TIDMDIS

RNS Number : 8204E

Distil PLC

04 July 2023

Distil plc

("Distil" or the "Group")

Final Results for year ended 31 March 2023

"A year of transition"

Distil plc (AIM: DIS), owner of premium drinks brands RedLeg

Spiced Rum, Blackwoods Gin and Vodka, Blavod Black Vodka, TRØVE

Botanical Spirit and Diva Vodka, announces its final results for

the year ended 31 March 2023.

Operational highlights

-- Major move from UK distributor to a new business model

-- Relationship with major UK retail customers taken under direct control

-- Commercial Director appointed to manage major retail and

exports to deliver ambitious growth plans

-- Appointment of leading distributor, Marussia Beverages, to

service the UK hospitality sector

-- RedLeg TV advertisement developed and tested in two key regions

-- Major listing for RedLeg Tropical with leading pub group

-- New export markets opened in Scandinavia and Latin America

with further plans to strengthen and expand global footprint

-- Groundwork laid to create innovative new to world brands

including a blended malt Whisky in partnership with Ardgowan

-- Blackwoods Gin & Vodka Distillery and visitor centre at

the Ardgowan site progressing well with plans to invite trade later

this year once works have progressed further across the wider

site

Financial and corporate highlights

-- Turnover decreased 55% to GBP1.32 million (2022: GBP2.94 million)

-- Gross profit decreased 58% to GBP684k (2022: GBP1.63 million)

-- Volumes (litres) decreased 56%

-- Margins decreased to 52% (2022: 55%)

-- Advertising and promotion spend decreased 34% to GBP582k (2022: GBP890k)

-- Adjusted* administrative expenses increased 21% to GBP903k (2022: GBP746k)

-- Adjusted** EBITDA of GBP(785)k (2022: GBP9k)

-- Operating loss of GBP804k (2022: GBP132k)

-- Net cash outflow*** of GBP845k (2022: GBP500k inflow)

resulting in year-end cash reserves of GBP717k (2022: GBP1.56

million)

-- Net assets of GBP6.80 million (2022: GBP7.55 million) at 31 March 2023

-- Michael Keiller is to step down from the Board and is being

replaced as Non-Executive Director by Shaun Claydon at the

forthcoming AGM

* Administrative costs in 2022 adjusted to remove the one-off

transaction costs associated with the Ardgowan investment

** EBITDA adjusted for one-off transaction costs associated with

Ardgowan investment and annual share based payment expense

*** Prior period cash flows and cash reserves include (1)

proceeds from the fundraising completed in August 2021 amounting to

GBP3.20 million (before expenses), of which GBP3 million was

invested in Ardgowan by way of a convertible loan and (2) proceeds

from the exercise of warrants in September 2021 of GBP433k .

Don Goulding, Executive Chairman of Distil, said:

"It has been a transitional year for the business as we

remodelled to set-up for accelerated growth. The focus has been our

decision to move away from our relationship with distributor

Hi-Spirits in the UK - our largest market - which had a one-off

knock-on effect in relation to sales as existing stock in the

market was depleted.

Our new business model has given us control of the relationship

with the major UK retailers, managed internally by our Commercial

Director, and we are working closely with new on-trade distributor,

Marussia Beverages, with positive headway made in the UK

hospitality sector.

At a Board level, we announce that Mike Keiller is to step down

from the Board at the forthcoming AGM. We thank Mike for the wealth

of experience that he has brought to the business throughout his

tenure, and we wish him all the best as he enjoys his well-earned

retirement.

In order to replace Mike, Shaun Claydon will move from part time

Finance Director to Non-executive Director, whilst retaining his

role as Company Secretary. Current Head of Finance and Operations,

Adebola Adebo ACCA, will assume Shaun's day-to-day

responsibilities.

We intend to further strengthen the Board through the

appointment of an additional independent Non-executive Director who

can add relevant experience and value as soon as reasonably

practicable and in any event by the end of the current financial

year.

We're confident that we have weathered the turbulence related to

the business remodel and the shape of the business model is

expected to yield revenue upside from the current financial year

onwards with accelerated business growth."

