TIDMBBGI

RNS Number : 8665K

BBGI Global Infrastructure S.A.

31 August 2023

The information contained within this Announcement is deemed by

the Company to constitute inside information. Upon the publication

of this Announcement via a Regulatory Information Service this

inside information is now considered to be in the public

domain.

31 August 2023

BBGI Global Infrastructure S.A.

(" BBGI " or the " Company ")

Interim results for the six months ended 30 June 2023

Strong operational and resilient financial performance

BBGI Global Infrastructure S.A. (LSE ticker: BBGI), the global

infrastructure investment company, is pleased to announce its

interim results for the six months ended 30 June 2023.

Sarah Whitney, Non-Executive Chair of BBGI, commented:

"I am pleased to report the strong operational performance of

our globally diversified portfolio of social infrastructure assets

for the first six months of 2023. These results reflect the

low-risk investment strategy, prudent financial management and

value driven asset management approach that we have successfully

deployed since our IPO in 2011.

Our financial performance was resilient throughout H1 2023,

despite the ongoing challenging macroeconomic environment. The

defensive and global nature of our portfolio has again provided

stable, predictable and inflation-linked cash flows, and we have

continued to generate secure, high-quality inflation-linked income

and increased dividends that are expected to remain well

covered.

BBGI has not been immune to the uncertain market and economic

backdrop that has impacted investor sentiment on almost all UK

listed investment companies. The Board does not believe the current

share price adequately reflects the value of the portfolio and its

high-quality inflation linkage, nor does it reflect our strong

financial position and operational performance."

Duncan Ball and Frank Schramm, Co-CEOs of BBGI, said:

"Our results for H1 2023 demonstrate our continued strong

operational performance despite the challenging economic times.

Through our consistent, disciplined approach to active asset

management and prudent financial management, our investments have

continued to deliver during the period, with a resilient financial

performance.

In the current macro-economic environment, our strategy focuses

on directing surplus capital towards the repayment of any

outstanding drawings on the revolving credit facility. We will

continue to maintain a disciplined approach to capital allocation

and transaction activity, only participating in the market and

evaluating potential investment opportunities when they are clearly

value accretive.

Preserving and enhancing the value of our portfolio remain our

top priorities. The strength of our assets is evidenced by the

continued strong market demand for similar assets, thanks to their

high-quality, secure, and long-term inflation-linked contracts,

which generate predictable cash flows. This, in turn, enables us to

deliver attractive returns to our shareholders over the long term.

We approach the future with confidence."

Six months in numbers

Financial highlights [i]

Investment Basis NAV per share Annualised total

NAV NAV return per share

since IPO

GBP1,056.7m 147.8pps 8.8%

down 1.2% as at down 1.4% as at 30 FY 2022: 9.1%

30 June 2023 June 2023

(31 Dec 2022: GBP1,069.2m) (31 Dec 2022: 149.9pps[ii])

High-quality inflation Annualised ongoing Cash dividend cover

linkage charges

0.6% 0.92% 1.68x

FY 2022: 0.5% FY 2022: 0.87% FY 2022:1.47x

2023 target dividend 2024 target dividend 2025 target dividend

7.93pps 8.40pps 8.57pps

+6% +6% +2%

Financial and operational highlights

Strong operational performance

* Strong operational performance of our globally

diversified portfolio of 56 high-quality, 100 per

cent availability-style infrastructure assets.

* Maintained a consistently high asset availability

rate of 99.9 per cent .

* At the period end, BBGI's investment portfolio was

99.5 per cent operational. We have one asset under

construction; Highway 104 in Nova Scotia, Canada, and

substantial completion is scheduled for Q3 2023.

* Our portfolio investments are the essential assets on

which people rely every day, such as schools,

hospitals, fire and police stations, affordable

housing, modern correctional facilities and

transport.

* We partner with the public sector, underpinned by

government or government-backed counterparties, to

help deliver and manage responsibly these assets for

the long term.

* Located in Australia, Canada, Germany, the

Netherlands, Norway, the UK, and the US, all

Portfolio Companies are in stable, well-developed,

and highly-rated investment grade countries.

* As at 30 June 2023, BBGI had a weighted average

portfolio life of 19.8 years. By prioritising

acquiring assets with a long residual life, we have

maintained a portfolio with a long weighted average

life.

* Disciplined approach to capital allocation and

potential acquisitions and will only consider

transactions that are accretive to our shareholders.

Generating secure, inflation-linked income

* Our asset portfolio delivers attractive, predictable

and inflation-linked cash flows.

* Contracted high-quality inflation linkage of 0.6 per

cent.

* Reaffirmed dividend targets of 7.93 pps for 2023 and

8.40 pps for 2024, representing a 6 per cent increase

year on year, and a dividend target of 8.57 pps for

2025. All dividends are e x pected to be fully

cash-covered.

* Cash receipts ahead of projections, with no material

lockups or defaults reported.

* Strong cash dividend cover of 1.68x in H1 2023.

* Half-year dividend declared of 3.965 pps for H1 2023 ,

to be paid in October 2023, in-line with target.

* Average dividend increase of 3.4 per cent on a

compound annual growth rate from 2012 to 2023. BBGI's

progressive dividend outpaced UK CPI delivering

positive real returns to shareholders.

Global portfolio and financial performance resilient despite

market volatility and uncertainty

* There has been market rerating across all sectors in

the alternative asset space in H1 2023.

* During the period, we have observed a modest decrease

in the NAV per share of 1.4 per cent to 147.8 pps

(2022: 149.9 pps) , impacted by macroeconomic

variables beyond our control. This reduction is

mainly attributed to an increase in discount rates

and negative foreign exchange movements. The negative

valuation effects have been partly mitigated by

increased deposit and inflation rates, as well as the

value enhancements or team has delivered across our

portfolio.

o The weighted average discount rate increased from 6.9 per cent

to 7.2 per cent over H1 2023, largely due to the rise in long-term

gilt yields in the UK impacting our UK assets, which constitute

33 per cent of our portfolio .

o In the UK, the risk-free rate has materially increased during

H1 2023, with c. 0.5 per cent added to 20-year gilt yields since

31 December 2022. Conversely, outside the UK, long-term government

bond yields have declined in all jurisdictions except Norway.

o T he weighted average risk-free rate has remained stable at

c. 3.8 per cent since December 2022. The discount rate of 7.2

per cent represents a risk premium of c. 340 basis points, which

the Company views to be adequate and towards the conservative

end for low-risk availability-style investments.

o The negative net effect of foreign exchange movements, after

adjusting for the offsetting effect of the Company's hedging strategy,

resulting in a NAV decrease of GBP12.9 million or 1.2 per cent.

* During the period, the Company recognised an increase

in the portfolio value of GBP13.8 million, or a 1.3

per cent increase in the NAV, resulting from changes

in macroeconomic assumptions. The main drivers were

short-term and long-term deposit rates accounting for

GBP12.9 million of this increase, with the balance

reflecting marginal changes in short-term inflation

forecasts.

* Annualised total NAV return per share since IPO of

8.8 per cent. ([iii])

Prudent financial and risk management

* Our liquidity position remains robust, with a net

debt position of GBP7.9 million and GBP25.8 million

of cash drawings under our GBP230 million

multi-currency RCF, maturing in May 2026. By using

excess cash generated by the Company's portfolio of

investments, these drawings could be repaid by 31

December 2023.

* Fund level leverage remains modest, representing only

2.4 per cent of NAV with no investment transaction

commitments.

* No structural gearing at Group level.

