RNS Number:3753N

Celsis International PLC

20 November 2001

Celsis International plc

Interim Results for the 6 months to 30 September 2001

Celsis International plc, which provides analytical services and develops and

supplies diagnostic systems, that detect and measure contamination, for the

pharmaceutical, personal care & cosmetic and food industries worldwide,

announces its interim results for the period ended 30 September 2001.

Key highlights for the period include:

* Significant progress made

* New strategy implemented, potential being delivered

* Continuing activities: revenues 13.9% ahead; H1 2001 #8.52m (2000 H1: #

7.48m)

* Profit before tax continuing activities H1 #40,000 (2000 H1: #328,000)

* H1 product sales affected by September 11th

* Cash position substantially improved

* Acquisition of Concell fully integrated

Jack Rowell, Chairman commented:

"We have made significant progress since reporting last and are beginning to

see an upward trend in our performance indicators. The first half began

positively with strong results from our Product Group and a very positive

performance from our Laboratory Group in the US. However, the second quarter

became extremely challenging with a sharp downturn in activity after the

tragic events of 11th September 2001, which affected one or our two main

shipping months. The Company normally has a second half bias but following

the sharp fall off in September this will be accentuated in the current year."

Jay LeCoque, Chief Executive stated:

"Following the restructuring and management changes last year I can

confidently state that we are starting to see the benefits of the new

operating structure, particularly in Europe. The global acceptance of our

technology and products is proven by the quality and quantity of our customer

base. The opportunity our markets present and our ability to capitalize on our

current position remain undiminished."

20th November 2001

Enquiries:

Celsis International plc Tel: 01223 426 008

Jay LeCoque, Chief Executive

College Hill Tel: 020 7457 2020

Michael Padley

Nicholas Nelson

Chairman's Statement

This has been a period of change where the new management team has implemented

the strategy previously outlined to enable the Company to deliver the

potential that Celsis has in the marketplace. We have made significant

progress since reporting last and are beginning to see an upward trend in our

performance indicators.

The first half began positively with strong results from our Products Group

and a very positive performance from our Laboratory Group in the US. However,

the second quarter became extremely challenging with a sharp downturn in

activity after the tragic events of 11th of September 2001, which affected one

of our two main shipping months. We have since faced immediate postponement of

capital spending, and a very depressed macro-economic environment. In the

immediate aftermath of the disaster a number of our major customers in the US

stopped all overseas flights and this had a significant affect on the

installation of orders. We experienced a sharp downturn in order intake and

deliveries during the last three weeks of the period under review, however we

believe these have been deferred rather than lost.

For the six month period, ended September 30, 2001 we are reporting a small

profit on revenue of #8,515,000 in the continuing activities, which is a 13.9%

increase over the comparable period last year when revenue was #7,478,000. The

Company normally has a second half bias but following the sharp fall off in

September this will be accentuated in the current year.

Chief Executive's Review

Products Division

Following the restructuring and management changes last year I can confidently

state that we are starting to see the benefits of the new operating structure,

particularly in Europe following the acquisition of Concell in March 2001.

Margins in the European dairy sector remain under pressure following the

regional competition experienced last year but the acquisition of Concell, has

enabled a cessation of price erosion and the recapture of market share

previously lost. Prices have stabilised and a combination of the state of the

art instrument, first developed by Concell, plus improved reagents developed

by teams from Celsis and Concell, form the basis of our strategy to defend and

grow the dairy business. The acquisition has also enabled the Group to solve

one of its main problems. Prior to the acquisition we were marketing

different products to different regions. Following the Concell integration we

have implemented a global strategy offering each product on a worldwide basis.

The new product range has also allowed us to leverage our worldwide

position. Returns in the European dairy businesses are still not as good as

we would like but are improving.

The Global Corporate Account Management (GCAM) programme has allowed us to

accelerate the growth within the existing client base whilst also expanding

into Asia and Latin America. Under the programme we are focused on building

relationships worldwide with major corporates in the pharmaceutical and

personal care & cosmetic industries. Our strategy has allowed us to expand

more rapidly, increase turnover and improve the access to leading corporate

accounts. We are now successfully marketing, not just on the quality of the

technology - which is not in question - but on the cost savings that the

implementation of the equipment can give. We have an excellent product and we

have a proven selling system with which to maximise its commercial potential.