Distil PLC

Don Goulding, Executive Chairman Tel: +44 20 3283 4006

Shaun Claydon, Finance Director

----------------------

SPARK Advisory Partners Limited

(NOMAD)

----------------------

Neil Baldwin Tel: +44 20 3368 3550

Mark Brady

----------------------

Turner Pope Investments (TPI)

Ltd (Broker)

----------------------

Andy Thacker/James Pope Tel: +44 20 3657 0050

----------------------

This announcement contains inside information as stipulated

under the UK version of the Market Abuse Regulation No 596/2014

which is part of English Law by virtue of the European (Withdrawal)

Act 2018, as amended. On publication of this announcement via a

regulatory information service this information is considered to be

in the public domain

About Distil

Distil Plc is quoted on the AIM market of the London Stock

Exchange. It owns drinks brands in a number of sectors of the

alcoholic drinks market. These include premium spiced rum, vodka,

gin, vodka vanilla cream liqueur and are called RedLeg Spiced Rum.

Blackwoods Vintage Gin, Blackwoods Vodka, Blavod Original Black

Vodka, TRØVE Botanical Spirit and Diva Vodka.

Chairman's statement

Performance

It has been a transitional year as we remodelled the business to

allow us to handle all sales and marketing to our major UK retail

customers directly, and appointed Marussia Beverages, the UK's

leading artisanal spirits business, to grow our brands within the

on-trade and independent sectors.

This major move resulted in a one-off impact to full year

revenue, which sits slightly below market expectations, however the

shape of the business model is expected to yield revenue upside

from 2023 financial year onwards.

Reported losses are mainly attributed to the decline in sales as

stock in the UK trade was depleted following the remodel. There was

a larger job to be done than anticipated due to higher volumes of

stock available in the UK trade than anticipated, however we are

now through these issues, trading well with direct customers, and

have seen the strongest results of the year in Q4, indicating that

we are successfully rebuilding following the remodel.

In addition, the investment into RedLeg Spiced Rum TV campaign

in Q1, along with increased promotions to assist with stock

depletion and the reduction in distribution of Blackwoods gin as

the UK gin market declines, attributed to the loss.

Marketing and new product development

Throughout this transitional period, we have focussed on

stabilising the business, strengthening our export sales, and

ensuring robust plans are in place in order to help accelerate

growth through the new business model.

With direct control of our major UK retail customers, we have

been able to deliver price premiumisation, and have robust

promotional plans in place, supported by above-the-line in-store

and online visibility to drive volume through these customers.

The coming financial year will see a strong programme of events

and brand activation across RedLeg Spiced Rum to drive awareness

and consumer trial. The on-trade will play a significant part in

this, and the team at Marussia Beverages UK are on-track to help

deliver volume-driving activation across key customers.

New packaging formats are also due to be launched into major

retailers in Q2 which will support brand premiumisation and give us

stand-out on shelf product. Our partnership with a well-established

national gifting company to secure listings within miniature gift

packs in major grocery also continues.

The new Blackwoods 2021 Vintage, which launched Q1 of FY 22/23,

involved creating a new, premium liquid in conjunction with Master

Distiller, Sion Edwards, which showcased the best Scottish produce,

including coastal botanicals such as kelp and sea buckthorn, to tie

the new Vintage to the brand home being built on the Ardgowan

estate. All distillation and bottling of the Blackwoods range now

proudly take place in Scotland. The range has been well received

and was awarded silver at the Scottish Gin Awards 2022.

Progress remains positive at the Ardgowan site with all internal

renovation work now complete and the 1,000L hand-built

Scottish-built copper still is in situ ready for commissioning. The

first Blackwoods liquids are due to be distilled this year. The

team is working closely with Ardgowan to design the visitor

experience, with plans to invite trade later this year.

Further to this, the team has been working to design an exciting

new product development programme, which will see us enter

lucrative new categories, including the launch of a blended malt

whisky in accordance with our partnership with Ardgowan. We look

forward to sharing further details with shareholders in due

course.

Export growth

Export sales are down 54% as we lapped particularly strong prior

year sales as we opened significant new markets with new varieties

of RedLeg Spiced Rum and benefited from associated pipe-fill sales

along with additional pipeline fill in established markets post

lockdown.

