TIDMCYAN

RNS Number : 3172H

CyanConnode Holdings PLC

26 July 2023

The following amendment has been made to the Final Results

announcement released today at 07:00 under RNS No. 1716H. Within

the Operational Review (India) section four references to Q1 FY23

are amended to Q1 FY24. All other details remain unchanged and the

full amended text is set out below.

26 July 2023

CyanConnode Holdings plc

("CyanConnode", "the "Group" or the "Company")

Final Results for the Year Ended 31 March 2023

CyanConnode Holdings plc (AIM: CYAN), a global leader in

Narrowband Radio Frequency (RF) Smart Mesh Networks, announces its

audited results for the year ended 31 March 2023.

Financial highlights

-- Increase of 23% in revenue to GBP11.7m in FY23 from GBP9.6m

in FY22, the highest annual revenue for the Group to date after

four consecutive years of growth [1]

-- Reduction in gross profit to GBP4.2m in FY23 (FY22: GBP5.0m)

as a result of lower margin sales of third-party products

-- Increase in operating loss to GBP3.3m in FY23 (FY22: GBP1.0m)

as a result of lower gross margin, higher operating costs and a

GBP1.0m impairment of intangible assets

-- Increase in EBITDA loss to GBP2.9m in FY23 (FY22: GBP0.4m loss)

-- Reduction in adjusted EBITDA [2] to loss of GBP1.6m in FY23 (FY22: GBP0.06m profit)

-- Increase in cash position to GBP4.1m in FY23 (FY22: GBP2.4m)

-- Increase in cash collected from customers to GBP10.7m in FY23 (FY22: GBP8.2m)

Operational Highlights

-- Orders for 2.3m modules won in India during the period -

higher than the total number of modules won in India in the

company's history prior to the current year taking order book to

3.6m during the financial year, of which 2.3m were still to be

deployed. Post period this order book has increased further to 4.2m

as set out in the post period highlights below

-- Order worth USD 6.7m won from MENA for NB-IoT gateways

-- Further new order worth USD 2.5m won from MENA for Cellular gateways

-- Oversubscribed placing and subscriptions completed raising,

in aggregate, GBP5.8m before expenses

-- 391,000 Omnimesh Radio Frequency (RF) Modules shipped against

current contracts during the period (FY22: 612,000), along with

46,000 NB-IoT gateways and 63,000 Cellular gateways

-- Strategic Framework Agreement signed to deliver 3m units

Post Year End Highlights

-- 600,000 Omnimesh RF Modules and associated products ordered from a subsidiary of IntelliSmart Infrastructure Private Limited, taking order book to 4.2m modules

-- CyanConnode India recognised as Dun and Bradstreet 'Start-Up 50 Trailblazer'

-- Memorandum of Association (MOU) signed with Alfanar

-- Revenue of greater than GBP2.8m in Q1 of FY24, being 2.1

times revenue of the whole of H1 FY23

-- 291k modules shipped in Q1 of FY24 vs 391k shipped in the whole of FY23

-- GBP3.6m cash received from customers in Q1 FY24

-- Investment into areas such as recruitment to scale up the business

John Cronin, Executive Chairman of CyanConnode, commented:

"FY23 has once again shown record revenues and orders won, and a

fourth consecutive year of growth.

Since the year end the number of live tenders in India has

continued to increase and move through the tendering process, and

the Company has won a further 0.6m Omnimesh units.

We'd like to thank all employees for their ongoing hard work and

dedication to achieve these record revenues. We'd also like to

thank all shareholders for their continued support and look forward

to continuing to deliver successful results."

- Ends -

The information contained within this announcement is deemed to

constitute inside information for the purposes of Article 7 of EU

Regulation 596/2014 (Market Abuse Regulations) which is part of UK

law by virtue of the European Union (Withdrawal) Act 2018. Upon

publication of this announcement, this inside information is now

considered to be in the public domain.

Enquiries:

CyanConnode Holdings plc Tel: +44 (0) 1223 865

750

John Cronin, Executive Chairman www.cyanconnode.com

Strand Hanson Limited (Nominated and Financial Tel: +44 (0) 20 7409

Adviser) 3494

James Harris / Richard Johnson / David Asquith

Zeus Capital Limited (Broker) Tel: +44 (0) 20 3829

Simon Johnson / Alexandra Campbell-Harris 5900

Chairman's Statement

Dear Shareholders

The financial year ending March 2023 has been the most

successful financial year for the Group in terms of revenue, orders

won and cash collected from customers. It is encouraging to see the

vast increase in volumes and numbers of tenders being released in

India after many years working in the country, as the government

continues with its plans to roll out 250 million meters by

2025.

In addition, we have seen success with contracts in other

territories around the world, particularly in the Middle East North

Africa (MENA) region.

I'm encouraged to see the momentum from FY2023 continuing into

the current financial year and am delighted to provide more details

on the highlights of both FY2023 and the current business in the

FY23 Annual Report.

Operational Review

India

The union budget of 2020-21 paved the way for the replacement of

250 million conventional electricity meters with smart meters by

2025 by announcing the Revamped Distribution Sector Scheme (RDSS).