Contract Laboratory Services Group

The business goes from strength to strength and has maintained its excellent

growth rate. Margins have improved and with the enhancement of its services

we expect this to continue. We are exploiting our niche strategy in a growing

market and we expect to benefit from the trend in outsourcing by both

Pharmaceutical and Personal Care Companies. We are maintaining the improved

level of customer service and the additional capital expenditure has allowed

us to further increase the capacity to meet demand. CLG continues to be a

solid, growing cash contributor to the Celsis Group with an overall improving

performance.

Disposal/Closure

During the period the Company disposed of the Hygiene Monitoring business that

had turnover of #300,000 per annum and was loss making. Over the next 3 years

we will receive a royalty, based on sales. However, there will be a write-off

associated with this disposal as described in the financial review.

We have also discontinued our Brazilian operation due to revised import

restrictions placed on capital equipment by the Brazilian Government. However,

we remain committed to the growth of our activities in Brazil and throughout

Latin America.

Financial Review

We have changed the revenue recognition policy, as previously stated, and

despite the shortfall in September the Company recorded an operating profit.

Gross profit increased 9% and due to variation in the products and services

mix, our gross margin decreased slightly to 60% from 62% last year.

This is due to sales and marketing expenses on continuing operations having

increased by 14% on an annual basis, as each of the four geographic regions

are now headed by a profit centre manager. We have also invested in marketing

and promotional activities following the integration of the Concell products

together with training of our sales force and the rationalisation of the two

distribution channels, markets and general corporate branding.

R & D and administrative expenses have increased 2% from #1,364,000 to #

1,395,000, and previous periods costs analysis have been restated to reflect

the current breakdown of costs between sales and marketing, R & D and

administrative, to allow for easier comparison.

Inventory has been reduced from #2,829,000 a year ago to #2,021,000 this year

and debtors have decreased by 17.5 % during the last 6 months. This is a

reflection of the continuous efforts to improve cashflow and reduce working

capital. Cash and cash equivalents improved, as of Sept 30, 2000. The cash

inflow from operating activities has improved by #1,275,000 compared to the

same period last year; moving from an outflow of #1,093,000 to a positive

inflow of #182,000.

We shall continue our efforts to control our receivables position, and have

recently reviewed the credit terms given to our distributor network

Investment in our Divisions has continued, particularly in the Laboratory

Group to meet an increased demand for our testing services requiring state of

the art instrumentation and equipment, and our capital spent during the first

six months of this year is up from #274,000 to #415,000. This expenditure

will allow the Laboratory Group to maintain and further develop its

competitive and qualitative edge in the next year.

We believe that our current cash position, line of credit, investment

requirements and existing commitments will satisfy our expected working

capital needs throughout the present fiscal year. The Company has no long

term borrowings and has substantially reduced its short term liabilities

during the 6 months under review from #4,510,000 to #3,681,000 at the end of

September 2001.

Disposal/Closure

On Sept 26, 2001 we signed an agreement with Hygiena LLC to dispose of all the

assets of our Hygiene Monitoring Division.We also filed the articles of

dissolution of our Brazilian Subsidiary Celsis Ltda at the Rio de Janeiro

Trade Register at the end of September 2001. Discontinuing our Hygiene

Monitoring activities and the activities of our Brazilian subsidiary has led

us to restructure our operating divisions and R & D department.

This reorganisation has had a material effect on the nature and focus of the

Group's operations and as such has been classified as non-operating

exceptional items in accordance with FRS3. During the period under review we

recorded #1,543,000 of restructuring costs and special charges including

accruals for stock obsolescence of #257,000, debt write-offs of #221,000 and

other receivables write-offs of #724,000.

As a result of this restructuring program, we expect pre-tax savings in

operating expenses to be slightly more than #600,000 on an annualised basis.

Our net operating result on continuing operations for the 6 months period

shows a profit of #56,000 and an operating loss after inclusion of the

discontinued operations of #252,000.

As there are corporation tax losses within the Group, there is no tax

attributable to exceptional items. The net profit after interest and tax is #

40,000 for the 6 month period but after inclusion of the discontinued

operations and the exceptional items related to the discontinued operations

leads to a net loss after interest and tax of #1,811,000.

Summary

We continue to make significant progress and are now cash generative,

profitable at the operating level with an improving gross margin and we have

the potential to significantly expand our operations. The global acceptance of

our technology and products is proven by the quality and quantity of our

customer base. The opportunity our markets present and our ability to

capitalize on our current position remain undiminished and in its first year

this management team has proven that it can react quickly and confidently to

changing market conditions so that Celsis remains the supplier of choice to

the Pharmaceutical, Personal Care and Dairy manufacturers across the world.

