TIDMBWRA

RNS Number : 9739U

Bristol Water PLC

29 November 2023

Announcement of unaudited interim results for the six months

ended 30 September 2023

Bristol Water plc (the "Company") announces its unaudited

results for the six months ending 30 September 2023.

The Company's interim financial results are set out below and

can also be accessed via the Company's website.

FINANCIAL HIGHLIGHTS

Six months Six months

to to

30 September 30 September

2023 2022

(unaudited) (unaudited)

GBPm GBPm

Revenue - 69.7

EBITDA (0.3) 32.9

Profit before taxation (0.1) 0.4

Earnings per share

Statutory (loss) / profit per share (5.0)p 5.0p

On 1st February 2023 the Company's licence, trading, assets and

liabilities were transferred to South West Water Limited. Post this

statutory transfer the only transactions in the income statement

relate to the remaining preference shares, debentures and pension

asset. The remaining obligations relating to these are met from

matching intra-group contracted assets and related receipts.

During the period the Company declared a dividend of GBP143.0m,

payable to the parent company, South West Water Limited, as part of

the planned group restructuring steps post statutory transfer. This

dividend reduced the intercompany debtor balance owed by South West

Water Limited.

For further information, please contact:

Paul Boote Group Chief Financial Officer 01392 443 168

Jennifer Cooke Group Head of Investor Relations 01392 443 618

James Murgatroyd

Harry Worthington FGS Global 020 7251 3801

INCOME STATEMENT

For the six months ended 30 September 2023

Six months to Six months to Year to

30 September 30 September 31 March

2023 2022 2023

(unaudited) (unaudited) (audited)

Note GBPm GBPm GBPm

Revenue before non underlying items 5 - 69.7 115.6

Non underlying revenue - - (6.6)

=============== ============== ===========

Revenue - 69.7 109.0

Operating costs 6 (0.3) (49.1) (84.6)

Impairment losses on trade receivables - (2.1) (3.5)

=============== ============== ===========

Operating costs before non underlying items (0.3) (51.2) (88.1)

Non underlying operating costs - - (1.2)

=============== ============== ===========

Total net operating costs (0.3) (51.2) (89.3)

Operating (loss) / profit (0.3) 18.5 19.7

Interest payable and similar charges before non underlying items 7 (0.6) (20.1) (34.0)

Interest receivable and similar charges before non underlying

items 0.8 2.0 2.7

Non underlying interest payable and similar charges - - (13.1)

=============== ============== ===========

Net interest payable and similar charges 0.2 (18.1) (44.4)

(Loss) / profit on ordinary activities before taxation (0.1) 0.4 (24.7)

Taxation on (loss) / profit on ordinary activities 8 (0.2) (0.1) 4.5

(Loss) / profit for the period/year (0.3) 0.3 (20.2)

=============== ============== ===========

(Loss) / earnings per ordinary share 9 (5.0)p 5.0p (336.7)p

Substantially all of the Company's operations were discontinued

during the year ended 31 March 2023.

STATEMENT OF COMPREHENSIVE INCOME

For the six months ended 30 September 2023

Six months to Six months to Year to

30 September 30 September 31 March

2023 2022 2023

(unaudited) (unaudited) (audited)

Note GBPm GBPm GBPm

(Loss) / profit for the period/year (0.3) 0.3 (20.2)

Other comprehensive income:

Items that will not be reclassified to profit and loss

Actuarial losses on retirement benefit surplus - 0.1 0.5

Re-measurement of defined benefit pension scheme 8 - - (0.1)

============== ============== ==========

Other comprehensive income for the period/year, net of tax - 0.1 0.4

Total comprehensive (loss) / profit for the period/year (0.3) 0.4 (19.8)

============== ============== ==========

STATEMENT OF FINANCIAL POSITION

As at 30 September 2023

30 September 30 September 31 March

2023 2022 2023

restated

(unaudited) (unaudited) (audited)

