TIDMBRU2

RNS Number : 1981A

Bruntwood Bond 2 PLC

01 February 2022

1st February 2022

BRUNTWOOD GROUP LIMITED

BRUNTWOOD INVESTMENTS PLC

BRUNTWOOD BOND 2 PLC

UPDATE STATEMENT ON 2021 ANNUAL RESULTS

Bruntwood Group Limited ("Bruntwood") today updates the market

on the recent publication of the 2021 financial statements and a

summary of the latest rent collection position.

The value of Bruntwood's 100% owned Bruntwood Works portfolio

surpassed GBP1bn for the first time after reaching GBP1.03bn (2020:

GBP973.1m). This followed new investment and strategic acquisitions

in key cities.

Bruntwood SciTech's portfolio also grew, reaching GBP669.5m

(2020: GBP545.7m) taking the total value of Bruntwood's assets to

more than GBP1.7bn.

Chris Oglesby, CEO of Bruntwood, said

"Our ability to attract, retain and grow with our customers owes

a huge amount to our unwavering commitment to invest in our

offering, even when operating within the challenging economic

environment of the past two years. The impact of this approach is

clear to see in our strong financial performance last year.

In the early days of the pandemic, there was a lot of ill

considered commentary about the decline of our city centres and

their workplaces. But in fact, what happened was that businesses

and people felt the impact their absence had on the innovation,

collaboration and interactions that make our economies successful

and our lives richer."

The first quarter of the current financial year began with

further significant investments and leasing growth across the

Bruntwood Group.

This included the acquisition by Bruntwood Works of the 84,000

sq ft, Grade II listed Pall Mall Court building in Manchester.

Greater Manchester's tech success story, Autocab, recently

announced its relocation to No.2 Circle Square and with it the aim

to create 200 new jobs.

Financial Position

The Group filed its annual accounts for the year ending

September 30th 2021. Despite the challenges presented by the

pandemic, underlying performance was extremely encouraging. Key

highlights include:

After suffering an GBP18.9m pandemic-induced loss in 2020,

pre-tax profits returned this year (GBP44.9m) as core rental income

and property valuations increased.

The result was even more noteworthy as pre-tax profits were

stated after taking into account exceptional refinancing costs of

GBP7.4m and the effect of deferred tax rate changes on our JV's

(GBP4m), resulting in a like for like swing in profit of

GBP75.2m.

Net asset value increased to GBP606.5m (2020: GBP588.6m) despite

the on-going impact of the pandemic and social distancing

restrictions since October 2020. Without a change in deferred tax

rates, the like for like number would be GBP627m.

The Group's financial position continued to strengthen after the

completion of two major funding deals including a new GBP276m,

15-year sustainability-linked facility with Aviva Investors and the

extension of a GBP240m club loan with

NatWest/HSBC/Barclays/Santander to March 2023.

The Group invested GBP18.6m into refurbishment and capital

improvement projects across its portfolio last year, along with an

additional GBP27.8m of equity injected into Bruntwood SciTech that

was matched by Legal & General. SciTech committed GBP80.8m to

new development schemes.

Operating Highlights

Bruntwood Works completed a transformative refurbishment at Bloc

- which is now at 92% leased and 97% serviced occupancy - and 111

Piccadilly in Manchester, both of which were delivered under the

Pioneer investment programme.

Bruntwood completed more than 745,000 sq ft of leasing

transactions across its portfolio lettings during the period, with

73% of customers retained at lease break or expiry, a 53%

improvement on 2020 levels. Vacancy levels were maintained at under

10%.

2022 has also started strongly with 578,000 square feet of new

lettings instructed or exchanged.

The full financial statements can be found at:

https://bruntwood.co.uk/our-performance/disclaimer/retail-bond-2025/

As of 26th January, the Group has GBP9.2m of cash reserves,

GBP28m of undrawn committed available facilities and GBP71m of

unencumbered assets upon which further finance could be

secured.

