TIDMCASP

RNS Number : 3123C

Caspian Sunrise plc

12 June 2023

Caspian Sunrise PLC

("Caspian Sunrise", or the "Company")

Sale of 50% of Caspian Explorer & Operational Update

Introduction

The Board of Caspian Sunrise is pleased to update the market

with news of the conditional sale of 50% of the Caspian Explorer

for $22.5 million together with a general operational update.

Background

The Caspian Explorer is a drilling vessel designed specifically

for use in the shallow northern Caspian Sea where traditional deep

water rigs cannot be used.

Caspian Sunrise acquired it for approximately $3.7 million in

2020, since then it has undertaken a safety related contract for

the North Caspian Operating Company .

In March 2023, the Company announced its first drilling

contract, which is scheduled to be drilled in the summer of 2024

with a well to be drilled to a planned depth of 2,500 meters for

the Isatay Operating Company LLP ,a Kazakh registered explorer, in

which Italy's ENI is a leading participant.

Disposal of 50%

The Company has conditionally agreed to sell 50% of the shares

in the UAE registered Prosperity Petroleum FZE, the holding company

of the Kazakh registered KC Caspian Explorer LLP, which in turn

owns the Caspian Explorer drilling vessel, for a cash consideration

of $22.5 million. The purchaser is Stepping Stone Investments

Limited, a company registered in the Seychelles.

The sale is conditional inter alia upon payment being received

by the Company and the re registration of the sale shares in the

UAE.

The carrying value in the Group's 2021 financial statements of

100% of the Caspian Explorer was $3.6 million. The disposal would

therefore be expected to result in a gross accounting profit of

approximately $20 million.

In the year ended 31 December 2022 the Caspian Explorer had no

revenue and costs of approximately $850,000.

The proceeds from the sale would be used in the further

development of the Group's assets.

Operational update

In recent months the focus of the Company's work at its flagship

BNG Contract Area has been at the shallow wells and in particular

Well 142.

Work at Deep Well 802 on the Yelemes Deep structure was

suspended awaiting additional equipment, which due to the sanctions

on Russia, now needs to be sourced via China with much longer lead

times. Accordingly, the crew at Deep Well 802 was moved to work on

Shallow Well 142, historically one of BNG's best performing shallow

wells, at which the Company is drilling a horizontal side

track.

The Company is yet to bring Well 142 back into production but is

now ready to resume work at Deep Well 802 to which the crew has

returned. The Directors estimate it will be up to a further two

months before the Company is able to complete our work at Deep Well

802.

Recent production volumes at BNG have been approximately 2,000

bopd.

As previously reported, the high levels of discount for oil

transported through the Russian pipeline network, even though

Kazakh produced oil is not subject to sanctions, together with tax

still being assessed based on international rather than actual

prices, means the Company is not using the international markets to

sell its oil.

However, the recent fall in the international oil price means

that the net price achieved from sales to mini refineries is now

broadly equivalent to the net price the Company would expect from

international sales without the Urals oil discount.

Preparatory work has begun at Deep Well 803 which is to be

drilled on the Yelemes Deep structure. The Company plans to spud

the well in Q3 and complete it before the end of the year in

accordance with this year's work programme commitments.

Annual General Meeting

This year's AGM will be held on 30 June 2023.

2022 audited financial statements

Work continues in the preparation of the 2022 financial

statements, which are not now expected to be published until

towards the end of June 2023.

Clive Carver, Chairman said

"We are naturally pleased that our faith in the Caspian Explorer

will result in a significant influx of funding to further develop

the Group's assets without any dilution to shareholders."

Caspian Sunrise PLC

Clive Carver, Chairman +7 727 375 0202

WH Ireland, Nominated Adviser & Broker

James Joyce +44 (0) 207 220 1666

James Bavister

Andrew de Andrade

Qualified person

Mr. Assylbek Umbetov, a member Association of Petroleum

Engineers, has reviewed and approved the technical disclosures in

this announcement.

This announcement has been posted to:

www.caspiansunrise.com/investors

The information contained within this announcement is deemed to

constitute inside information as stipulated under the retained EU

law version of the Market Abuse Regulation (EU) No. 596/2014 (the

"UK MAR") which is part of UK law by virtue of the European Union

(Withdrawal) Act 2018. The information is disclosed in accordance

with the Company's obligations under Article 17 of the UK MAR. Upon

the publication of this announcement, this inside information is

now considered to be in the public domain.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

DISUPUAWQUPWGQB

(END) Dow Jones Newswires

June 12, 2023 02:00 ET (06:00 GMT)

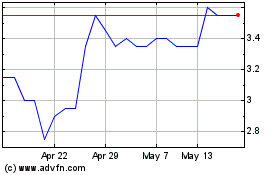

Caspian Sunrise (LSE:CASP)

Historical Stock Chart

From Dec 2024 to Jan 2025

Caspian Sunrise (LSE:CASP)

Historical Stock Chart

From Jan 2024 to Jan 2025