Note GBPm GBPm GBPm

Non-current assets

Property, plant and equipment - 689.6 -

Intangible assets - 13.3 -

Other investments - Loans to a

UK holding Company - 61.1 -

Other receivables 10 26.6 - 26.6

Retirement benefit surplus 11 8.2 8.0 8.2

============= ============= ===========

34.8 772.0 34.8

Current assets

Inventory - 2.2 -

Trade and other receivables 1.5 35.9 144.5

Current tax asset 0.6 - 0.7

Cash and cash equivalents 0.3 14.3 0.1

============= ============= ===========

2.4 52.4 145.3

Total assets 37.2 824.4 180.1

============= ============= ===========

Non-current liabilities

Lease liabilities - (0.9) -

Deferred income tax liabilities - (94.0) -

Borrowings and derivatives 12 (1.6) (413.5) (1.6)

8.75% irredeemable cumulative preference

shares 12 (12.5) (12.5) (12.5)

Deferred income - (1.6) -

Government Grants - (0.3) -

============= ============= ===========

(14.1) (522.8) (14.1)

Current liabilities

Lease liabilities - (0.4) -

Current portion of deferred income - (2.7) -

Trade and other payables (1.3) (43.4) (0.9)

Current tax liability - (5.5) -

(1.3) (52.0) (0.9)

Total liabilities (15.4) (574.8) (15.0)

============= ============= ===========

Net assets 21.8 249.6 165.1

============= ============= ===========

Equity

Called-up share capital 6.0 6.0 6.0

Share premium account 4.4 4.4 4.4

Other reserves 5.8 5.8 5.8

Retained earnings 5.6 233.4 148.9

============= ============= ===========

Total Equity 21.8 249.6 165.1

============= ============= ===========

The financial statements of Bristol Water plc, registered number 02662226

on pages 2 to 14 were approved by the Board of Directors 28 November

2023 and signed on its behalf by:

Paul Boote

Director

STATEMENT OF CHANGES IN EQUITY

For the six months ended 30 September 2023

Called up share capital Share premium Capital redemption Retained earnings Total

account reserve

GBPm GBPm GBPm GBPm GBPm

Balance at 1 April 2022

(restated, note 3.2) 6.0 4.4 5.8 232.9 249.1

======================== ============== =================== ================== ========

Profit for the period - - - 0.3 0.3

Other comprehensive

income for the period:

Actuarial gains

recognised in respect

of retirement - - - 0.1 0.1

benefit obligations

Re-measurement of - - - - -

defined benefit scheme

Total comprehensive

income for the period - - - 0.4 0.4

Ordinary dividends - - - - -

Share-based payments - - - 0.1 0.1

Balance as at 30

September 2022 6.0 4.4 5.8 233.4 249.6

======================== ============== =================== ================== ========

Balance at 1 April 2023 6.0 4.4 5.8 148.9 165.1

======================== ============== =================== ================== ========

Loss for the period - - - (0.3) (0.3)

Other comprehensive

income for the period:

Actuarial losses - - - - -

recognised in respect of

retirement

benefit obligations

Re-measurement of - - - - -

defined benefit scheme

Total comprehensive

income for the period - - - (0.3) (0.3)

Ordinary dividends - - - (143.0) (143.0)

Balance as at 30

September 2023 6.0 4.4 5.8 5.6 21.8

======================== ============== =================== ================== ========

The Board has not proposed interim dividends on the ordinary

shares in respect of the period ended 30 September 2023 (6 months

ended 30 September 2022: GBPnil).

CASH FLOW STATEMENT

For the six months ended 30 September 2023

Six months to Six months to Year to

30 September 30 September 31 March

2023 2022 2023

(unaudited) (unaudited) (audited)

Note GBPm GBPm GBPm

Cashflows from operating activities

(Loss) / profit before taxation (0.1) 0.4 (24.7)

Adjustments for:

Share based payments - 0.1 0.1

Deferred income amortisation - (2.0) (3.3)

Depreciation 6 - 12.7 21.4

Amortisation of intangibles 6 - 1.7 2.9

Difference between pension charges and contributions paid 0.3 0.2 0.6

Profit on disposal of assets - - 0.1

Interest income 7 (0.5) (1.8) (2.4)

Interest expense 7 0.6 20.1 47.1

Pension interest income 7 (0.3) (0.2) (0.3)

Increase in inventory - (0.3) (0.5)

(Increase) / decrease in trade and other receivables - (4.4) 0.5

(Decrease) / increase in trade and other creditors and

provisions (0.1) 5.7 9.5

=============== ============== ===========

Cash (used in) / generated from operations (0.1) 32.2 51.0

Interest paid - (7.2) (21.4)

Corporation taxes paid - (1.5) (1.6)

