% of the market price

prevailing at that time. In addition, the exercise price of the

Warrants and the number of warrant shares can be adjusted from time

to time in a limited number of circumstances, such as a change in

the nominal value of the Company's ordinary shares, further issues

of ordinary shares, bonus issues or capital distributions.

Up to 3 million New Ordinary Shares have been placed with

clients of Intrinsic Capital LLP, where Mark Horrocks (a former

Director of the Company and owner of Dewscope) is both a partner

and a client. As part of the Subscription, Mr Horrocks will

subscribe for 1,457,693 New Ordinary Shares.

Further information on the Dewscope loan conversion

On 15 June 2022, the Company entered into an unsecured facility

agreement ("Dewscope Loan Agreement") with Dewscope (a company of

which Mark Horrocks is a director and is an indirect beneficiary),

pursuant to which Dewscope agreed to make available a loan facility

of up to GBP2.49 million for a period of two years (the

"availability period"). The Company agreed to pay Dewscope an

arrangement fee in cash of 2% of the maximum facility amount and 3%

on each tranche draw down with a minimum tranche size of

GBP250,000. The Company is entitled to draw down amounts under this

facility at its discretion on notice to Dewscope. Interest is

payable on amounts drawn down at a rate of 12.5% per annum, paid

monthly in arrears. The facility is unsecured.

On 15 November 2022, GBP500,000 of the Dewscope Loan was drawn

down by the Company.

On 14 March 2023, the Company entered into a further agreement

with Dewscope ("Conversion Agreement") that allows for the Company

to elect to convert all or part of the GBP2.49 million of the

Dewscope Loan into New Ordinary Shares at a subscription price of

13 pence per New Ordinary Share. If the whole amount of the

Dewscope Loan was converted, the maximum number of New Ordinary

Shares that could be issued to Dewscope would be up to 19,153,847

New Ordinary Shares.

In addition, new Warrants that are exercisable at 20 pence per

share into new ordinary shares at a ratio of 1 warrant for every 19

ordinary shares issued by the Company, will be issued to Dewscope

on conversion of the Dewscope Loan into New Ordinary Shares. The

maximum number of warrants that could be issued in the event that

the Company draws down upon, and then elects to convert, the entire

loan facility of GBP2.49 million into new ordinary shares would

therefore be up to approximately 1,008,097 Warrants.

In respect of the Warrants, on the first anniversary of entering

into the Conversion Agreement, if the share price of the Company is

less than 90% of the exercise price of 20 pence, the original

exercise price can be adjusted to a figure equating to 110% of the

market price prevailing at that time. In addition, the exercise

price of the Warrants and the number of warrant shares can be

adjusted from time to time in a limited number of circumstances,

such as a change in the nominal value of the Company's ordinary

shares, further issues of ordinary shares, bonus issues or capital

distributions.

The Directors expect that conversion of the Dewscope Loan will

occur between now and June 2023; further announcements will be made

as appropriate.

By virtue of his interest in Dewscope, and participation in the

Subscription, Mark Horrocks, on conversion of the Dewscope Loan, is

expected to become interested in over 10% of the issued share

capital of the Company and therefore in turn its fully owned group

company, Fiinu Bank Limited, for which he has received FCA approval

as a controller.

Related Party Transactions

As Mark Horrocks was a Director of the Company until 8 July

2022, entering into the Conversion Agreement with Dewscope, and

participation in the Subscription, are related party transactions

for Fiinu under AIM Rule 13 of the AIM Rules for Companies. The

Directors consider, having consulted with SPARK Advisory Partners

Limited, the Company's Nominated Adviser, that the terms of the

Conversion Agreement and the Subscription are fair and reasonable

insofar as the Company's shareholders are concerned.

Further information on the GEM Subscription Facility

On 14 March 2023, the Company entered into a share subscription

facility agreement ("Subscription Facility") with GEM for a maximum

commitment period of three years. Under the Subscription Facility,

the Company can draw down, at its option, up to GBP40 million in

new equity funding, to be satisfied by the issue of new ordinary

shares in the Company, subject to certain conditions, including

Admission, by submitting a notice detailing the funds required by

the Company ("Subscription Notice").