* Portfolio-level borrowings are non-recourse with the

vast majority having fixed base rates during the

concession period. Of the 56 assets in our portfolio,

only one has a refinancing obligation for a tranche

of debt.

* Our proportionate share of Portfolio Company deposits

total approximately GBP385 million[iv]. Through our

proactive asset management strategy, we have secured

competitive deposit rates, which currently average

around c. 4.5 per cent. The interest generated from

these deposits acts as a cushion, providing a

counterbalance against the negative impact on our

portfolio's valuation caused by the increased

weighted average discount rate.

* No outstanding commitments to acquire assets and no

requirement to raise capital in the foreseeable

future.

* Disciplined approach to capital allocation and

potential acquisitions.

* Hedging strategy aimed to reduce NAV foreign exchange

('FX') sensitivity to c. 3 per cent for a 10 per cent

movement in FX.

Value-driven asset management

* We focus on operational performance to drive

efficiencies and generate portfolio optimisation. Our

hands-on approach preserves and enhances the value of

our investments, delivering well-maintained social

infrastructure for communities and end-users, and

attractive returns over the long term for

shareholders.

* Value-accretive activities, including effective

lifecycle cost management, Portfolio Company cost

savings, and optimised cash reserving, contributed

approximately GBP7.6 million to the NAV.

* We maintain our track record of no reported lock-ups

or material defaults at our Portfolio Companies, and

we continue to generate a consistently high asset

availability rate of 99.9 per cent.

* As the sole internally managed equity infrastructure

investment company on the London Stock Exchange, our

structure ensures our interests are fully aligned

with our investors. We are not incentivised by assets

under management, but rather value creation.

Sustainability

* During the period, a comprehensive data collection

exercise was conducted to capture Scope 1, 2 and

material Scope 3 GHG emissions data from all our

Portfolio Companies between 2019 to 2022, a crucial

step in the journey to net zero.

* Our objective is to have 70 per cent of our Portfolio

Companies by value to be 'net zero' 'aligned', or

'aligning', by 2030, with these principles embedded

in our executive remuneration targets.

* Our asset management approach is aligned to six

Sustainable Development Goals ('SDGs') with a focused

ESG approach fully integrated into our business model,

which is led by our purpose. In June 2023, we

published our 2022 ESG report, which provides

detailed information on our ESG progress and

showcases achievements at our 56 Portfolio Companies.

* Under Sustainable Finance Disclosure Regulation

('SFDR'), we fall within the scope of Article 8,

where the investment product promotes social

characteristics and follows good governance

practices. In June 2023, we filed our latest SFDR

disclosures, including details on how we measure our

performance in engaging with our stakeholders and our

contributions to meeting our social characteristics.

Market trends and pipeline

* We believe infrastructure will remain an attractive

asset class due to its defensive nature, predictable

cash flows, and inflation linkage. Looking ahead, the

availability-style infrastructure asset class shows

promising prospects, driven by the need for

decarbonisation, digitalisation, and the upgrade or

replacement of ageing infrastructure.

* In the current macro-economic environment, our

strategy focuses on directing surplus capital towards

the repayment of any outstanding drawings on the

revolving credit facility. However, when appropriate

opportunities arise, we have a structured process for

considering potential new investments. These

opportunities are evaluated with a focus on both

dividends and returns, illustrating our commitment to

pursuing selective and disciplined growth.

* We will continue to maintain a disciplined approach

to capital allocation and transaction activity, only

participating in the market and evaluating potential

investment opportunities when they are clearly value

accretive. Preserving and enhancing the value of our

portfolio remain our top priorities.

Company presentation for analysts and investors

A Company presentation for analysts and investors will take

place today, Thursday, 31 August 2023, at 9.00am (BST) time via an

in-person meeting and a live webcast and audio only dial in

conference call.

For those analysts and investors who wish to attend the

in-person presentation or live conference call, please contact

InvestorServices@bb-gi.com

To access the live webcast, please register in advance here:

https://www.lsegissuerservices.com/spark/BBGISICAVSA/events/9a49493e-5908-4e1b-902b-55f19a7739e1

Webcast participants can type questions into the question

box.

The recording of the interim results presentation and slides

will be made available later in the day via the Company website:

www.bb-gi.com *

FOR FURTHER INFORMATION, PLEASE CONTACT:

BBGI Management Team +352 263 479-1

Duncan Ball

--------------------------------

Frank Schramm

--------------------------------

H/Advisors Maitland (Communications

advisor) +44(0) 20 7379 5151

--------------------------------

James Benjamin BBGI-maitland@h-advisors.global

--------------------------------

Rachel Cohen

--------------------------------

NOTES

BBGI Global Infrastructure S.A. (BBGI) is a responsible

infrastructure investment company and a constituent of the FTSE

250. We invest in and actively manage for the long-term a globally

diversified, low-risk portfolio of essential social infrastructure

investments. Our purpose is to deliver healthier, safer and more

connected societies, while creating sustainable value for all our

stakeholders.

BBGI is committed to delivering stable and predictable cash

flows with progressive long-term dividend growth and attractive,

sustainable, returns for shareholders. Through our proactive and

disciplined approach to active asset management and prudent

financial management, and with a strong focus on ESG, we preserve

and enhance the value of our investments, and deliver well

maintained social infrastructure that serve and support local

communities and end users.

All of BBGI's investments are availability-style and supported

by secure public sector-backed contracted revenues, with high

quality inflation-linkage. Availability-style means that our

revenues are paid so long as the assets are available for use, and

we maintain a consistently high level of asset availability of

99.9%.

BBGI's investment portfolio is over 99% operational with all its

investments located across highly rated investment grade countries

with stable, well developed operating environments.

BBGI's in-house management team is incentivised by shareholder

returns and consistently maintains low comparative ongoing charges

to shareholders.

BBGI is targeting dividends of 7.93 pence and 8.40 pence per

ordinary share for the twelve months ending 31 December 2023 and 31

December 2024, respectively, representing a 6% increase year on

year, and a dividend target of 8.57pps for 2025: all are expected

to be fully cash-covered**.

Further information about BBGI is available on its website at www.bb-gi.com *

The Company's LEI: 529900CV0RWCOP5YHK95

Any reference to the Company or BBGI refers also to its

subsidiaries (where applicable).

* Neither the Company's website nor the content of any website

accessible from hyperlinks on its website (or any other website) is

(or is deemed to be) incorporated into, or forms (or is deemed to

form) part of this announcement.

** These are guidance levels or targets only and not a profit

forecast and there can be no assurance that they will be met.

BBGI Global Infrastructure S.A. Interim Results for the Six

Months Ended 30 June 2023

About BBGI

BBGI Global Infrastructure S.A. (BBGI, the 'Company', and

together with its consolidated subsidiaries, the 'Group') is a

global infrastructure investment company helping to provide

responsible capital to build and maintain critical social

infrastructure ([v]) .

From hospitals to schools, to affordable housing and safer

roads, we partner with the public sector to deliver social

infrastructure that forms the building blocks of local economies,

while creating sustainable value for all stakeholders.

Our purpose: To deliver social infrastructure for healthier,

safer, and more connected societies, while creating sustainable

value for all stakeholders.

Our vision: We invest to serve and connect people.

Our values :

* Trusted to deliver.

* Dependable partner.

* Investor with impact.

* Present-focused, future-ready.