Contributions received - 1.5 2.8

=============== ============== ===========

Net cash (used in) / generated from operating activities (0.1) 25.0 30.8

=============== ============== ===========

Cash flows from investing activities

Purchase of property plant and equipment and intangibles - (23.0) (40.7)

Interest received 0.8 - 2.4

Repayment of intercompany loan receivable - - 61.1

Transfer of trade and assets - - (5.1)

=============== ============== ===========

Net cash generated from / (used in) investing activities 0.8 (23.0) 17.7

=============== ============== ===========

Cash flows from financing activities

Proceeds from loans and borrowings - 8.0 81.1

Repayment of loans and borrowings - (7.0) (75.8)

Payment of lease liabilities - (0.2) (0.3)

Preference dividends paid (0.5) (0.5) (1.1)

Equity dividends paid - - (64.3)

=============== ============== ===========

Net cash (used in) / generated from financing activities (0.5) 0.3 (60.4)

=============== ============== ===========

Net increase / (decrease) in cash and cash equivalents 0.2 2.3 (11.9)

Cash and cash equivalents, beginning of period 0.1 12.0 12.0

Cash and cash equivalents, end of period 0.3 14.3 0.1

=============== ============== ===========

The current year movement in trade and other receivables

includes a dividend in specie of GBP143.0m which was used to reduce

the intercompany debtor balance owed by South West Water

Limited.

NOTES TO THE INTERIM ACCOUNTS

For the six months ended 30 September 2023

1 General Information

Bristol Water plc ("the Company") is a public company, limited by shares, with irredeemable

preference shares and debenture stock listed on the London Stock Exchange.

The Company is incorporated and domiciled in England, United Kingdom. The address of its registered

office is Bridgwater Road, Bristol, BS13 7AT, England.

2 Basis of preparation

The financial information contained in this interim announcement does not constitute statutory

accounts within the meaning of section 435 of the Companies Act 2006. The interim accounts

have been prepared in accordance with Financial Reporting Standard 104 "Interim Financial

Reporting" issued by the Financial Reporting Council and the Disclosure Rules and Transparency

Rules of the United Kingdom's Financial Conduct Authority.

The Company has adopted FRS 101 "Reduced disclosure framework - Disclosure exemptions from

EU-adopted IFRS for qualifying entities".

3 Accounting policies

The same accounting policies used in preparing the annual financial statements as at 31 March

2023 have been used in preparing these interim accounts.

3.1 Going concern

Following the transfer of the Company's licence, trade, assets and obligations to South West

Water Limited on 1 February 2023, the Company's remaining obligations will be met by matching

intra-group contracted assets and related receipts. The Company has received confirmation

from Pennon Group plc that it will provide support to the Company should it be required, to

meet its liabilities as they fall due for the period which covers the period from approval

of these interim financial statements through to 30 November 2024. As a result, the Directors

have concluded that the Company has adequate resources, or the reasonable expectation of raising

further resources as required, to continue in operational existence for the foreseeable future.

The Company therefore continues to adopt the going concern basis in preparing its financial

statements . Further information on the Company's borrowings is given in note 12.

3.2 Change in accounting policies

As at 30 September 2022, the Company's accounting policies were aligned to its parent company

Pennon Group plc resulting in a restatement of the opening balance sheet as at 1 April 2022.

At 31 March 2023 the estimates used in the September 2022 interim financial statements were

updated resulting in a small additional change to the opening retained earnings and deferred

tax liability balances as at 1 April 2022. The Company's financial statements for the comparative

period, i.e. 30 September 2022, have been restated so all periods are comparable. The impact

of this adjustment also includes the correction of a presentational error whereby deferred

tax assets should have been offset against deferred tax liabilities in line with IAS 12 and

a change in the presentation of current tax liability as a separate line item in the balance

sheet in line with IAS 1.

4 Critical accounting estimates and judgments

The preparation of interim financial statements requires management to make judgements, estimates

and assumptions that affect the application of accounting policies and the reported amounts

of assets and liabilities, income and expense. Actual results may differ from these estimates.

Estimates and judgments are continually evaluated and are based on historical experience and

other factors, including expectations of future events that are believed to be reasonable

under the circumstances.