Expanding the global reach of our brands remains a focus across

the business. Over the past year we have opened two new markets in

Scandinavia and Latin America, with interest from further markets

being nurtured across the portfolio.

In addition, we have increased communication with existing

markets in order to better understand the changing needs of each

post-Brexit, so that we can ensure that we are better supporting

the brands. For the coming financial year, we plan to increase

above the line marketing spend across key markets to help drive

sales.

Cost pressures

Management of operations and cost of goods has been challenging

throughout the year due to the turbulent economic environment which

has seen us faced with double-digit price increases from suppliers

in reaction to inflation. The team continues to work hard to

mitigate these increases and reduce our costs moving forward

without compromising on product quality.

Through close management of suppliers, the margin benefits of

supplying our major customers directly, and price premiumisation,

we expect our margins to recover in the medium term.

Ardgowan

We took the decision in Q3 not to exercise the option (which

expired at the end of December 2022) to invest a further GBP2m into

the Ardgowan Distillery project at this time to focus cash

resources on our core business. However, Ardgowan plans remain

intact and the project represents a significant long-term

investment for the business.

We are working closely with the team to deliver the Blackwoods

brand home and we look forward to welcoming the first visitors in

the coming year.

Board Changes

Mike Keiller has announced his intention to step down from the

Board at the forthcoming AGM.. Mike has brought a wealth of

experience to the business during his tenure, however he has taken

the decision to resign his position in order to enjoy his

well-earned retirement.

In order to replace Mike, Shaun Claydon will move from part time

Finance Director to Non-executive Director, whilst retaining his

role as Company Secretary. Current head of finance and operations,

Adebola Adebo will assume Shaun's day to day responsibilities.

We intend to further strengthen the Board through the

appointment of an additional independent Non-executive Director who

can add relevant experience and value as soon as reasonably

practicable and in any event by the end of the current financial

year.

Outlook

The past year has seen significant changes within the business

as we remodelled and strengthened the team across departments to

support direct to customer channels and accelerated growth of our

brands.

As we enter the new financial year, we are conscious of global

pressures that still remain in terms of economic uncertainty and

the impact that this will have on consumer spending habits as

disposable income is squeezed.

However, we are confident that our brands are well positioned as

affordable premium products, meaning that they will remain

attractive to consumer and trade alike.

We will continue to focus on finding efficiencies across the

supply chain to ensure that our margins recover, and seek new

markets and channels within which to drive volume.

In conjunction with our remodelled business, new product

development programme and investment into brand marketing, we are

confident that we will be able to accelerate business growth

throughout the coming financial year, creating significant value

for shareholders. We will update the market on progress milestones

in due course.

Strategic report

Results for the year

The loss before tax attributable to shareholders for the year

amounted to GBP654k (2022: loss before tax GBP95k). Adjusted

EBITDA* was a loss of GBP785k (2022: profit of GBP9k).

Year-on-year sales revenues and volumes declined 55 % and 56 %

respectively and reflects a number of one-off issues affecting the

business during the financial year. These included the

implementation of a new business model moving from a

distributor-based model to taking direct control of supplying major

UK customers. This transition resulted in a significant one-off

reduction in UK market stock cover with a consequential reduction

in revenues during the year. This was compounded by a system issue

at a major retail customer resulting in a significant reduction in

Redleg Spiced Rum stock availability during the key Christmas

trading period together with a delisting of Blackwoods gin by a

mid-sized retailer. More broadly the UK spirits market proved

softer than expected in response to the challenging economic

environment, particularly inflation which impacted consumer

confidence.

Gross margins fell to 52% (2022: 55%) primarily due to a

significant increase in the cost of goods as our suppliers

implemented double digit price increases in response to inflation.

In the short-term gross margins will remain subdued due to these

cost increases whilst in the medium term we expect recovery toward

prior year levels as the benefits of the change in business model

to direct customer supply and brand premiumisation filter

through.

We continued to invest in brand development during the period.

