TIDMCHRY

RNS Number : 9695D

Chrysalis Investments Limited

27 June 2023

The information contained in this announcement is restricted and

is not for publication, release or distribution in the United

States of America, any member state of the European Economic Area

(other than to professional investors in Belgium, Denmark, the

Republic of Ireland, Luxembourg, the Netherlands, Norway and

Sweden), Canada, Australia, Japan or the Republic of South

Africa.

27 June 2023

Chrysalis Investments Limited ("Chrysalis" or the "Company")

Interim Results

Financial Summary

31 March 2023 30 September % Decrease

2022

NAV per share 130.02p 147.79p 12.0%

--------------- --------------- -----------

Share price 58.70p 61.70p 4.9%

--------------- --------------- -----------

Total net assets GBP774 million GBP880 million 12.0%

--------------- --------------- -----------

Headlines

- NAV per share of 130.02p, representing a 12.0% decrease over

the first half of the financial year, driven by lower values of the

tech-enabled companies used as comparables to the portfolio,

although the NAV did see an increase in the second quarter of the

period

- Follow on investment of cGBP25 million, including primary

investment into InfoSum (GBP1.4 million) and wefox (GBP3.6

million), and the purchase of secondary capital in Starling Bank

(GBP20 million)

- Further investment was made into Smart Pension following the period end (GBP12.5 million)

- The first six months of the financial year saw a continuation

of the difficult market conditions that have been prevalent since

early 2022, driven by rising inflation and interest rate

expectations

- The Investment Adviser has continued to work with the

portfolio management teams to shift the focus from pure growth to

more of a balance between profitability and growth, in line with

investor demand

- Following the investment into Smart Pension, 84% (by NAV) of

the portfolio is now either profitable or funded to anticipated

profitability, up from 67% at 30 September 2022

- The Company remains in a strong liquidity position with total

liquidity of cGBP43 million as of 23 June 2023

Andrew Haining, Chair, commented:

"The NAV decrease in the period reflects movements in both peer

group stock market valuations and the tough capital market

conditions we continue to see. That said, I am encouraged by the

strong and steady improvement seen in the underlying companies'

performance, with these downward pressures being partially offset

by strong revenue growth and significant progress in profitability,

or the pathway to profitability.

It has been a challenging period, but we remain confident in the

huge potential of our portfolio companies and in the value that

Chrysalis can create for its shareholders. "

Nick Williamson and Richard Watts, co-portfolio managers,

commented:

"Revenue growth across the portfolio remains strong at 46%,

despite the ongoing market challenges brought about by continued

high inflation levels, rising interest rates and a still depressed

IPO market. The robust levels of growth generated by the portfolio

companies is all the more impressive given the switch in focus

towards profit generation from predominantly sales growth. We are

also pleased to report that 84% of the portfolio is now profitable

or funded to anticipated profitability. This positive news reflects

the incremental investments Chrysalis has made into the portfolio

and the hard work of the portfolio company management teams.

The portfolio is stronger because of these efforts and is well

positioned not only to weather any further challenges, but also to

take advantage of the opportunities that will arise when market

activity begins to normalise again. Chrysalis in turn remains well

placed, with a substantially derisked portfolio and a strong

liquidity position."

-S-

For further information, please

contact

Media +44 (0) 7976 098 139

Montfort Communications chrysalis@montfort.london

Charlotte McMullen / Toto Reissland

/ Lesley Kezhu Wang

Jupiter Asset Management:

James Simpson +44 (0) 20 3817 1696

Liberum:

Chris Clarke / Darren Vickers

/ Owen Matthews +44 (0) 20 3100 2000

Numis:

Nathan Brown / Matt Goss +44 (0) 20 7260 1000

Maitland Administration (Guernsey)

Limited:

Chris Bougourd +44 (0) 20 3530 3109

LEI: 213800F9SQ753JQHSW24

A copy of this announcement will be available on the Company's

website at https://www.chrysalisinvestments.co.uk

The information contained in this announcement regarding the

Company's investments has been provided by the relevant underlying

portfolio company and has not been independently verified by the

Company. The information contained herein is unaudited.

This announcement is for information purposes only and is not an

offer to invest. All investments are subject to risk. Past

performance is no guarantee of future returns. Prospective

investors are advised to seek expert legal, financial, tax and

other professional advice before making any investment decision.

The value of investments may fluctuate. Results achieved in the

past are no guarantee of future results. Neither the content of the

Company's website, nor the content on any website accessible from

hyperlinks on its website for any other website, is incorporated

into, or forms part of, this announcement nor, unless previously

published by means of a recognised information service, should any

such content be relied upon in reaching a decision as to whether or

not to acquire, continue to hold, or dispose of, securities in the

Company.

Chairman's Statement

The six-month period from September 2022 to March 2023 has seen

a further reduction in values in our portfolio of investments, but

I am encouraged by the strong and steady improvement in the

underlying companies' performance.

Chrysalis' Net Asset Value ("NAV") for the period declined from

147.79p per share to 130.02p per share. This decrease reflects

movements in both peer group stock market valuations and the

tougher capital market conditions for both "follow on" and

"secondary market" private capital. These downward pressures have

been partially outweighed by strong revenue growth and significant

progress in profitability, or pathway to profitability, being

achieved across our portfolio. It is encouraging to note that the

pace of downward change in valuations has slowed, with the NAV

showing an upward movement for the second quarter of this interim

period.

The Investment Adviser's report will go through each of our

portfolio companies in more detail. I would like to focus on the

significant investment issues that your Board has been considering

during the period.

Portfolio Investment

We invested in our portfolio of companies in the knowledge that

as "growth stories" these companies were likely to need further

capital in order to reach their operating goals. We remain

confident that, in aggregate, these companies are on track to

achieve the levels of growth, scale and profitability required to

unlock alternative sources of expansion capital provided by the

public capital markets, while generating potential liquidity for

early investors such as Chrysalis.

The Investment Adviser has set out clearly in its report what

drives our desire to reinvest in our portfolio companies in its

analysis of the individual investments. From a portfolio

perspective, the Investment Adviser has worked closely with the

Board to achieve the right balance of investment, both across the

portfolio, and within each individual investment, to maximise the

potential increase in NAV per share for shareholders. The

Investment Adviser has sought, and will continue to seek, to

allocate the Company's available capital to those companies that

stand the best chance of making a significant contribution to NAV

in the future.

As a supportive and constructive investor in private companies,

we have had to balance the desire to support our portfolio

management teams with the prevailing capital market conditions,

which have seen the cost of private capital increase significantly

over the last twelve months. This latter point has manifested

itself across the market, and in certain cases in our portfolio, in

follow on rounds in which capital has been raised at a sizeable

discount, or conditions have been applied which protect investors

downside, or simply when shareholders who need to sell have had to

accept discounts to obtain their desired level of liquidity.

Our Valuation Committee has taken these circumstances into

account in arriving at its valuation adjustments. This has led,

appropriately, to downward valuations in some of our strongly

performing investments that were involved in either a primary or a

secondary transaction. Some companies, Klarna Holding AB ("Klarna")

for example, took very early action, both on its operating model

and its capital valuation, to fundraise through to profitability.

Others, such as Starling Bank Limited ("Starling"), did not need to

raise capital but were marked down due to some shareholders needing

to sell their positions in a buyers' market. In both instances,

Chrysalis was determined to reinvest, believing that the price of

the round was at a significant discount to the likely long-term

valuation achievable by those companies.

