TIDMCSSG

RNS Number : 5582S

Croma Security Solutions Group PLC

07 November 2023

Croma Security Solutions Group Plc

("CSSG", "Croma", "the "Company" or the "Group")

Full Year Results

Core Business and Acquisitions Deliver Ahead of Expectations

Croma, the AIM listed innovation and service-focused security

solutions provider, is pleased to report its trading results for

the 12 months to 30 June 2023 (the "Period" or "FY23") as well as

provide an update on its strategy. The core businesses are

delivering strong organic growth and acquisitions are performing

ahead of expectations, affirming the Group's strategy to refocus on

its core businesses and to identify acquisition opportunities where

there is significant scope to enhance sales growth and

profitability.

Financial Highlights

-- Group revenue for the Period including Vigilant of GBP42.83

million (FY22: GBP35.17 million)

-- Revenues on continuing operations for the period up 38% at

GBP8.03 million (FY22: GBP5.83 million)

-- Like-for-like sales growth on continuing businesses of 21%

-- Gross margin improvement on continuing businesses of 300 basis points to 47% (FY22: 44%)

-- EBITDA on continuing businesses of GBP0.95 million (FY22: GBP0.55 million)

-- Strong balance sheet with net cash of GBP2.14 million at the end of the Period

-- Proposed final dividend of 2.2 p per share (FY22: 2.1 p)

Operational Highlights

-- Vigilant was sold on 30 June 2023 for a total consideration

of GBP6.5 million plus intercompany balances of GBP1.07 million

-- Acquisition of Southern Stronghold Limited and Safecell

Security Group Limited for net cash of GBP1.22 million adds an

online business and three new security centres to the network,

increasing our total security centres to 14

-- Refreshed Board of Directors - Jo Haigh joins as Chair, Steve

Naylor as a NED and Teo Andreeva, previously Group Financial

Controller was appointed CFO and joined the Board

Outlook

-- FY24 has started well with a number of new commercial orders and the ongoing sales of iLOQ

-- Acquisition pipeline is encouraging - the Group continues to

identify opportunities to expand its security centre network where

it sees the chance to enhance product offering to drive sales

growth as well as to benefit from efficiencies of scale and

expertise

-- The Group will continue to drive organic growth by investing

in our security centres and expanding its sales network

-- The acquisition pipeline is promising.

Croma CEO, Roberto Fiorentino commented: "We are truly excited

to be starting a new chapter for Croma as we focus our efforts on

our core businesses, Croma Locksmiths and Croma Fire & Security

(formerly branded Croma Systems), where we see strong growth

prospects. There is real scope for us to build out a nationwide

presence and we have a proven track-record of acquiring businesses

and enhancing their in-store product offer, sales growth,

profitability and delivering ahead of targets. FY24 has started

well and there are a number of acquisition opportunities in the

pipeline; I am confident that we will deliver a strong performance

this year."

For further information visit www.cssgroupplc.com or

contact:

Croma Security Solutions Group Plc Tel: +44 (0)1489 566166

Roberto Fiorentino, CEO

Teo Andreeva, CFO

WH Ireland Limited Tel: +44 (0)207 220 1666

(Nominated Adviser and Broker)

Mike Coe

Sarah Mather

Novella Tel: +44 (0)203 151 7008

Tim Robertson

Claire de Groot

Safia Colebrook

This announcement contains inside information for the purposes

of Article 7 of the UK version of Regulation (EU) No 596/2014 which

is part of UK law by virtue of the European Union (Withdrawal) Act

2018, as amended ("MAR"). Upon the publication of this announcement

via a Regulatory Information Service, this inside information is

now considered to be in the public domain

Croma - Unlocking Growth Potential

Croma, the AIM listed innovation and service-focused security

solutions provider is pleased to report its trading results for the

12 months to 30 June 2023 (the "Period" or "FY23") as well as to

provide an update on its strategy.

Chairman's Statement

When I joined Croma Group as non-executive Chairman in April

this year, it was with the conviction that I was joining a Group

with a truly exciting future. My career has been focused on

providing advisory services to growth companies such as Croma.

