TIDMBNC

RNS Number : 6611I

Banco Santander S.A.

17 June 2011

Press Release

Banco Santander's Annual Shareholders' Meeting

Emilio Botin: "We expect profit to be in line with 2010 and to

maintain the dividend at EUR 0.60 per share"

-- "Over the coming years, I am confident that the real

potential of the bank's results will be reflected in the

significant rates of growth of our profit."

-- The Board of Directors yesterday agreed to pay a first

interim dividend for 2011 on 1 August amounting to 0.13 euros per

share, which is equal to that paid in 2010.

-- "After three years of a strong economic and financial crisis

we can assure that the international economy is recovering."

-- "Our business in Spain has reached a moment in which the

trend is clearly changing, a turning point. The customer margin is

recovering and non-performing loans have peaked."

-- "Now is the time to continue working towards reducing the

distance from those countries that are making a clear recovery. To

do so, the key is completing the restructuring of the financial

system.

-- "Spain will get through this crisis, as it has always done in

difficult moments. What is needed can be summed up in three words:

Reforms, work and confidence. We have very competitive companies

and the best prepared generation of young people in the history of

the country."

-- "With a dividend yield of 7.5%, the Banco Santander share is

clearly an excellent investment opportunity."

-- "Our aim is to further improve our business model in terms of

geographical diversification, balance sheet strength, liquidity,

high return on our share capital, dividends, operating efficiency,

service quality and a strong and attractive brand."

Madrid, June 17, 2011 - Banco Santander Chairman Emilio Botin

today presided over the Bank's Annual Shareholders' Meeting, which

approved the bank's 2010 results. Banco Santander registered net

attributable profit of EUR 8,181 million last year, down 8.5% from

2009. Mr. Botin said: "Against the difficult backdrop of 2010,

marked by instability in the markets, significant changes in

financial regulation and a fragile economic recovery, Banco

Santander was able to achieve an excellent year. This profit is

from ordinary income, does not include any type of extraordinary

gains and was achieved along with a highly prudent provisioning

policy."

In his speech to shareholders, Santander's Chairman recalled

that, "For a fourth year in a row, Banco Santander was one of the

banks with the largest profits worldwide, which confirms its

ability to be profitable even in more difficult economic scenarios.

Accumulated profit over the last four years amounted to EUR 35

billion, which places the bank in third place worldwide in terms of

earnings. During this same period, Banco Santander kept shareholder

remuneration stable, distributing a total of EUR 18.8 billion."

Botin described the four pillars which support Banco Santander's

growth and differentiate Santander from other large international

banks:

-- Capital and liquidity strength: "The strength of the balance

sheet has been one of our priorities in 2010 and we have continued

making this a priority during the first few months of 2011. Banco

Santander has high solvency ratios of maximum quality," Botin said.

He explained that core capital is now above 9% (last year, this

ratio closed at 8.8%) which is greater than that stipulated by the

new regulation. He added: "This excellent performance is to a large

extent the result of the Group's ability to organically generate

capital. Banco Santander has a rate of return on capital which is

one of the highest among the main global banks." Regarding the

liquidity position, he recalled that the Bank raised EUR 109

billion in deposits and launched issues in various markets

amounting to EUR 38 billion.

-- Strict risk management. "We maintain our non-performing loans

ratios below the system average in all geographical areas in which

we are present. In addition, except for Spain and Portugal, the

non-performing loans ratio already shows a downward trend in the

Group's other main units. This is all being reinforced with a very

conservative provisioning policy. In recent years we have

recognised provisions amounting to EUR 27.3 billion, and we have

limited exposure to the construction and property development

sector in Spain."

-- The customer-focused retail banking business model: Retail

banking represents 80% of the Group's profit. "Banco Santander has

the largest international banking branch network, with 14,700

offices providing service to 101 million customers. Over the last

year and a half, we have increased our distribution capacity by

1,100 offices and the number of customers by nine million. Our

retail banking business model is closely related to our structure

of autonomous subsidiaries in terms of capital and liquidity, which

is strengthened by listing our main subsidiaries on the stock

market."