Over the coming quarters, we may well see a number of these

investments moving from a "price of last round" valuation to a

"peer group" valuation, with a resulting positive impact on the

NAV. Over the period covered by these interim accounts, and post

period end, it is especially pleasing to see continuing positive

activity, particularly in our larger holdings.

Smart Pension Limited's ("Smart") recently announced

fundraising, led by a new investor bringing more growth capital to

the company, is extremely encouraging. We have supported Smart from

an early stage and look forward to working with the team on

building the business and achieving its goal of a public

listing.

The Brandtech Group LLC ("Brandtech") has also continued to grow

and build its leading presence in the digital marketing sector. Its

latest acquisition of Jellyfish is strategically important for the

operating business, and the transaction terms, which remain

confidential, helped to underpin our valuation of the business.

Smart and Brandtech account for approximately 23.4% of the

Company's portfolio.

I would like to focus on two investments where there was

significant activity during the quarter and where the Board has

worked particularly closely with the Investment Adviser.

Revolution Beauty Group PLC ("Revolution Beauty")

I highlighted in our 2022 year-end accounts that we were

considering our position regarding Revolution Beauty, following

audit concerns that were raised in late 2022, and the subsequent

share suspension. Since then, we have been consulting with our

retained lawyers to establish whether there is a case to be

answered by either the company, or any individuals. Chrysalis

wishes to enable businesses to develop into public companies

successfully - if that is their goal - so we take the obligations

and undertakings of those who bring companies to the public market

very seriously. In some instances, the poor performance of any

recently listed company can occur because of poor management and a

lack of understanding of how to operate in the public domain. In

the instance of Revolution Beauty, we believe other factors were at

play.

We are currently considering all our options and will be

notifying shareholders of any decision at the appropriate time.

Whilst corporate legal action on our own, or in conjunction with

litigation funding partners, may not recover all our losses, we

would like to reassure our shareholders that any decision to engage

in legal action will be based entirely on what is deemed to be in

their best financial interest. We note that Revolution Beauty is

now alleging the co-founder and former chief executive breached

fiduciary and other duties and is looking "to recover material sums

relating to the exceptional costs incurred as a result of the

matters alleged".

Starling

Starling is an important part of our portfolio. During the

period, the disposal by Jupiter of its holding in Starling, which

was managed by Citi, completed. This process took some time to

arrange and so straddled a period of considerable uncertainty in

both private capital markets, and the banking sector. Nevertheless,

the performance of Starling throughout this period remained strong

and profitability continued to improve. Chrysalis was determined to

take advantage of the opportunity to re-invest in a bank with a

strong profit trajectory, an efficient technology platform and

limited credit exposure, in a period of rising interest rates, by

acquiring, in conjunction with other shareholders, the holdings

being sold by Jupiter.

As can be seen from the recent publication of Starling's

results, the purchase was made at an undemanding multiple of

historic profits. We remain very excited by Starling and its

potential in our portfolio. Starling accounts for 16.9% of the

Company's portfolio.

On the release of Starling's results, Anne Boden (CEO and

founder) decided to step aside. I would like to take this

opportunity to thank Anne for her fundamental role in this growth

story, having driven the development of Starling with real

entrepreneurial zeal. Starling is now a household name in a sector

previously dominated by established banks with large market shares

and entrenched customer bases. We look forward to working closely

with the ongoing management team and with Anne, as a fellow

shareholder, in the next stage of Starling's development.

Performance Fee Proposal

As previously outlined to shareholders we expect to send a

circular to shareholders shortly in order to seek approval to the

proposed changes in the performance fee arrangements with

Jupiter.

Valuation Committee and Process

I would like to thank Lord Rockley and his colleagues on the

Valuation Committee for their work. This has been a particularly

challenging period for valuations, and I am delighted with the

change we made to the process last year. The market knowledge the

committee has of both public and private markets, and the impact

this has had on the valuation process and outcomes, has been

significant.

Valuation is key to the information flow for investors and the

Board will continue to work with Lord Rockley and his colleagues to

refine this system.

Amongst other options, we have been asked to consider providing

monthly valuations to replace our current quarterly approach. We

have considered this very carefully but, for practical reasons, we

have decided to continue to provide quarterly valuations for the

time being. We are working towards improving the visibility around

our valuation methodology so investors can see the drivers of

individual company valuations more clearly, while taking into

account the non-disclosure agreements that typically govern our use

of our portfolio companies' data.

Discount Management and Share Buybacks

The Board continues to be concerned that the discount to NAV our

shares trade at is not a fair reflection of what our portfolio of

investments is worth. To give investors greater visibility into the

valuation process and comfort around the Company's activities more

generally, the following actions have been undertaken by the Board

and the Investment Adviser:

1) Upon moving to a self-managed structure in July 2022 we

introduced a new valuation process and committee. Its substance and

the increasing transparency of its work over time will, I hope,

build confidence in shareholders' minds and enable the shares to

trade at or above the NAV, reflective of the future growth

prospects of our underlying investments.

2) We have decided to apply our capital to reinvesting in the

portfolio at the current time. Notwithstanding the discount at

which the shares currently trade, we believe that this action will

secure the financial runways of our portfolio companies and that

our investment in their future growth will lead to greater

shareholder value in the long term.

3) We recognise that with the emerging maturity of some of our

investments, it is important for the Board and the Company to

consider whether it is appropriate to establish rules for future

share buybacks and/or returns of capital. Whilst there is no stated

requirement to return capital, we have indicated that some surplus

capital could be used in share buybacks, as and when realisations

occur. The Board believes we need to be more explicit on this and

will be canvassing larger shareholders for their views. The Board

also believes that such a policy, clearly stated, could assist in

reducing the discount to NAV at which the Company's shares

currently trade. These consultations will take place during the

summer with the intention of bringing a proposal to shareholders in

the fourth calendar quarter as part of the Continuation Vote

process (see below).

Continuation Vote

When Chrysalis was established, the Board was obligated to put a

proposal before shareholders at its AGM for the basis on which the

company should operate beyond the fifth anniversary of its IPO,

which is November 2023. The AGM to consider this, inter alia, will

be no later than April 2024.

It is the Board's intention that a circular be sent to

shareholders in the first quarter of 2024 with a proposal for the

ongoing management of the Company beyond April 2024. In summary,

shareholders will have an option at that AGM to determine if the

Company should continue investing proceeds from realisations, and

if so, how much and over what period of time, or whether

shareholders would prefer to see a return of all investment

proceeds (and therefore no reinvestment) over a managed exit

programme.

There are several variables which need to be considered to reach

the right outcome for the Company, its shareholders and

stakeholders. Therefore, in addition to canvassing our larger

shareholders for their views on the realisation/distribution policy

referred to above, we will also take the opportunity to elicit

broader views on the way forward for Chrysalis beyond next year's

AGM.

The Board and its advisers are working closely with the

Investment Adviser, and we look forward to setting out our

proposals to shareholders later in the year.

Finally, it remains for me to thank the Investment Adviser and

the management teams and staff of our underlying investee

companies, for their continued hard work and dedication during this

period. It has been a challenging period, but we remain confident

in the huge potential of our portfolio companies and in the value

that Chrysalis can create for its shareholders. We hope to begin to

see the benefit of that hard work in the coming months.

