Genel Energy PLC: AGM Statement (812159)

16 May 2019 - 4:01PM

UK Regulatory

Genel Energy PLC (GENL)

Genel Energy PLC: AGM Statement

16-May-2019 / 07:00 GMT/BST

Dissemination of a Regulatory Announcement, transmitted by EQS Group.

The issuer is solely responsible for the content of this announcement.

16 May 2019

Genel Energy plc

AGM Statement

Stephen Whyte, Chairman of Genel Energy plc ('Genel' or 'the Company'), will

give the following update on the business at the Company's Annual General

Meeting, which is being held at 11.00am today at Taj Hotel, St James' Court,

54 Buckingham Gate, London, SW1E 6AF:

"Genel had a very successful 2018, with free cash flow generation of $164

million even while making significant investment in growth.

2019 has seen us continue this success. We are delivering year-on-year

production growth, we have made portfolio additions that perfectly

complement our existing asset base, and our cash position continues to

strengthen.

Genel is participating in 20 wells this year, the most of any IOC in the

Kurdistan Region of Iraq ('KRI'). Drilling on the Tawke and Peshkabir fields

is ongoing, with activity ramping up as we progress through 2019. Year to

date production from the Tawke PSC is currently c.126,800 bopd, with

Peshkabir driving impressive growth compared to the prior year's period.

The drilling programme at Taq Taq has now delivered three successful wells,

and year to date production is currently c.13,300 bopd, an increase from the

2018 average of 12,350 bopd. We are continuing to achieve successful results

from the flanks of the field, and are drilling ahead at pace.

Total Genel working interest production across all assets is 37,600 bopd,

running slightly ahead of our expected 10% increase in year-on-year

production.

Even as we invest to deliver this production increase we continue to improve

our cash position, generating almost $50 million in free cash flow in the

first four months of the year. We expect to keep up this impressive run

rate. Our current expectation is that we will generate well over $100

million in free cash flow over the course of 2019, prior to the payment of

the dividend, even after increasing expenditure on our growth opportunities.

The results at Peshkabir show the significant success that can be obtained

from our low-cost, rapid return operations in the KRI. While investing to

increase production from 12,000 bopd to 55,000 bopd over the course of the

year, Genel still generated $50 million of free cash flow from the asset.

This level of return is hard to match anywhere else in the world, and

illustrates why we continue to look for further opportunities in the KRI.

Put simply, the KRI is a very good place in which to operate. Payments have

been made on a monthly basis for over three and a half years now, the

political situation continues to improve - with Baghdad having made budget

payments to the Kurdistan Regional Government for over a year - and the

low-cost of operations helping to set a breakeven oil price at an asset

level of $20/bbl. We are still looking to diversify the portfolio, but we

will not ignore further opportunities in the KRI - and indeed continue to

focus on these where our presence on the ground and regional expertise mean

we can maximise their value potential for shareholders.

In that context, as you are probably aware by now, we were delighted to add

Sarta and Qara Dagh to the portfolio. They tick all of the boxes, as we

partner with Chevron on assets that offer a mixture of near-term production

and long-term growth potential. Sarta is expected to enter production in the

middle of 2020, and we will develop the field utilising a similar strategy

to the one that was so successful (and cash-generative) at Peshkabir. While

we do not want to get ahead of ourselves there are hydrocarbons throughout

the structure in all of the typical KRI reservoirs, from the Tertiary down

to the Triassic.

We are focused on building an even stronger business with material growth

potential, providing a clear and compelling investment case that offers the

opportunity for a significant increase in shareholder value. As we

prioritise that growth, we have also initiated a material and sustainable

dividend, providing investors with a compelling mix of growth and returns.

I am delighted that Bill Higgs is now sitting alongside me as CEO, and that

Esa Ikaheimonen, our CFO, has also joined the Board.

On a personal level, the transition that I was keen to oversee is now

complete. As such I have decided that this will be my last AGM as Chairman

of Genel, and I will leave the Company for new challenges once a suitable

successor has been identified. When I joined the Board two years ago the

share price was under 80p, production was declining, Genel had unpaid oil

receivables of over $400 million and $142 million in net debt.

Genel's production and net cash position is now rising, the portfolio is

positioned to provide material organic growth, and Genel now has the right

team to deliver that growth. Management has a wealth of experience in the

sector, experience that can also be utilised to make further value-accretive

portfolio additions and optimise our growing cash pile to generate value for

shareholders."

Genel will announce results for the six months ending 30 June 2019 on

Tuesday 6 August 2019.

-ends-

For further information, please contact:

Genel Energy +44 20 7659 5100

Andrew Benbow, Head of Communications

Vigo Communications +44 20 7390 0230

Patrick d'Ancona

Notes to editors:

Genel Energy is an independent oil and gas exploration and production

company listed on the main market of the London Stock Exchange (LSE: GENL,

LEI: 549300IVCJDWC3LR8F94). The Company, with headquarters in London and

offices in Ankara and Erbil, is one of the largest London-listed independent

oil producers, and is the largest holder of reserves and resources in the

Kurdistan Region of Iraq. Genel has highly cash-generative oil production

from the Taq Taq and Tawke licences, with material growth potential from

other assets in the portfolio. Genel also continues to pursue further growth

opportunities. For further information, please refer to www.genelenergy.com

[1].

ISIN: JE00B55Q3P39

Category Code: AGM

TIDM: GENL

LEI Code: 549300IVCJDWC3LR8F94

Sequence No.: 8656

EQS News ID: 812159

End of Announcement EQS News Service

1: https://link.cockpit.eqs.com/cgi-bin/fncls.ssp?fn=redirect&url=3ec46b352f38452116096dbbab51b09e&application_id=812159&site_id=vwd_london&application_name=news

(END) Dow Jones Newswires

May 16, 2019 02:01 ET (06:01 GMT)

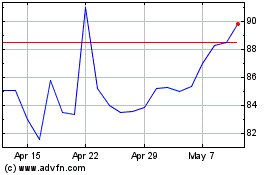

Genel Energy (LSE:GENL)

Historical Stock Chart

From Oct 2024 to Nov 2024

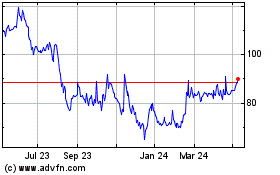

Genel Energy (LSE:GENL)

Historical Stock Chart

From Nov 2023 to Nov 2024