It also approved an outlay for the RDSS of Rs 3,03,758 Crore (circa

GBP30 billion) over 5 years. In August 2022, the Government of

India formally approved the RDSS to help Distribution Companies

(DISCOMs) improve their operational efficiencies and financial

sustainability by providing result-linked financial assistance to

strengthen supply infrastructure. The 'Collection Efficiency' of

not less than 98%, as set out in the RDSS and which CyanConnode

achieves, favours the Group's technology for network communication

and management. RDSS mandates compulsory installation of smart

meters across the country and will run for five years from FY22 to

FY26. In addition, the Rural Electrification Corporation proposed a

Request for Empanelment (RFE) to allow participation in the RDSS

tenders. This requires Advanced Metering Infrastructure Service

Providers (AMISP) to demonstrate their solutions in a controlled

test environment. Empanelment will be required by all AMISPs to

allow participation in RDSS tenders. Following an initial delay in

the empanelment process, forty-three companies are now empanelled.

Of the 250 million smart prepaid meters approved under the RDSS,

over 200 million (an addressable market to CyanConnode worth a

potential c. GBP2.5 billion) have been sanctioned so far, according

to information recently tabled in the Indian Parliament (set out

below).

Smart meters sanctioned under RDSS

----------------------------------------------------------------------------------------------------------------- ------------------

State Consumer* DT** Feeder Consumer DT** Feeder

-------------------- ---------------- ----------------- ------------------- ------------------- ------------------

No. of meters (per cent share)

------------ -------------------------------------- ----------------- ---------------------------------------- ------------------

Tamil Nadu 30,000,000 472,500 18,274 14.7 8.7 9.2

-------------------- ---------------- ----------------- ------------------- ------------------- ------------------

Uttar

Pradesh 26,979,056 1,526,801 20,874 13.2 28.2 10.5

-------------------- ---------------- ----------------- ------------------- ------------------- ------------------

Maharashtra 23,564,747 410,905 29,214 11.5 7.6 14.7

-------------------- ---------------- ----------------- ------------------- ------------------- ------------------

West Bengal 20,717,969 305,419 11,874 10.1 5.6 6.0

-------------------- ---------------- ----------------- ------------------- ------------------- ------------------

Gujarat 16,481,871 300,487 5,229 8.1 5.6 2.6

-------------------- ---------------- ----------------- ------------------- ------------------- ------------------

Rajasthan 14,274,956 434,608 27,128 7.0 8.0 13.6

-------------------- ---------------- ----------------- ------------------- ------------------- ------------------

Kerala 13,289,361 87,615 6,025 6.5 1.6 3.0

-------------------- ---------------- ----------------- ------------------- ------------------- ------------------

Madhya

Pradesh 12,980,102 406,503 8,411 6.3 7.5 4.2

-------------------- ---------------- ----------------- ------------------- ------------------- ------------------

Punjab 8,784,807 184,044 12,563 4.3 3.4 6.3

-------------------- ---------------- ----------------- ------------------- ------------------- ------------------

Haryana 7,405,618 195,319 13,204 3.6 3.6 6.6

------------ -------------------- ---------------- ----------------- ------------------- ------------------- ------------------

Total for

above

states 174,478,487 4,324,201 152,796 85.3 79.8 76.7

------------ -------------------- ---------------- ----------------- ------------------- ------------------- ------------------

Rest of

India 30,144,695 1,087,807 46,030 14.7 20.2 23.3

------------ -------------------- ---------------- ----------------- ------------------- ------------------- ------------------

All-India

total 204,623,182 5,412,008 198,826 100.0 100.0 100.0

------------ -------------------- ---------------- ----------------- ------------------- ------------------- ------------------

*prepaid;**distribution transformer; Table shows top

10 states wrt consumer smart meters

------------------

The win rate from contracts tendered since April 2022 has been

approximately 38% in volume and the installed rate is around 25%.

CyanConnode is currently bidding for contracts worth over GBP1

billion in value.

During the period, CyanConnode won three new orders, totalling

approximately 2.3 million units from its customers IntelliSmart,

Genus and Monte Carlo Group, to be deployed in three different

states. This volume was significantly higher than the total volume

of units won by the Company in India in all years prior to FY2023

(1.3 million). All orders were for Omnimesh RF Modules together

with advanced metering infrastructure, standards-based hardware,

services, Omnimesh head-end software, perpetual license and annual

maintenance contracts. To the end of March 2023, a total of 327,000

modules and associated gateways had been shipped against these new

contracts, with a further 282,000 shipped during Q1 FY24, bringing

the total modules shipped against these contracts at the end of

June 2023 to 609,000.

The first two orders, totalling 300,000 units, were from

IntelliSmart for deployment in the state of Assam. IntelliSmart is

the first service provider to use the Design, Build, Finance, Own,

Operate, Transfer (DBFOOT) model and it has also installed the

first smart prepaid meter in India under the RDSS. To the end of

March 2023, a total of 195,000 modules and associated gateways had

been shipped against these two contracts, with a further 49,000

shipped during Q1 FY24, bringing the total modules shipped against

these contracts at the end of June 2023 to 244,000.

The third order, CyanConnode's largest order in its history, was

for 1 million units, received by Genus for a deployment in South

Bihar. To the end of March 2023, a total of 81,000 modules and

associated gateways had been shipped against this contract, with a

further 109,000 shipped during Q1 FY24, bringing the total modules

shipped against these contracts at the end of June 2023 to

190,000.