Andrew Haining

Chairman

26 June 2023

Portfolio Statement

As at 31 March 2023

Company Location Opening

value

1 October Net invested Fair value Closing

Cost 2022 / returned movements Value

% of

net

(GBP'000) (GBP'000) (GBP'000) (GBP'000) (GBP'000) assets

Wefox Holding AG Germany 69,187 154,943 3,562 8,045 166,550 21.5

Starling Bank Limited UK 118,248 113,394 20,000 (9,410) 123,984 16.0

The Brandtech Group

LLC USA 46,440 103,390 - (8,388) 95,002 12.3

Smart Pension Limited UK 90,000 95,187 - (18,598) 76,589 9.9

Deep Instinct Limited USA 62,225 81,829 - (10,991) 70,838 9.2

Klarna Holding AB Sweden 71,486 56,135 - (4,177) 51,958 6.8

Featurespace Limited UK 29,546 53,139 - (10,979) 42,160 5.4

Tactus Holdings

Limited UK 40,130 36,795 - (1,961) 34,834 4.5

Cognitive Logic Inc.

("InfoSum") USA 48,454 30,299 1,327 (3,450) 28,176 3.6

Graphcore Limited UK 57,589 45,065 - (28,744) 16,321 2.1

Secret Escapes Limited UK 21,509 13,232 - 61 13,293 1.7

Wise PLC UK 4,807 20,317 (5,894) (2,453) 11,970 1.5

Sorted Holdings

Limited UK 27,941 18,429 - (17,104) 1,325 0.2

Revolution Beauty

Group PLC UK - - (5,220) 5,220 - 0.0

Growth Street Holdings

Limited UK 11,223 209 (149) 3 63 0.0

Rowanmoor Group

Limited UK 13,363 - - - - 0.0

Total investments 712,148 822,363 13,626 (102,926) 733,063 94.7

Cash and cash equivalents 43,305 5.6

Other net current

liabilities (2,552) (0.3)

------------ --------

Total net assets 773,816 100.0

============ ========

Investment Adviser's Report

Market Context

The first six months of the financial year saw a continuation of

the difficult market conditions that have been prevalent since

early 2022, driven by rising inflation and interest rate

expectations. This has led to generally lower valuations for the

tech-enabled companies which are used as comparables to generate

data to assist in valuing the Chrysalis portfolio holdings, when

compared with the prior year. While some listed tech stocks have

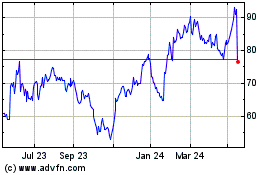

seen their share prices rally over the course of 2023 to date, the

impact of this broad dynamic has maintained pressure on valuation

multiples, a key driver of the Company's NAV.

Evidence of weak investor sentiment over the period can be

demonstrated by the paucity of IPO activity.

The change in market pre and post the Great Financial Crisis

("GFC") can be clearly seen and is one of the key reasons why

Chrysalis was established: to enable investors to access companies

that were no longer coming to market. Over the ten years pre-GFC,

approximately 54 companies per quarter were undertaking an IPO. In

the eleven years post GFC, this had more than halved to

approximately 20.

However, over the last five quarters to March 2023, only nine

companies came to market on average, marking a significant

slowdown, from arguably an already heavily depressed level.

Despite the market backdrop, revenue growth across the portfolio

has remained strong at around 46%, measured as reported growth over

the year to March 2023.

This high level of growth is all the more noteworthy given the

switch in focus by the majority of the portfolio from driving sales

growth, towards balancing growth with profit generation and, in

certain cases, on the back of a normalisation in sales patterns

following COVID-19 and/or a potential throttling of growth in light

of expected economic conditions.

This shift in focus has continued to lead to an improvement in

the overall risk profile of the portfolio, with 84% (by NAV) now

profitable or funded to anticipated profitability. This is explored

in more detail below.

Activity

Given the focus of the Company's capital on supporting the

current portfolio, no new investments have been made since the

purchase of a position in Tactus, in August 2021.

Over the period, the following investments were made in existing

portfolio companies:

-- In October 2022, GBP1.4 million was invested in InfoSum, to

assist it in continuing to scale;

-- In February 2023, GBP3.6 million was invested in wefox, as

part of a wider round to continue to fund the company as it drives

towards profitability;

-- In March 2023, a GBP20m secondary purchase of Starling Bank

was undertaken; the Investment Adviser remains optimistic over

Starling's prospects.

Post period end, a GBP12.5 million investment was made in Smart

Pension as part of a wider Series E round. This capital should

provide runway for the company to get to profitability, as well as

backing for future M&A.

Some realisations were also completed, notably:

-- In October 2022, approximately GBP5.9 million of Wise was

sold at an average share price of 674p;

-- In the same month, a small recovery of approximately

GBP150,000 was made from Growth Street; and

-- In November 2022, approximately GBP5.2 million was realised

from an off-market transaction in Revolution Beauty, which effected

a total exit for the Company.

At the Capital Markets Day in November 2022, the Investment

Adviser highlighted a likely further funding requirement in the

portfolio of approximately GBP20 million. Since that time,

investments in Smart Pension (which was the expected major

component of this capital) and wefox have been made, accounting for

approximately GBP16 million in aggregate.

As a result of these investments, at the time of writing, 84% of

the Company's portfolio was either profitable, or funded to

anticipated profitability.

Shift of focus towards profitability

The Investment Adviser has been working closely with the

portfolio management teams to adapt to the change in market

conditions that gathered a head of steam in early 2022, and still

persist today; that of a shift in investor focus from pure growth

to more of a balance between profitability and growth.

One of the key factors considered at the point of any initial

investment is the likely profitability that can be expected at

maturity. Depending on the company in question, topics such as unit

economics and cohort analysis are considered, as well as observable

anecdotal evidence from other familiar investments.

While the predominant focus within the portfolio has been on

growth, striking the right balance between growth and profitability

typically has been a constant consideration at portfolio company

board level. In the Investment Adviser's view, Chrysalis' position

in March 2022 was better than many in the industry, in that about

42% of the portfolio was profitable. However, of the companies that

comprised the remaining 58% that were not profitable, none were

funded to hit profitability on their available cash resources at

that time.

By March 2023, this position had substantially improved.

Approximately 38% of the portfolio was profitable (this drawdown is

explained by the Company's exit from THG and Revolution Beauty),

but crucially, a further 36% was funded to anticipated

profitability. This situation improved further with the funding

round in Smart Pension that completed post period end, taking the

'funded to anticipated profitability' percentage up to 46%.

This now means that approximately 84% of the portfolio is funded

to anticipated profitability or is currently profitable. Not only

does this reduce the risk that Chrysalis will need to commit more

capital to these businesses, but the Investment Adviser believes it

will also make these businesses more attractive to external

shareholders if they do need to raise again, for example to

complete M&A.

The Investment Adviser believes that this push towards

profitability is occurring across the market and that investors

will be more likely to back companies targeting profitability. This

raises the prospect of corporate insolvencies for those companies

unable to make meaningful moves towards profit and a potentially

fertile environment for those investors still with capital to

deploy.

As discussed at the Company's Capital Markets Day in November

2022, of the remaining 16% of the portfolio that is not funded to

anticipated profitability, the Investment Adviser sees three

possible outcomes it might pursue:

1. Chrysalis provides further capital, and/ or;

2. Other investors provide capital, or;

3. Chrysalis looks to exit its position

In determining the correct course of action for this group of

companies, and while wishing to support as much of the portfolio as

possible, the Investment Adviser recognises its responsibility to

prioritise capital to those investments with the best potential

return profile for shareholders. The reality of options two and

three above is that these may result in outcomes that yield returns

lower than current carrying values.