Six months in numbers

Financial highlights

Investment Basis NAV per share Annualised total

NAV NAV return per share

since IPO

GBP1,056.7m 147.8pps 8.8%

down 1.2% as at down 1.4% as at 30 FY 2022: 9.1%

30 June 2023 June 2023

(31 Dec 2022: GBP1,069.2m) (31 Dec 2022: 149.9pps)

High-quality inflation Annualised ongoing Cash dividend cover

linkage charges

0.6% 0.92% 1.68x

FY 2022: 0.5% FY 2022: 0.87% FY 2022:1.47x

2023 target dividend 2024 target dividend 2025 target dividend

7.93pps 8.40pps 8.57pps

+6% +6% +2%

Portfolio highlights

* Strong operational performance of our globally

diversified portfolio of 56 high-quality, 100 per

cent availability-style infrastructure assets.

* Maintained a consistently high asset availability

rate of 99.9 per cent .

* Contracted high-quality inflation linkage of 0.6 per

cent.

* 6 per cent dividend growth targets for 2023 and 2024

reaffirmed.

* Cash receipts ahead of projections, with no material

lockups or defaults.

* Fund level leverage remains modest with GBP25.8

million of RCF cash drawings, representing only 2.4

per cent of NAV, which could be repaid with excess

cash by 31 December 2023. Net debt of GBP7.9 million.

* No structural gearing at Group level, and, with

limited exceptions only, borrowing costs are fixed at

the Portfolio Company level, providing stability and

predictability. 55 of 56 projects have no refinancing

risk during the concession period.

* No outstanding commitments to acquire assets and no

requirement to raise capital in the foreseeable

future.

* Disciplined approach to capital allocation and

potential acquisitions.

* Weighted average discount rate increased to 7.2 per

cent from 6.9 per cent as at 31 December 2022,

reflecting an equity risk premium of c. 3.4 per cent,

mainly reflecting an increase in UK risk-free rates.

* Hedging strategy aimed to reduce NAV foreign exchange

('FX') sensitivity to c. 3 per cent for a 10 per cent

movement in FX.

* Completed a comprehensive data collection process to

assess our portfolio's Scope 1, 2 and material Scope

3 greenhouse gas ('GHG') emissions, carbon footprint

and carbon intensity, a crucial step in the journey

to net zero.

Portfolio at a Glance

The fundamentals

Based on portfolio value as at 30 June 2023.

Investment type

100 per cent availability-style[vi] revenue stream.

Investment type

======================= ========= ======== =======

Availability-style revenue

assets 100%

100%

Investment status

Low-risk operational portfolio.

Investment status

====================== ======== =========== ========

Operations 99.4%

Construction 0.6%

100%

Geographical split

Geographically diversified in stable developed countries.

Geographic split

==================== =====

Canada 35%

UK 33%

Continental Europe 12%

US 10%

Australia 10%

100%

Sector split

Well-diversified sector exposure with large allocation to

lower-risk availability-style road and bridge investments.

Sector split

==================================== =====

Transport 53%

Healthcare 21%

Blue light and modern correctional

facilities 12%

Education 8%

Affordable housing 3%

Clean energy 2%

Other 1%

100%

Investment life

Long investment life with 46 per cent of portfolio by value with

a duration of greater than or equal to 20 years; weighted average

life of 19.8 years. Average portfolio debt maturity of 15.9

years.

Investment life

================== =====

>=25 years 24%

>=20 years and

<25 years 22%

>=10 years and

<20 years 48%

<10 years 6%

100%

Our top five investments

Well-diversified portfolio with no major single asset

exposure.

Top-five investments

========================== ========= ====== =======

Ohio River Bridges

(US) 10.1%

Golden Ears Bridge

(Canada) 9.3%

Northern Territory Secure

Facilities (Australia) 4.4%

A7 Motorway (Germany) 4.3%

A1/A6 Motorway (Netherlands) 4.1%

Next five largest investments 16.1%

Remaining investments 51.7%

100%

Investment ownership

78 per cent of assets by value in the portfolio are 50 per cent

owned or greater.

Investment ownership

======================= =====

100% 45%

>=75% and <100% 7%

>=50% and <75% 26%

<50% 22%

100%

Country rating

All assets located in countries with ratings between AA and

AAA[vii].

Country rating

================= =====

AAA 57%

AA+ 10%

AA 33%

100%

Projected portfolio cash flow

Our underlying assets generate a consistent and long-term stream

of inflation-linked cash flows, extending up to 2051. These cash

flows are predictable due to the involvement of government or

government-backed counterparties and the contractual nature of the

agreements.

Based on current estimates, and assuming no further acquisitions

for illustrative purposes only, the portfolio is forecasted to

enter the capital repayment phase in September 2039. After this,

cash inflows from the portfolio are paid to our shareholders as

capital and the portfolio valuation reduces as assets reach the end

of their concession term.

As at 30 June 2023, BBGI had a weighted average portfolio life

of 19.8 years, a decrease of 0.4 years compared with 31 December

2022. By prioritising the acquisition of assets with a long

residual life, we have maintained a portfolio with a long weighted

average life.

This illustrative chart is a target only, as at 30 June 2023,

and is not a profit forecast. There can be no assurance this target

will be met. The hypothetical target cash flows do not consider any

unforeseen costs, expenses or other factors that may affect the

portfolio assets and therefore the impact on the cash flows to the

Company. As such, the chart above should not in any way be

construed as forecasting the actual cash flows from the portfolio.

There are minor cash flows extending beyond 2051 but for

illustrative purposes, these are excluded from the chart above.

Chair's statement

On behalf of the Supervisory Board, I am pleased to report the

strong operational performance of our globally diversified

portfolio of social infrastructure assets for the first six months

of 2023. These results reflect the low-risk investment strategy,

prudent financial management and value driven asset management

approach that we have successfully deployed since our IPO in

2011.

Our financial performance was resilient throughout H1 2023,

despite the ongoing challenging macroeconomic environment, which

has been characterised by high inflation and rising interest rates,

general market uncertainty and the volatile geopolitical

backdrop.

The defensive and global nature of our portfolio has again

provided stable, predictable and inflation-linked cash flows, and

we have continued to generate secure, high-quality inflation-linked

income and increased dividends that are expected to remain well

covered.

Revenue from our 56 assets is 100 per cent availability-style,

meaning revenues are paid so long as the assets are available for

use. We are insulated from demand risk which can be subject to the

volatility of the economic cycle. At the period end, BBGI's

investment portfolio was 99.4 per cent operational, underlining the

strength of our portfolio and the quality of the operational

management delivered by our teams. We have only one asset under

construction, Highway 104 in Nova Scotia, Canada, where completion

is scheduled for Q3 2023.

Global portfolio resilient despite market volatility and

uncertainty

There has been market rerating across all sectors in the

alternative asset space in H1 2023. During this period, we have

observed a modest decrease in the NAV per share of 1.4 per cent to

NAV 147.8pps, impacted by macroeconomic variables beyond our

control. This reduction is mainly attributed to an increase in

discount rates and negative foreign exchange movements. The

increase in discount rates particularly impacted our UK assets,

which constitute 33 per cent of our portfolio. In the UK, the

risk-free rate has materially increased during H1 2023, with c. 0.5

per cent added to 20-year gilt yields since 31 December 2022.

Conversely, outside the UK, long-term government bond yields have

declined in all jurisdictions except Norway.

The negative valuation effects have been partly mitigated by

increased deposit and inflation rates, as well as the value

enhancements our team has delivered across our portfolio.