The fourth order, for 984,000 units was received from a new

customer, Monte Carlo Group, relating to a smart metering

deployment in Jabalpur, Madhya Pradesh. To the end of March 2023, a

total of 51,000 modules and associated gateways had been shipped

against this contract, with a further 124,000 shipped during Q1

FY24, bringing the total modules shipped against these contracts at

the end of June 2023 to 175,000.

In February 2023 the Group announced it had entered into a

strategic framework agreement with a key partner to supply its

Radio Frequency (RF) mesh technology in India. As a preferred

partner, CyanConnode will provide Omnimesh RF modules, Advanced

Metering Infrastructure, Standards-Based Hardware, Omnimesh

Head-End Software and associated components, Perpetual License,

design, installation, implementation, integration, training and

support & Maintenance Contract for 3 million smart meters.

In March 2023, CyanConnode announced a collaboration with

Silicon Laboratories, Inc. (Silabs) a prominent supplier of

System-On-Chips (SOCs), under which it will integrate SiLabs' FG25

Sub-GHz Wireless SoC into its Omnimesh product range. The FG25 is

certified by the Wi-SUN Alliance (Wireless Smart Ubiquitous Network

Alliance), which is the leading IPv6 sub-GHz mesh technology for

smart city and smart utility applications. The open-source backbone

of Wi-SUN will enable CyanConnode to quickly scale deployments and

leverage the Wi-SUN ecosystem to provide new value to its

customers. CyanConnode's adoption of SiLabs' flagship SoC and

Wi-SUN would ensure that it is the first to meet the technical

requirement set by the Government of India as defined by BIS LITD28

standards for Smart Meter RF Communication systems.

CyanConnode's adoption of SiLabs' flagship SoC and Wi-SUN will

ensure that it continues to meet the Service Level Agreements

(SLAs) required by the Government of India. For a case study of the

implementation of the FG25 and Wi-SUN in India, please visit

https://www.silabs.com/applications/case-studies/leveraging-fg25-and-wi-sun-for-smart-metering-in-india

.

APAC and Middle East North Africa

The smart metering market in the APAC and MENA continues to

mature and presents a significant opportunity for CyanConnode.

In April 2022, an order was won for a smart metering deployment

in the MENA region. Under this contract CyanConnode will supply

65,000 interoperable smart NB-IoT gateways which will communicate

with and control all existing smart meters for both electricity and

water; the gateways will have the capacity to connect up to one

million smart meters. 46,000 gateways were delivered against this

contract during FY23.

In August 2022, an order was announced for Cellular Gateways to

provide smart communications for an Advanced Metering

Infrastructure project located in the MENA region. This order,

worth USD 2.5 million, was for a new cellular product to be fitted

to existing electricity meters. All of these gateways, plus an

additional 5,000 gateways were delivered during FY23.

CyanConnode continues to deliver The Metropolitan Electricity

Authority (MEA) project with JST's partner Forth (Forth Corporation

Public Company Limited), a telecommunication and electronics

company that provides products and integration services throughout

Thailand. MEA, who serve around 4 million customers in the city of

Bangkok and two adjacent provinces, is deploying a Smart Metro Grid

platform to improve power availability and reliability, as well as

to analyse distribution losses, automate meter reading, and

increase customer satisfaction.

CyanConnode's Omnimesh technology has been integrated into

Forth's electricity meters, using the frequency bands of 442 and

447MMHz, which have been allocated to the Thai energy utilities by

The National Broadcasting and Telecommunications Commission (NBTC)

of Thailand. During the period CyanConnode's scope of the Site

Acceptance Test (SAT) has been successfully delivered.

Fundraisings

During October 2022 CyanConnode was pleased to announce a share

subscription to raise GBP500,000 at a price of 12.25 pence per

share, being the mid-market price at the time.

In January 2023 the Company completed an oversubscribed placing

and subscription, raising GBP5.25 million before expenses, at a

price of 17 pence per share, the mid-market price at the time of

announcement of the fundraising.

The net proceeds of the above fundraisings are being used to

strengthen the Company's balance sheet, to increase working

capital, to allow the Company to continue to take advantage of its

significant growth opportunities and to execute the Company's

growing order book and pipeline.

Post period end and outlook

Momentum has continued into the new financial year, with the

Group announcing a new order in May 2023 from Paschimanchal

Infrastructure Pvt Ltd, a subsidiary of IntelliSmart Infrastructure

Private Ltd, for 600,000 Omnimesh Modules, taking the total number

of modules ordered in India to 4.2 million. The order also includes

Advanced Metering Infrastructure (AMI), Standards-Based Hardware,

Services, Omnimesh Head-End Software, a Perpetual License, and an

Annual Maintenance Contract and will support a smart metering

deployment in the utility, Pachimanchal Vidyut Vitran Nigam Ltd

(PVVNL), located in Uttar Pradesh, India.

In April 2023 CyanConnode announced the signing of a Memorandum

of Association with Alfanar, a leading engineering, procurement,

and construction (EPC) player, to explore joint investment

opportunities in Advanced Metering Infrastructure (AMI)

projects.

