TIDMVENN

RNS Number : 7142X

Venn Life Sciences Holdings PLC

10 May 2016

Venn Life Sciences Holdings Plc

("Venn" or the "Company"or "Group")

Final Results

for Year ended 31 December 2015

Venn Life Sciences (AIM: VENN), a growing Clinical Research

Organisation (CRO) providing drug development, clinical trial

management and resourcing solutions to pharmaceutical,

biotechnology and medical device clients, announces its audited

final results for the year ended 31 December 2015.

Financial Highlights

-- Revenue up 135% to EUR11.47m (2014: EUR4.88m)

-- EBITDA profit (before exceptional items) of EUR0.39m (2014: loss of EUR1.53m)

-- Loss for the year EUR0.20m (2014: EUR1.8m)

-- EBITDA profit attributable to CRO Business EUR0.8m (2014: loss of EUR0.96m)

-- EBITDA losses attributable to investment in Innovenn EUR0.44m (2014: loss of EUR0.57m)

-- Cash and cash equivalents as at 31 December 2015 of EUR3.8m (2014: EUR0.8m)

Operational Highlights

-- Acquisition of Kinesis Pharma BV, extending service capabilities into drug development

-- Resource base increased to 196 personnel

-- Re-location of existing Paris operations into "flagship" location

-- Piloting of new clinical trial management infrastructure

Post Period End

-- Strong rate of business wins and new proposals continues

-- EUR3.4m contract secured in January

-- Revenues of EUR4.4m booked for Q1 2016 (Q1 2015: EUR2.0m)

-- Successful cross selling of drug development and late phase services to expanded client base

-- Listing on Enterprise Securities Market

Commenting on the Group's outlook, Tony Richardson, CEO and

Chairman of Venn said:

"2015 has been a breakthrough year for Venn, delivering 135%

revenue growth and importantly, delivering its first EBITDA

profits. The acquisition of Kinesis Pharma BV in October 2015 has

broadened the service offering of the business and opened up

further opportunities for growth. With a strong start to 2016 Venn

is well positioned for further growth.

"Significant progress has been made at Innovenn during 2015. As

the business has now moved from its development phase into

commercialisation, the board intends to reposition this business

such that it has an independent footing, its own source of funding

and a value that can be clearly established. The board intends

implementing this repositioning in a manner that has a clear

quantifiable benefit for Venn shareholders, and gives greater

visibility to the strongly performing core CRO business."

Enquiries:

Venn Life Sciences Holdings Plc www.vennlifesciences.com

Tony Richardson, Chief Executive Officer Tel: +353 153 73 269

Aoife O Farrell, Marketing Manager Tel: +353 153 73 269

Davy (Nominated Adviser, ESM Adviser Tel: +353 1 679 6363

and Joint Broker)

Fergal Meegan / Matthew DeVere White

(Corporate Finance)

Paul Burke (Corporate Broking)

Hybridan LLP (Joint-Broker)

Claire Louise Noyce Tel: 020 3764 2341

Walbrook PR Ltd Tel: 020 7933 8787 or venn@walbrookpr.com

Paul McManus Mob: 07980 541 893

Lianne Cawthorne Mob: 07584 391 303

About Venn Life Sciences Limited: Venn Life Sciences is a

Contract Research Organisation providing drug development, clinical

trial management and resourcing solutions to pharmaceutical,

biotechnology and medical device organisations. With dedicated

operations in France, Germany, the Netherlands, the UK, Ireland and

Europe wide representation - Venn Life Sciences specialises in

rapid deployment and management of multisite projects, across all

phases. Venn Life Sciences also has an innovation division -

Innovenn - focused primarily on breakthrough development

opportunities in Skin Science.

For more information about the Company, please visit:

www.vennlifesciences.com

CHAIRMAN AND CHIEF EXECUTIVE STATEMENT

FOR THE YEARED 31 DECMEBER 2015

I am pleased to report that 2015 has been another strong year

for Venn, delivering revenue growth of 135% and maiden EBITDA

profits. The year has also seen the successful extension of service

capabilities and expertise though the acquisition of Kinesis Pharma

BV ('Kinesis') and a continued step up in the size and value of

projects undertaken.