The estimates and assumptions that have a significant risk of causing a material adjustment

to the carrying amount of assets and liabilities within the financial year relate to the defined

benefit scheme. The significant judgements made by management in applying the Company's accounting

policies and the key sources of estimate uncertainty relating to the defined benefit scheme

were the same as those applied to the financial statements for the year ended 31 March 2023.

5 Revenue

Six months to Six months to Year to

30 September 2023 30 September 2022 31 March 2023

(unaudited) (unaudited) (audited)

GBPm GBPm GBPm

Appointed income

Household - measured - 30.6 50.0

Household - unmeasured - 21.6 36.1

Non-household- measured - 13.2 22.2

Non-household - unmeasured - 0.2 0.3

Contributions from developers - 2.0 3.3

Third party services - 0.9 1.8

Rental income - 0.6 1.0

============================ ===================== ================

- 69.1 114.7

Non-appointed income

Recreations - 0.3 0.5

Rental income - 0.1 0.2

Other - 0.2 0.2

============================ ===================== ================

- 0.6 0.9

Revenue before non underlying items - 69.7 115.6

============================ ===================== ================

Non underlying income

Watershare + - - (6.6)

============================ ===================== ================

Total Revenue - 69.7 109.0

============================ ===================== ================

Appointed income was income earned under the Company's licence to supply water for the period

until 1 February 2023 when the licence was transferred to SWW. Non-appointed income related

to activities that do not require a water supply licence. All revenue related to the trade

and assets transferred to SWW.

The total revenue in the year ended 31 March 2023 includes GBP107.9m for revenue from contracts

with customers under IFRS 15 and GBP1.1m of leasing income under IFRS 16 "Leases".

In the year ended 31 March 2023, the Company offered Pennon Group plc's, its parent company,

WaterShare+ scheme to its customers whereby customers could choose to accept a credit on their

bill or take shares in Pennon Group plc. The value of the rebate equated to GBP13 per customer

and the total value of GBP6.6 million was recognised in full as a non-underlying reduction

to revenue. This item was non-underlying in nature given its individual size and its non-recurring

nature.

6 Operating expenses

Six months to Six months to Year to

30 September 2023 30 September 2022 31 March 2023

(unaudited) (unaudited) (audited)

GBPm GBPm GBPm

Operating expenses include -

Payroll cost, net of recharges to fixed assets

and including

retirement benefit costs - 8.6 14.0

Depreciation and amortisation - 14.4 24.3

Profit on disposal of assets - - 0.1

Non underlying costs include -

Legal costs - - 1.0

Integration costs - - 0.2

In the prior year GBP40m bonds due to be repaid in March 2041 were redeemed as part of the

statutory transfer of the Company's business to South West Water. Associated legal costs of

cGBP1m were incurred in relation to the bond redemption. The redemption of the bonds was non-recurring

and of a material value, hence the cost was treated as non-underlying.

In the prior year the Company incurred expenses of GBP0.2m relating to the integration and

statutory transfer of the Company's trade, assets and obligations to South West Water. These

costs were classified as non-underlying due to their non-recurring nature.

7 Net interest payable and similar charges

Six months to Six months to Year to

30 September 2023 30 September 2022 31 March 2023

(unaudited) (unaudited) (audited)

GBPm GBPm GBPm

Interest payable and similar charges:

Bank borrowings - (1.7) (3.7)

Term loans and debentures:

interest charges (0.1) (5.6) (9.4)

indexation - (12.8) (20.0)

Leases - - (0.1)

Capitalisation of borrowing cost - 0.5 0.9

Dividends on 8.75% irredeemable cumulative

preference shares (0.5) (0.5) (1.1)

Loan from Pennon Group plc - - (0.6)

==================== =================== ===============

(0.6) (20.1) (34.0)

Interest receivable and similar income:

Interest income in respect of retirement

benefit scheme 0.3 0.2 0.3

South West Water Ltd - interest receivable 0.5 - -

Bristol Water Holdings UK Ltd - interest

receivable - 1.8 2.4

==================== =================== ===============

0.8 2.0 2.7

Total underlying net interest receivable /

(payable) and similar charges 0.2 (18.1) (31.3)

==================== =================== ===============

Bond redemption costs - - (13.1)

Total net interest receivable / (payable) and

similar charges 0.2 (18.1) (44.4)

==================== =================== ===============

In the prior year bonds with a carrying value of GBP59.2m were redeemed for GBP72.3 million.