In June 2023 it was announced that CyanConnode Private Limited,

the subsidiary of CyanConnode Holdings plc had been recognised as a

Start-Up 50 Trailblazer by Dun & Bradstreet. This award

underscores the Company's firm commitment to innovation, quality,

and customer-centric solutions, with a robust roadmap for

sustainable growth and profitability.

We've been delighted to see the continued revenue growth into

the new financial year, with revenue for the first quarter of

greater than GBP2.8 million, more than double that of the whole of

the first half of FY23. In addition, more than 330k modules have

been shipped in the first quarter compared to 391k being shipped in

the whole of FY23.

As a result of the increased business and requirements for the

deployments, the Group is currently recruiting a number of new

roles, particularly in India to scale the business.

I'd like to thank all employees, who have worked incredibly hard

over the past year, for their commitment and contribution. I'd also

like to thank our partners with whom we look forward to continuing

to work on these groundbreaking projects. And as always I'd like to

thank all shareholders for their continued support. We're confident

that this momentum will continue through the current financial year

and look forward to updating you throughout the period.

John Cronin

Executive Chairman

Financial Review

Financial Year 23 has once again produced record results in

terms of orders won and also saw a fourth consecutive year of

revenue growth. The revenues reported during FY23 included revenues

not only from the Group's more traditional models seen for

contracts in India, but also revenues from other territories which

included revenue for sale of third-party products, often at a lower

margin. This has resulted in lower than expected gross margin for

the Group.

A summary of the key financial and non-financial Key Performance

Indicators ("KPIs") for the year and details relating to its

financing position at the year end are set out in the table below

and discussed in this section.

12 months Mar 2023 12 months Mar 2022 12 months Mar 2021 15 months Mar 2020 12 months Dec 2018

GBP000 GBP000 GBP000 GBP000 GBP000

================== ================== ================== ================== ==================

Revenue 11,732 9,562 6,437 2,451 4,465

================== ================== ================== ================== ==================

Gross Margin % 36% 52% 48% 56% 61%

================== ================== ================== ================== ==================

R&D expenditure

(including staff

costs) 2,247 1,755 1,791 2,381 2,466

================== ================== ================== ================== ==================

Operating costs 7,561 6,025 5,788 7,600 9,061

================== ================== ================== ================== ==================

Operating loss (3,347) (1,018) (2,685) (6,230) (6,320)

================== ================== ================== ================== ==================

Depreciation and

amortisation 489 616 627 773 472

================== ================== ================== ================== ==================

EBITDA (2,858) (401) (2,058) (5,457) (5,848)

================== ================== ================== ================== ==================

Stock impairment 102 62 108 4 578

================== ================== ================== ================== ==================

Impairment of

intangible assets 968 - - - -

================== ================== ================== ================== ==================

Share based

compensation 224 363 80 267 445

================== ================== ================== ================== ==================

Foreign exchange

losses / (gains) 8 34 (15) 267 16

================== ================== ================== ================== ==================

Adjusted EBITDA

[3] (1,556) 58 (1,885) (4,919) (4,809)

================== ================== ================== ================== ==================

Cash and cash

equivalents 4,070 2,355 1,489 1,172 4,564

================== ================== ================== ================== ==================

Average monthly

operating cash

outflow (185) (261) (81) (245) (487)

================== ================== ================== ================== ==================

Mar 2023 Mar 2022 Mar 2021 Mar 2020 Dec 2018

FTE [4] FTE FTE FTE FTE

Average 64 59 47 50 52

======== ======== ======== ======== ========

Year end 70 60 54 48 61

======== ======== ======== ======== ========

Included within the table above are two alternative performance

measures ("APMs" - see note 1): EBITDA and adjusted EBITDA. These

are additional measures which are not required under UK adopted

International Accounting Standards. These measures are consistent

with those used internally and are considered important to

understanding the financial performance and the financial health of

the Group.

EBITDA (Loss) before Interest, Tax, Depreciation and

Amortisation is a measure of cash generated by operations before

changes in working capital. Adjusted EBITDA is a measure of cash

generated by operations before stock impairment, impairment of

investments, share-based compensation, impairment of intangible

assets and foreign exchange losses. It is used to achieve

consistency and comparability between reporting periods.

Notably from the table on the previous page:

-- Revenue of GBP11.7 million was 23% higher than for FY22 (GBP9.6 million)

-- Increase in operating loss to GBP3.3 million from GBP 1.0 million

-- Reduction in adjusted EBITDA to loss of GBP1.6 million in FY23 from GBP0.06 million in FY22

-- EBITDA loss for the year to March 2023 increased to GBP2.9

million from GBP0.4 million loss in FY22

-- Cash and cash equivalents at the end of FY23 of GBP4.1

million was GBP1.7 million higher than the end of FY22

-- Share based compensation charges reflect the fair value of

share options granted to employees over the vesting period of these

options. Please see note 35 to the financial statements of the FY23

Annual Report for more information.