-- Geographical diversification: "Banco Santander's strategy in

recent years has been aimed at reaching a critical mass and high

quotas in our 10 main markets, of which half are developed markets

and half are emerging markets," Botin said. He highlighted that

"over the last few years, Banco Santander has been able to offset

the weak results in Spain and Portugal with the high growth of our

profits in Latin America and the growing results from the

integration of our banks in the United Kingdom and the United

States. We are the only international bank with a significant

presence in six economies of the G-20. The presence of Banco

Santander in Latin America is double that of the second global bank

in the region."

He outlined the excellent economic fundamentals and stability of

Brazil, which accounts for 25% of the Group's profit. "Banco

Santander anticipated Brazil's positive outlook and invested

$27.100 billion in this market. After unifying the brand and

technological integration, we expect to obtain greater commercial

strength and gain market share in the coming years." The rest of

Latin America represents 18% of the Group's profit and is also a

fundamental platform for growth."

Regarding the U.K, where Santander has 1,412 branches and which

accounts for 18% of the Group's profit, Botin said: We are the

second retail bank in terms of deposits, offices and mortgages and

the only international bank that is succeeding in this

country."

Botin also mentioned the Bank's business in Spain, which

contributes 15% to total profit. "After a few years of economic

weakness, which translated into less profit, our business has

reached a moment in which the trend is clearly changing, a turning

point. The results obtained during the first quarter have shown

this: the customer margin is recovering and non-performing loans

have peaked. We expect the non-performing loans ratio in Spain to

reach its highest level in 2011."

As to Portugal, he said: "We expect the sovereign debt crisis in

Portugal to have a very minimum impact on the Group. He explained

that the portfolio of Portuguese government debt amounts to EUR

1.600 billion. "Our bank is the most solvent and solid of the

country and represents 4% of the Group's business and 3% of

profit," he added.

Botin went through the acquisitions carried out in 2010 in

Germany (173 branches of SEB bank) and Poland (Zachodni Bank). He

said: This strategy of strengthening our geographic position was

accompanied by a policy of divestments which allowed the amount of

purchases carried out by Banco Santander in the last three years to

be virtually equal to the figure obtained from sales, totalling EUR

14 billion."

Botin highlighted the Group's strategy of listing its main

subsidiaries on local markets and mentioned the following

advantages:

- It is consistent with our model of autonomous subsidiaries in

terms of capital, liquidity and living wills.

- It enhances the value of our subsidiaries and serves as an

instrument for local purchases.

- It enables us to provide incentives to local teams.

- It is a potential source of very flexible and immediate

capital for the Group.

- Lastly, it promotes transparency and good corporate

governance

The international economic environment

Botin devoted part of his speech to a review of the

international economic outlook. "After three years of acute

economic and financial crisis, we can say that the international

economy is recovering. In particular, the data confirms the

strengthening of the emerging economies." In advanced economies, he

said that "the main countries show increasingly stronger signs of

consolidating their rate of growth, which will positively impact

other countries that are still in a slow recovery phase."

Regarding Spain, he noted that "In the past year, important

steps were taken with a view to recovering the confidence of

international markets. Structural reforms were launched which have

allowed Spain to remain separate from the peripheral countries.

Therefore, now is the time to continue working towards reducing the

distance. from those countries that are making a clear recovery. To

do so, the key is completing the restructuring of the financial

system. If we look at it with perspective, the changes that have

been made to the sector have been very significant over a short

period of time.

However, it is fundamental to move forward quickly on two

issues:

- First, the recapitalisation of certain institutions and their

stock exchange listings.

- Second, ensure its profitability, which requires paying

special attention to margins and reducing costs."

"Looking to the future, I am confident that Spain will get

through this crisis, as it has always done in difficult moments.

What is needed can be summed up in three words: reforms, work and

confidence. We have very competitive companies and the best

prepared generation of young people in the history of the country.

The situation of our economy offers many important challenges for

the bank. The key element is that solvent projects and the

productive sectors of the Spanish economy receive the necessary

financing.

Lastly, Botin discussed the future of the bank and his

confidence in the outlook for the share price. "The performance of

the Santander share is absolutely not in line with the trend of

results in recent years or the solidity of our balance sheet," he

said. He added that he is confident that "in view of our Group's

prospects for generating future profits, the Bank's share will

strongly recover and reflect the real value of the Santander Group.

