Operational & Corporate Update (1699005)

09 August 2023 - 4:00PM

UK Regulatory

Gulf Keystone Petroleum Ltd (GKP)

Operational & Corporate Update

09-Aug-2023 / 07:00 GMT/BST

=----------------------------------------------------------------------------------------------------------------------

9 August 2023

Gulf Keystone Petroleum Ltd. (LSE: GKP)

("Gulf Keystone", "GKP" or "the Company")

Operational & Corporate Update

In advance of the publication of its 2023 Half Year Results on 31 August 2023, Gulf Keystone, a leading independent

operator and producer in the Kurdistan Region of Iraq ("KRI" or "Kurdistan"), is today providing an update on

operational and corporate activity.

Jon Harris, Gulf Keystone's Chief Executive Officer, said:

"While no official timeline has been announced, we continue to believe the suspension of Kurdistan crude exports will

be temporary and that the KRG will resume oil sales payments in due course. As political negotiations continue, we

remain focused on what is within our control to preserve and bolster liquidity. We are pleased to have commenced local

sales in July and partially restarted Shaikan Field production, increasing gross average sales volumes to 11,700 bopd

in August to date while receiving payments in advance. We are actively pursuing additional local sales opportunities,

although pricing and volumes remain unpredictable. At the same time, we are continuing to reduce our costs, pursue

inventory sales and proactively manage our accounts payable. We look forward to providing a further update on progress

at our half year results later this month."

Following the shut-in of the Iraq-Turkey pipeline on 25 March 2023, exports from the Shaikan Field remain suspended and

no further oil sales payments have been received from the Kurdistan Regional Government ("KRG") since the payment of

the September 2022 invoice of USD26.9 million net on 9 March 2023. Outstanding receivables of USD151 million net are owed

to the Company for the months of October 2022 to March 2023 on the basis of the KBT pricing mechanism.

While no official timeline has been announced, GKP continues to believe that the suspension of exports will be

temporary and that the KRG will resume payments to GKP and other International Oil Companies ("IOCs") operating in

Kurdistan in due course.

In particular, the Company notes that:

-- Discussions between the KRG, the Iraqi Ministry of Oil and Turkish authorities regarding the restart of

pipeline operations remain ongoing

-- The approval of the 2023-2025 Iraqi budget marks significant progress towards creating a new framework

for KRG production that is recognised by Baghdad in return for budget transfers

? While there is the potential for budget transfers to broadly cover the KRG's monthly expenditures,

including ongoing IOC receivables, certain aspects to fully implement the budget and determine monthly transfer

amounts remain unclear and are the subject of ongoing negotiations between Kurdistan and Iraq

-- The KRG Prime Minister Masrour Barzani has assured GKP and other IOCs operating in Kurdistan that

production sharing contracts will be honoured and outstanding receivables will be repaid

In the interim, GKP remains focussed on preserving and bolstering its liquidity by exploring opportunities to increase

local crude sales, further reduce costs, pursue inventory sales and proactively manage accounts payable:

-- On 19 July 2023, the Company commenced sales to the local market by restarting production and trucking

operations from PF-1. Crude sales averaged around 4,900 bopd gross for the period from 19 July to 31 July. Since

the beginning of August, volumes have increased, with gross average sales of around 11,700 bopd. Volumes are sold

at realised prices in line with the local market, with advance payments received in accordance with production

sharing contract entitlements

-- The Company is actively pursuing additional opportunities to increase local sales further. While a number

of parties have expressed interest in purchasing Shaikan crude oil, the outlook for volumes and pricing remains

difficult to predict

-- The Company continues to aggressively reduce all costs across the business and remains focused on

maintaining net capital expenditures, operating costs and G&A expenses at a monthly run rate of around USD6 million

from July 2023, in line with previous guidance. The Company continues to explore options to further reduce costs

-- The Company's cash balance as at 8 August 2023 was USD80 million with no outstanding debt

Enquiries:

Gulf Keystone: +44 (0) 20 7514 1400

Aaron Clark, Head of Investor Relations aclark@gulfkeystone.com

FTI Consulting +44 (0) 20 3727 1000

Ben Brewerton

GKP@fticonsulting.com

Nick Hennis

or visit: www.gulfkeystone.com

Notes to Editors:

Gulf Keystone Petroleum Ltd. (LSE: GKP) is a leading independent

operator and producer in the Kurdistan Region of Iraq. Further

information on Gulf Keystone is available on its website

www.gulfkeystone.com

Disclaimer

This announcement contains certain forward-looking statements

that are subject to the risks and uncertainties associated with the

oil & gas exploration and production business. These statements

are made by the Company and its Directors in good faith based on

the information available to them up to the time of their approval

of this announcement but such statements should be treated with

caution due to inherent risks and uncertainties, including both

economic and business factors and/or factors beyond the Company's

control or within the Company's control where, for example, the

Company decides on a change of plan or strategy. This announcement

has been prepared solely to provide additional information to

shareholders to assess the Group's strategies and the potential for

those strategies to succeed. This announcement should not be relied

on by any other party or for any other purpose.

-----------------------------------------------------------------------------------------------------------------------

Dissemination of a Regulatory Announcement, transmitted by EQS

Group. The issuer is solely responsible for the content of this

announcement.

-----------------------------------------------------------------------------------------------------------------------

ISIN: BMG4209G2077

Category Code: MSCM

TIDM: GKP

LEI Code: 213800QTAQOSSTNTPO15

Sequence No.: 263256

EQS News ID: 1699005

End of Announcement EQS News Service

=------------------------------------------------------------------------------------

Image link:

https://eqs-cockpit.com/cgi-bin/fncls.ssp?fn=show_t_gif&application_id=1699005&application_name=news

(END) Dow Jones Newswires

August 09, 2023 02:00 ET (06:00 GMT)

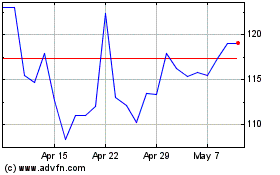

Gulf Keystone Petroleum (LSE:GKP)

Historical Stock Chart

From Jun 2024 to Jul 2024

Gulf Keystone Petroleum (LSE:GKP)

Historical Stock Chart

From Jul 2023 to Jul 2024