Through a combination of organic growth and acquisition the team

now comprises nearly 200 personnel, representing a solid base on

which we can now build. We have continued to improve our

infrastructure with the piloting of new clinical trial management

systems and the relocation of our Paris entities to a central

flagship location. With this stronger base, comprehensive service

offering and good geographical coverage we are now well positioned

to develop deeper areas of specialism within the business and

longer term more strategic client relationships. In 2015 we have

worked on some cutting edge Rare Disease projects, experience I

believe we can leverage in 2016 and beyond.

Innovenn has also delivered a strong year with progress on

Labskin and Clarogel. Both technologies are now through their

development phase and into commercialisation and the board intends

to reposition this business such that it has an independent

footing, its own source of funding and a value that can be clearly

established. The board is actively looking at ways to realise

shareholder value for these technologies in 2016.

Results and Commentary

Fee income for the full year was to EUR11.47m (2014: EUR4.88m)

amounting to an increase of 135% year on year. This increase in fee

income is attributable to an effective business development effort

delivering larger international projects coupled with an effective

recruitment drive to support the workload. EBITDA profit before

exceptional charges for the year was EUR0.39m (2014 loss of

EUR1.53m). The EBITDA profit attributable to our CRO business was

EUR0.8m (2014: loss of EUR0.96m) and what has been a year of

significant investment in Innovenn has resulted in an EBIDA deficit

of EUR0.44m (2014: loss of EUR0.57m) attributable to that part of

the business. The consolidated balance sheet as at 31 December 2015

had total net assets of EUR10.2m, EUR3.8m (2014: EUR0.8m) of which

was represented by cash and cash equivalents.

Post Period End

Venn has seen a solid start to 2016 demonstrated by booking

EUR4.4m of revenues in the first quarter. The Company has achieved

a strong rate of business wins with new proposals continuing to

come in. As previously stated we execute work to a consistently

high standard which brings significant rewards for the Company and

I am delighted to see this pattern continuing in 2016. As announced

in January we signed a EUR3.4m contract with a leading US based

biotechnology client and the magnitude of this new business win

demonstrates that our strategy of consolidation is effective and

that Venn is well positioned to win more substantial contracts.

The acquisition of Kinesis has enabled us to successfully

crosssell drug development and late phase services to our expanded

client base, being able to offer the complete range of services.

This in turn has allowed us to establish earlier and longer lasting

client relationships and it is extremely pleasing to see the

benefits of the October 2015 acquisition coming through so

quickly.

It's also worth noting that we successfully listed on the Irish

Stock Exchange's Enterprise Securities Market ('ESM') in January

2016 to utilise the ESMs dual listing with the London Stock

Exchange's AIM. This has enabled us to expand our investor base by

accessing both euro and sterling pools of capital and facilitate

future growth.

Plans and Outlook

We will continue to improve our knowledge base, expand our

geographical coverage and further develop emerging areas of

specialism during 2016. We continue to seek acquisition

opportunities in Central and Eastern Europe and are exploring

organic expansion into certain regions. Having developed into a

genuine full service Company with the addition of Kinesis we will

focus in 2016 on business integration and successful cross selling

of early and late phase services into the newly expanded client

base.

Anthony Richardson

Chief Executive Officer

10 May 2016

Consolidated Statement of Comprehensive Income

For the year ended 31 December 2015

2015 2014

Notes EUR'000 EUR'000

----------------------------------- ------ --------- --------

Continuing operations

Revenue 2 11,474 4,883

Direct Project and Administrative

Costs 3 (11,934) (6,817)

Other operating income 175 167

Operating loss (285) (1,767)

--------- --------

Depreciation (103) (47)

Amortisation (361) (140)

Exceptional items 3 (209) (47)

EBITDA before exceptional items 2 388 (1,533)

--------- --------

Finance income 4 2 9

Finance costs 4 (44) (71)