Following the divestment of Vigilant, the management team has a

clear vision. I am thrilled to join the Board to help execute on

that vision. It is with great pleasure that I am able to report on

the progress that we have made this year with the successful

divestment of Vigilant; on the opportunity that lies ahead within

our core businesses; as well as on the financial results for the 12

months to 30 June 2023.

I am very pleased to report that our core businesses delivered a

strong performance in the Period and have performed ahead of

management expectations in spite of the time and energy devoted by

management to secure the disposal of Vigilant. For the Period,

sales growth within the Group's core businesses was up 38% with

total sales of GBP8.03 million (FY22: GBP5.83 million). EBITDA (as

analysed in the Consolidated Statement of Comprehensive Income) on

continuing businesses increased 73% to 0.95 million (FY22 GBP0.55

million). We are in a strong cash position with net cash of GBP2.14

million at the year-end after the GBP1.2 million expensed on

acquisitions and the share buyback from the Vigilant directors.

This demonstrates the cash generative nature of our core business

in addition to the proceeds received and to be received from the

Vigilant disposal.

The strategic decision to divest Vigilant was made in 2022 in

order to refocus efforts on our core businesses, Croma Fire &

Security (Rebranded from Croma Systems) and Croma Locksmiths and to

allow us to scale up these businesses. Vigilant was sold for a

total consideration of GBP6.5 million plus intercompany balances of

just over GBP1 million. I believe that this represents an excellent

outcome in terms of price and gives us the firepower to scale our

core businesses.

With a strong balance sheet, the business refocused and a

refreshed Board, we are excited to be entering a new chapter for

the Group. We are focused on growing our core businesses both

organically and via acquisition, fully capitalising on the

expansion opportunity ahead and investing in growth. We have

ambitions to roll out our security centre network nationwide,

building on our current network of 14 security centres. This will

allow us to exploit cross-selling opportunities as we expand our

full product offering into new locations and deliver cost

synergies. We already have a strong track record of acquiring

businesses, adding value and increasing returns.

The Board is determined to work with a sense of rigour,

openness, and transparency, both within the Group as well as with

our external stakeholders. As a team, we will carefully assess the

opportunities ahead and be accountable for delivery.

The current financial year has started well and I believe that

we will be able to build on the growth that we achieved last year

with a number of new clients and the expansion of current services

to new locations, alongside a good acquisition pipeline. This

expansion will require up-front investment in people and

infrastructure but we believe this is the right strategy to manage

anticipated future growth.

The Board is pleased to recommend a final dividend to

shareholders of 2.2p per share and subject to approval at the

Annual General Meeting to be held on 1 December 2023, the final

dividend will be paid on 15 December 2023 to all shareholders on

the register at the close of business on 1 December 2023. The

shares will be marked ex-dividend on 30 November 2023.

I would like to thank the team for welcoming me so warmly to

Croma as well as for their determination and hard work. I have no

doubt that as we turn the page to a new chapter, we do so with

renewed energy and focus and I look forward to working together

with the Croma team to unlock growth, capitalising on the

opportunities that lie ahead.

J Haigh - Chairman

6 November 2023

CEO's Statement

FY23 was a busy year for Croma. In December 2022, we announced

our intention to divest Vigilant in order to focus on our core

businesses and I am pleased to report that this disposal was

completed at the end of June 2023. I am delighted to confirm that

our core businesses, Croma Fire & Security and Croma

Locksmiths, have delivered results ahead of our expectations, very

much underlining the opportunity that lies ahead.

I am very pleased to welcome Jo Haigh and Steve Naylor to the

Board as we take this opportunity to reset. Their collective

experience and advice will be invaluable in supporting us on a new

growth path. Teo Andreeva was appointed CFO in April 2023, prior to

this she was Group Financial Controller and I would like to thank

her for her long-term support and welcome her to the Board. As a

Board, we are determined to work together, to be transparent with

all stakeholders and, with the completion of the Vigilant disposal,

we can fully focus our attention on the task ahead.

