TIDMCLON

RNS Number : 4292N

Clontarf Energy PLC

25 September 2023

25 September 2023

Clontarf Energy plc

("Clontarf" or the "Company")

Interim Statement for the period ended 30 June 2023

Clontarf Energy plc (AIM: CLON), the energy company focused on

Australia, Africa and Bolivia, announces its unaudited financial

results for the six months ended 30 June 2023:

Highlights

-- Formation of a comprehensive joint venture with breakthrough

Direct Lithium Extraction ("DLE") technology developers NEXT-ChemX

(the "JV").

-- Brine samples from five priority salares provided by the

Bolivian State Lithium Company for testing.

-- All samples successfully navigated the US Customs checks

without setbacks.

-- The JV's pilot plant components have now largely been

assembled at sub-contractor facilities.

-- Technical improvements including development and perfection

of state-of-the-art German-engineered sensors, to improve

performance.

-- Pilot plant construction, including assembly of innovative

components, will shortly be underway in Texas, after which testing

will begin.

-- Subject to test results and Bolivian laws, Clontarf plans to

run large-scale production testing to fine-tune the process.

-- Under applicable laws, the JV is ready to construct mobile

pilot plants to process brines at different salares in Bolivia and

neighbouring countries.

-- Clontarf has been invited to participate in European Union

initiatives to deliver battery-grade lithium salts to European

automotive, grid storage and mobile electronics industries.

-- The Bolivian authorities have adopted the suggestion to

conduct a bid-round on medium-sized salares, certain of which

Clontarf has reviewed and sampled.

-- Ratification discussions on Tano 2A block with Ghanaian

authorities continue - though the authorities have sought to

re-negotiate (to their benefit) at the acreage and fiscal terms

previously agreed. A new realism seems evident.

-- Further Australian drill targets are under consideration,

especially for gas to serve the dynamic liquified natural gas

("LNG") market.

Chairman's Statement

Recent months have witnessed accelerated field-work on several

fronts:

Clontarf teams have conducted further site-visits, sampling and

related geological work to deepen our understanding of

opportunities and challenges offered by the development of Direct

Lithium Extraction technologies.

Our primary focus has been working with the Bolivian

authorities, in accordance with applicable laws. This covers both

our work on Direct Lithium Extraction technologies, in joint

venture with NEXT-ChemX, as well as Clontarf's proposals to explore

and develop medium-sized salares. The Bolivian authorities have now

confirmed their plan to run a bid-round, as required by law and

proper governance, on these high-potential though under-explored

salt-lakes. This reflects a vision to develop the world's greatest

lithium resource as soon as feasible, to benefit local communities,

the authorities, as well as our partners, customers and the road to

energy transition.

Our JV partners have completed financings and sub-contractor

supply agreements on long-lead time and scarce components. Some

components are being enhanced in order to serve anticipated as well

as current customer needs. Remaining elements are being shipped to

site for final assembly, commissioning and testing.

This progress has brought us to the attention of the EU

Commission, as well as State-backed initiatives in Britain and the

USA. Clontarf has been invited to participate in a drive to explore

and develop lithium and other strategic minerals in northern

Argentina, and possibly other jurisdictions. We believe that such

timely initiatives may open larger and lower cost sources of equity

and debt financings. This would cut our cost of capital and open

many new opportunities for value added and expansion.

Subject to applicable laws, Clontarf has offered to participate

in a Bolivian Lithium opportunity in partnership with YLB using DLE

technology being developed by our technical partner, Next ChemX

Corporation.

Every brine is different, and we must ensure that the processing

parameters are compatible with the quantity, quality and other

parameters of the minerals that are present in the particular

brine. This is necessary in order to complete the design of the

larger commercial pilot plant specifically made for the selected

Bolivian brines.

With all necessary permits, we plan to collect and process

larger samples for pilot plant testing, including kinetics

calculations, flow-rates, etc.

The NEXT-ChemX process works directly from the brine, and after

a quick filtering to ensure there are no solids or debris in the

brine we feed into our system. We normally produce pure Lithium

Chloride, which we can then convert to battery grade Li(2) CO(3) or

LiOH - or possibly Lithium metal for solid state lithium

batteries.

This pilot plant testing will enable fine tuning of the process,

and determine recovery parameters, as well as operating cost

numbers applicable for different brine samples.