Financial items of note during the year other than those set out

above were:

-- Cash received from customers during FY23 was GBP10.7 million (2022: GBP8.2million)

-- Trade and other receivables increased by GBP1.81 million

during the year to GBP9.26 million (including retentions) as a

result of increased revenue, particularly in the last two months of

the financial year

-- R&D cash tax credit of GBP0.7 million for FY23 (FY22: GBP0.6 million)

During the year an advance against the R&D tax credit was

received. This will be repaid out of the R&D tax credit funds

when received from HMRC. In addition, the loan from one director

remained in place at year end, and letters of credit, invoice

discounting and advance payments have been negotiated on recently

won contracts to help with working capital requirements.

Key Performance Indicators (KPIs)

The financial and non-financial KPIs for the Group are as set

out in the table above and described below.

-- FY23 revenues were 23% up on the previous year FY22 as a

result of major contracts in India which started deploying during

the year, and contracts delivered in the MENA region.

-- Gross margin for the year reduced from 52% to 36%, mainly as

a result of the sale of third-party hardware at gross margins lower

than usual for the Group. Gross margin will vary from year to year

depending on the stage of deployment of each contract. Hardware,

for which revenue is recognised typically during the first two

years of a contract, is at a lower gross margin than software and

services for which revenue can be recognised later in the

deployment.

-- O perating costs for the year increased by 25% compared to

FY22, as a result of additional costs required to scale the

business up to deploy its growing backlog of orders and a GBP1.0

million impairment of intangible assets.

-- Adjusted EBITDA decreased from a profit of GBP58k in FY22 to

a loss of GBP1.56 million in FY23 as a result of lower gross

margin, increased operating costs and EBITDA loss increased from a

loss of GBP0.4 million in FY22 to a loss of GBP2.9 million in FY23

also as a result of lower gross margin and increased operating

costs, as well as an impairment of intangible assets.

-- Average headcount increased by 5, and FTEs at year end

increased from 59 in FY22 to 64 in FY23.

-- Non-financial KPIs included the number of modules shipped

which decreased from 612,000 in FY22 to 391,000 in FY23. However

46,000 NB-IoT hubs and 63,000 Cellular Gateways were also delivered

in the MENA region.

The Group continually reviews whether additional financial and

non-financial KPIs should be monitored.

The Group's long-term strategy is to deliver shareholder returns

by generating revenue and moving into profitability. It seeks to do

this by focusing its resources on emerging but fast-growing markets

where it believes it can reach a market leading position with its

technology. Management uses KPIs to track business performance, to

understand general trends and to consider whether the Group is

meeting its strategic objectives. As it grows, and as highlighted

in the previous paragraph, it intends to review these KPIs and

adapt them as appropriate, in response to how the business and

strategy evolves.

The Group's key focus for the financial year ending March 2023

continued to be to streamline its processes from order to delivery

and working to close further orders. A further focus was ensuring

collection of cash from customers as Group revenues continued to

grow.

Dividends

The directors do not recommend the payment of a dividend (2022:

GBPnil). The Group has no plans to adopt a dividend policy in the

immediate future and all funds generated by the Group will be

invested in the further development of the business, as is normal

for its industry sector and stage of its development.

Heather Peacock

Chief Financial Officer

CyanConnode Holdings plc

Consolidated income statement

For the year ended 31 March 2023

Note Year Year

31 March 2023 31 March

GBP000 2022

GBP000

================================================== ==== ============== =========

Continuing operations

Revenue 11,732 9,562

Cost of sales (7,518) (4,554)

=================================================== ==== ============== =========

Gross profit 4,214 5,008

Exceptional item: impairment of intangible assets 2 (968) -

Other operating costs (6,593) (6,025)

--------------------------------------------------- ---- -------------- ---------

Operating loss (3,347) (1,017)

Amortisation and depreciation 489 616

Share-based payments 224 363

Stock impairment 102 62

Impairment of intangible assets 968 -

Foreign exchange losses 8 34

--------------------------------------------------- ---- -------------- ---------

Adjusted EBITDA (1,556) 58

--------------------------------------------------- ---- -------------- ---------

Finance income 35 3

Finance expense (136) (164)

--------------------------------------------------- ---- -------------- ---------

Loss before tax (3,448) (1,178)

Tax credit 1,042 307

--------------------------------------------------- ---- -------------- ---------

Loss for the year (2,406) (871)

=================================================== ==== ============== =========

Loss per share (pence)

Basic 3 (1.03) (0.42)

Diluted 3 (1.03) (0.42)

=================================================== ==== ============== =========

Consolidated statement of comprehensive income

Derived from continuing operations and attributable to the

equity owners of the Company.

For the year ended 31 March 2023 Year Year

31 March 31 March

2023 2022

GBP000 GBP000

========================================================== ========= =========

Loss for the year (2,406) (871)

Exchange differences on translation of foreign operations 21 76

========================================================== ========= =========

Total comprehensive income for the period (2,385) (795)

========================================================== ========= =========

CyanConnode Holdings plc

Consolidated statement of financial position

As at 31 March 2023

31 March 31 March

Note 2023 2022

GBP000 GBP000

================================================================ ====== ======== ========

Non-current assets

Intangible assets 3,433 4,093

Goodwill 1,930 1,930

Other financial assets 30 58

Property, plant and equipment 122 31

Right of use asset 62 153

Trade receivables 2,076 1,058

================================================================ ====== ======== ========