Despite seeing a reduction in absolute terms, marketing spend as a

percentage of sales increased to 44% (2022: 30%) partly due to Q1

costs associated with the Redleg Spiced Rum TV campaign and also as

we continued to build programmes to support our existing brands and

lay the groundwork to create and launch new products in response to

consumer trends during 2023.

The Group seeks to minimise overheads where possible, whilst

ensuring sufficient investment to support the growth in sales of

its existing brands and development of new brands. Other

administrative expenses increased by 11% over prior year. Adjusting

for the one-off costs associated with the financing and investment

in Ardgowan Distillery Limited in the prior year, the like-for-like

increase was 21%, primarily due to investment in staff recruitment

to support business growth, increased travel and professional fees

as well as general inflationary cost increases.

Cash flow

The operating loss together with net movements in working

capital resulted in a net cash outflow from operating activities of

GBP966k during the year (2022: GBP151k inflow). Net movements in

working capital were impacted by a GBP432k increase in inventories

during the year. This was due to the "one-off" return of unsold

stock from our former UK distributor as a result of our business

remodel together with lower than expected sales volumes. Following

convertible loan interest income of GBP150k from Ardgowan and

modest capex, the Company's cash and cash equivalents decreased by

GBP845k to GBP717k at the financial year end.

Balance sheet

The Group had net assets of GBP6.80m at the financial year end

(2022: GBP7.55m). This included financial assets of GBP3.0m (2022:

GBP3.0m), cash reserves of GBP0.72m (2022: GBP1.56m) and intangible

assets of GBP1.63m (2022: GBP1.61m) comprising expenditure on

trademarks related to our brands. Financial assets solely comprise

our investment in Ardgowan, further details of which are set out

below and note 12 to the accounts. Inventories increased to

GBP1.07m (2022: GBP637k) primarily due to the aforementioned

business model change and lower than expected sales volumes.

Investment in Ardgowan Distillery Limited

The GBP3 million strategic investment in Ardgowan is in the form

of a convertible loan yielding interest of 5% per annum. After

careful consideration by the Board it was decided not to exercise

the option to invest a further GBP2 million before its expiry on 31

December 2022 and to focus cash resources on our core business.

*EBITDA is adjusted for share based payment expenses of GBP3k

(2022: GBP59k) and one-off costs associated with the Ardgowan

financing and investment of GBPNil (2022: GBP66k).

Principal activities and business review

Distil Plc (the "Company") acts as a holding company for the

entities in the Distil Plc Group (the "Group"). The principal

activity of the Group throughout the period under review was the

marketing and selling of RedLeg Spiced Rum, Blackwoods Vintage Gin,

Blackwoods Vodka, Blavod Original Black Vodka, TRØVE Botanical

Spirit and Diva Vodka.

The 2023 financial year was a year of transition, and the

disappointing performance primarily reflects the change in business

model away from our UK distributor and taking direct control of

supply to major UK customers. This change required a one-off but

prolonged clearing of stocks from the previous distributor which

significantly impacted revenues. This was further compounded by a

softer than expected UK spirit market in response to the ongoing

challenging economic environment together with inflationary

pressure throughout our supply chain. Having completed this

transition the focus in the year ahead is to drive domestic and

export revenue growth through multi-channel and marketing

activities and new product launches whilst ensuring overhead costs

remain appropriate for the size of the Group.

Key performance indicators

The Group monitors progress with particular reference to the

following key performance indicators:

-- Contribution - defined as gross margin less advertising and promotional costs

Contribution for the year decreased GBP638k to GBP102k (2022:

GBP739k). This decrease was primarily due to a 55% fall in overall

sales revenues whilst advertising and marketing costs saw a lesser

reduction of 35% during the year as we maintained investment in

brand development.

-- Sales turnover versus previous year

Total sales decreased 55% year-on-year to GBP1.32m (2021:

GBP2.94m). Sales of RedLeg Spiced Rum which accounts for the

majority of sales revenue decreased 52% whilst Blackwoods gin

posted a 86% decrease in revenue during the period. Blackwoods

Vodka and Blavod Original Black Vodka experienced a reduction in

sales of 34% and 41% respectively whilst TRØVE Botanical Spirit

posted a sales increase of 59%, albeit all off relatively small

bases.