This work will help optimise output, demonstrating the

effectiveness of the Next ChemX technology and determining

throughput and recovery expected at in-situ pilot plants in South

America, and possibly elsewhere.

The mobile pilot plant will ideally run for 4 and 6 months, to

assess the potential of that location, after which the mobile pilot

plant can then be moved and reassembled at another salar. This

approach will enable customising of the DLE process for a variety

of brine grades and chemistries.

The Clontarf JV, in conjunction with the authorities, under

applicable laws, plans to build a full scale processing plant of an

agreed capacity to extract production tonnages of Lithium

Carbonate, or other desired form of Lithium. We would also assess

the viability for the recovery of calcium, magnesium, and potassium

chlorides at each location showing attractive flow volumes and

recoverable grade. The overall capacity will be scalable via

deployment of modular units over a period of months to years.

Each plant can be upgraded to produce value added production,

i.e. lithium chloride to lithium carbonate, lithium hydroxide and,

if feasible, lithium metal. A similar approach to boosting value

added will be implemented for other, economic non-lithium minerals,

such as magnesium and potassium.

In oil and gas, the tightening hydrocarbons' supply-demand

balance promises a long-overdue revival of exploration and the

farm-out market. Shortages of piped gas and LNG feedstock have

strengthened long-term prices. The centrality of LNG to fuel any

energy transition in Europe and Asia has now been broadly accepted

- except for fringe elements - and even by previous sceptics. There

can be no reliance on intermittent renewables generation without

reliable back-up.

The resurgence of interest in African exploration and

development may lead to additional proposals in the coming months.

Clontarf continues to insist on strict adherence to our ESG

standards.

Clontarf therefore progresses its interests in Bolivia,

Australia, Chad and Ghana, maintaining cordial communications with

the relevant authorities, and continues to operate efficiently on

minimal expenditure.

Funding

Subject to technical verification of its exploration projects,

and permitting, Clontarf is confident of securing adequate funding,

whether in London or Australia, for near to medium term ongoing

activities.

We set out to reduce political and geological risks.

Fortune favours the brave. The best is yet to come.

David Horgan

Chairman

22(nd) September 2023

This announcement contains inside information for the purposes

of Article 7 of Regulation (EU) 596/2014.

S

For further information please visit http://clontarfenergy.com

or contact:

Clontarf Energy

David Horgan, Chairman

Jim Finn, Director +353 (0) 1 833 2833

Nominated & Financial Adviser

Strand Hanson Limited

Rory Murphy

Ritchie Balmer +44 (0) 20 7409 3494

Broker

Novum Securities Limited

Colin Rowbury +44 (0) 207 399 9400

Public Relations

BlytheRay

Megan Ray +44 (0) 207 138 3206

Teneo

Luke Hogg

Alan Tyrrell +353 (0) 1 661 4055

CONDENSED CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

Six Months Ended Year Ended

30 June 23 30 June 22 31 Dec 22

unaudited unaudited audited

GBP'000 GBP'000 GBP'000

Administrative

expenses (288) (414) (672)

Impairment of

exploration

and evaluation

assets - (4,095) (4,095)

----------------------------------------- ------------------------------------------ -------------------------------------------

LOSS BEFORE

TAXATION (288) (4,509) (4,767)

Income Tax - - -

----------------------------------------- ------------------------------------------ -------------------------------------------

COMPREHENSIVE

INCOME FOR THE

PERIOD (288) (4,509) (4,767)

========================================= ========================================== ===========================================

LOSS PER SHARE

- basic and

diluted (0.01p) (0.34p) (0.26p)

========================================= ========================================== ===========================================

CONDENSED

CONSOLIDATED

BALANCE SHEET

30 June 23 30 June 22 31 Dec 22

unaudited unaudited audited

GBP'000 GBP'000 GBP'000

ASSETS:

NON-CURRENT

ASSETS

Intangible

assets 1,756 868 868

1,756 868 868

----------------------------------------- ------------------------------------------ -------------------------------------------

CURRENT ASSETS

Other

receivables - 1 -

Cash and cash

equivalents 381 188 932

----------------------------------------- ------------------------------------------ -------------------------------------------

381 189 932

TOTAL ASSETS 2,137 1,057 1,800

----------------------------------------- ------------------------------------------ -------------------------------------------

LIABILITIES:

CURRENT

LIABILITIES

Trade and other

liabilities (1,512) (2,088) (3,027)

----------------------------------------- ------------------------------------------ -------------------------------------------

(1,512) (2,088) (3,027)

----------------------------------------- ------------------------------------------ -------------------------------------------

TOTAL

LIABILITIES (1,512) (2,088) (3,027)

NET ASSETS /

(LIABILITIES) 625 (1,031) (1,227)

========================================= ========================================== ===========================================

EQUITY

Called-up share

capital 6,209 5,927 5,927

Share premium 12,737 10,985 10,985

Share based

payment

reserve 354 186 248

Retained

deficit (18,675) (18,129) (18,387)

----------------------------------------- ------------------------------------------ -------------------------------------------

TOTAL EQUITY 625 (1,031) (1,227)

========================================= ========================================== ===========================================

CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

Called-up Share based

Share Share Payment Retained

Capital Premium Reserves Deficit Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

As at 1

January 2022 2,177 10,985 186 (13,620) (272)

Shares issued 3,750 - - - 3,750

Total

comprehensive

income - - - (4,509) (4,509)

--------------------------------------- --------------------------------------- ----------------------------------------- ------------------------------------------ ----------------------------------------

As at 30 June

2022 5,927 10,985 186 (18,129) (1,031)

Share based

payment charge - - 62 - 62

Total

comprehensive

income - - - (258) (258)

--------------------------------------- --------------------------------------- ----------------------------------------- ------------------------------------------ ----------------------------------------

As at 31

December 2022 5,927 10,985 248 (18,387) (1,227)

Shares issued 282 1,849 - - 2,131

Share issue

expenses - (97) - - (97)

Share based

payment charge - - 106 - 106

Total

comprehensive

income - - - (288) (288)

-----------------------------------------

As at 30 June

2023 6,209 12,737 354 (18,675) 625

======================================= ======================================= ========================================= ========================================== ========================================

CONDENSED

CONSOLIDATED CASH

FLOW Six Months Ended Year Ended

30 June 23 30 June 22 31 Dec 22

unaudited unaudited audited

GBP'000 GBP'000 GBP'000

CASH FLOW USED IN

OPERATING ACTIVITIES

Loss for the period (288) (4,509) (4,767)

Impairment of

exploration and

evaluation assets - 4,095 4,095

Share based payment

charge 106 - 62

Exchange movements 2 1 3

----------------------------------------- ------------------------------------------ ------------------------------------------

(180) (413) (607)

----------------------------------------- ------------------------------------------ ------------------------------------------

Movements in working

capital

Decrease in other

receivables - 2 2

(Decrease)/Increase

in trade and other

payables (1,516) 601 1,541

----------------------------------------- ------------------------------------------ ------------------------------------------

(1,516) 603 1,543

----------------------------------------- ------------------------------------------ ------------------------------------------

NET CASH USED IN

OPERATING

ACTIVITIES (1,696) 190 936

----------------------------------------- ------------------------------------------ ------------------------------------------

CASH FLOWS USED IN

INVESTING ACTIVITIES

Payments for

intangible assets (406) (4,095) (4,095)

NET CASH USED IN

INVESTING

ACTIVITIES (406) (4,095) (4,095)

----------------------------------------- ------------------------------------------ ------------------------------------------

CASH FLOW FROM

FINANCING ACTIVITIES

Issue of shares 1,650 3,750 3,750

Share issue expenses (97) - -

----------------------------------------- ------------------------------------------ ------------------------------------------

NET CASH GENERATED

FROM FINANCING

ACTIVITIES 1,553 3,750 3,750

----------------------------------------- ------------------------------------------ ------------------------------------------

NET

(DECREASE)/INCREASE

IN CASH AND CASH

EQUIVALENTS (549) (155) 591

Cash and cash

equivalents at

beginning of the

period 932 344 344

Exchange loss on

cash and cash

equivalents (2) (1) (3)

CASH AND CASH

EQUIVALENT AT THE OF THE PERIOD 381 188 932

========================================= ========================================== ==========================================

Notes:

1. INFORMATION

The financial information for the six months ended 30 June 2023

and the comparative amounts for the six months ended 30 June 2022

are unaudited. The financial information above does not constitute

full statutory accounts within the meaning of section 434 of the

Companies Act 2006.

