Bruntwood Bond 2 PLC Update statement on Covid 19 and rent collection

23 October 2020 - 6:00PM

RNS Non-Regulatory

TIDMBRU2

Bruntwood Bond 2 PLC

23 October 2020

23rd October 2020

BRUNTWOOD GROUP LIMITED

BRUNTWOOD INVESTMENTS PLC

BRUNTWOOD BOND 2 PLC

UPDATE STATEMENT ON COVID-19 AND LATEST RENT COLLECTION

Bruntwood Group Limited ("Bruntwood") today updates the market

on the impact of the Covid-19 pandemic on its business, including a

summary of the latest rent collection position.

Chris Oglesby, CEO of Bruntwood, said

"Since the start of the COVID crisis - our primary focus has

always been the safety and wellbeing of our colleagues and

customers. Over the last seven months, we made every effort to stay

connected with them - provided a wide range of both colleague and

customer support and communications. This includes a comprehensive

"return to the workplace" programme and operational plans in place

across all of our buildings to ensure they operate to the highest

standards of COVID safeguarding - as positively assessed by The

British Safety Council. All of this meant that, when they were

ready, both customers and colleagues have felt safe and comfortable

coming back into our COVID secure spaces; and in recent months we

have been gradually welcoming back increasing numbers."

Financial Position

Following the repayment of the 2020 Retail bonds, the Group has

GBP30m of cash reserves, GBP50m of undrawn committed available

facilities and GBP68m of unencumbered assets upon which further

finance could be secured.

The Board has modelled various scenarios including reviewing

estimated customer default rates, lower retention rates, higher

concessions and valuation yield movement. Based on the output of

these models, The Board considers there to be sufficient income and

valuation headroom across Bruntwood's debt facilities and does not

expect Bruntwood to breach any terms relating to them. We have

modelled the forecast covenant performance on each loan facility.

Valuation covenant headroom is in excess of 30% on the majority of

our facilities and in excess of 25% on our NatWest Club facility.

Income would have to fall by over 30% on all of our facilities

before any interest cover covenants are breached. In addition, we

would expect that the existence of GBP68m of unencumbered assets

would provide the resources to remedy any breaches in such

circumstances. The earliest major bank facility maturity is not

until March 2022.

Impact on Operations

Bruntwood has a well diversified customer base and is not

exposed to the failure of any single customer or sector. We have

sought to pass on the benefit of any savings made by Bruntwood in

respect of lightly utilised customer space during the Covid period,

and we continue to work with customers in response to any requests

for support which are considered on a case by case basis.

As of 20th October 2020, 95% of March quarter rents and 90% of

June rents were collected with the balance being on payment plans

or being actively pursued at the date of this announcement. If we

exclude retail customers, the relevant metrics increase to 97% of

March rent and 93% of June.

As at 20th October 2020, 79% of September quarter rents had been

collected (81% excluding retail). This is ahead of the March / June

quarters at a comparable point but behind the 92% collected at the

same date last year. We continue to speak with all our customers on

a regular basis and work with every customer to support them as far

as possible through these challenging times. We will continue to

work closely with all customers and where support is required we

will seek to reach a fair solution for everyone.

Strong cash collection and reduction in non-essential overheads

has meant that the business continues to run cash positive before

capital outlay is taken into account. Despite lettings being well

behind where we would expect them to be in a non-Covid year, record

retention levels mean that vacancy has remained consistent at

8.6%.

The 400,000 square foot first commercial phase of Circle Square

(part of the SciTech JV with Legal and General) is on track to

reach practical completion in November 2020. The majority of space

is prelet. Future phases and further development schemes will only

proceed based on the achievement of pre-let hurdles or equivalent

de-risking mechanisms. All of our current major development schemes

are pre-funded with any equity requirement having already been

injected.

ENDS

For further information, please see Bruntwood's website at

https://bruntwood.co.uk/ or contact:

Kevin Crotty (Chief Financial Officer) +44 (0) 161 212 2222

Sean Davies (Director of Financing

& Investment) +44 (0) 161 212 2222

Forward-Looking Statements: This announcement contains certain

forward-looking statements with respect to Bruntwood's expectations

and plans, strategy, management objectives, future developments and

performances, costs, revenues and other trend information. These

statements are subject to assumptions, risk and uncertainty. Many

of these assumptions, risks and uncertainties relate to factors

that are beyond Bruntwood's ability to control or estimate

precisely and which could cause actual results or developments to

differ materially from those expressed or implied by these

forward-looking statements. Certain statements have been made with

reference to forecast process changes, economic conditions and the

current regulatory environment. Any forward-looking statements made

by or on behalf of Bruntwood are based upon the knowledge and

information available to Directors on the date of this

announcement. Accordingly, no assurance can be given that any

particular expectation will be met and Bruntwood's bondholders are

cautioned not to place undue reliance on the forward-looking

statements. Additionally, forward-looking statements regarding past

trends or activities should not be taken as a representation that

such trends or activities will continue in the future. Other than

in accordance with its legal or regulatory obligations (including

under the UK Listing Rules and the Disclosure Guidance and

Transparency Rules of the Financial Conduct Authority), Bruntwood

does not undertake to update forward-looking statements to reflect

any changes in events, conditions or circumstances on which any

such statement is based. Past bond performance cannot be relied on

as a guide to future performance. Nothing in this announcement

should be construed as a profit forecast. The information in this

announcement does not constitute an offer to sell or an invitation

to buy securities in Bruntwood or an invitation or inducement to

engage in any other investment activities.

This information is provided by Reach, the non-regulatory press

release distribution service of RNS, part of the London Stock

Exchange. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NRAPPGUAUUPUUQW

(END) Dow Jones Newswires

October 23, 2020 03:00 ET (07:00 GMT)

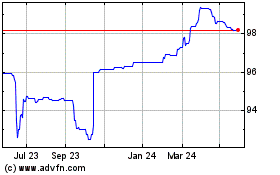

Bruntwood Bd 6% (LSE:BRU2)

Historical Stock Chart

From Nov 2024 to Dec 2024

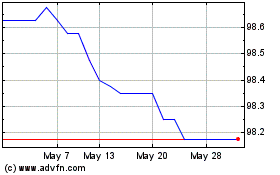

Bruntwood Bd 6% (LSE:BRU2)

Historical Stock Chart

From Dec 2023 to Dec 2024