-- Gross margin versus previous year

Gross margin as a percentage of sales experienced a reduction to

52% (2022: 55%) due to an increase in the costs of sales caused by

inflationary pressures throughout the Group's supply chain. The

change in business model away from the UK distributor model should

mitigate these increases in the short to medium term as we capture

additional margin from the supply chain and premiumise our

brands.

We also closely monitor both the level of, and value derived

from our advertising and promotional costs and other administrative

costs. As a percentage of sales, advertising and promotional spend

amounted to 44% (2022: 30%) during the year, reflecting our

continued commitment to investing in existing and new brand

development.

Other administrative costs increased 11% to GBP903k (2022:

GBP812k). Adjusting for the one-off costs associated with the

financing and investment in Ardgowan during the prior year

(GBP66k), other administrative costs increased 21%. This increase

was primarily due to an increase in staff costs, as we strengthened

the team during the period, additional professional fees and travel

costs and general inflationary cost increases.

Principal risks and uncertainties

As a relatively small but growing business our senior management

is naturally involved day to day in all key decisions and the

management of risk. Where possible, structured processes and

strategies are in place to monitor and mitigate as appropriate.

This involves a formal review at Board level.

The directors are of the opinion that a thorough risk management

process has been adopted which involves a formal review of the

principal risks identified below. Where possible, processes are in

place to monitor and mitigate such risks.

-- Economic downturn

The success of the business is reliant on consumer spending. An

economic downturn, resulting in reduction of consumer spending

power, will have a direct impact on the income achieved by the

Group. In response to this risk, senior management aim to keep

abreast of economic conditions. In cases of severe economic

downturn, marketing and pricing strategies will be modified to

reflect the new market conditions.

-- High proportion of fixed overheads and variable revenues

A large proportion of the Group's overheads are fixed. There is

the risk that any significant changes in revenue may lead to the

inability to cover such costs. Senior management closely monitor

fixed overheads against budget on a monthly basis and cost saving

exercises are implemented wherever possible when there is an

anticipated decline in revenues.

-- Competition

The market in which the Group operates is highly competitive. As

a result, there is constant downward pressure on margins and the

additional risk of being unable to meet customer expectations.

Policies of constant price monitoring and ongoing market research

are in place to mitigate such risks.

-- Failure to ensure brands evolve in relation to changes in consumer taste

The Group's products are subject to shifts in fashions and

trends and the Group is therefore exposed to the risk that it will

be unable to evolve its brands to meet such changes in taste. The

Group carries out regular consumer research on an ongoing basis in

an attempt to carefully monitor developments in consumer taste.

-- Portfolio management

A key driver of the Group's success lies in the mix and

performance of the brands which form the Group's portfolio. The

Group constantly and carefully monitors the performance of each

brand within the portfolio to ensure that its individual

performance is optimised together with the overall balance of

performance of all brands marketed and sold by the Group.

Future developments

We remain focused on four key growth drivers to maintain

profitable brand growth and create value. These are listed

below:

Brand activation and marketing at the point of sale:

-- Precise timing and frequency of promotional activity including occasions & gifting.

-- Bringing promotions to life and aligned with changing consumer needs.

-- Marketing and promotional activity tailored to local market needs.

Innovation in liquid & packaging development:

-- Pack sizes & formats, new brands, liquids and flavours.

Route to consumer:

-- Build long term relationships with capable local distributors in each key market.

-- Open new territories for each key brand, targeting premium growth markets.

-- Develop new trade channels through format and product.

Access to new production and design:

-- Across all aspects of distilling, bottling, packaging.