The Interim Financial Report has been prepared in accordance

with IAS 34 Interim Financial Reporting as adopted by the U.K. The

accounting policies and methods of computation used in the

preparation of the Interim Financial Report are consistent with

those used in the Group 2022 Annual Report, which is available at

www.clontarfenergy.com

The interim financial statements have not been audited or

reviewed by the auditors of the Group pursuant to the Auditing

Practices board guidance on Review of Interim Financial

Information.

2. DIVID

No dividend is proposed in respect of the period.

3. GOING CONCERN

The Group incurred a loss for the period of GBP288,472 (2022:

GBP4,766,646) and had net current liabilities of GBP1,130,220

(2022: GBP2,094,612) at the balance sheet date. These conditions,

as well as those noted below, represent a material uncertainty that

may cast doubt on the Group's ability to continue as a going

concern.

Included in current liabilities is an amount of GBP1,450,565

(2022: GBP1,525,565) owed in respect of Directors' remuneration due

at the balance sheet date. The Directors have confirmed that they

will not seek settlement of these amounts in cash until after the

end of 2024.

The Group had a cash balance of GBP381,420 (2022: GBP931,902) at

the balance sheet date. As the Group is not revenue or cash

generating it relies on raising capital from the public market. On

16 January 2023 the Group raised GBP1,300,000 on a placing and a

further GBP350,000 on 1 June 2023. Further information is detailed

in Note 7 below.

As in previous years the Directors have given careful

consideration to the appropriateness of the going concern basis in

the preparation of the financial statements and believe the going

concern basis is appropriate for these financial statements. The

financial statements do not include the adjustments that would

result if the Group and Company were unable to continue as a going

concern.

4. LOSS PER SHARE

Basic loss per share is computed by dividing the loss after

taxation for the year attributable to ordinary shareholders by the

weighted average number of ordinary shares in issue and ranking for

dividend during the year. Diluted earnings per share is computed by

dividing the loss after taxation for the year by the weighted

average number of ordinary shares in issue, adjusted for the effect

of all dilutive potential ordinary shares that were outstanding

during the year.

The following table sets out the computation for basic and

diluted earnings per share ("EPS"):

Six Months Ended Year Ended

30 June 23 30 June 22 31 Dec 22

GBP'000 GBP'000 GBP'000

Loss for the

year

attributable

to equity

holders (288) (4,509) (4,767)

================================== ================================== ==================================

Denominator Number Number Number

For basic and

diluted EPS 4,385,660,371 1,328,908,309 1,856,031,596

================================== ================================== ==================================

Basic and

diluted EPS (0.01p) (0.34p) (0.26p)

================================== ================================== ==================================

Basic and diluted loss per share are the same as the effect of

the outstanding share options is anti-dilutive and is therefore

excluded.

5. INTANGIBLE ASSETS

30 June 30 June 31 Dec

23 22 22

GBP'000 GBP'000 GBP'000

Exploration

and

evaluation

assets

Cost:

At 1 January 12,735 8,640 8,640

Additions 888 4,095 4,095

Closing

Balance 13,623 12,735 12,735

============================ ============================ ============================

Impairment:

At 1 January 11,867 7,772 7,772

Provision

for

impairment - 4,095 4,095

Closing

Balance 11,867 11,867 11,867

============================ ============================ ============================

Carrying

value:

At 1 January 868 868 868

============================ ============================ ============================

At period

end 1,756 868 868

============================ ============================ ============================

Regional 30 Jun 30 Jun 31

Analysis 23 22 Dec22

GBP'000 GBP'000 GBP'000

Bolivia - 888 - -

Investment

in JV

Ghana 868 868 868

---------------------------- ---------------------------- ----------------------------

1,756 868 868

============================ ============================ ============================

Exploration and evaluation assets relate to expenditure incurred

in prospecting and exploration for lithium, oil and gas in Bolivia

and Ghana. The Directors are aware that by its nature there is an

inherent uncertainty in exploration and evaluation assets and

therefore inherent uncertainty in relation to the carrying value of

capitalised exploration and evaluation assets.

During 2018 the Group resolved the outstanding issues with the

Ghana National Petroleum Company ("GNPC") regarding a contract for

the development of the Tano 2A Block. The Group has signed a

Petroleum Agreement in relation to the block and this agreement

awaits ratification by the Ghanian government.