Case study - Klarna

Klarna's positive response to the shift in the market since the

beginning of 2022 is exemplary and demonstrates how the strength of

its business model has allowed it to continue to thrive.

In response to changing market conditions, in late May 2022

Klarna announced that it would enact tighter control over its cost

base and reduce its workforce by approximately 10%. Shortly

afterwards, in July 2022, Klarna managed to raise $800 million in

the teeth of the worst growth selloff since the GFC.

Despite this being a considerable down round - occurring at a

$6.7 billion post-money valuation, versus $45.6 billion a year

earlier - it was seen as a significant vote of confidence by

investors in Klarna's investment case. Chrysalis committed $8.7

million to this round, which was its pro rata entitlement.

In the quarter to June 2022, which would have been too early to

see any material impact from reduced costs, Klarna reported an

adjusted operating result (analogous to adjusted PBT) of

approximately -SEK2.9 billion (circa GBP233 million).

Despite market fears that worsening economic conditions would

see Klarna's credit loss ratios move sharply higher, and rising

bond yields would have a damaging impact on Klarna's profit and

loss account, the Investment Adviser remained optimistic,

particularly regarding credit losses, as Klarna's average loan

duration of 40 days means the book can be repriced very

rapidly.

In the event, these market worries proved unfounded.

By 1Q23, Klarna's adjusted operating loss had fallen to under

-SEK0.5 billion, or by over 80%, with credit losses having fallen

from a peak of 80 basis points ("bps") in 2Q22 to 37bps by

1Q23.

Despite this significant improvement in operating performance,

Gross Merchandise Volume ("GMV") growth remained broadly stable at

22% over 2022, and was 13% in 1Q23.

Growth

Revenue growth across the portfolio remained very strong. Over

the twelve months to March 2023, the portfolio grew revenues on a

blended average basis by approximately 46%, compared with slightly

over 80% in the two prior years.

This slower growth rate when compared to the two prior years is

partly a function of many of Chrysalis' businesses becoming

substantially larger over this period and the natural slowdown in

growth rates off a much larger revenue base. For example, Starling

has seen revenues more than quadruple to GBP415 million from the

year to March 2021 to March 2023.

There has also been an impact from the refocusing by the

majority of the portfolio away from outright growth, towards a more

balanced approach between growth and profitability.

The drive towards profitability has had a major positive effect

on the portfolio.

Aggregating the profits/losses by portfolio company in the

quarter to the end of March 2023 (in order to give a sense of what

"run rate" profitability is currently), versus that of the quarter

to March 2022, shows a material improvement. While this exercise

may not yield a fundamental financial metric, the Investment

Adviser believes it gives a good indication of progress made as

portfolio companies drive towards profitability.

The data reflects the unweighted aggregate profit/loss in the

portfolio, so is naturally skewed to those companies that have

larger profits or losses, such as Starling and Klarna respectively,

regardless of their position sizes in the portfolio. The chart

clearly shows that losses in the portfolio have reduced by

approximately GBP189 million year-on-year; approximately a 74%

reduction.

The chart above shows the contribution by company to the GBP189

million improvement in the loss position in the portfolio since 31

March 2022, with Klarna being the main driver, due to its large

losses in the prior year and the aggressive action it took over

2022. Of the twelve companies assessed (excluding Wise, due to lack

of quarterly profit data), ten of them have shown an improvement in

profits or narrowing of losses over the year. This demonstrates the

widespread focus on driving towards profitability in the

portfolio.

Another point worth noting is that if Klarna hits its stated

target of profitability in the second half of 2023, then the

portfolio would be in a position of net profitability, ceteris

paribus.

Outlook

While the intensity of investor concerns over rising interest

rates and growth valuations appears to have diminished to a degree

since the end of 2022, "animal spirits" still appear to be absent

from global markets, with the US yield curve remaining inverted and

the short end moving higher over the last few months. Whilst the

impact on the Chrysalis portfolio was negligible, the collapse of

Silicon Valley Bank and wider concerns across the banking sector,

have also had an impact on sentiment.

The hiatus in stock issuance, and in particular IPOs, is marked.

In the UK, only 27 IPOs occurred over the year to March 2023.

While an IPO is only one option for Chrysalis to realise its

investments, it is likely to be an important one, and a

well-functioning IPO market would be beneficial for Chrysalis.

Given the first quarter of 2023 was also weak, and the second

quarter has not started well, the market is currently in the sixth

quarter of anaemic issuance in the UK. By comparison, the GFC, a

much more severe crisis, saw low issuance last for seven quarters.

It is always difficult to "call the bottom", but the duration of

this slowdown suggests we are nearer the end, rather than the

beginning, of the normalisation process.

For over a year now, the focus has been on strengthening the

portfolio, as well as strengthening Chrysalis to adapt to the new

environment. In November 2022, the Company set out a likely primary

follow-on requirement in the portfolio of approximately GBP20

million. With the conclusion of the Smart Pension funding round,

which was the major component, as well as the much smaller

investment into wefox, much of this capital allocation has now been

utilised.

These investments have strengthened the portfolio, particularly

in the larger names. As of period end, the Company had cash of

approximately GBP43 million, and following the post period end

investment in Smart Pension, cash stands at approximately GBP33

million. In combination with the listed position in Wise, the

Investment Adviser believes this represents a strong liquidity

position.

Company section

wefox Holding AG ("wefox")

wefox grew strongly through 2022, reaching nearly EUR600 million

of revenue, and this momentum has carried through into 2023. When

Chrysalis first invested in the company, back in 2019, wefox

generated approximately EUR50 million of revenue and through

organic growth and selective M&A, it has grown into one of the

largest insurtech companies globally.

Over the past twelve months, management teams across the entire

portfolio have been encouraged to focus on demonstrating strong

unit and customer acquisition economics, appropriately managing the

cost base and driving profitability. The wefox management team has

done a good job so far on executing this strategy and the

Investment Adviser believes that the business is on track to

generate run-rate profitability towards the end of 2023.

In order to ensure that the business is funded to anticipated

profitability, wefox completed a second-close to the EUR400 million

Series D funding round it announced in July 2022, earlier this

year. The company raised EUR55 million of primary capital on the

same terms as that round, with Chrysalis contributing EUR4 million

to the raise.

wefox has continued to scale internationally, and the proceeds

of the Series D funding round were used to acquire TAF, a

market-leading life insurance company in the Netherlands. This

takes the total number of countries the group operates in to seven:

Germany, Austria, Spain, Italy, Switzerland, Poland and the

Netherlands. By acquiring established insurance companies globally,

wefox has been able to build a significant international scale and

is driving them towards profitability more quickly than an organic

route was likely to deliver. The Investment Adviser has been

pleased with the progress made on integrating and digitising recent

acquisitions.

In recent weeks, wefox announced that it has launched its global

affinity business which will enable it to connect insurance

companies with partners who can distribute insurance products, thus

increasing its network and the routes to market for its own

insurance products. This announcement is viewed as a precursor to

wefox scaling its software revenues by providing the technological

infrastructure necessary for market incumbents to launch and

distribute digital insurance products.

The short-term target for wefox remains getting to profitability

- expected in 2H23 on a run rate basis.