----------------------------------- ------ --------- --------

Loss before income tax (327) (1,829)

Income tax credit 5 125 20

----------------------------------- ------ --------- --------

Loss for the year (202) (1,809)

----------------------------------- ------ --------- --------

Profit/(Loss) attributable

Owners of the parent 15 (1,533)

Non-controlling interest (217) (276)

----------------------------------- ------ --------- --------

Loss for the year (202) (1,809)

Currency translation differences 49 8

----------------------------------- ------ --------- --------

Total comprehensive loss for the

year (153) (1,801)

----------------------------------- ------ --------- --------

Profit/(loss) per ordinary share 6

Basic and diluted 0.04c (6.0c)

----------------------------------- ------ --------- --------

Consolidated and Company's Statement of Financial Position

As at 31 December 2015

Group Group Company Company

2015 2014 2015 2014

Notes EUR'000 EUR'000 EUR'000 EUR'000

------------------------------- ------- -------- -------- -------- --------

Assets

Non-current assets

Property, plant and equipment 381 194 - -

Intangible assets 7 5,437 2,820 - -

Investments in subsidiaries - - 7,468 4,432

Investments 31 31 31 31

Total non-current assets 5,849 3,045 7,499 4,463

------------------------------- ------- -------- -------- -------- --------

Current assets

Trade and other receivables 5,560 2,097 8,220 3,531

Income tax recoverable 23 32 - -

Cash and cash equivalents 3,798 806 554 -

------------------------------- ------- -------- -------- -------- --------

Total current assets 9,381 2,935 8,774 3,531

------------------------------- ------- -------- -------- -------- --------

Total assets 15,230 5,980 16,273 7,994

------------------------------- ------- -------- -------- -------- --------

Equity attributable to

owners

Share capital 155 112 155 112

Share premium account 14,011 5,483 14,011 5,483

Group re-organisation

reserve (541) (541) - -

Merger relief reserve - - 3,531 3,531

Reverse acquisition reserve 45 45 - -

Foreign currency reserves 49 - - -

Share option reserve 13 - 13 -

Retained earnings (3,826) (3,841) (2,351) (2,015)

------------------------------- ------- -------- -------- -------- --------

9,906 1,258 15,361 7,111

Non-controlling interest 327 544 - -

------------------------------- ------- -------- -------- -------- --------

Total equity 10,233 1,802 15,361 7,111

------------------------------- ------- -------- -------- -------- --------

Liabilities

Non-current liabilities

Borrowings 52 99 - -

Total non-current liabilities 52 99 - -

------------------------------- ------- -------- -------- -------- --------

Current liabilities

Trade and other payables 4,218 3,302 912 670

Deferred taxation 692 271 - -

Deferred consideration - 213 - 213

Borrowings 35 293 - -

Total current liabilities 4,945 4,079 912 883

------------------------------- ------- -------- -------- -------- --------

Total liabilities 4,997 4,178 912 883

------------------------------- ------- -------- -------- -------- --------

Total equity and liabilities 15,230 5,980 16,273 7,994

------------------------------- ------- -------- -------- -------- --------

Consolidated and Company's Statement of Cash Flows

For the year ended 31 December 2015

Group Group Company Company

2015 2014 2015 2014

Notes EUR'000 EUR'000 EUR'000 EUR'000

Cash Flow from operating activities

Cash used in operations 8 (2,275) (994) (4,736) (1,071)

Interest paid - (54) - (9)

Income tax received/(paid) 125 20 (31) -

------------------------------------------------------- ------ -------- -------- -------- --------

Net cash used in operating activities (2,150) (1,028) (4,767) (1,080)

------------------------------------------------------- ------ -------- -------- -------- --------

Cash flow from investing activities

Acquisition of subsidiaries, net of cash acquired (1,893) (307) - (424)

Acquisition of investments - - -

Exceptional costs (209) - -

Purchase of property, plant and equipment (713) (99) (3,037) -

Proceeds from sale of property, plant and equipment - 5 - -

Interest received - 9 - -

------------------------------------------------------- ------ -------- -------- -------- --------