The Company is in negotiations with the Vice-Ministry of

Electrical Technologies and the State Lithium Company in Bolivia on

exploration and development of salt-lakes in accordance with law.

Samples have been analysed and process work is underway.

On 15 February 2023 the Company announced a heads of agreement

around the potential formation of a 50:50 Joint Venture with US

based, OTC Markets traded, technology company, NEXT-ChemX

Corporation ("NCX") covering testing, marketing, and deploying of

NCX's proprietary (patent pending) direct lithium ion extraction

("DLE") technology in Bolivia. Formation of the JV was subject to

final due diligence and the parties entering into formal

documentation.

On 5 May 2023 the Company announced that all conditions

precedent had been satisfied with respect to the JV with NEXT-ChemX

coming into force. In this regard, Clontarf paid NEXT-ChemX

Corporation US$500,000 and has issued to NEXT-ChemX 385 million new

Ordinary Shares in the capital of Clontarf of which half are

subject to a 12-month lock in requirement.

The Directors believe that there were no facts or circumstances

indicating that the carrying value of intangible assets may exceed

their recoverable amount and thus no impairment review was deemed

necessary by the Directors. The realisation of these intangibles

assets is dependent on the successful discovery and development of

economic deposit resources and the ability of the Group to raise

sufficient finance to develop the projects. It is subject to a

number of potential significant risks, as set out below.

The Group's activities are subject to a number of significant

potential risks including:

-- licence obligations;

-- exchange rate risks;

-- uncertainties over development and operational costs;

-- political and legal risks, including agreements with

Governments for licences, profit sharing and taxation;

-- foreign investment risks including increases in taxes,

royalties and renegotiation of contracts;

-- title to assets;

-- financial risk management;

-- going concern; and

-- ability to raise finance.

6. TRADE AND OTHER PAYABLES

30 June 30 June 31 Dec

23 22 22

GBP'000 GBP'000 GBP'000

Creditor

-

Western

Gas - 550 553

Trade

payables 35 48 57

Other

payables 1,451 1,480 1,526

Cash

received

in

advance

of share

placing - - 870

Related

parties 13 - 5

Other

accruals 12 10 16

---------------------------- ---------------------------- ----------------------------

1,511 2,088 3,027

============================ ============================ ============================

Other payables relate to amounts due to Directors and a former

Director for remuneration accrued but not paid at period end.

7. SHARE CAPITAL

Deferred Shares - nominal value of 0.24p

Number Share Capital Share Premium

GBP'000 GBP'000

At 1 January 2022 - - -

-------------- -------------- --------------

At 30 June 2022 - - -

Transfer from ordinary shares 2,370,826,117 5,690 -

-------------- -------------- --------------

At 31 December 2022 and 30 June 2023 2,370,826,117 5,690 -

============== ============== ==============

Ordinary Shares - nominal value of 0.01p

Allotted, called-up and fully paid:

Number Share Capital Share Premium

GBP'000 GBP'000

At 1 January 2022 870,826,117 2,177 10,985

Issued during the period 1,500,000,000 3,750 -

At 30 June 2022 2,370,826,117 5,927 10,985

Transfer to deferred shares (5,690) -

-------------- -------------- --------------

At 31 December 2022 2,370,826,117 237 10,985

Issued during the period 2,822,500,000 282 1,849

Share issue expenses - - (97)

-------------- -------------- --------------

At 30 June 2023 5,193,326,117 519 12,737

============== ============== ==============

On 4 August 2022 the 2,370,826,117 issued ordinary shares of

0.25p each were subdivided via ordinary resolution into

2,370,826,117 ordinary shares of 0.01p each and 2,370,826,117

deferred shares of 0.24p each.

Movements in issued share capital

On 16 January 2023 the Company raised GBP1,300,000 via a placing

of 2 billion new ordinary shares of 0.01p each, via several

Australian based brokers, at a price of 0.065p per share. In

connection with the placing 97,500,000 warrants were issued to the

brokers involved in the placing. Further information is detailed in

Note 8 below. The proceeds were used to advance the Company's

lithium projects in Bolivia, and petroleum projects in Ghana,

Australia, and elsewhere.

On 5 May 2023 as part of the Joint Venture agreement with

NEXT-ChemX the Company issued 385 million ordinary shares of 0.01p

each at a price of 0.125p to NEXT-ChemX. Further information is

detailed in Note 5 above.