Strong liquidity position and robust portfolio-level debt

financing arrangements

W e continue to benefit from a robust liquidity position - of

the 56 assets in our portfolio, only one has a refinancing

obligation for a small tranche of debt . We are therefore largely

insulated from recent increases in interest rates. Our fund level

leverage also remains modest. Drawings on our RCF could be repaid

using excess cash generated by the Company's portfolio of

investments by 31 December 2023. W e have no investment transaction

commitments.

Re-affirming our progressive dividend policy and dividend

targets

I n March 2023, we provided revised dividend targets for 2023

and 2024 of 7.93pps and 8.40pps, respectively. These revised

dividend targets will increase the dividend growth rate to 6 per

cent, ensuring our shareholders benefit from the increased value

created by our high-quality, inflation-linked portfolio. We had

strong cash dividend cover of 1.68x in H1 2023, with c ash receipts

ahead of projections, and no reported lock-ups or material defaults

reported at any of our Portfolio Companies. We expect our dividend

targets to be fully cash covered.

Strengthening our environmental, social and governance processes

and progress

Our purpose is to focus on delivering social infrastructure for

healthier, safer and more connected societies, while creating

sustainable value for all stakeholders. Our portfolio investments

are the essential assets on which people rely every day, such as

schools, hospitals, fire and police stations, affordable housing,

modern correctional facilities and transport. We partner with the

public sector, underpinned by government or government-backed

counterparties, to help deliver and manage responsibly these assets

for the long term.

Given our role as a steward of essential infrastructure, ESG is

a fundamental part of how we do business and we are focused on

embedding our environmental and social commitments as part of our

sustainability obligations. We are developing our ESG reporting

processes and now report Scope 1, 2 and material Scope 3 GHG

emissions, where possible, for all our Portfolio Companies. We

believe that the measuring and reporting of emissions is the first

step towards meaningful progress on our journey to net zero.

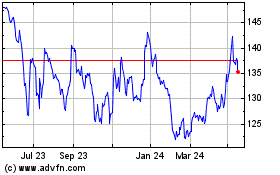

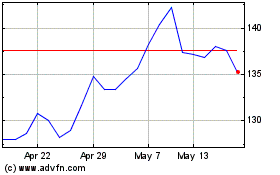

Outlook

BBGI has not been immune to the uncertain market and economic

backdrop that has impacted investor sentiment on almost all UK

listed investment companies. The Board does not believe the current

share price adequately reflects the value of the portfolio and its

high-quality inflation linkage, nor does it reflect our strong

financial position and operational performance. As part of its

overall capital allocation strategy, the Board will continue to

closely monitor the discount and will take it into consideration.

However, any potential actions to reduce the discount will only be

undertaken after thorough consideration and taking into account the

long-term implications.

The macroeconomic environment is expected to remain volatile,

particularly in the UK, and inflation is likely to remain high at

least for the near term. As an internally-managed investment

company, our leadership team's alignment of interest with our

shareholders is clear. In this period of economic volatility, we

will continue to be disciplined in our approach to capital

allocation and will only consider transactions that are accretive

to our shareholders.

Sarah Whitney

Chair

Co-CEO's statement

Our investment proposition is robust and defensive: we invest in

creditworthy, government-backed assets, with high-quality

inflation-linked cash flows, that perform well throughout market

and economic cycles.

Our results for H1 2023 demonstrate our continued strong

operational performance despite the challenging economic times.

Through our consistent, disciplined approach to active asset

management and prudent financial management, our investments have

continued to deliver during the period, with a resilient financial

performance. Over the past six months, we have continued to

generate high-quality, predictable and inflation-linked cash flows,

and strong dividend cover for our shareholders.

We are creating a positive sustainable impact on the local

communities served by our 56 infrastructure assets, helping to

provide the responsible capital required to build and maintain

critical social infrastructure in the countries where we do

business.

Key highlights for H1 2023

* Half-year dividend declared of 3.965 pps for H1 2023 ,

to be paid in October 2023, in-line with target.

* Strong cash dividend cover of 1.68x (2022: 1.47 x ).

* Cash receipts from portfolio distributions ahead of

projections.

* Reaffirmed dividend targets of 7.93 pps for 2023 and

8.40 pps for 2024, representing a 6 per cent increase

year on year, and a dividend target of 8.57 pps for

2025: all e x pected to be fully cash-covered.

* NAV per share decreased 1.4 per cent to 147.8 pps

(2022: 149.9 pps), impacted by a rise in discount

rates and negative foreign exchange movements, and

partly offset by increases in interest earned on

deposits, positive impact of inflation on revenues

and value enhancements.

* Annualised total NAV return per share since IPO of

8.8 per cent. ([viii])

* Annualised ongoing charges of 0.92 per cent (2022:

0.87 per cent).

* Fund level leverage remains modest with GBP25.8

million of cash drawings, representing only 2.4 per

cent of NAV, which could be repaid with excess cash

by 31 December 2023. Net debt of GBP7.9 million. The

company has no investment transaction commitments.

* Completed a comprehensive data collection process to

assess our portfolio's Scope 1, 2 and material Scope

3 GHG emissions, carbon footprint and carbon

intensity, an important step in the journey to net

zero.

Valuation and NAV update

As at 30 June 2023, our NAV per share decreased by 1.4 per cent

to 147.8pps (31 December 2022: 149.9pps). There are several

market-specific factors that contributed to the net decrease in the

NAV, the more notable being:

* The weighted average discount rate increased from 6.9

per cent to 7.2 per cent over H1 2023, largely due to

the rise in long-term gilt yields in the UK impacting

our UK assets.

* The negative net effect of foreign exchange movements,

after adjusting for the offsetting effect of the

Company's hedging strategy, resulting in a NAV

decrease of GBP12.9 million or 1.2 per cent.

* These valuation impacts have been partly mitigated by

updated inflation and deposit rate assumptions and

value enhancements to our portfolio.

The number of availability-style transactions and available

market data points have increased in H1 2023 compared to H2 2022,

and these data points support our revised discount rate of 7.2 per

cent. Notwithstanding, the Company complements its market-based

approach by using the Capital Asset Pricing Model where government

risk-free rates plus an equity risk premium are used to calculate

discount rates. This method is used as a reasonability check to our

market-based approach.

During H1 2023, short-term interest rates continued to rise. The

most significant impact on long-term government bond yields, and

subsequently on the discount rates used in the valuation process,

was observed in the UK, where we have seen an increase of c. 0.5

per cent on the risk-free rate thereby contributing to an increase

in the UK discount rate for stable operational projects to 7.5 per

cent. In contrast, in all other countries where we invest with the

exception of Norway, long-term government bond yields have declined

and as a result the weighted average risk-free rate across the

portfolio remained flat. We benefitted from the global nature of

our portfolio of investments with no singular concentration risk in

any one country.

Capital Allocation Policy

In the current macro-economic environment, our strategy focuses

on directing surplus capital towards the repayment of any

outstanding drawings on the revolving credit facility. However,

when appropriate opportunities arise, we have a structured process

for considering potential new investments. These opportunities are

evaluated with a focus on both dividends and returns, illustrating

our commitment to pursuing selective and disciplined growth.

Prudent financial and risk management

Our approach to risk management remains unchanged and there has

been no material movement in our risk profile over the past year.

Our portfolio is not directly impacted by the conflict in Ukraine

or energy price volatility. Through our effective hedging strategy,

we have managed to limit foreign exchange losses .