At that point, the company will have a choice to make, in

conjunction with investors: either keep growing at current rates

and build profitability further, or accelerate growth with

investment, accepting lower profits/running at breakeven.

The Investment Adviser is optimistic that substantial value

would be generated by either route.

Starling Bank Limited ("Starling")

Progress has continued to be impressive at Starling.

Its financial results to March 2023 were released in May, which

showed very strong growth in both sales and profits, as shown

below.

Starling Bank - Financial Performance (Year to indicated

date)

Nov-19 Mar-21 Mar-22 Mar-23 % chg

(Mar21 -23)

Total income (GBPm) 14.2 87.8 188.1 414.8 372%

------- -------- -------- -------- -------------

Implied costs (67.8) (101.5) (156.0) (220.2) 117%

------- -------- -------- -------- -------------

Profit before tax

(GBPm) (53.6) (13.7) 32.1 194.6

------- -------- -------- -------- -------------

Return on Tangible

Equity 18.3% 29.0%

------- -------- -------- -------- -------------

Source: Starling and Jupiter

The growth in profits has been driven by strong revenue growth

and a scalable cost base, which has grown significantly less

quickly than the top line over the last two years.

Revenue growth in 2023 was predominantly derived from both new

lending, which has risen over 100% since Mar-21, assisted by the

introduction of 'Buy To Let' mortgage origination via the

acquisition of Fleet Mortgages, and via increases in yields on cash

("Loans to banks") and on debt securities, as a result of increases

in the Bank of England's Base Rate and its impact on wider market

yields.

Starling - Simplified Balance Sheet (at Nov-19, Mar-21, Mar-22

and Mar-23)

Lending to % chg

customers Nov-19 Mar-21 Mar-22 Mar-23 (Mar21-23)

Mortgages - - 1,216 3,437

--------- --------- ---------- ---------- ------------

SME lending - 2,187 2,006 1,404

--------- --------- ---------- ---------- ------------

Retail 59 77 51 33

--------- --------- ---------- ---------- ------------

Total Lending 59 2,264 3,272 4,874 115%

--------- --------- ---------- ---------- ------------

Loans to banks 765 3,196 6,105 6,110 91%

--------- --------- ---------- ---------- ------------

Debt securities 332 1,516 2,330 2,480

--------- --------- ---------- ---------- ------------

Other 46 73 198 249

--------- --------- ---------- ---------- ------------

Total assets 1,202 7,048 11,905 13,713 95%

--------- --------- ---------- ---------- ------------

Deposits (1,007) (5,828) (9,027) (10,552) 81%

--------- --------- ---------- ---------- ------------

Other liabilities (125) (1,080) (2,448) (2,464)

--------- --------- ---------- ---------- ------------

Total liabilities (1,132) (6,908) (11,475) (13,016) 88%

--------- --------- ---------- ---------- ------------

Total equity 70 140 430 697 394%

--------- --------- ---------- ---------- ------------

Source: Starling and Jupiter

Despite the strong growth in lending over the period

illustrated, the loan-to-deposit ratio only rose by approximately

ten percentage points to circa 46%, due to the strong growth in

deposits. Over the course of 2021, these excess deposits received

minimal yield from the Bank of England with commensurately lower

yields for debt securities. But as yields have risen since late

2021, the return on these funds has begun to rise.

The chart above shows the evolution of UK base rates with

Starling's last three fiscal years overlaid. Given the starting

point of base rates for Starling's fiscal 2024 is higher than the

average received over fiscal 2023, it is reasonable to assume that,

ceteris paribus, Starling's income will continue to benefit from

putting excess deposits to work at market rates.

Starling also continues to expand and, in March 2023, announced

plans to add up to 1,000 new jobs in a new office in Manchester, on

top of the 2,500 people it already employs.

In January, it won a trio of awards, including placing very well

on the Current Account Switching Service ("CASS") leader board for

net switches. Over the quarter from 1 July 2022 to 30 September

2022, Starling grew by 9,070 net switches, behind only the

behemoths of Santander and HSBC, despite being the only one of the

three not to offer incentives to switch.

The Brandtech Group LLC ("Brandtech")

Brandtech has been profitable since the point of investment and

has seen an improving margin profile in recent years, as the

company has scaled. Growth has also remained strong and has

typically been best-in-class year-on-year, averaging 30% revenue

growth per annum over the last four years, demonstrating the

company's ability to deliver for enterprise clients globally and

maximise the revenue potential of existing accounts.

Completing strategic M&A that would broaden geographic reach

and the range of products and services provided to enterprise

clients formed a key part of the initial investment thesis. Some

progress on this front was made last year with the acquisition of

DP6 - Latin America's leading marketing technology and data company

- and Acorn-I - an ecommerce platform. While these acquisitions

made sense strategically, they were much smaller than the

acquisition of Oliver, for example.

In June, Brandtech announced the acquisition of Jellyfish, a

performance and digital marketing agency. Jellyfish was founded in

2005 by Rob Pierre and now has more than 2,000 employees across 38

offices around the world. It joins Brandtech after its most

profitable year yet. Jellyfish is a global partner in digital and

performance marketing to some of the world's leading brands such as

Google, Netflix, and Uber. It is one of the most globally certified

companies across today's platforms, including Google Marketing

Platform, Google Cloud, Salesforce, Snap, Amazon, Facebook and

other major social platforms.

This is viewed as a very exciting development by the Investment

Adviser as it represents Brandtech's ninth and largest ever

acquisition; importantly, this acquisition provides Brandtech with

scale in Media, which is the largest part of the addressable market

and also the most profitable segment to operate in. The acquisition

of Jellyfish creates the number one digital-only marketing group in

the world with over $1bn in revenue, over 7,000 employees, working

for eight out of ten of the world's largest advertisers, and 49 of

the top 100.

In April 2021, Brandtech hired former Mindshare Global chief

executive Nick Emery to run Brandtech Media. Nick Emery was a

founding member of Mindshare when WPP set it up in 1997 and

Mindshare grew into one of the biggest media agency networks in the

world, with approximately $18 billion in annual billings. Nick will

be responsible for integrating and scaling Jellyfish and the

Brandtech Media division going forward.

Brandtech is one of Chrysalis' later-stage assets and, given the

company's scale and profitability, the Investment Adviser believes

it will make an excellent IPO candidate in due course. The public

market should make it easier for Brandtech to execute its

acquisition strategy, as seen with several media conglomerates

historically, and the Investment Adviser is excited about the

prospects for the group.

Smart Pension Limited ("Smart")

The key news for Smart occurred post period end, with the

announcement of its $95 million Series E funding round, led by

Aquiline Capital Partners. Chrysalis also participated - committing

GBP12.5 million to the round - alongside other existing investors,

such as Fidelity International Strategic Ventures, DWS, Natixis

Investment Managers and Barclays.

This new, substantial quantum of capital was raised at a time of

on-going stress in the private funding market, which the Investment

Adviser believes is testament to the strength and attractiveness of

Smart's business model and will enable the business to continue to

grow its offering. This is expected to occur both via organic means

- such as the PCCW contract in the Far East - and via inorganic

means, similar to the acquisition of Stadion in the US last

year.

Over the course of 2022, Smart Pension grew its assets under

management ("AuM") to over GBP4.7 billion, up over 123% from GBP2.1

billion a year earlier. In doing so, it added over 5,000 employers

and 105,000 employees. Strong growth is expected to continue into

2023, partly driven by M&A, with the company forecasting AuM in

excess of GBP10 billion by the end of 1H23. This should enable

Smart to continue to build on the impressive 65% revenue growth it

experienced in 2022, which took total sales to GBP67 million.