Unaudited Consolidated Profit and Loss Account

for the six month period ended 30.09.2001

Dis- Dis-

Continuing continuing Continuing continuing

operations operations Total opeartions operations Total

Un- Un-

audited audited Total

Six Six Six Six Six Six Audited

months months months months months months Year

to to to to to to to

30 30 30 30 30 30 31

Sept Sept Sept Sept Sept Sept March

2001 2001 2001 2000 2000 2000 2001

#'000 #'000 #'000 #'000 #'000 #'000 #'000

restated

Notes

Turnover 8,515 150 8,665 7,478 145 7,623 17,509

Cost of (3,383) (100)(3,483) (2,778) (91) (2,869) (5,800)

Sales

Gross 5,132 50 5,182 4,700 54 4,754 11,709

profit

Overheads

Sales & (3,725) (314)(4,039) (2,603) (355) (2,958) (7,022)

marketing

expenses

Administrative (983) (983) (974) (974) (1,998)

expenses

Research & (368) (44) (412) (390) (390) (787)

development

expenditure

Operating 56 (308) (252) 733 (301) 432 1,902

profit/(loss)

Exceptional - (1,543)(1,543) (397) - (397) (924)

items

Profit/(loss) 56 (1,851)(1,795) 336 (301) 35 978

before

interest

Interest 58 - 58 31 - 31 290

receivable

& similar

income

Interest (74) - (74) (39) - (39) (189)

payable

Profit/(loss) 40 (1,851)(1,811) 328 (301) 27 1,079

before

taxation

Taxation - - - 95 - 95 (147)

Retained 40 (1,851)(1,811) 423 (301) 122 932

profit/(loss)

for the period

Earnings

per

Ordinary

Share

Before 0.05p (0.29p) (0.24p) 0.71p (0.29p) 0.42p 1.80p

exceptional

costs

Exceptional - (1.50p) (1.50p) (0.39p) - (0.39p)(0.90p

costs

Earnings 1 0.05p (1.79p) (1.74p) 0.32p (0.29p) 0.03p 0.90p

per

Ordinary

Share

IIMR 0.05p (1.79p) (1.74p) 0.32p (0.29p) 0.03p 0.90p

earnings

per

Ordinary

Share

Diluted 1 0.05p (1.79p) (1.74p) 0.32p (0.29p) 0.03p 0.90p

earnings

per share

Statement of total recognised gains and losses

Total Total Total

Unaudited Unaudited Audited

Six months Six months Year to

to 30 Sept to 30 Sept 31 March

2001 2000 2001

#'000 #'000 #'000

(Loss)/(profit) for the financial (1,811) 122 932

period

Currency translation (273) 577 504

differences on foreign

currency net investments

Prior year adjustment (3,312) (3,312)

Total (losses)/profit recognised (2,084) (2,613) (1,876)

since last annual report

Unaudited Consolidated Balance Sheet

at 30 September 2001

At 30 Sept At 30 Sept At 31 March

2001 2000 2001

#'000 #'000 #'000

Notes Unaudited restated Audited

Fixed Assets

Intangible assets 1,312 401 1,321

Tangible assets 3,298 4,189 3,372

Investments 5 13 5

4,615 4,603 4,698

Current Assets

Stocks 2,021 2,829 2,556

Debtors : amounts falling due after one year 530 703 614

Debtors : amounts falling due within one 6,766 6,762 8,230

year

Cash at bank and in hand 843 299 1,590

10,160 10,593 12,990

Creditors - due within one year (3,382) (2,916) (4,183)

Net Current Assets 6,778 7,677 8,807

Total Assets less Current Liabilities 11,393 12,280 13,505

Creditors - due after more than one year (299) (452) (327)

Net Assets 11,094 11,828 13,178

Capital and Reserves:

Called up share capital 1,071 1,032 1,071

Share premium account 6 14,564 13,990 14,564

Profit and loss account 5 (5,582) (4,235) (3,498)

Reserve arising on consolidation 1,041 1,041 1,041

Equity shareholders' funds 11,094 11,828 13,178

Unaudited Cashflow Statement

for the six month period ended 30 September 2001

Six Six Year

months months

to 30 to 30 to 31

Sept Sept March

2001 2000 2001

#'000 #'000 #'000

Unaudited restated Audited

Net cash inflow/(outflow) from operating activities

Net cash inflow/(outflow) before exceptional costs 1,725 (1,093) 1,604

Outflows related to exceptional costs (1,543) - (924)

Net cash (outflow)/inflow from operating activities 177 (1,093) 680

Returns on investments and servicing of finance

Interest received 59 31 259

Interest paid (54) (39) (189)