Consolidated statement of comprehensive income

For the year ended 31 March 2023

2023 2022

GBP'000 GBP'000

-------------------------------------- --------- ---------

Revenue 1,320 2,942

Cost of sales (636) (1,313)

--------------------------------------- --------- ---------

Gross profit 684 1,629

Administrative expenses:

Advertising and promotional costs (582) (890)

Other administrative expenses (903) (812)

Share based payment expense (3) (59)

Total administrative expenses (1,488) (1,761)

--------------------------------------- --------- ---------

Loss from operations (804) (132)

Finance income 150 37

Loss before tax (654) (95)

Taxation (94) 269

--------------------------------------- --------- ---------

(Loss)/profit for the year and total

comprehensive income (748) 174

--------------------------------------- --------- ---------

(Loss)/earnings per share

Basic (pence per share) (0.11) 0.03

Diluted (pence per share) (0.11) 0.02

--------------------------------------- --------- ---------

Consolidated statement of financial position

As at 31 March 2023

2023 2022

GBP'000 GBP'000

----------------------------------------- -------- --------

Assets

Non-current assets

Property, plant and equipment 153 167

Intangible assets 1,633 1,606

Financial assets at amortised cost 3,000 3,000

Deferred tax asset 351 445

------------------------------------------ -------- --------

Total non-current assets 5,137 5,218

------------------------------------------ -------- --------

Current assets

Inventories 1,069 637

Trade and other receivables 883 687

Cash and cash equivalents 717 1,562

------------------------------------------ -------- --------

Total current assets 2,666 2,886

------------------------------------------ -------- --------

Total assets 7,806 8,104

------------------------------------------ -------- --------

Liabilities

Current liabilities

Trade and other payables 854 407

Financial liabilities at amortised cost 150 150

------------------------------------------ -------- --------

Total current liabilities 1,004 557

------------------------------------------ -------- --------

Total liabilities 1,004 557

------------------------------------------ -------- --------

Net assets 6,802 7,547

------------------------------------------ -------- --------

Equity

Share capital 1,474 1,474

Share premium 6,211 6,211

Share-based payment reserve 200 198

Accumulated losses (1,084) (336)

------------------------------------------ -------- --------

Total equity 6,802 7,547

------------------------------------------ -------- --------

Consolidated statement of changes in equity

For the year ended 31 March 2023

Share-based

Share Share payment Accumulated

capital premium reserve losses Total equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------------- -------- -------- ----------- ----------- ------------

Balance at 1 April

2021 1,292 2,908 117 (510) 3,807

Profit for the year

and total comprehensive

income - - - 174 174

Shares issued 182 3,466 - - 3,648

Share issue costs - (141) - - (141)

Share based payment

expense - (22) 81 - 59

------------------------- -------- -------- ----------- ----------- ------------

Balance at 31 March

2022 and

1 April 2022 1,474 6,211 198 (336) 7,547

------------------------- -------- -------- ----------- ----------- ------------

Loss for the year

and total comprehensive

income - - - (748) (748)

Share based payment

expense - - 3 - 3

------------------------- -------- -------- ----------- ----------- ------------

Balance at 31 March

2023 1,474 6,211 201 (1,084) (6,802)

------------------------- -------- -------- ----------- ----------- ------------

Consolidated statement of cash flows

For the year ended 31 March 2023

2023 2022

GBP'000 GBP'000

------------------------------------------------- -------- ---------

Cash flows from operating activities

Loss before taxation (654) (95)

Adjustments for non-cash/non-operating items:

Finance income (150) (37)

Depreciation 16 16

Expenses settled by shares - 15

Share-based payment expense 3 59

(785) (42)

Movements in working capital

Increase in inventories (432) (84)

Increase in trade and other receivables (196) (78)

Increase in trade and other payables 447 54

Net cash used in operating activities (966) (150)

-------------------------------------------------- -------- ---------

Cash flows from investing activities

Purchase of property, plant and equipment (2) (16)

Expenditure relating to licences and trademarks (27) (8)

Payment on issue of convertible loan notes - (2,850)

-------------------------------------------------- -------- ---------

Net cash used in investing activities (29) (2,874)

-------------------------------------------------- -------- ---------

Cash flows from financing activities

Proceeds from issue of shares, net of issue

costs - 3,492

Interest received on convertible loans 150 32

Net cash generated from financing activities 150 3,524

-------------------------------------------------- -------- ---------

Net (decrease)/increase in cash and cash

equivalents (845) 500

Cash and cash equivalents at beginning of

year 1,562 1,062

Cash and cash equivalents at end of year 717 1,562

-------------------------------------------------- -------- ---------

Note : the above "Note" references refer to the Notes to the

Financial Statements in the Annual Report & Accounts, a copy of

which will be available shortly on the Company's website

www.distil.uk.com and which will be available from the Company's

registered office. A further notification will be made at that

time.