Our decision to divest Vigilant and focus on scaling up Croma

Locksmiths and Croma Fire & Security was based on our belief

that the real growth opportunity lies within these higher margin

businesses. Its disposal marks a transformational moment for Croma

and gives us the financial resource to unlock growth as we identify

and capitalise on the opportunities ahead.

The Croma Locksmiths and Croma Fire & Security businesses

are our heritage, they are where the business started and have

served us well over many years. Both businesses have a loyal client

base, reliable recurring and repeat revenues and are profitable and

cash generative. Croma Locksmiths currently operates out of 14

security centres across the UK which offer one-stop shop security

solutions to commercial and retail customers. This business boasts

a diversified and loyal customer base. Within the Croma Fire &

Security businesses, we have very strong relationships and

expertise within the hospital and leisure sector and are well-known

for our innovative and technology-led offers as well as for our

reliability and high levels of service.

There is significant scope for Croma Locksmiths and Croma Fire

& Security to grow as we build out a nationwide presence and

bring together our product offer and expertise across both

businesses in new locations. We are seeking to acquire retail

locksmith businesses typically located just off the high street.

The UK locksmith market is fragmented, characterised by small,

often family-owned, local players. We have a proven track record of

acquiring these businesses, significantly enhancing their in-store

offer and developing them into modern security centres with a full

product range for commercial and individual customers. We have

acquired many decades of expertise in the industry and are able to

apply our know-how and state-of-the-art software to acquired

businesses as well as deliver benefits of scale, as we drive real

efficiencies and support businesses with our central services.

This has proven very successful in the past and we believe that

many more such opportunities lie ahead at valuation levels where we

can apply the same template, add value and deliver good returns. Of

course, we will need to ensure that identified businesses and

valuations stand scrutiny and we are rigorous in due diligence but

we believe there are significant opportunities open on the

horizon.

Roberto Fiorentino - CEO

6 November 2023

The directors present the Group Strategic Report for Croma

Security Solutions Group plc and its subsidiary companies for the

year ended 30 June 2023.

Financial and Operational Review

Group sales for the Period were GBP42.83 million (FY22: GBP35.17

million) including a full year of Vigilant which was divested as at

close of year end on 30 June 2023.

Sales from continuing businesses, Croma Locksmiths and Croma

Fire and Security were up 38% to GBP8.03 million, (FY22 GBP5.83

million), reflecting acquisitions made during the period as well as

strong organic growth within the core businesses of 21% for the

year.

Gross margins on continuing businesses increased by 300 basis

points to 47% (FY22: 44%). EBITDA on continuing businesses before

central costs for the Period was GBP1.60 million (FY22: GBP1.34

million), an increase of 19%. Adjusting for central Group

overheads, EBITDA was up 73% at GBP0.95 million (FY22: GBP0.55

million).

Group net profit on continuing businesses for the Period was

GBP3.24 million (FY22: GBP(0.61) million) and EPS was 21.7p (FY22:

(4.1)p), including disposal proceeds, excluding disposal proceeds

EPS was 1.11p.

Over the year, we invested GBP1.68 million on acquisitions to

include two freeholds - Totton (Southampton) and Coventry. In

addition to the above figure, we purchased our existing security

centre property in Southsea (Portsmouth). These investments reflect

our long-term belief in the prospects of our security centre

network.

Vigilant posted sales of GBP34.80 million and EBITDA of GBP0.92

million for FY23. The total consideration to be received for the

disposal will amount to GBP6.5 million plus outstanding

intercompany balances of GBP1.07 million. The Group incurred

non-recurring costs related to the disposal of Vigilant totalling

GBP0.23 million for the Period.

The proceeds from the divestment of Vigilant as well as solid

underlying cash generation enabled us to end the year ungeared,

with a net cash balance of GBP2.14 million (FY22: GBP2.56 million).

Our cash position and ungeared balance sheet should allow us to

continue our stated strategy of acquiring locksmiths and building

out our security centres network where there is scope to enhance

the offering and deliver synergies.

Croma Locksmiths

Croma Locksmiths consists of the following subsidiaries - Croma

Locksmiths & Security Solutions Limited, Basingstoke Locksmiths

Limited, Safeguard (NW) Limited, Southern Stronghold Ltd and

Authorized Access Systems Ltd.