On 1 June 2023 the Company raised GBP350,000 via a placing of

437,500,000 ordinary shares of 0.01p each at a price of 0.08p per

share. Proceeds raised will be used to provide additional working

capital and fund developments costs.

8. SHARE BASED PAYMENTS

SHARE OPTIONS

The Group issues equity-settled share-based payments to certain

Directors and individuals who have performed services for the

Group. Equity-settled share-based payments are measured at fair

value at the date of grant.

Fair value is measured by the use of a Black-Scholes model.

The Group plan provides for a grant price equal to the average

quoted market price of the ordinary shares on the date of

grant.

30 Jun 23 30 Jun 22 31 Dec22

Options Weighted Options Weighted Options Weighted

Number average Number average Number average

'000 exercise '000 exercise '000 exercise

price in price in price in

pence pence pence

At 1 January 40,500 0.7 40,500 0.7 40,500 0.7

Issued 160,000 0.0725 - -

---------------------------- ----------------------------- ---------------------------- ----------------------------- ---------------------------- -----------------------------

Outstanding

at end of

period 200,500 0.20 40,500 0.7 40,500 0.7

---------------------------- ----------------------------- ---------------------------- ----------------------------- ---------------------------- -----------------------------

Exercisable

at end of

period 200,500 0.20 30,500 0.7 40,500 0.7

============================ ============================= ============================ ============================= ============================ =============================

On 17 January 2023 a total of 160,000,000 options were granted

with a fair value of GBP106,632 to Directors and individuals who

have performed services for the Group. These fair values were

calculated using the Black-Scholes valuation model.

The inputs into the Black-Scholes valuation model were as

follows:

Grant 17 January 2023

Weighted average share price at date of grant (in pence) 0.07p

Weighted average exercise price (in pence) 0.0725p

Expected volatility

144.39%

Expected life

7 years

Interest free rate

5%

Expected dividends none

Expected volatility was determined by management based on their

cumulative experience of the movement in share prices. The terms of

the options granted do not contain any market conditions within the

meaning of IFRS 2.

The Group capitalised expenses of GBPNil (2022: GBPNil) and

expensed costs of GBP106,632 (2022: GBP61,695) relating to

equity-settled share-based payment transactions during the

year.

Warrants

30 Jun 23 30 Jun 22 31 Dec22

Warrants Weighted Warrants Weighted Warrants Weighted

Number average Number average Number average

'000 exercise '000 exercise '000 exercise

price in price in price in

pence pence pence

At 1 January 435,683 0.25 - - - -

Issued 97,500 0.065 435,683 0.25 435,683 0.25

----------------------------- ----------------------------- ----------------------------- ----------------------------- ----------------------------- -----------------------------

Exercisable

at end of

period 533,183 0.22 435,683 0.25 435,683 0.25

============================= ============================= ============================= ============================= ============================= =============================

On 16 January 2023 in connection with the share placing a total

of 97,500,000 warrants were issued to the brokers involved with the

placing. The warrants have an exercise price of 0.065p.

9. POST BALANCE SHEET EVENTS

On 1 August 2023 the Company announced that the following

long-term, incentive share options have been granted over, in

aggregate, 300,000,000 ordinary shares of 0.01p each in the

Company. The Options vest immediately, have an exercise price of

0.10p and an expiry date of 30th July 2030.

The Options have been awarded as follows:

Number of Options Granted

David Horgan 115,000,000

James Finn 75,000,000

Peter O'Toole 75,000,000

Dipti Mehta 35,000,000

10. The Interim Report for the six months to 30 June 2023 was

approved by the Directors on 22 September 2023.

11. The Interim Report will be available on the Company's

website at www.clontarfenergy.com .

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR PPUUUBUPWGMP

(END) Dow Jones Newswires

September 25, 2023 02:00 ET (06:00 GMT)

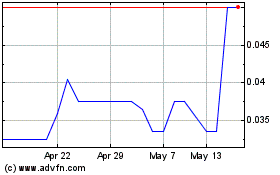

Clontarf Energy (LSE:CLON)

Historical Stock Chart

From Feb 2025 to Mar 2025

Clontarf Energy (LSE:CLON)

Historical Stock Chart

From Mar 2024 to Mar 2025