As of 30 June 2023, our liquidity position remains robust, with

a net debt position of GBP7.9 million and GBP25.8 million of cash

drawings under our GBP230 million multi-currency RCF, maturing in

May 2026. Fund level leverage remains modest, representing only 2.4

per cent of NAV with no investment transaction commitments. All

cash drawings at 30 June 2023 were in Euros, with an all-in debt

rate of 5.08[ix] per cent. By using excess cash generated by the

Company's portfolio of investments, these drawings could be repaid

31 December 2023.

Furthermore, we have benefitted from strong liquidity and our

portfolio-level debt financing arrangements, therefore rising debt

costs have had a limited impact on our financial health, as

evidenced by:

* No structural gearing

* Portfolio-level borrowings are non-recourse with the

vast majority having fixed base rates during the

concession period. Of the 56 assets in our portfolio,

only one has a refinancing obligation for a tranche

of debt. This minor refinancing risk exists in

relation to changes in the lending margin only as the

base market rate has been hedged for the entire debt

term. If the lending margin increases by 1 per cent

from the current forecast, the NAV could be

negatively impacted by GBP7.9 million (0.7 per cent

of NAV).

* Our proportionate share of Portfolio Company deposits

total approximately GBP385 million[x]. Through our

proactive asset management strategy, we have secured

competitive deposit rates across all currencies and

currently earn c. 4.5 per cent on weighted average

basis. The interest generated from these deposits

provides a counterbalance against the negative impact

on our portfolio valuation caused by the increased

weighted average discount rate.

Value-driven asset management

We focus on operational performance to drive efficiencies and

generate portfolio optimisation. Our hands-on approach preserves

and enhances the value of our investments, delivering

well-maintained social infrastructure for communities and

end-users, and attractive returns over the long term for

shareholders.

Value-accretive activities, including effective lifecycle cost

management, Portfolio Company cost savings, and optimised cash

reserving, contributed approximately GBP7.6 million to the NAV.

We maintain our track record of no reported lock-ups or material

defaults at our Portfolio Companies, and we continue to generate a

consistently high asset availability rate of 99.9 per cent.

As the sole internally managed equity infrastructure investment

company on the London Stock Exchange, our structure ensures our

interests are fully aligned with our investors. We are not

incentivised by assets under management, but rather value

creation.

Dividend

We declared a h alf-year dividend of 3.965 pps for H1 2023 , in

line with our target. We are reconfirming our progressive dividend

policy and our dividend targets, which we revised in March 2023 for

2023 and 2024, increasing the dividend growth rate to 6 per cent.

This ensures our shareholders benefit from the increased value

created by our high-quality, inflation-linked portfolio. We also

introduced a new dividend target of 8.57pps for 2025 and we expect

all our dividend targets to be fully cash covered. While our

dividend growth target is set at 6 per cent for 2023 and 2024 in

response to higher short term inflation assumptions, our 2025

target projects a 2 per cent growth under our progressive dividend

policy, predicated on an assumption of a more stable macroeconomic

environment. Assuming a scenario where no additional investments

are made, the projected cash flows generated in the income phase

from BBGI's current portfolio of 56 investments would sustain the

Company's progressive dividend policy[xi] for at least 15

years.

Contributing to a net-zero future

Our asset management approach is aligned to six Sustainable

Development Goals ('SDGs') with a focused ESG approach fully

integrated into our business model, which is led by our purpose. In

June 2023, we published our 2022 ESG report, which provides

detailed information on our ESG progress and showcases achievements

at our 56 Portfolio Companies.

Under Sustainable Finance Disclosure Regulation ('SFDR'), we

fall within the scope of Article 8, where the investment product

promotes social characteristics and follows good governance

practices. In June 2023, we filed our latest SFDR disclosures,

including details on how we measure our performance in engaging

with our stakeholders and our contributions to meeting our social

characteristics.

During the period, a comprehensive data collection exercise was

conducted to capture Scope 1, 2 and material Scope 3 GHG emissions

data from all our Portfolio Companies between 2019 to 2022.

Our objective is to have 70 per cent of our Portfolio Companies

by value to be 'net zero' 'aligned', or 'aligning', by 2030, with

these principles embedded in our executive remuneration

targets.

Looking ahead

We would like to thank our team once again for their hard work

over the past six months. Their dedication and approach are

outstanding and remain a fundamental part of our success.

We will continue to maintain a disciplined approach to capital

allocation and transaction activity, only participating in the

market and evaluating potential investment opportunities when they

are clearly value accretive. Preserving and enhancing the value of

our portfolio remain our top priorities. The strength of our assets

is evidenced by the continued strong market demand for similar

assets, thanks to their high-quality, secure, and long-term

inflation-linked contracts, which generate predictable cash flows.

This, in turn, enables us to deliver attractive returns to our

shareholders over the long term. We approach the future with

confidence.

Duncan Ball Frank Schramm

Co-CEO Co-CEO

Our investment strategy

BBGI provides access to a globally diversified portfolio of

infrastructure investments, which generate long-term and

sustainable returns and serve a critical social purpose in their

local communities. Our portfolio is well diversified across sectors

in education, healthcare, blue light (fire and police), affordable

housing, modern correctional facilities, clean energy and transport

infrastructure assets.

Our business model is built on four strategic pillars:

Low-risk

* Availability-style investment strategy.

* Secure, public sector-backed contracted revenues.

* Stable, predictable cash flows, with high-quality

inflation linkage and progressive long-term dividend

growth.

Globally diversified

* Focus on highly rated investment grade countries.

* Stable, well-developed operating environments.

* A global portfolio, serving society through

supporting local communities.

Strong ESG approach

* ESG fully integrated into the business model.

* Focus on delivering positive social impact - SFDR

Article 8 ([xii]) - and high degree of climate

resilience.

* Executive compensation linked to ESG performance.

Internally managed

* In-house management team focused on delivering

shareholder value first, portfolio growth second.

* Management interests aligned with those of

shareholders.

* Strong pricing discipline and portfolio management.

* Lowest comparative ongoing charges.[xiii]

Our business model is the bedrock of our success, enabling us to

deliver:

o Robust shareholder returns

o Low correlation to other asset classes

o Sustainable growth

Operating model

We follow a proven operating model based on three principles:

value-driven active asset management, prudent financial management

and a selective acquisition strategy, which are fundamental to our

success. This model aims to preserve and create value, while

achieving portfolio growth, ensuring that ESG considerations are

embedded in our processes.

Our active asset management approach seeks to ensure stable

operational performance, preservation of value and, where possible,

identification and incorporation of value enhancements over the

lifetime of the assets under our stewardship. Our approach aims to

reduce costs to our public sector clients and asset end-users, to

enhance the operational efficiency of each asset and to generate a

high level of asset availability, underpinning the social purpose

of our portfolio.

Our prudent financial management approach focuses on efficient

cash and corporate cost management and the implementation of our

foreign exchange hedging strategy. Due to our portfolio's extensive

geographical diversification, we are exposed to foreign exchange

volatility, which we actively seek to mitigate.

We pursue a selective acquisition strategy, so our Management

Board's focus remains within its area of expertise, and we uphold

the strategic pillars defined by our investment proposition. We

actively seek, through portfolio construction, acquisitions with

long-term, predictable, and inflation-protection characteristics

that support our contracted, high-quality, inflation linkage of 0.6

per cent.

Value-driven active asset management

We pursue a standardised approach across our portfolio to

preserve value, to derive operational and value enhancements, and

to improve clients' experience, including:

* Strong client relationships, by prioritising regular

meetings to achieve high rates of client

satisfaction.

* Focused asset management, to ensure distributions are

on time, and on or above budget.

* Focused cost management and portfolio-wide

cost-saving initiatives, to leverage economies of

scale or outperform the base case, such as portfolio

insurance and standardised management contracts for

Portfolio Companies, and lifecycle cost reviews.

