TIDMCOA

RNS Number : 2028U

Coats Group PLC

22 November 2023

22 November 2023

Coats Group plc

Trading Update

Strengthening margins and cash; signs of gradual market

recovery; trading in line with expectations

Coats Group plc ('Coats', the 'Company' or the 'Group'), the

world's leading industrial thread and global footwear component

manufacturer, today announces a trading update for the period 1

July to 31 October 2023 (the 'period').

H1 2023 1(st) July to 31(st) October

2023 vs same period in 2022(3)

Organic(1,3)

CER Reported CER(1) Organic(1) CER

------------ ---------- ------- ---------------

Apparel -20% -7% -5% -5%

------------ ---------- ------- ---------------

Footwear -23% 0% 0% -18%

------------ ---------- ------- ---------------

Performance Materials -14% -21% -20% -20%

------------ ---------- ------- ---------------

Group -19% -9% -8% -12%

------------ ---------- ------- ---------------

All following references are at CER unless specified.

The Group traded as expected during the four month period. Group

organic revenue is on an improving trend at 12% lower year-on-year

(compared to H1 2023 down 19%), including early signs of the

anticipated gradual recovery in Apparel, where organic revenue was

5% lower. Reflecting the timing lag of destocking having started

later, Footwear organic revenue was 18% lower year-on-year in the

period.

Performance Materials continues to be impacted by the previously

disclosed customer insourcing of production, as well as customer

phasing issues in some US end markets. As a result, organic revenue

in Performance Materials was 20% lower.

The Group has continued to deliver significant benefits from its

strategic projects which, together with agile and effective

pricing, and the delivery of synergies from last year's footwear

acquisitions, have resulted in adjusted operating margins

strengthening further in the period. This increases our confidence

of achieving our 2024 goal of c.17%.

As previously indicated, we have seen modest translational

foreign exchange headwinds across the majority of our major

currencies against the US dollar YTD, which we expect to

accommodate within existing guidance. However, accounting

requirements related to significant rate fluctuations from the

Turkish Lira mean that the Group is likely to incur a specific

incremental translation impact to full year adjusted operating

profit, which at current exchange rates we estimate would be c.$5

million (see note 2).

Cash generation remained strong through the period, supporting

the Group's robust balance sheet. As at 31 October 2023, leverage

was 1.5 times, comfortably within the target range of 1-2

times.

Great Place to Work

On 16 November 2023, Coats was named one of the 2023 World's

Best Workplaces by Great Place to Work (GPTW), being one of only 25

companies chosen globally. GPTW selects companies based on their

dedication to creating exceptional workplace cultures, prioritising

people, fostering a culture of trust and empowering colleagues

worldwide to achieve their full potential.

Outlook

With early signs of a gradual recovery in Apparel, and our

adjusted operating margin continuing to strengthen, we expect our

full year performance to be in line with the Board's expectations.

This is before any specific impact from Turkish Lira translation as

described above.

We remain focused on delivering the significant operational and

financial benefits of our strategic projects, acquisition synergies

and delivering our other ongoing self-help actions . As a result,

we remain confident of achieving our 2024 operating profit margin

goal of c.17%. Over the medium term, our scale and global

footprint, strong digital platform and technical support

capabilities, alongside continued investment in innovation,

sustainability and operational efficiency, will enable us to grow

ahead of our market with strong profitability and cash

generation.

The Group will release its Full Year 2023 results on 7 March

2024.

Enquiries

Victoria Huxster +44 (0)7880 471350

/ Coats Group / +44 (0)7720

Investors Julian Wais plc 999764

Richard Mountain

/ +44 (0)20 3727

Media Nick Hasell FTI Consulting 1374

1. Constant exchange rate (CER) figures are 2022 results

restated at 2023 exchange rates. Organic CER figures are results on

a CER basis and includes like-for-like contributions from Texon

(post acquisition date of July 2022) and Rhenoflex (post

acquisition date of August 2022).

2. Since mid-2022 hyperinflation accounting methodology has been

required to be applied in our Turkey market. This requires the

translation of local currency results for a reporting period at the

spot rate at the end of the period (vs average rate for

non-hyperinflation accounting countries). As a result, and given

significant depreciation of the Turkish Lira, reported results for

our Turkey business in USD can be volatile and so no guidance has

been able to be given YTD on the impact of this. The Turkish Lira

has depreciated by over 50% during 2023. Based on latest exchange

rates (31 Oct), and assuming no further significant Turkish Lira

volatility for the rest of the year, we expect a $5 million

incremental adjusted operating profit headwind due to this impact

vs previous FX guidance (which excluded Turkey).

3. Following the completion of the European Zips sale on 31

August 2023, reported, CER and organic CER numbers exclude European

Zips sales from both 2023 and 2022.

About Coats Group plc

Coats is a world leader in thread manufacturing and structural

components for apparel and footwear, as well as an innovative

pioneer in performance materials. These critical solutions are used

to create a wide range of products, including ones that provide

safety and protection for people, data, and the environment.

Headquartered in the UK, Coats is a FTSE250 company and a FTSE4Good

Index constituent. Revenues in 2022 were $1.6bn. Trusted by the

world's leading companies to deliver vital, innovative, and

sustainable solutions, Coats provides value-adding products,

including apparel, accessory and footwear threads, structural

components for footwear and accessories , fabrics, yarns, and

software applications. Customer partners include companies from the

apparel, footwear, automotive, telecoms, personal protection, and

outdoor goods industries. With a proud heritage dating back more

than 250 years and a spirit of evolution to constantly stay ahead

of changing market needs, Coats has operations across some 50

countries with a workforce of over 18,000, serving its customers

worldwide. Coats connects talent, textiles, and technology to make

a better and more sustainable world. Worldwide, there are four

dedicated Coats Innovation and Sustainability Hubs, where experts

collaborate with partners to create the materials and products of

tomorrow. It participates in the UN Global Compact and is committed

to Science-Based sustainability targets for 2030 and beyond, with a

goal of achieving net-zero by 2050. Coats is also committed to

achieving its goals in Diversity, Equity and inclusion, workplace

health and safety, employee and community wellbeing, and supplier

social performance. To find out more about Coats, visit

www.coats.com .

Cautionary statement

Certain statements in this interim report are forward-looking.

Although the Group believes that the expectations reflected in

these forward-looking statements are reasonable, we can give no

assurance that these expectations will prove to have been correct.

Because these statements contain risks and uncertainties, actual

results may differ materially from those expressed or implied by

these forward-looking statements. We undertake no obligation to

update any forward-looking statements, whether as a result of new

information, future events or otherwise.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTNKDBKCBDDODB

(END) Dow Jones Newswires

November 22, 2023 02:00 ET (07:00 GMT)

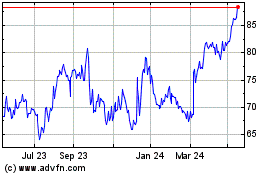

Coats (LSE:COA)

Historical Stock Chart

From Nov 2024 to Dec 2024

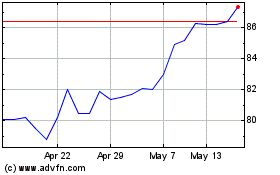

Coats (LSE:COA)

Historical Stock Chart

From Dec 2023 to Dec 2024