Total non-current assets 7,653 7,323

Current assets

Inventories 793 159

Trade and other receivables 7,182 6,393

R&D tax credit receivables 748 562

Cash and cash equivalents 4,070 2,355

================================================================ ====== ======== ========

Total current assets 12,793 9,469

================================================================ ====== ======== ========

Total assets 20,446 16,792

================================================================ ====== ======== ========

Current liabilities

Trade and other payables (3,833) (2,364)

Short-term borrowings (1,226) (1,867)

Corporation tax liabilities - (193)

Lease liabilities (29) (28)

---------------------------------------------------------------- ------ -------- --------

Total current liabilities (5,088) (4,452)

================================================================ ====== ======== ========

Net current assets 7,705 5,017

================================================================ ====== ======== ========

Non-current liabilities

Lease liabilities (94) (125)

Deferred tax liability (452) (746)

Other payables (42) (38)

================================================================ ====== ======== ========

Total non-current liabilities (588) (909)

Total liabilities (5,676) (5,361)

================================================================ ====== ======== ========

Net assets 14,770 11,431

================================================================ ====== ======== ========

Equity

Share capital 4 5,438 4,726

Share premium account 78,671 73,883

Own shares held (3,611) (3,611)

Share option reserve 804 1,068

Translation reserve 52 31

Retained losses (66,584) (64,666)

================================================================ ====== ======== ========

Total equity being equity attributable to owners of the Company 14,770 11,431

================================================================ ====== ======== ========

CyanConnode Holdings plc

C onsolidated Statement of Changes in Equity

For the year ended 31 March 2023

Share Own Share

Share Premium Shares Option Translation Retained Total

Capital Account Held Reserve Reserve Losses Equity

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

------------------------ --------- --------- -------- --------- ------------ --------- --------

Balance at 31 March

2021 3,735 69,662 (3,253) 925 (45) (64,015) 7,009

------------------------ --------- --------- -------- --------- ------------ --------- --------

Loss for the year - - - - - (871) (871)

Other comprehensive

income for the year - - - - 76 - 76

------------------------ --------- --------- -------- --------- ------------ --------- --------

Total comprehensive

income for the year - - - - 76 (871) (795)

Issue of share capital 991 4,221 (358) - - - 4,854

Credit to equity

for share options - - - 363 - - 363

Transfer - - - (220) - 220 -

------------------------ --------- --------- -------- --------- ------------ --------- --------

Total transactions

with owners 991 4,221 (358) 143 - 220 5,217

------------------------ --------- --------- -------- --------- ------------ --------- --------

Balance at 31 March

2022 4,726 73,883 (3,611) 1,068 31 (64,666) 11,431

Loss for the year - - - - - (2,406) (2,406)

Other comprehensive

income for the year - - - - 21 - 21

------------------------ --------- --------- -------- --------- ------------ --------- --------

Total comprehensive

income for the year - - - - 21 (2,406) (2,385)

Issue of share capital 712 4,788 - - - - 5,500

Credit to equity

for share options - - - 224 - - 224

Transfer - - - (488) - 488 -

------------------------ --------- --------- -------- --------- ------------ --------- --------

Total transactions

with owners 712 4,788 - (264) - 488 5,724

------------------------ --------- --------- -------- --------- ------------ --------- --------

Balance at 31 March

2023 5,438 78,671 (3,611) 804 52 (66,584) 14,770

------------------------ --------- --------- -------- --------- ------------ --------- --------

CyanConnode Holdings plc

C onsolidated cash flow statement

For the year ended 31 March 2023

Year Year

Note 31 March 2023 31 March

GBP000 2022

GBP000

======================================================== ====== =============================== ===================

Net cash outflow from operating activities 5 (2,217) (3,134)

Investing activities

Interest received 3 3

Purchases of property, plant and equipment (31) (26)

Purchases of intangible assets (734) (259)

(Purchase) / disposal of other financial assets (4) (14)

======================================================== ====== =============================== ===================

Net cash outflow from investing activities (766) (296)

======================================================== ====== =============================== ===================

Financing activities

Interest paid on borrowings (125) (157)

Cash inflow from borrowings 500 500

Cash net (outflow) / inflow from debt factoring (541) (366)

Loan repayment (600) (385)

Capital repayments of lease liabilities (30) (153)

Interest paid on lease liabilities (11) (7)

Proceeds on issue of shares 5,844 5,177

Share issue costs (344) (327)

======================================================== ====== =============================== ===================

Net cash inflow from financing activities 4,693 4,282

======================================================== ====== =============================== ===================

Net increase in cash and cash equivalents 1,710 852

Effects of exchange rate changes on cash and cash

equivalents 5 14

Cash and cash equivalents at beginning of the year 2,355 1,489

-------------------------------------------------------- ------ ------------------------------- -------------------

Cash and cash equivalents at end of the year 4,070 2,355

-------------------------------------------------------- ------ ------------------------------- -------------------

Analysis of changes in net cash / (debt)

Other Net foreign

At 1 April non-cash exchange At 31

2022 Cash flow movements difference March 2023

For the year ended 31 GBP000 GBP000 GBP000 GBP000 GBP000

March 2023

--------------------------- ------------- ------------ ----------- ------------ -------------