1. Basis of preparation and summary of significant accounting policies

The consolidated and company financial statements are for the

year ended 31 March 2023. They have been prepared in accordance

with UK-adopted International Accounting Standards ("IFRS").

The financial statements have been prepared under the historical

cost convention. The measurement bases and principal accounting

policies of the Group are set out below.

Distil Plc is the Group's ultimate parent company. The Company

is a public limited company incorporated and domiciled in England

and Wales. The address of Distil Plc's registered office is 201

Temple Chambers, 3-7 Temple Avenue, EC4Y 0DT and its principal

place of business is 73 Watling Street, EC4M 9BJ.

These results are audited; however, the financial information

does not constitute statutory accounts as defined under section 434

of the Companies Act 2006. The consolidated balance sheet at 31

March 2023 and the consolidated statement of comprehensive income,

consolidated statement of changes in equity and consolidated

statement of cash flows for the year then ended have been extracted

from the Group's 2023 statutory consolidated financial statements

upon which the auditor's opinion is unqualified. The statutory

consolidated financial statements for the year ended 31 March 2023

were approved by the Board on 3 July 2023 and will be delivered to

the Registrar of Companies in due course.

The financial information for the year ended 31 March 2023 has

been derived from the Group's statutory consolidated financial

statements for that year, as filed with the Registrar of Companies.

Those consolidated financial statements contained an unqualified

audit report.

A copy of the Annual Report & Accounts will shortly be

available on the Company's website www.distil.uk.com and will be

available from the Company's registered office.

2. (Loss)/earnings per share

The calculation of the basic earnings per share is based on the

results attributable to ordinary shareholders divided by the

weighted average number of shares in issue during the year.

The diluted earnings per share is calculated based upon dilutive

share options and warrants, see note 16 (c). In the current year,

as the Group was loss making, the share options and warrants have

not been included in the calculation as they would be

anti-dilutive.

The earnings and weighted average number of shares used in the

calculations are set out below.

2023 2022

---------------------------------------- ------------ ------------

(Loss)/profit attributable to ordinary

shareholders (GBP'000) (748) 174

Weighted average of number of shares 684,399,579 676,801,406

---------------------------------------- ------------ ------------

Basic per share (pence) (0.11) 0.03

Diluted per share (pence) (0.11) 0.02

---------------------------------------- ------------ ------------

3. Segment reporting

2023 2022

GBP'000 GBP'000

--------- -------- --------

Revenue

UK 1,190 2,612

Export 130 330

--------- -------- --------

1,320 2,942

--------- -------- --------

Gross profit

UK 598 1,424

Export 86 205

-------------- ---- ------

684 1,629

-------------- ---- ------

The directors have decided that providing a geographical split

by two locations, UK and Export, offers an enhanced indicator of

business activity. Only revenue and gross profit can be easily

identifiable when splitting between UK and export markets. All

trade is undertaken, and assets are held in one geographic

location, being the UK.

The Group's revenue included 3 (2022: 1) customers making up

more than 10% each during the year:

2023 2022

GBP'000 GBP'000

Revenue by Type

Customer 1 552 -

Customer 2 217 -

Customer 3 140 -

Customer 4 97 2,531

All other customers 314 411

--------------------- -------- --------

1,320 2,942

--------------------- -------- --------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR NKNBNABKDAOK

(END) Dow Jones Newswires

July 04, 2023 02:00 ET (06:00 GMT)

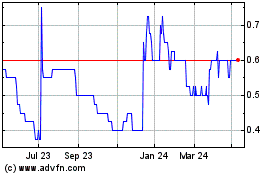

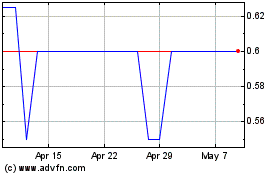

Distil (LSE:DIS)

Historical Stock Chart

From Dec 2024 to Dec 2024

Distil (LSE:DIS)

Historical Stock Chart

From Dec 2023 to Dec 2024