With a dividend yield of 7.5%, the Banco Santander share is clearly

an excellent investment opportunity." He recalled that goal of

keeping shareholder remunration in 2011 at EUR 0.60 a share, and

announced that the Board of Directors yesterday agreed to

distribute, from Aug. 1, the first dividend against 2011 results of

EUR 0.13 a share, unchanged from the same dividend in 2010.

"During the first few months of 2011 we have confirmed our

ability to generate recurring profit. Profit for the first quarter

amounted to EUR 2.108 billion. The forecast for the second quarter

is that these trends will continue. Accordingly, in 2011 we expect

to obtain net profit in line with that obtained in 2010," he said.

He added that, "In the coming years, I am confident that the real

potential of the bank's results will be reflected in the

significant rates of growth in our profit."

"Our strategy will not change. Our aim is to further develop our

business model in terms of geographical diversification, balance

sheet strength, liquidity, high return on our share capital,

dividends, operating efficiency, service quality, a strong and

attractive brand. Our objective is not size for the sake of size,

but rather the solidity and profitability of the Bank. Therefore,

we will analyse opportunities for acquisition or divestment as

carefully and with as much detail as we have always done. We will

only consider investments that fit into our business model and

clearly add value for shareholders in the medium term. Today Banco

Santander is a more solvent, leading bank with greater potential

for growth than at the beginning of the financial crisis," he

concluded.

Alfredo Saenz: "Our presence in emerging markets will be a key

driver of growth for the Group in the coming years"

Banco Santander Chief Executive Alfredo Saenz, explained the

bank's 2010 results and his vision of the future to shareholders.

"We are one of the best positioned international Banks to continue

generating profitable growth in the coming years. We are

well-diversified, with one of the most solid balance sheets in

international banking, with a presence in markets that are growing

and with a banking model that has proved its success, year after

year," Saenz said.

Saenz reviewed performance in the various markets in which the

bank is present: mature markets, where the recovery is still

beginning and emerging markets with strong growth." This portfolio

of businesses reflects the advantages of a well-diversified Group:

each one of the units is in a different cycle and this translates

into strong stability for the Group's earnings. Our presence in

emerging markets will be a key driver of growth for the Group in

coming years," he said.

The Chief Executive outlined three important challenges facing

the sector:

- "The lack of growth in business volumes in economies that will

continue to deleverage alter years of growth in lending, for

example Spain and Portugal as well as the U.K. and the U.S."

- "New banking regulations, which place pressure on the

underlying returns of the system, diminish the supply of credit and

make it more expensive. We are living through very significant

regulatory changes in the financial sector that will make it more

solid, stable and robust." Regarding the new capital and liquidity

requirements know as Basel III, Saenz noted that they would not

come into full effect until 2019. He also pointed out that some

very important issues are still to be concluded, for example the

regulations regarding systemic risk. "The authorities now recognize

that size is not the most important factor in reviewing systemic

risk; rather other factors, such as the risk assumed by the

institution and the degree of interconnection among its various

units and businesses."

- High funding costs for financial institutions in financial

markets, which in turn affect customers and lowers their demand for

credit. The differentials at which the bank issues in wholesale

markets are going to be higher than what we saw prior to 2007."

"The financial sector has a clear mission to accomplish in the

coming years: recognize the changes in the landscape; adapt

ourselves to them; and seek out markets or sectors with high

potential for growth," said Saenz. He also identified the key

characteristics that winning Banks will have in the new landscape:

balance sheet solidity; critical mass in the markets n which they

operate; strong presence in growing markets and, specifically, in

emerging markets.

"We have great opportunities ahead of us and we are working to

make sure we take advantage of them. We are well positioned to

continue generating profitable growth and, therefore, to continue

to add value despite the difficult environment for the sector.

"

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCLLFFLRSIDLIL

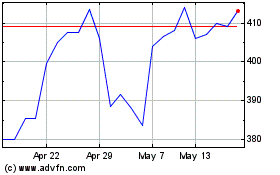

Banco Santander (LSE:BNC)

Historical Stock Chart

From Jan 2025 to Feb 2025

Banco Santander (LSE:BNC)

Historical Stock Chart

From Feb 2024 to Feb 2025