* Comprehensive monitoring, to ensure we fulfil our

contractual obligations.

* Detailed climate risk assessment and ESG KPI tracking

tool, which includes over 100 KPIs and questions, to

evaluate the sustainable performance of each of our

investments.

* Maintaining high availability levels by proactively

managing any issues, including site visits to all

significant investments.

* Monitoring and periodically reviewing Portfolio

Company debt facilities and investigating potential

refinancing benefits.

* Measured exposure to construction risk to support NAV

uplift by de-risking assets over the construction

period.

Prudent financial management

We focus on cash performance at both the asset and portfolio

level to drive efficiencies, including:

* Progressive future dividend growth, underpinned by

high-quality inflation linkage and strong portfolio

distributions. Assuming a scenario where no

additional investments are made, the projected cash

flows in the income phase from BBGI's current

portfolio of 56 investments could sustain the

Company's progressive dividend policy for at least 15

years.

* Low ongoing charges through our efficient and

cost-effective internal management structure.

* Managing and mitigating foreign exchange risk through

our hedging strategy: hedging forecast portfolio

distributions, balance sheet hedging through foreign

exchange forward contracts, and borrowing in

non-Sterling currencies.

* Euro-denominated running costs, which provide a

natural hedge against Euro-denominated portfolio

distributions.

* Efficient treasury management system for cash in the

underlying Portfolio Companies to maximise interest

income on deposits.

* Maintaining modest cash balances at the corporate

level to limit cash drag, facilitated through access

to the RCF.

Selective acquisition strategy and strategic investment

partnership

We maintain strategic discipline in our acquisition strategy and

portfolio composition to ensure we pursue growth that builds

shareholder value, not just for growth's sake, including:

* Broad industry relationships throughout multiple

geographies.

* Pre-emption rights to acquire co-shareholders'

interests.

* Visible pipeline through a North American strategic

partnership, which offers an option, but not an

obligation, to transact.

* Global exposure to benefit from geographical

diversification.

* Robust framework embedding ESG principles into

investment due diligence.

* Revolving corporate debt facility to support

transaction execution.

* Focus on the Management Board's core areas of

expertise.

We leverage strong relationships with leading construction

companies to source potential pipeline investments, which support

our low-risk and globally diversified investment strategy.

Typically, these contractors have secured the mandate to design and

build new assets, but look to divest financially after the

construction period has finished - thereafter often maintaining

facility management contracts through a long-term partnership. BBGI

is an attractive partner for several reasons:

* Our cost of capital is typically lower than

construction companies, so involving BBGI can make

the bid more competitive.

* We are a long-term investor with a publicly-listed

status, which is attractive to government and

government-backed counterparties.

* We are considered a reliable source of liquidity

should a construction partner decide to sell.

* Having a financial partner is a prerequisite for some

construction companies so they can avoid

consolidating Portfolio Company debt onto the balance

sheet of their parent company.

* We have extensive asset credentials and a strong

track record, which can assist with the shortlisting

process for new projects.

Portfolio review

Portfolio summary

Our investments as at 30 June 2023 consisted of interests in 56

high-quality, availability-style social infrastructure assets, 99.9

per cent of which are fully operational (by portfolio value). The

portfolio is well diversified across sectors in education,

healthcare, blue light (fire and police), affordable housing,

modern correctional facilities, clean energy , and transport

infrastructure assets.

Located in Australia, Canada, Germany, the Netherlands, Norway,

the UK, and the US , all Portfolio Companies are in stable,

well-developed, and highly-rated investment grade countries.

No. Asset Country Percentage

holding

%

1 A1/A6 Motorway Netherlands 37.1

---------------------------------- ------------ -----------

2 A7 Motorway Germany 49

---------------------------------- ------------ -----------

Aberdeen Western Peripheral

3 Route UK 33.3

---------------------------------- ------------ -----------

4 Avon & Somerset Police HQ UK 100

---------------------------------- ------------ -----------

5 Ayrshire and Arran Hospital UK 100

---------------------------------- ------------ -----------

Barking Dagenham & Havering

6 Primary Care (LIFT) UK 60

---------------------------------- ------------ -----------

7 Bedford Schools UK 100

---------------------------------- ------------ -----------

8 Belfast Metropolitan College UK 100

---------------------------------- ------------ -----------

9 Burg Correctional Facility Germany 90

---------------------------------- ------------ -----------

10 Canada Line Canada 26.7

---------------------------------- ------------ -----------

11 Champlain Bridge Canada 25

---------------------------------- ------------ -----------

12 Clackmannanshire Schools UK 100

---------------------------------- ------------ -----------

13 Cologne Schools Germany 50

---------------------------------- ------------ -----------

14 Coventry Schools UK 100

---------------------------------- ------------ -----------

15 E18 Motorway Norway 100

---------------------------------- ------------ -----------

16 East Down Colleges UK 100

---------------------------------- ------------ -----------

17 Frankfurt Schools Germany 50

---------------------------------- ------------ -----------

18 Fürst Wrede Barracks Germany 50

---------------------------------- ------------ -----------

19 Gloucester Royal Hospital UK 50

---------------------------------- ------------ -----------

20 Golden Ears Bridge Canada 100

---------------------------------- ------------ -----------

21 Highway 104 Canada 50

---------------------------------- ------------ -----------

22 John Hart Generating Station Canada 80

---------------------------------- ------------ -----------

23 Kelowna and Vernon Hospital Canada 100

---------------------------------- ------------ -----------

24 Kent Schools UK 50

---------------------------------- ------------ -----------

25 Kicking Horse Canyon Highway Canada 50

---------------------------------- ------------ -----------

26 Lagan College UK 100

---------------------------------- ------------ -----------

27 Lisburn College UK 100

---------------------------------- ------------ -----------

Liverpool & Sefton Primary

28 Care (LIFT) UK 60

---------------------------------- ------------ -----------

29 M1 Westlink UK 100

---------------------------------- ------------ -----------

30 M80 Motorway UK 50

---------------------------------- ------------ -----------

McGill University Health

31 Centre Canada 40

---------------------------------- ------------ -----------

32 Mersey Care Hospital UK 79.6

---------------------------------- ------------ -----------

33 Mersey Gateway Bridge UK 37.5

---------------------------------- ------------ -----------

34 N18 Motorway Netherlands 52

---------------------------------- ------------ -----------

35 North Commuter Parkway Canada 50

---------------------------------- ------------ -----------

36 North East Stoney Trail Canada 100

---------------------------------- ------------ -----------

North London Estates Partnerships

37 Primary Care (LIFT) UK 60

---------------------------------- ------------ -----------

38 North West Fire and Rescue UK 100

---------------------------------- ------------ -----------

39 North West Regional College UK 100

---------------------------------- ------------ -----------

Northwest Anthony Henday

40 Drive Canada 50

---------------------------------- ------------ -----------

Northern Territory Secure

41 Facilities Australia 100

---------------------------------- ------------ -----------

42 Ohio River Bridges US 66.7

---------------------------------- ------------ -----------

Poplar Affordable Housing

43 & Recreational Centres UK 100

---------------------------------- ------------ -----------

44 Restigouche Hospital Centre Canada 80

---------------------------------- ------------ -----------

45 Rodenkirchen Schools Germany 50

---------------------------------- ------------ -----------

46 Royal Women's Hospital Australia 100

---------------------------------- ------------ -----------

47 Scottish Borders Schools UK 100

---------------------------------- ------------ -----------

48 South East Stoney Trail Motorway Canada 40

---------------------------------- ------------ -----------

49 Stanton Territorial Hospital Canada 100

---------------------------------- ------------ -----------

50 Stoke & Staffs Rescue Service UK 85

---------------------------------- ------------ -----------

51 Tor Bank School UK 100

---------------------------------- ------------ -----------

52 Unna Administrative Centre Germany 90

---------------------------------- ------------ -----------

53 Victoria Correctional Facilities Australia 100

---------------------------------- ------------ -----------

54 Westland Town Hall Netherlands 100

---------------------------------- ------------ -----------

55 William R. Bennett Bridge Canada 80

---------------------------------- ------------ -----------

56 Women's College Hospital Canada 100

---------------------------------- ------------ -----------

Projects listed above are in alphabetical order

Operating model in action

Preserving and enhancing value through active asset

management

Increasing short-term interest rates across all jurisdictions

over the past 12 to 18 months has led to a renewed emphasis on

treasury management and optimisation. During the reporting period,

we have finalised cash pooling arrangements in the UK and Canada to

maximise interest generated on cash deposits of our Portfolio

Companies.