The Croma Locksmiths business delivers one-stop-shop security

solutions to both commercial and residential customers and now

comprises 14 security centres across the UK.

Sales for the Period within Croma Locksmiths were up 45% to

GBP4.70 million (FY22: GBP3.25 million), while EBITDA of GBP0.97

million was up 31% from GBP0.74 million. We see a significant

opportunity within this business for cross-selling. For example, we

have an important housing maintenance client who has moved from

using one local security centre to using a greater number of our

security centres on a national basis to service their needs. As a

result, this is expected to be a GBP0.20 million client for us in

FY24 vs GBP0.02 million in FY23.

Our partnership with ILOQ, as their preferred mainstream

Locksmith supplier in the UK market, continues to show great

potential. Sales for the Period were GBP0.32 million. We secured

further orders in the second half which will be delivered in the

first half of the current financial year.

Croma Fire and Security (formerly Croma Systems)

Croma Fire & Security consists of the following subsidiaries

- CSS Total Security Ltd, Safecell Security Ltd and The Safecell

Security Group Ltd.

Croma Fire and Security provides a full range of electronic

security solutions and services to commercial and individual

customers and has strong commercial relationships across the public

health and hospitality sectors.

Croma Fire and Security recorded sales for the Period of GBP3.48

million (FY22: GBP2.58 million) up 35%. EBITDA for the period was

up 5% to GBP0.63 million compared to GBP0.60 million in FY22. The

business invested for the future and appointed a commercial manager

as a new role. During the Period, sales were supported by ongoing

customer relationships as well as some new customer wins with CCTV

orders from transport and infrastructure clients. A number of new

hospital contracts were also secured in second half of the year

which will be recognised in current year numbers.

FASTVEIN/Biometrics - We have seen little progress in our

innovative technology and moving forwards it is unlikely to play a

large role in our strategic plan. However, we continue to provide a

number of established clients with software and maintenance

contracts contributing to our annual recurring revenues and will

also continue to support any new enquiries.

Sale of Vigilant

The Vigilant disposal was completed on 30 June 2023. The total

consideration to be received for the disposal will amount to

GBP6.50 million plus the outstanding intercompany balance of

GBP1.07 million. GBP0.67 million was paid in cash on completion

together with GBP1.07 million of intercompany loan repayments and

circa 800,000 shares owned by S. Morley and P. Williamson, former

Directors (with a value of GBP0.38 million) which have been placed

into treasury. Croma is scheduled to receive the balance of the

proceeds as the loan notes and redeemable shares are settled over

the next 36 months.

The consideration of GBP6.50 million (excluding the intercompany

balance of GBP1.07 million) is broken down as follows:

i) GBP0.67 million was paid in cash on completion

ii) GBP0.38 million via the buyback of shares from S. Morley and

P. Williamson (non-cash transaction)

iii) GBP4.13 million covered by the issue of Loan Notes and

iv) GBP1.30 million was paid on completion via the issue of redeemable shares.

Acquisitions

The Group completed two acquisitions for the Croma Fire &

Security and Croma Locksmiths division during the period, Southern

Stronghold Limited and Safecell Security Group Limited. These

acquisitions increased the number of the Group's security centres

to 14. Southern Stronghold Limited is a well-established locksmith

business that operates from two premises, one in Coventry which has

a large master key systems business, and one in Totton near

Southampton. Stronghold also has an online business, Stronghold

Direct, which has significant potential for the Group. Safecell is

a long-standing Greater Manchester security business with a focus

on electronic, physical security and fire systems, with a strong

commercial and retail customer base in the North of England. Both

these businesses provide an opportunity for Croma to roll out its

offering into new locations as well as to leverage its central

services and are performing well to date.

Outlook

The year has started well with a number of new commercial orders

and the continued success of ILOQ. We believe that we will be able

to drive sales growth organically through new sales and marketing

initiatives, expanding our network of sales people, and focusing on

the development of our online presence. We will also expand the

network via acquisition - the pipeline is promising. The Croma

balance sheet is strong, we are cash generative, and we are

well-placed to take advantage of the opportunities ahead.