The initial draw down, set out in this announcement, has been

agreed at an amount up to GBP3.50 million, the Subscription Notice

submitted to GEM, and will settle after a period of 30 trading days

from today, being on or around 28 April 2023, subject to Admission.

The number and subscription price of the New Ordinary Shares issued

in return will be calculated as 90% of the average of the 30

closing bid prices at the end of that 30 day trading period, but is

conditional upon the subscription price for the New Ordinary Shares

in this initial Subscription Notice being not less than 10 pence

per New Ordinary Share, which is the nominal value of the Company's

shares, therefore the maximum number of shares that could be issued

to GEM pursuant to the initial draw down is 35,000,000. As receipt

of the GBP3.50 million remains subject to Admission, application

for New Ordinary Shares to be admitted to trading on AIM will be

made in due course.

In respect of future possible drawdowns from the GEM Facility,

the potential number of new ordinary shares issued by the Company

and the funds received as a result of each Subscription Notice are

dependent upon the average volume of trading in the shares of the

Company over a preceding period of 30 trading days and the average

closing bid prices at the end of each 30-day trading period.

In addition, in consideration of entering into the Subscription

Facility, the Company issued 17 million new warrants to GEM ("GEM

Warrants") with an expiry date of 14 March 2026, that are

exchangeable into new ordinary shares with an exercise price of 20

pence. The GEM Warrants (which will not be admitted to trading on

AIM, although the underlying ordinary shares upon exercise will be)

are transferable at GEM's option.

In respect of the GEM Warrants, on the first anniversary of

entering into the Facility Agreement, if the share price of the

Company is less than 90% of the exercise price of 20 pence, the

original exercise price can be adjusted to a figure equating to

110% of the market price prevailing at that time. In addition, the

exercise price of the GEM Warrants and the number of warrant shares

can be adjusted from time to time in a limited number of

circumstances, such as a change in the nominal value of the

Company's ordinary shares, further issues of ordinary shares, bonus

issues or capital distributions.

Whilst the Subscription Facility has a maximum drawdown

capability of up to GBP40 million over the three-year period, there

is no guarantee that the Company will raise any further money from

GEM following the initial GBP3.50 million.

In addition, under the terms of the Subscription Facility, at no

time is GEM able to own more than 10% of the issued share capital

of the Company.

Further announcements will be made as appropriate.

Possible effect of the fundraise on the Issued Share Capital of

the Company

When all of the transactions envisaged in this announcement have

been completed, excluding the exercise and issue of all warrants,

using 13 pence per New Ordinary Share as an illustration, there

would be a total number of ordinary shares in issue of

approximately 315,054,940. At the present time, the Company has

265,131,861 ordinary shares in issue.

Admission and Total Voting Rights

The Fundraising is subject to Admission. The Company has the

authority to issue and allot the New Ordinary Shares pursuant to

certain existing shareholder authorities granting such powers to

the directors at the Company's General Meeting held on 20 February

2023. It is expected that Admission for the New Ordinary Shares

issued and allotted in respect of the Subscription will become

effective, and dealing in these New Ordinary Shares will commence,

at 8.00a.m, on or about 20 March 2023. Further announcements

regarding Admission of the New Ordinary Shares in respect of the

Subscription Facility and/or the Conversion Agreement will be made

as appropriate.

Following Admission of the New Ordinary Shares in respect of the

Subscription, the share capital of the Company will comprise

268,978,016 Ordinary Shares. The above figure of 268,978,016 may be

used by shareholders as the denominator for the calculations by

which they will determine if they are required to notify their

interest in Fiinu under the Financial Conduct Authority's

Disclosure Guidance and Transparency Rules.