Smart's business is split between the Smart Master Trust - which

operates in the UK - and its international operations. Both sides

of the company are powered by Keystone, Smart's technology

platform. In the UK, Smart passed one million members in the

period, partly helped by the acquisition of the Ensign Master

Trust, with GBP158 million in AuM.

Post period end, Smart announced the acquisition of US based

ProManage, which offers managed retirement solutions, taking AuM to

over GBP8 billion and putting the business well on track to achieve

its AuM target for the year.

Bolt-on deals such as these can be highly lucrative, given the

efficiency of Keystone, and have been a key driver of the UK Master

Trust achieving profitability.

The global retirement savings market is one of the largest

markets in the world. With cutting edge technology to tackle the

inefficiencies inherent in managing many small value pension pots,

the Investment Adviser believes Smart is well positioned to

continue to grow.

Deep Instinct Limited ("Deep Instinct")

The Investment Adviser remains optimistic about the prospects

for Deep Instinct and is pleased with the financial and operational

progress that has been made in recent months.

The company announced the appointment of Lane Bess as CEO in

September 2022 and he has been working hard to bolster sales

productivity and establish key partnerships. Momentum in these

areas has already been seen, with Deep Instinct announcing a new

partnership with eSentire, a leader in Managed Detection and

Response ("MDR") cybersecurity services. This partnership will

protect eSentire customers from unknown and zero-day attacks with

an efficacy and speed not delivered by any other MDR provider.

In addition to this partnership, Deep Instinct also announced

that eSentire Board Member Amit Mital will join its board of

directors. Most recently, Amit served as a special assistant to the

President and senior director of the National Security Council in

The White House. Amit has over 30 years of industry experience and

spent most of that time as a corporate vice president at Microsoft,

leading the conceptualisation and execution of disruptive

technologies and products. This represents another great

appointment for the company and demonstrates how important this

partnership could be.

Deep Instinct is the first company to develop a purpose-built,

AI-based deep learning framework for cybersecurity and the

Investment Adviser's belief that the company is at the forefront of

innovation in the sector continues to be validated. In March, Deep

Instinct announced its inclusion in the 2022 Gartner Magic Quadrant

or Endpoint Protection Platforms ("EPP"). Of the 18 vendors in the

2022 report, Deep Instinct is the only new vendor to be added for

its ability to execute and the completeness of vision.

The Company completed a follow-on investment in Deep Instinct in

September 2022, to extend the cash runway of the business, and the

Investment Adviser was encouraged by the fact that PayPal Ventures

announced an investment into the company as part of a second-close.

This funding will help further accelerate Deep Instinct's growth

and was completed on the same terms as Chrysalis' investment.

Klarna Holding AB ("Klarna")

In the March 2022 Interim Report, the Investment Adviser

highlighted the likely ramifications of Klarna achieving

profitability on the back of its cost cutting programme. At the

time, there was still significant scepticism in the market that

Klarna's business model would survive rising interest rates and

likely higher impairment.

Scroll forward to today, and Klarna appears to be in rude

health.

As of its 1Q23 results, Klarna's adjusted operating losses had

fallen materially, improving by over 80% since the nadir in 2Q22.

This has been a function of both improving credit losses - driven

by Klarna's responsible decision to limit credit growth last year

in the light of deteriorating economic conditions - and lower

operating costs - driven by Klarna's cost cutting programme that

was largely enacted over 2Q22.

At its full year results, Klarna stated it was "...making

concrete progress towards profitability..." and achievement of

this goal would be a key moment, despite this being a business

which ran profitably for most of its early existence. This drive

towards profit was restated in its 1Q23 press release.

The US continues to be a key engine of growth, growing 71% in

GMV terms over 2022, despite improving credit loss ratios by 37%,

as customer cohorts matured. As of last year, Klarna had 34 million

US consumers and over 150 million globally.

Klarna is more than just a Buy Now Pay Later ("BNPL") lender,

which it estimated accounts for less than 50% of GMV. Payments are

also a key, via products such as "Pay Now", which allows users to

benefit from Klarna's ease of use, but pay immediately. In

addition, marketing services have been a source of strong growth,

and includes products such as sponsored content as well as serving

retailers with over 600 million leads over 2022.

As a result of customer take up, Klarna's marketing services

revenue grew 131% over 2022 to SEK1.6 billion and

accounted for over 8% of total revenues. This rapid pace of

development continued into 1Q23.

The Investment Adviser believes that diversification of revenue

streams will be attractive to investors, lowering the reliance on a

single source of income.

Featurespace Limited ("Featurespace")

Featurespace continues to lead the market in fraud detection and

has seen strong growth as a result, the former evidenced by

Featurespace's announcement in April 2023 that its technology had

managed to improve NatWest's financial scam detection rate by 135%.

False positives also fell by 75% in the same test, which has a

material impact in terms of reducing workloads on staff having to

check erroneously blocked transactions.

Featurespace won a number of awards over the period, including

being named one of the winners in the PETs (Privacy-Enhancing

Technologies) Challenge. Featurespace combined different PETs to

allow AI models to make better fraud predictions, without exposing

sensitive data.

The company's results for 2021 showed revenue growth of

approximately 27% to GBP26.7 million, Annual Recurring Revenue grew

by 33%, albeit with losses widening to GBP16.3 million, due to

on-going investment. Results for 2022 are due post the summer and

are expected to show continued growth.

Over the course of the last twelve months, Featurespace has

added 9 new direct customers, taking the total to 55, and has

continued to see very strong customer traction and contact wins,

with 2022 delivering a record TCV of over GBP60 million.

In April 2023, Featurespace announced the appointment of John

Shipsey as CFO. John was previously CFO at Smiths Group from

2017-2022 and prior to that was CFO of Dyson. The Investment

Adviser views this as very positive news and indicative of the

attractiveness of Featurespace to someone who has been in several

high-profile roles at substantially larger companies in the

past.

Featurespace's market-leading technology, and the seemingly

never-ending growth in financial crime across the globe, means the

Investment Adviser believes the company is very well positioned to

continue to grow its business and its offering.

Tactus Holdings Limited ("Tactus")

Tactus has completed a number of acquisitions since Chrysalis'

initial investment, including coding and robotics firm pi-top, B2B

IT reseller BIST Group, PC gaming brand Chillblast and more

recently Box, an online retailer of consumer technology and

specialist devices. The focus over the last twelve months has been

on integrating these assets and the management team has

successfully migrated its warehousing and fulfilment capabilities

to a single site in Tamworth, rebranded CCL and Chillblast and

begun to re-platform its ecommerce sites. This should enable Tactus

to drive operational efficiencies and realise further synergies

from its M&A.

The trading environment over the last twelve months has been

challenging. Microsoft recently announced that Xbox hardware sales

declined by 30% for the three months ended 31 March 2023, while

Apple reported a 40% decline in Mac sales over the same period.

These recent trends have made it more difficult for Tactus to drive

higher rates of organic growth, but it has been able to take market

share in recent months and has continued to outperform many of its

competitors. Longer term, it is believed that the global gaming

industry will continue to grow strongly, and the company will

ultimately be a beneficiary of this trend. Despite a challenging

backdrop, Tactus has managed to continue trading profitably.