Group financials FY2023 FY2022 FY2022

Continuing Continuing Continuing

operations operations and discontinued

operations

GBP000s GBP000s GBP000s

Revenue 8,025 5,831 35,165

Gross profit 3,749 2,558 6,396

Gross margin % 46.7% 43.9% 18.2%

Other operating income 3 56 86

Impairment of goodwill - (627) (627)

Operating profit 427 (479) 245

EBITDA 4,023 548 1,590

Profit for the year 3,235 (612) 63

Earnings per share* 1.11p (4.11p) 0.42p

Net assets 15,151 - 12,143

Cash (used in) / generated from

operations 2,406 - (860)

Cash and cash equivalents 2,144 - 2,556

Dividends per share in relation

to the year 2.2p - 2.1p

The above financials relate to continuing operations for 2023,

compared to 2022, which includes the divested division.

Profit from discontinued operations for FY2023 was GBP465k

(FY2022: GBP675k).

*The earnings per share figure stated excludes the profit from

disposal of discontinued operations of GBP3,069k which contributed

20.6p to the earnings per share figure for the year of 21.7p.

Below is a detailed EBITDA breakdown:

Croma Croma Group Total

Locksmiths Fire &

Security

GBP,000 GBP,000 GBP,000 GBP,000

EBITDA 970 630 2,423 4,023

Vigilant - Profit on Disposal (3,069) (3,069)

----------- --------- -------- ----------

EBITDA, Continuing Operations 970 630 (646) 954

----------- --------- -------- ----------

EBITDA on continued operations for 30 June 2023, on a like for

like basis, was GBP954k compared with GBP548k for 30 June

EBITDA on continued operations for 30 June 2023, on a like for

like basis, was GBP954k compared with GBP548k for 30 June 2022 an

increase of 73%.

Cash collection has improved in the year compared to last year

with debtors reducing by 11 days from 54 to 43.

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME FOR THE YEAR

ENDED 30 JUNE 2023

CONSOLIDATED STATEMENT OF FINANCIAL POSITION FOR THE YEAR ENDED

30 JUNE 2023

CONSOLIDATED STATEMENT OF CASH FLOWS FOR THE YEAR ENDED 30 JUNE

2023

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY FOR THE YEAR ENDED

30 JUNE 2023

NOTES FORMING PART OF THE FINANCIAL STATEMENTS FOR THE YEAR

ENDED 30 JUNE 2023

1. Basis of preparation

The Group financial statements have been prepared under the

historical cost convention and approved by the Directors in

accordance with UK-adopted international accounting standards.

While the financial information included in this preliminary

announcement has been computed in accordance with Adopted IFRSs,

this announcement does not itself contain sufficient information to

comply with Adopted IFRSs.

This announcement does not constitute statutory accounts of the

Group for the years ended 30 June 2022 or 30 June 2023.

The financial information has been extracted from the statutory

accounts of the Company for the year ended 30 June 2023. The

auditors reported on those accounts; their reports were unqualified

and did not include references to any matters to which the auditors

drew attention by way of emphasis without qualifying their report

and did not contain a statement under either Section 498 (2) or

Section 498 (3) of the Companies Act 2006.

The accounts for the year ended 30 June 2022 have been delivered

to the Registrar of Companies, whereas those for the year ended 30

June 2023 will be delivered to the Registrar of Companies following

the Company's Annual General Meeting.

The Annual Report will be posted to all shareholders who have

requested a copy on shortly and will be available on request from

Unit 7 & 8 Fulcrum 4, Solent Way, Whiteley, Hampshire PO15 7FT

and on the Company website at http://www.cssgplc.com/investors/.

The Annual Report contains full details of the principal accounting

policies adopted in the preparation of these financial

statements.

2. Accounting policies

The accounting policies applied by the Group in this report are

the same as those applied by the Group in the consolidated

financial statements for the year ended 30 June 2023 and the year

ended 30 June 2022. The directors expect similar accounting

policies for the year ended 30 June 2024.