Cash and cash equivalents 2,355 1,710 - 5 4,070

--------------------------- ------------- ------------ ----------- ------------ -------------

Short-term borrowings (1,867) 641 - - (1,226)

Lease liabilities (153) 41 (11) - (123)

--------------------------- ------------- ------------ ----------- ------------ -------------

(2,020) 682 (11) - (1,349)

--------------------------- ------------- ------------ ----------- ------------ -------------

Net cash / (debt) at

end of year 335 2,392 (11) 5 2,721

--------------------------- ------------- ------------ ----------- ------------ -------------

Other Net foreign

At 1 April non-cash exchange At 31

2021 Cash flow movements difference March 2022

For the year ended 31 GBP000 GBP000 GBP000 GBP000 GBP000

March 2022

--------------------------- ------------- ------------ ----------- ------------ ----------------------

Cash and cash equivalents 1,489 852 - 14 2,355

--------------------------- ------------- ------------ ----------- ------------ ----------------------

Short-term borrowings (2,118) 251 - - (1,867)

Lease liabilities (98) 160 (215) - (153)

--------------------------- ------------- ------------ ----------- ------------ ----------------------

(2,216) 411 (215) - (2,020)

--------------------------- ------------- ------------ ----------- ------------ ----------------------

Net cash / (debt) at

end of year (727) 1,263 (215) 14 335

--------------------------- ------------- ------------ ----------- ------------ ----------------------

Other non-cash movements include interest on lease liabilities and

new leases taken out in the year.

Notes to the Financial Information

For the year ended 31 March 2023

1. General information

CyanConnode Holdings plc, (Company Registered No. 04554942), is

a company limited by shares, incorporated in the United Kingdom

under the Companies Act 2006. The address of the registered office

is Merlin Place, Milton Road, Cambridge CB4 0DP.

The final results announcement is based on the financial

statements which have been prepared in accordance with UK-adopted

International Accounting Standards. The financial information has

been prepared in accordance with the accounting policies used in

the statutory financial statements for the year ended 31 March

2022.

The financial information set out in the announcement does not

constitute the company's statutory accounts for the years ended 31

March 2022 or 31 March 2023 within the meaning of section 434 of

the Companies Act 2006 but is derived from those audited financial

statements . The auditor's report on the consolidated financial

statements for the years ended 31 March 2022 and the year ended 31

March 2023 is unqualified, does not contain statements under

s498(2) or (3) of the Companies Act 2006 but referred to a material

uncertainty regarding the Group's ability to continue as a going

concern.

Going concern

To assess the ability of CyanConnode Holdings plc ("Group") to

continue as a going concern, the directors have prepared a business

plan and cash flow forecast for the period to 31 March 2025 which,

together, represent the directors' best estimate of the future

development of the Group. The forecast contains certain

assumptions, the most significant of which are the level and timing

of sales, the timing of customer payments and the level of working

capital requirements. The detailed cashflow scenarios include

Letters of Credit which have been secured from customers against

contracts recently won.

At 31 March 2023 the Group had cash reserves of GBP4.1 million

(FY22: GBP2.4m) and based on detailed cash flows provided to the

Board within the FY24/25 budget, there is sufficient cash to see

the Group through to profitability based on its standard operating

model. However, should the Group require additional cash to cover

working capital, as a result of rapid growth, there could be a

requirement for additional funding to cover this. The Group is

discussing working capital funding solutions with banks,

particularly in India.

To assist with working capital, a loan from one director for

GBP300,000 is still in place, after being extended to the Group in

November 2020. The Company received an advance of GBP500,000

secured against its R&D tax credit in November 2022 and an

invoice discounting facility secured against Letters of Credit for

deliveries of Omnimesh modules in India. The advance against the

R&D tax credit will be repaid out of the HMRC receipt which is

expected to be received by October 2023.

Notwithstanding the material uncertainties described above which

may cast significant doubt on the ability of the Group to continue

as a going concern, on the basis of sensitivities applied to the

cash flow forecast, the directors have a reasonable expectation

that the company can continue to meet its liabilities as they fall

due, for a period of at least 12 months from the date of approval

of this report.

Alternative Performance Measures

The Group presents Alternative Performance Measures ("APMs") in

addition to the statutory results of the Group. These are presented

in accordance with the Guidelines on APMs issued by the European

Securities and Markets Authority ("ESMA").

2. Exceptional item: impairment of intangible asset

SMIP intangible carrying value

We have modelled expected net cash flows from Connode AB's UK

SMIP contract over the lifetime of the contract and compared the

net present value of these cashflows to the GBP3,259k carrying

value of the related intangible asset at the end of March 2023.

Connode AB's contract involves the supply of software in areas

where traditional smart meter technology would not work due to lack

of mobile coverage ("not-spots"). The intangible asset had

originally been valued based on the assumption that 10% of the

areas being supplied by the contract would be not-spots, which

would result in 2.3 million units of software being supplied over

the duration of the contract.

The Group has now been notified by its customer Toshiba, that

due to an end-of-life Telit component, which is essential in the

design of the Toshiba hardware (mesh hub), there will now only be a

maximum of 761k mesh hubs supplied under the contract. In addition,

the Group has been notified that 3G is gradually being switched off

in the UK, and meters will be replaced with 4G, commencing in

2025.