The difference of GBP13.1m arising on early settlement was debited to finance costs in the

year ended 31 March 2023. The redemption of the bonds is non-recurring and of a material value,

hence the debit was treated as non-underlying.

The rate used to determine the amount of borrowing costs eligible for capitalisation in the

period ended 30 September 2022: 9.2%, which is the weighted average interest rate of applicable

borrowings.

Dividends on the 8.75% irredeemable cumulative preference shares are payable at a fixed rate

of 4.375% on 1 April and 1 October each year. Payment by the Company to the share registrars

is made two business days earlier. The payments are classified as interest in accordance with

IFRS 9 "Financial Instruments".

8 Taxation Six months to Six months to Year to

30 September 2023 30 September 2022 31 March 2023

(unaudited) (unaudited) (audited)

GBPm GBPm GBPm

Tax expense / (income) included in Income

Statement

Current tax:

Corporation tax on profits for the period /year 0.2 5.7 0.4

Adjustment in respect of prior period - - (0.1)

==================== =================== ===============

Total current tax 0.2 5.7 0.3

Deferred tax:

Origination and reversal of timing differences - (5.6) (4.9)

Adjustment to prior periods - - 0.1

Total deferred tax - (5.6) (4.8)

Tax expense/(income) on profit / (loss) 0.2 0.1 (4.5)

==================== =================== ===============

Tax expense included in other comprehensive

income

Remeasurement of post-employment benefit

liability - - 0.1

Total tax expense included in other comprehensive

income - - 0.1

==================== =================== ===============

9 (Loss) / earnings per ordinary share

At At At

30 September 2023 30 September 2022 31 March 2023

(unaudited) (unaudited) (audited)

m m m

Basic (loss) / earnings per ordinary share have

been calculated as follows -

(Loss) / earnings attributable to ordinary shares GBP(0.3) GBP0.3 GBP(20.2)

Weighted average number of ordinary shares 6.0 6.0 6.0

==================== =================== ===============

(5.0)p 5.0p (336.7)p

As the Company has no obligation to issue further shares, disclosure of earnings per share

on a fully diluted basis is not relevant.

10 Other receivables:

Other receivables comprise loan notes issued to the Company on 1 February by SWW.

At At At

30 September 2023 30 September 2022 31 March 2023

(unaudited) (unaudited) (audited)

GBPm GBPm GBPm

Fixed interest rate

GBP25,000,000 fixed rate loan note 6% 25.0 - 25.0

GBP1,405,218 fixed rate loan note 4% 1.4 - 1.4

GBP72,900 fixed rate loan note 3.5% 0.1 - 0.1

GBP54,875 fixed rate loan note 4% 0.1 - 0.1

GBP36,740 fixed rate loan 4.25% - - -

note

==================== =================== ===============

26.6 - 26.6

==================== =================== ===============

11 Retirement benefits

Pension arrangements for former employees have historically been provided through the Company's

membership of the Water Companies' Pension Scheme (WCPS), which provides defined benefits

based on final pensionable pay. The Company's membership of WCPS is through a separate section

of the scheme. On 7 June 2018 the Trustee of the Bristol Water Section of the WCPS purchased

a bulk annuity policy to insure the benefits for the members in the section. Following this,

the method for valuing the liabilities of the pension scheme has remained the same. The pension

liability, following the purchase of the bulk annuity policy, matches the value of the insurance

asset.

The gross pension surplus of GBP12.6m at 30 September 2023 (30 September 2022 GBP12.4m) relates

to the market value of assets still held by the scheme other than the annuity policy/insurance

asset.

Looking ahead, we expect the insurer will take over responsibility for the payment and administration

of member benefits. Once this has happened members will no longer be members of the Section,

instead they will have individual policies with the insurer. At this point the Section will

be wound up.