The business is in much better shape than when Chrysalis first

invested back in 2021 and should be well placed to take advantage

as industry conditions improve.

Cognitive Logic Inc. ("InfoSum")

Despite Alphabet announcing last year that it was delaying

Google Chrome's third-party cookie deprecation to 2024, which was

initially expected by 2022, it is clear that InfoSum is operating

in a huge addressable market that will increasingly benefit from

regulatory tailwinds; this was a key part of the initial investment

thesis.

The deprecation of third-party cookies will make it increasingly

difficult for brands to gather first-party data, increasing the

need for direct data collaboration with their advertising partners

to salvage addressability.

However, privacy regulations are particularly penal and brands

are nervous about sharing data with outside partners, given the

financial implications and the potential impact on consumer trust

and brand reputation. Data clean rooms are the key to solving the

issues around harnessing first-party data, but they are typically

difficult to set up and operate. This is the fundamental issue that

InfoSum is trying to solve for.

In recent months, the Interactive Advertising Bureau (IAB) Tech

Lab released the first draft of proposed standards for data clean

rooms along with a guidance document. This is positive for InfoSum

as, in the absence of established standards, it's been difficult

for marketing organisations to understand what constitutes a data

clean room and the differentiating factors between vendors.

In recent months, InfoSum announced the launch of Platform

Sigma, which solves many of the issues facing the industry.

Platform Sigma will enable customers to analyse first-party data

without sharing or moving data and allows for faster and more

seamless use cases, including deep consumer insights, cross-channel

activation and measurement, with end-to-end protection and

security. The Investment Adviser believes that the upgrades to the

technology platform will drive sales conversion and platform

adoption of InfoSum's market-leading technology solution.

Graphcore Limited ("Graphcore")

Over the period, Graphcore has continued to develop both its

software and hardware offerings.

In terms of the former, Poplar SDK 3.1 was released in December

2022, which added a range of functionality including support for

certain libraries. In terms of the latter, a C600 PCIe card was

launched, based on the MK2 IPU. The PCIe form factor was a response

to customer demand for datacentre configurations.

In terms of new customer wins, the US Department of Energy's

Argonne National Laboratory - which is attempting to integrate high

performance computing with AI accelerators to develop next

generation ML workloads - installed a Bow IPU system in October

2022. In May 2023, it opened its IPU resources to researchers

around the world for free.

Post period end, Nvidia - the major supplier of AI accelerators

in the market - announced a significant beat to analysts' estimates

for 1Q23 EPS, but more importantly, a massive increase in sales

guidance for 2Q23 ($11 billion vs expectations of $7.2 billion).

The commentary suggested that this marks the start of a multi-year

upgrading of datacentre processors, to deal with AI-driven workload

demand.

Graphcore is one of only a handful of companies with a chip

designed for deep learning/ AI type work. The Investment Adviser

identified the likely explosion in AI interest five years ago, and

despite the ongoing encouraging performance of the technology, it

is frustrating that widespread commercial traction has proved

elusive for Graphcore.

The Investment Adviser believes that the set of conditions that

now exist in the market must surely mark a very positive backdrop

for the company to pursue its development plans.

Secret Escapes Limited ("Secret Escapes")

Following a tough few years, with trading disrupted by COVID-19

and travel restrictions, the backdrop and market environment appear

to be improving for Secret Escapes. The company's financial

performance year to date versus 2019 (pre-COVID) has been

encouraging and the outlook for the remainder of 2023 looks

positive.

Secret Escapes proactively reduced its cost base through the

COVID-19 period and this is now translating into a more attractive

margin profile versus 2019. With trading patterns beginning to

normalise, Secret Escapes can begin to accelerate customer

acquisition to drive its rate of organic growth and unit economics,

thus creating a faster growing, more profitable business in the

near to medium term.

Wise plc ("Wise")

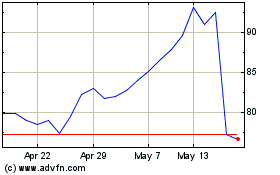

As a listed asset, there is considerable financial information

available on Wise and it has continued to see strong growth over

its year to March 2023, as evidenced by the chart below.

Over the course of its fiscal year to March 2023, total income

grew approximately 73% and adjusted EBITDA grew approximately 92%.

Wise's consistent medium-term guidance since IPO has been for

adjusted EBITDA margins to be "at or above 20%", as the company

continues to drive down prices for customers and invest in the

offering.

Despite this, margins are expected to have gently trended

upwards over FY23, as the pace of revenue growth has meant that it

has not been possible to invest surplus contribution sufficiently

rapidly.

Part of the reason for the strong operating performance of Wise

has been its exposure to UK base rates. Like Starling, Wise has

deposits on its platform that it can lodge with the Bank of England

and other central banks, which have achieved negligible yields for

several years. Following the global shift upwards in yields, these

excess deposits are now earning a return.

Wise has begun to offer products to customers, such as Wise

Interest, which may see the effective retained yield normalise. But

customer behaviour towards low balances is such that not all of

these offers will be taken up. As a result, the trend in higher

base rates has fed into company income forecasts, as shown in the

chart above, which illustrates the development of these forecasts

against base rate changes.

Looking forward, Wise is well positioned to continue to take

market share from other financial institutions, especially in money

transfer, and the shape of current yield curves augurs well for

continuing returns on customer balances.

Sorted Holdings Limited ("Sorted")

Sorted continued to grow over the period, winning new customers,

but, given its stage of development and the current difficult

funding markets, the Company's carrying valuation has been written

down.

The Investment Adviser continues to work closely with management

to determine the best approach to maximising shareholder value.

Environmental, Social and Governance Report

Chrysalis predominantly provides primary capital to unlisted

businesses that offer the technology to transform the way we live

and work. While no new investments were made during the period, the

Company continued to implement the ESG policy established by the

Board and enhance the systematic integration of ESG analysis across

the portfolio.

The portfolio

There is no single type of business in which Chrysalis invests,

however, the Investment Adviser's aim is to find companies which

display a number of characteristics. Typically, they will be high

growth, innovative businesses which are leading transformation

within their sectors and operate in huge addressable markets with

structural tailwinds. Their core assets are intellectual property

and the people who create it. They use best in class scalable

technologies to capitalise on societal change and to solve customer

problems in novel ways. Lastly, companies should also have a clear

roadmap to profitability, and the ability to achieve and sustain

exceptional rates of growth.

The current portfolio includes many companies which provide

solutions to urgent business problems with broader societal costs -

such as fraud, cyber risks, data privacy and affordable pension

provision - or which disrupt highly profitable financial services

incumbents and share cost savings with consumers. The demand to

reduce these broader societal costs is a crucial driver which

underpins the long-term growth story of these investments.

Chrysalis also has investments in other consumer-facing companies

which are taking tangible steps to enhance the sustainability

profile of their operations.

Strengthening governance

The Investment Adviser firmly believes that in order to grow

successfully, companies and their founders must not only execute

strategically, they must also lay the foundations for future growth

by fostering a healthy corporate culture, a talented and diverse

workforce and creating appropriate corporate governance

structures.

During the period Chrysalis' portfolio companies continued to

strengthen their corporate governance, building capacity at

management and board level. For example, and as mentioned in the

company update section of this report, in April 2023, Featurespace

announced the appointment of John Shipsey as CFO. John was

previously CFO at Smiths Group from 2017-2022 and prior to that was

CFO of Dyson. This is viewed as very positive and indicative of the

attractiveness of Featurespace to someone who has been in several

high-profile roles and substantially larger companies in the

past.