A model has now been created based on sensitivities to determine

if an impairment to the intangible asset is required. Sensitivities

were run based on various percentages of the finite number of 761k

hubs being activated. Due to the uncertainties surrounding the

contract and taking into account the numerous delays that have

already occurred, the Board has agreed that an impairment of

GBP968k would be taken in FY23 based on an assumption that 70% of

the finite number of 761k hubs, being 532k meters, would be

activated.

We note that if a 60% activation assumption had been adopted

then there would have been an additional impairment of GBP352k with

no impairment arising if an assumption of 90% had been taken.

3. Loss per share

The calculation of the basic and diluted loss per share is based

on the following data:

2023 2022

============================================================================================ =========== ===========

Loss for the purposes of basic loss per share being net loss attributable to equity holders

of the parent (GBP000) (2,406) (871)

============================================================================================ =========== ===========

Weighted average number of ordinary shares for the purposes of basic and diluted loss per

share (excluding own shares held) 232,763,664 205,173,434

============================================================================================ =========== ===========

Loss per share (pence) (1.03) (0.42)

============================================================================================ =========== ===========

The weighted average number of shares and the loss for the year

for the purposes of calculating diluted loss per share are the same

as for the basic loss per share calculation. This is because the

outstanding share options would have the effect of reducing the

loss per share and would not, therefore, be dilutive under the

terms of IAS 33.

4. Share capital

Issued and fully paid, ordinary shares No GBP000

of 2.0 pence each

As at 31 March 2021 186,742,898 3,735

Issue of new shares 49,566,137 991

----------------------------------------------- ------------ ---------

As at 31 March 2022 236,309,035 4,726

Issue of new shares 35,578,329 712

----------------------------------------------- ------------ ---------

As at 31 March 2023 271,887,364 5,438

----------------------------------------------- ------------ ---------

In the year, shares were issued at prevailing market prices as

settlement for professional services provided. GBP68,750 was raised

this way during the year (2022: GBP4,710).

In October 2022 the Company successfully raised funding of

GBP500,000 before expenses through a subscription for 4,081,632

ordinary shares.

In January 2023 the Company successfully raised funding of

GBP5.25m before expenses through a placing of 30,882,354 ordinary

shares.

During the year, shares were issued to directors and employees

as part payment for their remuneration. GBP24,175 was raised this

way during the year (2022: GBP4,710).

During the year 451,722 shares were issued as a result of the

exercise of share options (2022: 201,250 shares). The Company has

one class of ordinary share which carries no right to fixed

income.

5. Reconciliation of operating loss to net cash outflow from operating activities

Group 2023 2022

GBP000 GBP000

========================================================= ======= =======

Operating loss for the year: (3,347) (1,017)

Adjustments for:

Depreciation of property, plant and equipment 32 31

Amortisation of Intangible assets 426 432

Depreciation on right of use assets 31 153

Impairment of intangible assets 968 -

Interest received on contract assets 32 -

Foreign exchange 8 20

Shares issued in lieu of bonus 24 5

Share-option payment expense 224 363

---------------------------------------------------------- ------- -------

Operating cash flows before movements in working capital (1,602) (13)

(Increase)/decrease in inventories (634) 52

Increase in receivables (1,827) (2,054)

Increase/(decrease) in payables 1,475 (1,568)

---------------------------------------------------------- ------- -------

Cash reduction from operating activities (2,588) (3,583)

Income taxes received 371 449

========================================================== ======= =======

Net cash outflow from operating activities (2,217) (3,134)

========================================================== ======= =======

Cash and cash equivalents (which are presented as a single class

of assets on the face of the balance sheet) comprise cash at bank

and other short-term highly liquid investments with maturity of

three months or less.

6. Annual Report and Accounts and Notice of Annual General Meeting

The Notice of AGM and Proxy Form and full colour Annual Report

and Accounts will be sent to shareholders by 1 August 2023 and made

available on the Company's website shortly thereafter.

[1] The majority of the Group's revenues are received in rupees

for India and US dollars for the rest of world, whilst accounts are

reported in Pound Sterling. Foreign exchange volatility can have an

impact on the reported figures. Stockmarket Broker forecasts during

2022 used a rate of 1.15 against the USD and 95 against the

Rupee

[2] Where Adjusted EBITDA is Operating loss before amortisation,

depreciation, stock impairment, impairment of intangible assets,

share-based compensation and foreign exchange losses.

[3] Where Adjusted EBITDA is Operating loss before amortisation,

depreciation, stock impairment, impairment of intangible assets,

share-based compensation and foreign exchange losses.

[4] Where FTE is the equivalent number of full-time

equivalents

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR FZGZNVVZGFZM

(END) Dow Jones Newswires

July 26, 2023 12:34 ET (16:34 GMT)

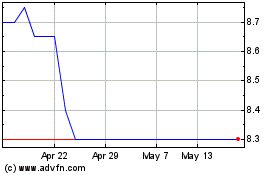

Cyanconnode (LSE:CYAN)

Historical Stock Chart

From Jan 2025 to Feb 2025

Cyanconnode (LSE:CYAN)

Historical Stock Chart

From Feb 2024 to Feb 2025