Value-accretive activities, including effective lifecycle cost

management, Portfolio Company savings, and optimised cash

reserving, contributed approximately GBP7.6 million to the NAV.

The operational performance of the Portfolio Companies continued

to be strong. Through our active value-driven approach to asset

management and the robustness of our portfolio we have achieved an

asset availability level of approximately 99.9 per cent. Deductions

were either borne by third-party facility management companies and

road operators or were part of planned expenditures.

There were no material lock-ups, default events or covenant

breaches in the underlying debt financing agreements reported in

the six months to 30 June 2023. This means that all our investments

contributed to our strong dividend cover with distributions ahead

of projections. We are very proud of this achievement.

High-quality inflation linkage

During the reporting period, inflation and interest rates

continued to remain at elevated levels in all jurisdictions where

BBGI invests. The rise in long-term interest rates had an impact on

discount rates, but it has become clear that not all asset classes

perform identically in a rising interest rate environment.

Our equity cash flows are positively linked to inflation at

approximately 0.6 per cent. If long--term inflation is 1 per cent

higher than our assumptions for all future periods, returns should

increase from 7.2 per cent to 7.8 per cent. We achieve this

high-quality inflation linkage through contractual indexation

mechanics in our Project Agreements with our public sector clients

at each Portfolio Company, and update the inflation adjustment at

least annually.

We pass on the indexation mechanism to our subcontractors - on

whom we rely to support our assets' operations - providing an

inflation cost hedge to effectively manage our cost base. The

Portfolio Companies enter facilities management and operating

subcontracts that mirror the inflation arrangements contained in

the Project Agreement. In the UK, Project Agreements tend to have a

Retail Price Index (RPI) adjustment factor, while other regions

commonly use Consumer Price Index (CPI) indexation. However, some

Project Agreements have bespoke inflation indexes that reflect

expected operations and maintenance costs.

The extent of a Portfolio Company's linkage to inflation is

determined by the portion of income and costs linked to inflation.

In most cases, cash flows are positively inflation-linked as the

indexation of revenues is greater than the indexation of

expenses.

The high-quality and defensive nature of our inflation linkage

is underpinned by:

Contractual increases: The adjustment for inflation is a

contractual component of the availability-style cash flows for each

Portfolio Company, supported by creditworthy government or

government-backed counterparties in AA to AAA-rated countries.

While other types of assets may offer a strong theoretical

inflation linkage (e.g., the ability to raise prices in response to

an increase in CPI), they may be subject to changes in elasticity

of demand. For example, toll roads and student accommodation

projects may have the potential to increase prices in response to

an increase in CPI but may be hindered by market demand from

increasing revenue, while costs may simultaneously rise. Such

assets would therefore need to be priced at an appropriate

risk-adjusted basis.

Protection against rising costs: We transfer the indexation

mechanism to our subcontractors, who are crucial in supporting the

operations of our assets. This arrangement serves as an inflation

cost hedge, helping us to efficiently control our cost base.

Similarly, in most cases, the risk of energy cost increases rests

with our public sector client or has been passed down to the

subcontractor.

Not dependent on regulatory review: The inflation adjustment is

automatic and contractual and is not subject to regulatory review.

Once the relevant reference factor is published, the adjustment is

mechanical.

Portfolio approach: Our inflation linkage comes from diverse

Portfolio Companies in different countries.

Prudent financial management

Our assets continued to perform well during the reporting period

with cash receipts during the period ahead of projections.

Our net debt position as of 30 June 2023 was GBP7.9 million with

drawings outstanding under the RCF representing 2.4 per cent of

NAV.

We have efficient cash management in place, which aims to avoid

cash drag. We use the proven financing methodology of drawing on

our RCF before raising new equity to repay the temporary debt. The

committed amount available to the Company from the RCF is GBP230

million, which matures in 2026. Furthermore, the Company has the

possibility of increasing the quantum to GBP300 million by means of

an accordion provision. This provides us with the ability to

execute larger acquisitions in an efficient manner, and ensures we

are a trusted and repeat partner in our key markets.

Despite increasing cost pressures resulting from heightened

levels of inflation, our diligent approach to cost management has

enabled us to maintain our ongoing charges at a competitive level

of 0.92 per cent.

Selective acquisition strategy

During the period, we remained active in the market and

carefully assessed new investment opportunities. Although we

evaluated several opportunities, the Management Board chose not to

pursue them as they did not meet our criteria for accretive

inflation-linkage, yield, or residual life.

Supply chain monitoring

The Management Board consistently monitors the potential

concentration risk posed by operations and maintenance (O&M)

contractors that provide counterparty services to our assets. The

table below depicts the level of O&M contractor exposure as a

percentage of portfolio value. ([xiv])

O&M contractors

==================================== ======= =====

Portfolio Company in-house 13%

SNC-Lavalin O&M Inc 10%

Capilano Highway Services 10%

Cushman and Wakefield 6%

Black & McDonald 6%

Integral FM 5%

Honeywell 5%

Hochtief Solutions

AG 4%

Carmacks Maintenance Services 4%

Graham AM 3%

Intertoll Ltd. 3%

BEAR Scotland 3%

Guildmore Ltd. 3%

Amey Community Ltd. 3%

Galliford Try FM 3%

Remaining investments 19%

100%

The Management Board has thoroughly assessed the risk exposure

and has not identified any significant risks. We have a strict

supply chain monitoring policy in place and maintain a diverse

contractor base and supply chain, with no concentrated exposure.

Additionally, we have implemented risk mitigation measures to

address any potential supply chain issues proactively.

Construction defects

We proactively monitor the quality of our assets to promptly

identify any construction defects. When necessary, we take

appropriate remediation measures to ensure the highest standard of

our portfolio. The responsibility for, and the cost of remediation

and related deductions lie with the relevant construction

subcontractor on each asset, in line with statutory limitation

periods. This plays an important role in our effective counterparty

risk management.

Latent defects risk was mitigated during the reporting period,

with 58 per cent of portfolio value covered by either limitation or

warranty periods and there were no material defects reported on any

of our portfolio assets.

Latent defects limitations / Warranty

period remaining

========================================== =====

Expired 42%

Within 1 year 10%

1-2 years 8%

2-5 years 19%

5-10 years 15%

10+ years 6%

100%

Project hand back

At the end of a concession, the private partner transfers

control and management of the project back to the public sector.

This process is termed 'hand back'. The concessions for two of the

Company's UK accommodation assets will expire in January 2026 and

August 2027. Preparations for their hand back is underway.