The Board has modelled various scenarios including reviewing

estimated customer default rates, lower retention rates, higher

concessions and valuation yield movement. Based on the output of

these models, The Board considers there to be sufficient income and

valuation headroom across Bruntwood's debt facilities and does not

expect Bruntwood to breach any terms relating to them. We have

modelled the forecast covenant performance on each loan facility.

Valuation covenant headroom is in excess of 20% on all of our

facilities. Income would have to fall by over 35% on all of our

facilities before any interest cover covenants are breached. In

addition, we would expect that the existence of GBP71m of

unencumbered assets would provide the resources to remedy any

breaches in such circumstances. The earliest major bank facility

maturity is not until March 2023.

The 2025 bond covenants have been tested as at September 2021

and are met with significant headroom. The covenant testing and

certificate are reported on the Bruntwood website (link as

above).

Impact on Operations

As of 20th January 2022, 98% of June quarter rents and 97% of

September rents were collected with the balance being on payment

plans or being actively pursued at the date of this announcement.

If we exclude retail customers, the relevant metrics increase to

98% of June rent and 98% of September.

As at 24th January 2022, 89% of December quarter rents had been

collected. This is comparable to the September / June quarters at

the same point. We continue to speak with all our customers on a

regular basis and work with every customer to support them as far

as possible through what remain challenging times.

ENDS

For further information, please see Bruntwood's website at

https://bruntwood.co.uk/ or contact:

Kevin Crotty (Chief Financial Officer) +44 (0) 161 212 2222

Sean Davies (Director of Financing

& Investment) +44 (0) 161 212 2222

Patrick King (Peel Hunt) +44 (0) 203 597 8622

Mark Glowery (Allia C&C) +44 (0) 203 039 3465

Forward-Looking Statements: This announcement contains certain

forward-looking statements with respect to Bruntwood's expectations

and plans, strategy, management objectives, future developments and

performances, costs, revenues and other trend information. These

statements are subject to assumptions, risk and uncertainty. Many

of these assumptions, risks and uncertainties relate to factors

that are beyond Bruntwood's ability to control or estimate

precisely and which could cause actual results or developments to

differ materially from those expressed or implied by these

forward-looking statements. Certain statements have been made with

reference to forecast process changes, economic conditions and the

current regulatory environment. Any forward-looking statements made

by or on behalf of Bruntwood are based upon the knowledge and

information available to Directors on the date of this

announcement. Accordingly, no assurance can be given that any

particular expectation will be met and Bruntwood's bondholders are

cautioned not to place undue reliance on the forward-looking

statements. Additionally, forward-looking statements regarding past

trends or activities should not be taken as a representation that

such trends or activities will continue in the future. Other than

in accordance with its legal or regulatory obligations (including

under the UK Listing Rules and the Disclosure Guidance and

Transparency Rules of the Financial Conduct Authority), Bruntwood

does not undertake to update forward-looking statements to reflect

any changes in events, conditions or circumstances on which any

such statement is based. Past bond performance cannot be relied on

as a guide to future performance. Nothing in this announcement

should be construed as a profit forecast. The information in this

announcement does not constitute an offer to sell or an invitation

to buy securities in Bruntwood or an invitation or inducement to

engage in any other investment activities.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ACSEASFFDDEAEFA

(END) Dow Jones Newswires

February 01, 2022 02:59 ET (07:59 GMT)

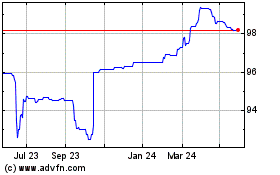

Bruntwood Bd 6% (LSE:BRU2)

Historical Stock Chart

From Feb 2025 to Mar 2025

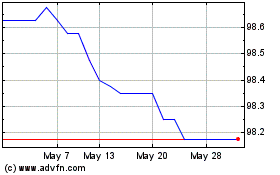

Bruntwood Bd 6% (LSE:BRU2)

Historical Stock Chart

From Mar 2024 to Mar 2025