In summary, assets and liabilities under IAS 19 were:

At At At

30 September 2023 30 September 2022 31 March 2023

(unaudited) (unaudited) (audited)

GBPm GBPm GBPm

Fair value of section assets 116.0 123.7 124.6

Present value of liabilities (103.4) (111.3) (112.0)

==================== =================== ===============

Surplus in the section 12.6 12.4 12.6

Less: restriction of surplus (4.4) (4.4) (4.4)

Net pension asset on IAS 19 basis 8.2 8.0 8.2

==================== =================== ===============

12 Net borrowings

At At At

30 September 2023 30 September 2022 31 March 2023

(unaudited) (unaudited) (audited)

GBPm GBPm GBPm

Net borrowings comprise -

Borrowings and derivatives due after one year 1.6 413.5 1.6

Lease liabilities due after one year - 0.9 -

Current portion of lease liabilities - 0.4 -

1.6 414.8 1.6

Cash and cash equivalents (0.3) (14.3) (0.1)

==================== =================== ===============

Net borrowings excluding 8.75% irredeemable

cumulative

preference shares 1.3 400.5 1.5

8.75% irredeemable cumulative preference shares 12.5 12.5 12.5

Net borrowings 13.8 413.0 14.0

==================== =================== ===============

Fair value of financial assets and liabilities measured at amortised cost .

The fair value of financial assets and liabilities are as follows:

Six months to Six months to Year to

30 September 2023 30 September 2022 31 March 2023

(unaudited) (unaudited) (audited)

GBPm GBPm GBPm

Financial liabilities

Non-current 20.2 487.4 23.0

Current - 6.2 -

Financial assets

Non-current (21.8) - (26.6)

==================== =================== ===============

(1.6) 493.6 (3.6)

==================== =================== ===============

13 Ultimate parent company and controlling party

The immediate parent company for this entity is South West Water

Limited a company incorporated in England and Wales.

As at 30 September 2023 and 31 March 2023, the Directors considered

the ultimate parent and controlling party of the Company to

be Pennon Group plc.

The smallest and largest group in which the Company is consolidated

is Pennon Group plc which is registered in England and copies

of its consolidated interim report are available from Peninsula

House, Rydon Lane, Exeter, Devon, England, EX2 7HR.

14 Related party transactions

During the year ended 31 March 2023 the Company spent GBP2.9m

on the purchase of customer related services from BWBSL, a joint

venture company between Bristol Water Holdings Limited and Wessex

Water Services Limited. At 30 September and 31 March 2023 GBPnil

was receivable from BWBSL and GBPnil was payable to BWBSL.

During the year ended 31 March 2023 the Company recognised sales

of GBP16.2m to Water 2 Business Limited (W2B), an associate

company within the BWHUK group of companies. At 30 September

and 31 March 2023 GBPnil was receivable from W2B.

During the year ended 31 March 2023 the Company recognised sales

of GBP0.9m to PWS. At 30 September and 31 March 2023 GBPnil

was receivable from PWS.

15 Circulation

This interim announcement is available on the Bristol Water

web site. Paper copies are also available from the Company's

registered office at Bridgwater Road, Bristol, BS13 7AT, England.

DIRECTORS' RESPONSIBILITIES FOR THE PREPARATION OF INTERIM

ACCOUNTS

The directors confirm that these condensed interim financial

statements have been prepared in accordance with FRS104 'Interim

Financial Reporting', and that the interim management report

includes a fair review of the information required by DTR 4.2.7 and

DTR 4.2.8, namely:

-- an indication of important events that have occurred during

the first six months and their impact on the condensed set of

financial statements, and a description of the principal risks and

uncertainties for the remaining six months of the financial year;

and

-- material related-party transactions in the first six months

and any material changes in the related-party transactions

described in the last annual report.

The directors of Bristol Water Plc are listed in the Bristol

Water Plc Annual Report for 31 March 2023.

Going concern

The directors have a reasonable expectation that the Company has

adequate resources available to it to continue in operational

existence for the foreseeable future and have therefore continued

to adopt the going concern policy in preparing the interim

accounts. This conclusion is based upon, amongst other matters, a

review of the Company's financial projections together with

confirmation of support from its parent company Pennon Group

plc.

By order of the Board

P Boote

Chief Financial Officer

28 November 2023

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR NKFBBCBDDNDB

(END) Dow Jones Newswires

November 29, 2023 02:00 ET (07:00 GMT)

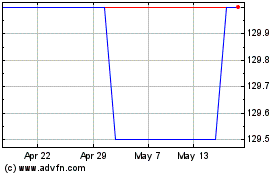

Bristol Wtr.8t% (LSE:BWRA)

Historical Stock Chart

From Dec 2024 to Jan 2025

Bristol Wtr.8t% (LSE:BWRA)

Historical Stock Chart

From Jan 2024 to Jan 2025