Following the Infrastructure and Projects Authority UK's

guidelines, collaborative working groups have been established,

comprising representatives from the Authority, the FM contractor,

and the Portfolio Companies, each involved in the projects. The FM

contractor bears the hand back risk for both assets.

The hand back process is progressing positively, with notable

advancements made so far. Interactions and cooperation among all

parties are robust, fostering strong relationships. As of now, no

risks that could affect either of the Portfolio Companies have been

detected in the process.

Market trends and pipeline

BBGI continues to operate in an unpredictable macroeconomic and

geopolitical environment. Financial markets remain volatile, and

peak inflation and interest rate levels and timing remain

uncertain.

As rising long-term risk-free rates were predominantly observed

in the UK during the reporting period, we have seen robust demand

and only a moderate increase in pricing for high-quality

availability-style infrastructure assets, as evidenced by

third-party transactions. However, the changing macroeconomic

conditions have negatively impacted the share prices of listed

infrastructure companies, limiting sector participants' short-term

access to equity capital markets. Therefore, we will continue to

exercise discipline and only pursue transactions that are accretive

and enhance our portfolio construction.

We believe infrastructure will remain an attractive asset class

due to its defensive nature, predictable cash flows, and inflation

linkage. Looking ahead, the social infrastructure asset class shows

promising prospects, driven by the need for decarbonisation,

digitalisation, and the upgrade or replacement of ageing

infrastructure.

With a healthy balance sheet and a largely untapped RCF, we are

well positioned to navigate the evolving core infrastructure

landscape with discipline and ambition. Our objective is to deliver

accretive long-term predictable and inflation-linked cash flows to

our shareholders.

As many market participants are evaluating the prospects of an

economic recession, we take comfort in the resilience of the

contractual nature of our cash flows, which are paid by high

credit-quality government clients, in return for delivering

essential social infrastructure.

Within the broader infrastructure sector, there has been a wide

variation in how different types of assets have performed. Going

forward, economic infrastructure investments may be impacted if the

economy grows at lower rates than forecast. However, the

availability-style infrastructure assets in which we invest are

less cyclical, and thus more resilient during potential economic

downturns.

New opportunities

While BBGI's primary focus remains on the secondary market, we

recognise that primary market activity serves as an essential

indicator for future secondary opportunities in the medium to

longer term. Although there is no guarantee that the planned

infrastructure spending will result in investment opportunities, we

expect that governments will seek private sector capital to support

their ambitious plans, especially considering the significant

strain on government balance sheets following the Covid

pandemic.

Numerous countries have announced substantial infrastructure

investments in response to climate change targets. The OECD

forecasts a need for US$6.9 trillion in global investment annually

until 2030 to meet climate and development objectives.[xv]

Canada : The 'Investing in Canada Plan' commits over C$180

billion until 2035 for infrastructure projects benefitting

Canadians. Over C$136 billion has been invested to date. The

Investing in Canada Plan is designed to achieve three objectives:

create long-term economic growth to build a stronger middle class;

support the resilience of communities and transition to a clean

growth economy; and build social inclusion and socio-economic

outcomes for all Canadians. Investments will be directed towards

infrastructure to support a resilient recovery, focusing on public

transit, low-carbon transition initiatives, and a national

infrastructure fund.

UK: The UK Infrastructure Bank, established in 2021, aims to

stimulate growth and transition to net zero by 2050. Together with

the private sector and local government, the bank is leading a

shared mission to accelerate investment in the UK's infrastructure.

The government expects to support at least GBP40 billion of

investments in various sectors, including transport, water, waste

and digital.

US: The Infrastructure Investment and Jobs Act, a US$1.2

trillion bipartisan bill approved in November 2021, commits

significant funding to infrastructure development across various

areas, including roads, bridges, public transit and broadband. It

is the largest such investment programme in more than a generation

and raises federal infrastructure spending to its highest share of

GDP since the early 1980s.

EU: The European Commission unveiled a major infrastructure

investment strategy aimed at mobilising up to EUR300 billion of

investments in global development between 2021 and 2027[xvi]. The

strategy will seek to develop physical infrastructure in five key

sectors: digital; climate and energy; transport; health; and

education and research and allows the EU to leverage public and

private investment in priority areas. The European Commission said

the European Fund for Sustainable Development will make up to

EUR135 billion available for guaranteed investments for

infrastructure projects between 2021 and 2027.

Australia: The Australian Government is investing A$120 billion

over ten years from 2022-2033 in land transport infrastructure

through its rolling infrastructure pipeline, most of which is

delivered under the Infrastructure Investment Program. The

government has committed to upgrading key freight routes in the

regions, reducing traffic congestion in cities, developing faster

rail, improving road safety, and empowering local councils to

support projects that matter to local communities.

2023 and beyond: BBGI's pipeline for transactions

BBGI remains committed to expanding its essential social

infrastructure portfolio. From 19 availability-style assets in

2011, our portfolio has grown to 56 assets, including roads,

schools, healthcare facilities, transport and modern correctional

facilities.

Our focus remains on assets with long-term predictable and

inflation-linked revenues, often with public sector counterparties,

either through concessions or direct ownership. These opportunities

will further diversify and strengthen our portfolio, ensuring

sustainable returns for our shareholders.

Operating and financial review

The Management Board is pleased to present the Operating and

Financial Review for the six months ended 30 June 2023.

Highlights and key performance indicators

Certain key performance indicators ('KPIs') for the past 3.5

years are outlined below:

KPI Target Dec-20 Dec-21 Jun-23 Commentary

Dec-22

Progressive long-term 50% of the

Dividends dividend growth 2023 target

(paid or declared) in pps 7.18 7.33 7.48 3.965 declared

------------------------------ ------ ------ -------- ----------- -----------------

Not achieved

Positive NAV per during the

NAV per share share growth 1.2% 2.1% 6.6% (1.4%) reporting period

------------------------------ ------ ------ -------- ----------- -----------------

Annualised total 7% to 8% annualised

shareholder return on IPO issue price

since IPO of GBP1 per share 11.0% 10.4% 8.8% 7.4% Achieved

------------------------------ ------ ------ -------- ----------- -----------------

Competitive cost

Ongoing charge position 0.86% 0.86% 0.87% 0.92%[xvii] Achieved

------------------------------ ------ ------ -------- ----------- -----------------

Cash dividend

cover >1.0x 1.27x 1.31x 1.47x 1.68x Achieved

------------------------------ ------ ------ -------- ----------- -----------------

Asset availability > 98% asset availability P P P P Achieved

------------------------------ ------ ------ -------- ----------- -----------------

Single asset To be less than 9% 11% 11% 10 % Achieved

concentration 25% of portfolio

risk immediately post-acquisition

(as a percentage (GEB) (ORB) (ORB) (ORB)

of portfolio)

------------------------------ ------ ------ -------- ----------- -----------------

Availability-style

assets

(as a percentage Maximise availability-style

of portfolio) assets 100% 100% 100% 100% Achieved

------------------------------ ------ ------ -------- ----------- -----------------

Asset management

Cash performance

Our portfolio of 56 high-quality, availability-style PPP

infrastructure investments performed well during the period, with

total cash flows ahead of projections and the underlying financial

models.

Construction exposure

Our investment policy is to invest principally in assets that

have completed construction and are operational. Accordingly,

investments in assets that are under construction are limited to 25

per cent of the portfolio's value. We aim to produce a stable

dividend, while gaining exposure to the potential NAV uplift that