Net cash inflow/(outflow) from returns on 5 (8) 70

investments and servicing of finance

Taxation

Corporation tax paid - (91) (47)

- (91) (47)

Capital expenditure and financial investment

Purchase of tangible fixed assets (415) (274) (849)

Sale of tangible fixed assets - 1,219

Purchase of intangible fixed assets - (20)

Net cash (outflow)/inflow from returns on (415) (274) 350

investment and capital expenditure

Acquisitions

Purchase of subsidiary undertaking (less cash - - (498)

acquired)

Cash (outflow)/inflow before financing (233) (1,466) 555

Financing

Issue of shares - 7 -

Proceeds from share options exercised - - 5

Repayment of principal under finance leases (5) (47) (96)

Repayment of loan principal - (10) (376)

Net cash (outflow) from financing - (50) (467)

(Decrease)/increase in cash in the period (233) (1,516) 88

Notes to the Financial Statements

for the six month period ended 30 September 2001

1. Basic & diluted (loss)/profit per Ordinary Share

Six months Six months Year

to 30 Sept to 30 Sept to 31 March

2001 2000 2001

#'000 #'000 #'000

Unaudited restated Audited

(Loss)/profit on ordinary activities (1,811) 122 932

after taxation

Basic weighted average number of Ordinary 103,226,366 103,065,415 103,226,366

Shares in issue

Diluted weighted average number of Ordinary 103,972,363 104,242,651 103,972,363

Share in issue

2. Reconciliation of operating (loss)/profit

to net cash (outflow)/inflow from operating

activities

Operating (loss)/profit before exceptional costs (252) 432 1,902

Exchange (loss)/gain 31 (411)

Depreciation of tangible fixed assets 400 447 1,073

Provision for reduction in valuation of shares

held by ESOT - 6 14

Amortisation of intangible assets 23 15 31

(Profit)/loss on disposal of tangible fixed assets 13 - (262)

(Increase)/decrease in debtors 1,417 (651) (1,197)

(Increase)/decrease in stocks 792 (278) 60

(Decrease)/increase in trade & other creditors (699) (653) (17)

Net cash inflow/(outflow) from continuing

operating activities 1,725 (1,093) 1,604

3. Reconciliation of net cash flow to

movement in net funds

(Decrease)/increase in cash in the period (233) (1,516) 88

Repayment of finance lease and loan obligations 5 57 472

Changes in net funds resulting from cashflows (228) (1,459) 560

New finance leases - - (208)

Exchange adjustment 20 406 (31)

Movement in net funds in the period (208) (1,053) 321

Net funds at the beginning of the period 343 22 22

Funds/(defecit) at the end of the period 135 (1,031) 343

Notes to the Financial Statements

Continued

4. Analysis of net funds

At start of Cashflow Non-cash Exchange At end of

period changes differences period

#'000 #'000 #'000 #'000 #'000

Six months ended 30

September 2001

Cash at bank and in 1,590 (755) - 8 843

hand

Bank overdrafts (884) 522 - - (362)

Loans - - - - -

Finance leases (363) 5 - 12 (346)

343 (228) - 20 135

Six months ended 30

September 2000

Cash at bank and in 591 (742) - 450 299

hand

Bank overdrafts - (774) - 2 (772)

Loans (348) 10 - (29) (367)

Finance leases (221) 47 - (17) (191)

22 (1,459) - 406 (1,031)

Year ended 31 March

2001

Cash at bank and in 591 971 - 28 1,590

hand

Bank overdrafts - (884) - - (884)

Loans (348) 376 - (28) -

Finance leases (221) 97 (208) (31) (363)

22 560 (208) (31) 343

5. Profit and loss account

Six months Six months Year

to 30 Sept to 30 Sept to 31 March

2001 2000 2001

#'000 #'000 #'000

Retained (loss)/profit brought forward (3,498) (1,622) (1,622)

Prior year adjustment - (3,312) (3,312)

At 1 April (restated) (3,498) (4,934) (4,934)

Retained (loss)/profit for the period (1,811) 122 932

Exchange difference (273) 577 504

Retained loss carried forward (5,582) (4,235) (3,498)

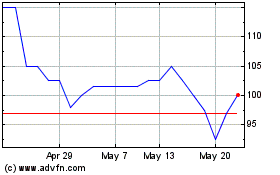

Celadon Pharmaceuticals (LSE:CEL)

Historical Stock Chart

From Oct 2024 to Nov 2024

Celadon Pharmaceuticals (LSE:CEL)

Historical Stock Chart

From Nov 2023 to Nov 2024