Distil PLC Trading Update (1491Z)

10 January 2024 - 6:00PM

UK Regulatory

TIDMDIS

RNS Number : 1491Z

Distil PLC

10 January 2024

Distil PLC

Trading Update

Distil plc (AIM: DIS), owner of premium drinks brands RedLeg

Spiced Rum, Blackwoods Gin and Vodka, TRØVE Botanical Vodka and

Blavod Black Vodka, is pleased to provide an update on trading for

the third quarter of its current financial year ending 31 March

2024.

Unaudited year-on-year third quarter (October to December 2023)

results:

-- Revenues increased 39% to GBP571k (October to December 2022: GBP411k)

o Cumulative revenues for 9 months to end 31 December grew 38%

year-on-year to GBP1.2m (April - December 2022: GBP0.87m)

-- Volumes increased 10%

-- Gross profit increased 23% to GBP272k (October to December 2022: GBP222k)

o Cumulative gross profit for 9 months to end 31 December

increased 26% year-on-year to GBP554k

-- A&P increased 48% to GBP198k (October to December 2022:

GBP134k) representing increased promotional slots in major grocery

over the Christmas period

-- Launch and sell-out of RedLeg Limited Edition in major grocery

Don Goulding, Executive Chairman of Distil, said:

"I'm pleased to share the Q3 results which, despite a

challenging economic environment and a suppressed consumer spirits

market, show that the business is continuing to grow following the

business remodel in 2022 and reported growth in H1.

This quarter saw the launch of the first RedLeg Limited Edition,

available via RedLeg's e-commerce site, as well as major UK

grocery. The product sold out at a business level pre-Christmas,

and we saw strong performance both in grocery and online,

increasing off-promotion sales, recruiting new consumers and

building brand equity. Following the launch, revenues online grew

261% versus the previous period, demonstrating consumer engagement

and demand.

RedLeg also benefitted from increased promotional activity

year-on-year, including investment into in-store media, additional

shelf space in select stores, and more weeks on promotion in our

key trading period.

Blackwoods Gin & Vodka saw Q3 revenue grow 123% year-on-year

(72% revenue growth year-to-date vs same period last year), driven

by growth in both the on-and off-trade across all SKUs. With the

first distillation at Ardgowan due in January 2024, and the visitor

brand experience scheduled to open in the Spring, we're encouraged

by the traction that is being built with the brand and are excited

about the growth opportunities to come.

We continue to make progress in the UK on-trade, with key

account wins in Q3. The on-trade is facing significant challenges

as a result of utilities and duty increases squeezing consumer

spending, but our brands are well positioned to continue to build

on the success we've seen so far this year.

The fundraise in Q3 provided working capital to ensure that our

customers were serviced to a high level during our busiest period,

and will support our growth plans through to the end of March 2025,

including the fit-out and opening of the Blackwoods brand

experience at the distillery, and launch of new products. Cash

balances at 31 December (unaudited) amounted to GBP581k

Despite the medium-term macro outlook continuing to be

challenging as the overall spirits market remains soft due to

increased pressures on consumer spending, we are encouraged by a

positive quarter and the growth achieved year-to-date. Thanks to

the flexibility afforded by our business remodel, we are confident

that we can continue to build on this growth in Q4, ensuring that

our brands and business is well positioned into the new financial

year."

For further information please contact:

Distil PLC

Don Goulding, Executive Chairman Tel: +44 203 405 0475

----------------------

SPARK Advisory Partners Limited

(NOMAD)

----------------------

Neil Baldwin Tel: +44 203 368 3550

Mark Brady

----------------------

Turner Pope Investments (TPI)

Ltd (Broker)

----------------------

Andy Thacker Tel: +44 203 657 0050

James Pope

----------------------

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION AS STIPULATED

UNDER THE UK VERSION OF THE MARKET ABUSE REGULATION NO 596/2014

WHICH IS PART OF ENGLISH LAW BY VIRTUE OF THE EUROPEAN (WITHDRAWAL)

ACT 2018, AS AMENDED. ON PUBLICATION OF THIS ANNOUNCEMENT VIA A

REGULATORY INFORMATION SERVICE, THIS INFORMATION IS CONSIDERED TO

BE IN THE PUBLIC DOMAIN.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTFLFLDLIIAIIS

(END) Dow Jones Newswires

January 10, 2024 02:00 ET (07:00 GMT)

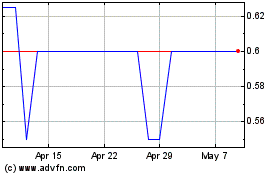

Distil (LSE:DIS)

Historical Stock Chart

From Nov 2024 to Dec 2024

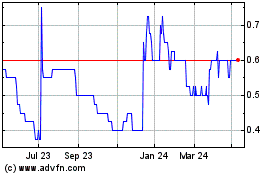

Distil (LSE:DIS)

Historical Stock Chart

From Dec 2023 to Dec 2024