Discontinued operations

A discontinued operation is a component of the Group's business,

the operations and cash flows of which can be clearly distinguished

from the rest of the Group and which represents a separate major

line of business operation.

Classification as a discontinued operation occurs at the earlier

of disposal or when the operation meets the criteria to be

classified as held-for-sale under IFRS 5.

When an operation is classified as a discontinued operation, the

comparative statement of profit or loss and OCI is re-presented as

if the operation had been discontinued from the start of the

comparative year.

Disposal of subsidiaries

At the date of disposal of a subsidiary all assets and

liabilities of the disposed subsidiary are derecognised in the

financial statements. The fair value of consideration is recognised

in the financial statements and any resulting gain or loss in

profit or loss attributable to the parent.

6. Earnings per share

The calculation of basic earnings per share is based on the

profit attributable to ordinary shareholders, from continuing

operations, divided by the weighted average number of shares in

issue during the year, calculated on a daily basis.

The calculation of diluted earnings per share is based on the

basic earnings per share adjusted to allow for the issue of shares

and the post-tax effect of dividends and interest on the assumed

conversion of all other dilutive options and other potential

ordinary shares.

* Share options have an average exercise price of GBP0.9 and are

not dilutive at 30 June 2023.

EPS for earnings for the year on continuing operations

(excluding the profit on disposal of discontinued operations) and

used in basic and diluted EPS 1.11p.

The earnings per share figure stated excludes the profit from

disposal of discontinued operations of GBP3,069k which contributed

20.6p to the earnings per share figure for the year on continuing

operations of 21.7p.

Transaction costs of GBP23k relating to the acquisition of

Southern Stronghold Limited have been recognised as an expense and

included within administrative expenses in the statement of profit

or loss.

If the acquisition of Southern Stronghold Limited had been

completed on the first day of the financial year, Group revenues

for the period would have been GBP8,025k and Group profit

attributable to equity holders of the parent would have been

GBP3,700k. Southern Stronghold Limited contributed GBP607k to the

Group's revenue and GBP197k to the Group's profit before tax for

the period from the date of acquisition to the year-end date.

The amounts recognised at acquisition date in respect of

property, plant and equipment acquired include fair value

adjustments of GBP337k to recognise the uplift to market value.

Furthermore, the amounts recognised at acquisition date in respect

of inventories acquired include a negative fair value adjustments

of GBP274k to recognise inventories at the lower of cost and net

realisable value. All other book amounts are considered to

approximate their fair values.

In addition to the above acquisition, the group acquired

Manchester based Safecell Security Group Limited and its two 100%

owned subsidiaries on 19th December 2022, trading out of a retail

shop and office space in Bury, North Manchester.

Transaction costs of GBP30k relating to the acquisition of

Safecell Security Group Limited have been recognised as an expense

and included within administrative expenses in the statement of

profit or loss.

If the acquisition of Safecell Security Group Limited had been

completed on the first day of the financial year, Group revenues

for the period would have been GBP8,505k and Group profit

attributable to equity holders of the parent would have been

GBP3,748k. Safecell Security Group Limited contributed GBP499k to

the Group's revenue and GBP83k to the Group's profit before tax for

the period from the date of acquisition to the year-end date.

The amounts recognised at acquisition date in respect of

property, plant and equipment acquired include a negative fair

value adjustments of GBP16k to recognise the write down of plant

and equipment. All other book amounts are considered to approximate

their fair values.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR NKABPFBDDQDK

(END) Dow Jones Newswires

November 07, 2023 02:00 ET (07:00 GMT)

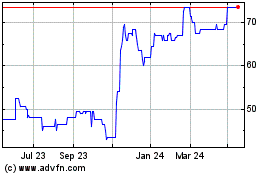

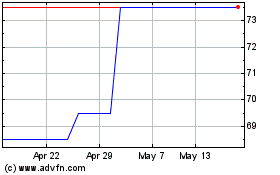

Croma Security Solutions (LSE:CSSG)

Historical Stock Chart

From Jan 2025 to Feb 2025

Croma Security Solutions (LSE:CSSG)

Historical Stock Chart

From Feb 2024 to Feb 2025