Further funding requirements

As previously announced on 26 January 2023, the Company plans to

raise a total of approximately GBP35-40 million on a staged basis

commencing in the run-up to Easter through to completion in July

2023 in preparation for its anticipated exit from mobilisation and

the commencement of unrestricted banking services. This Fundraising

is the start of that staged funding process and management

forecasts indicate that this initial funding combined with the

balance of that GBP35-40 million total funding, when achieved, will

be sufficient to resource the Company in its initial year of full

banking activity assuming the grant of the unrestricted banking

licence in July 2023.

Further announcements will be made regarding this process as

appropriate.

Market Abuse Regulation ('MAR') Disclosure

Certain information contained in this announcement would have

been deemed inside information for the purposes of Article 7 of the

Market Abuse Regulation (EU) No 596/2014 ('MAR'), which is part of

UK law by virtue of the European Union (Withdrawal) Act 2018, until

the release of this announcement.

ENDS

Enquiries:

Fiinu plc via Brazil London (press

Chris Sweeney, Chief Executive Officer office for Fiinu)

Philip Tansey, Chief Financial Officer

www.fiinu.com

SPARK Advisory Partners Limited (Nomad) Tel: +44 (0) 203 368

Mark Brady / Adam Dawes 3550

SP Angel Corporate Finance LLP (Joint Tel: +44 (0) 207 470

Broker) 0470

Matthew Johnson / Charlie Bouverat (Corporate

Finance)

Abigail Wayne / Rob Rees (Corporate Broking)

Panmure Gordon (UK) Limited (Joint Broker) Tel: +44 (0)207 886

Stephen Jones / Atholl Tweedie (Corporate 2500

Finance)

Tom Scrivens / Hugh Rich (Corporate Broking)

Brazil London (press office for Fiinu) Tel: +44 (0) 207 785

Joshua Van Raalte / Christine Webb / 7383

Jamie Lester Email: fiinu@agencybrazil.com

About Fiinu

Fiinu, founded in 2017, is a fintech group, including Fiinu

Bank({1]) , which is authorised by the Prudential Regulatory

Authority([1]) . Fiinu's Plugin Overdraft(R) is an unbundled

overdraft solution which allows customers to have an overdraft with

Fiinu Bank without changing their existing bank. The underlying

Bank Independent Overdraft(R) technology platform is bank agnostic,

allowing Fiinu Bank to serve all other banks' customers. Open

Banking allows Fiinu's Plugin Overdraft(R) to attach ("plugin") to

the customer's primary bank account, no matter which bank they may

use. Fiinu's vision is built around Open Banking, and it believes

that it increases competition and innovation in UK banking.

For more information, please visit www.fiinu.com .

([1]) Fiinu Bank Limited obtained its UK deposit-taking banking

licence with restrictions from the Prudential Regulation Authority

(PRA) and with the consent of the Financial Conduct Authority (FCA)

in July 2022.

About GEM

GEM Global Yield LLC SCS, part of the Global Emerging Markets

Group, is a $4 billion, alternative investment group with offices

in Paris, New York, and Nassau (Bahamas). GEM manages a diverse set

of investment vehicles and has completed over 600 transactions in

70 countries.

For more information, please visit www.gemny.com

About Dewscope Limited

Dewscope Limited is a company of which Mark Horrocks is a

director and is an indirect beneficiary.

About Intrinsic Capital LLP

Intrinsic Capital LLP ("Intrinsic") is authorised by the

Financial Conduct Authority to provide general financial advice and

investment services across a wide range of strategies and

products.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IOEUVURRONUOARR

(END) Dow Jones Newswires

March 15, 2023 03:00 ET (07:00 GMT)

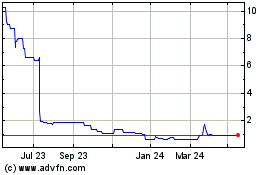

Fiinu (LSE:BANK)

Historical Stock Chart

From Nov 2024 to Dec 2024

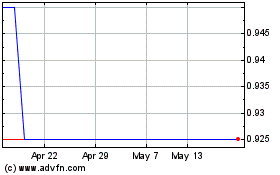

Fiinu (LSE:BANK)

Historical Stock Chart

From Dec 2023 to Dec 2024