In September 2022 Deep Instinct announced the appointment of

Lane Bess, former CEO of Palo Alto Networks, as CEO. Deep Instinct

also announced that eSentire Board Member Amit Mital will join its

board of directors. Amit has over 30 years of industry experience

and spent most of that time as a corporate vice president at

Microsoft. wefox continued to build capacity across the executive

management team, recruiting Nicholas Walker as Chief HR Officer.

Walker is a seasoned HR professional with more than 25 years'

global experience that spans technology, fintech and payment

industries, and most recently was at Paysafe.

Delivering sustainable outcomes

The Investment Adviser expects all companies to minimise any

direct and indirect negative impact on the environment and broader

society. During the period portfolio companies continued to develop

their own sustainability initiatives.

Smart Pension is the first UK pension provider to offer

customers a range of lifestyle strategies that are all fully

sustainable, including the Smart Pension default fund. In January

2023, the company announced the launch of three new fully

sustainable lifestyle strategies with different growth fund

options. All three growth funds fully invest in funds that

positively contribute to the planet and society, including

investing in areas such as renewable energy projects, clean water

and healthcare. The Smart Pension Master Trust was also approved as

a signatory to the UK Stewardship Code in March 2023.

In February 2023, Smart Pension announced that it has halved the

emissions of its default growth fund. This is over two years ahead

of the 50% reduction target it announced in June 2022 and

represents considerable progress towards the company's pledge to

make its default growth fund net zero by 2040. This is also well

ahead of the goals of the Paris Agreement, which called for

emissions to be reduced by 45% by 2030 and to reach net zero by

2050.

Starling's latest gender pay gap figures (2022), show that the

median gender pay gap has decreased from 10.34% to 9.24%, while the

mean has narrowed from 16.05% to 12.34%. Both its mean and median

gender pay gaps remain substantially lower than those of

competitors. The continued improvement reflects the range of

diversity, equity and inclusion initiatives Starling has enacted

since becoming a signatory to the Women in Finance Charter in

2017.

Post-period end, Klarna provided an update on the progress of

its Give One initiative, launched in April 2021, which pledges 1%

of all future funding rounds to support change-makers on the

frontlines of environmental challenges. Klarna has contributed $11

million to the initiative since launch in April 2021, funds which

have enabled the planting of 3.4 million trees worldwide. Give One

supports 56 environmental initiatives which include over 70

organisations throughout North America, South America, Africa,

Europe, and Asia.

Our stewardship approach

Stewardship is an important responsibility and a core aspect of

the Company's investor approach. There is a continuous process of

dialogue with the leadership teams of the investee companies. Where

the Investment Adviser has a board seat or board observer status,

the Investment Team attend board meetings and provide input where

it can advise companies on how to meet their strategic objectives.

This includes regular dialogue on ESG related topics, and the

Investment Adviser seeks to influence companies where it believes

the management of material ESG factors can be improved.

The Investment Adviser has developed an internal dashboard of

metrics to assess the ESG performance of portfolio companies. This

data is collected directly from private investee companies or

sourced from the sustainability disclosures of listed holdings. The

Investment Adviser uses the resulting metrics to assess each

company's ESG performance relative to its level of corporate

development and maturity and incorporates insights gained into

dialogue with company leadership teams, in order to assist their

continued development. Chrysalis will continue to report using the

metrics in the 2023 Annual Report.

Where the Investment Adviser identifies potential material ESG

risks or areas of group governance which require further

development, it will communicate these conclusions to management

and seek to work collaboratively with them to improve this aspect

of the company. This may take the form of longer-term objectives,

such as IPO readiness, or short term remedial actions. Areas

identified in action plans undertaken during the period relate to

areas such as cyber security, financial controls and carbon

emissions reporting. Company action plans and any material ESG

incidents are reported to the Risk Committee and monitored over

time to assess progress.

Investment Objective and Policy

Investment objective

The investment objective of the Company is to generate long term

capital growth through investing in a portfolio consisting

primarily of equity or equity-related investments in unquoted and

listed companies.

Investment policy

Investments will be primarily in equity and equity-related

instruments (which shall include, without limitation, preference

shares, convertible debt instruments, equity-related and

equity-linked notes and warrants) issued by portfolio companies.

The Company will also be permitted to invest in partnerships,

limited liability partnerships and other legal forms of entity

where the investment has equity like return characteristics.

The Company may invest in publicly traded companies (including

participating in the IPO of an existing unquoted company

investment), subject to the investment restrictions below. In

particular, unquoted portfolio companies may seek IPOs from time to

time following an investment by the Company, in which case the

Company may continue to hold its investment without

restriction.

For the purposes of this investment policy, unquoted companies

shall include companies with a technical listing on a stock

exchange but where there is no liquid trading market in the

relevant securities on that market (for example, companies with

listings on The International Stock Exchange and the Cayman Stock

Exchange). Further, the Company shall be permitted to invest in

unquoted subsidiaries of companies whose parent or group entities

have listed equity or debt securities.

The Company is not expected to take majority shareholder

positions in portfolio companies but shall not be restricted from

doing so. Further, there may be circumstances where the ownership

of a portfolio company exceeds 50% of voting and/or economic

interests in that portfolio company notwithstanding an initial

investment in a minority position. While the Company does not

intend to focus its investments on a particular sector, there is no

limit on the Company's ability to make investments in portfolio

companies within the same sector if it chooses to do so.

The Company will seek to ensure that it has suitable investor

protection rights through its investment in portfolio companies

where appropriate.

The Company may acquire investments directly or by way of

holdings in special purpose vehicles, intermediate holding vehicles

or other fund or similar structures.

Investment restrictions

The Company will invest and manage its assets with the objective

of spreading risk, as far as reasonably practicable. No single

investment (including related investments in group entities) will

represent more than 20% of Gross Assets, calculated at the time of

that investment. The market value of individual investments may

exceed 20% of Gross Assets following investment.

The Company's aggregate equity investments in publicly traded

companies that it has not previously held an investment in prior to

that Company's IPO will represent no more than 20% of the Gross

Assets, calculated as at the time of investment.

Subject in all cases to the Company's cash management policy,

the Company's aggregate investment in notes, bonds, debentures and

other debt instruments (which shall exclude for the avoidance of

doubt convertible debt, equity-related and equity-linked notes,

warrants or equivalent instruments) will represent no more than 20%

of the Gross Assets, calculated as at the time of investment.

The Company will not be required to dispose of any investment or

rebalance its portfolio as a result of a change in the respective

value of any of its investments.

B oard Members

The Board comprises six independent non-executive Directors (of

whom one third are female) and meets at least quarterly, in

addition to ad hoc meetings convened in accordance with the needs

of the business, to consider the Company's affairs in a prescribed

and structured manner. All Directors are considered independent of

the Investment Adviser for the purposes of the Association of

Investment Companies Code of Corporate Governance (the "AIC Code")

and Listing Rule 15.2.12A.

The Board is responsible for the Company's long term sustainable

success and the generation of value for shareholders and in doing

so manages the business affairs of the Company in accordance with

the Articles of Incorporation, the investment policy and with due

regard to the wider interests of stakeholders as a whole.

Additionally, the Board have overall responsibility for the

Company's activities including its investment activities and

reviewing the performance of the Company's portfolio. The Board are