Net cash used in investing activities (2,815) (392) (3,037) (424)

------------------------------------------------------- ------ -------- -------- -------- --------

Cash flow from financing activities

Proceeds from issuance of ordinary shares 8,571 1,194 8,571 1,194

Payment of deferred consideration (310) (154) (213) (154)

Financing from non-controlling interests - 800 - -

Repayments on borrowings (94) (40) - -

Net cash generated by financing activities 8,167 1,800 8,358 1,040

------------------------------------------------------- ------ -------- -------- -------- --------

Net increase/ (decrease) in cash and cash equivalents 380 554 (464)

Cash and cash equivalents at beginning of year 596 216 - 464

Exchange losses on cash and cash equivalents - - - -

------------------------------------------------------- ------ -------- -------- -------- --------

Cash and cash equivalents at end of year 3,798 596 554 -

------------------------------------------------------- ------ -------- -------- -------- --------

Consolidated and Company's Statement of Changes in Shareholders'

Equity

Group

Re-organisation

& Reverse Share Foreign

Share Share acquisition Option currency Retained Non-controlling

capital premium reserve reserve reserve earnings Total interests Total

EUR'000 EUR'000 EUR'000 EUR'000 EUR'000 EUR'000 EUR'000 EUR'000 EUR'000

--------------- --------- --------- ---------------- -------- ---------- ---------- -------- ----------------- --------

At 1 January

2014 102 3,431 (496) 0 (8) (2,308) 721 - 721

--------------- --------- --------- ---------------- -------- ---------- ---------- -------- ----------------- --------

Changes in

equity for the

year

ended 31

December 2014

Loss for the

year - - - - - (1,533) (1,533) (276) (1,809)

Currency

translation

differences - - - - 8 - 8 - 8

--------------- --------- --------- ---------------- -------- ---------- ---------- -------- ----------------- --------

Total

comprehensive

loss for

the year - - - - 8 (1,533) (1,525) (276) (1,801)

--------------- --------- --------- ---------------- -------- ---------- ---------- -------- ----------------- --------

Transactions

with the

owners

Shares issued 10 2,052 - - - - 2,062 820 2,882

--------------- --------- --------- ---------------- -------- ---------- ---------- -------- ----------------- --------

Total

contributions

by and

distributions

to owners 10 2,052 - - - - 2,062 820 2,882

--------------- --------- --------- ---------------- -------- ---------- ---------- -------- ----------------- --------

At 31 December

2014 112 5,483 (496) 0 - (3,841) 1,258 544 1,802

--------------- --------- --------- ---------------- -------- ---------- ---------- -------- ----------------- --------

Changes in

equity for the

year

ended 31

December 2015

Profit/ (Loss)

for the year - - - - - 15 15 (217) (202)

Currency

translation

differences - - - - 49 - 49 - 49

--------------- --------- --------- ---------------- -------- ---------- ---------- -------- ----------------- --------

Total

comprehensive

profit

/(loss) for

the year - - - - 49 15 64 (217) (153)

--------------- --------- --------- ---------------- -------- ---------- ---------- -------- ----------------- --------

Transactions

with the

owners

Shares issued 43 8,528 - - - - 8,571 - 8,571

Options issued - - - 13 - - 13 - 13

--------------- --------- --------- ---------------- -------- ---------- ---------- -------- ----------------- --------

Total

contributions

by and

distributions

to owners 43 8,528 - - - - 8,584 - 8,584

--------------- --------- --------- ---------------- -------- ---------- ---------- -------- ----------------- --------

At 31 December

2015 155 14,011 (496) 13 49 (3,826) 9,906 327 10,233

--------------- --------- --------- ---------------- -------- ---------- ---------- -------- ----------------- --------

Company

Share Share Merger relief Retained

Share capital premium Option reserve reserve earnings Total

EUR'000 EUR'000 EUR'000 EUR'000 EUR'000 EUR'000

----------------- -------------------- --------- ---------------- ---------------- ---------- --------

As at 1 January

2014 102 3,431 - 3,531 (1,815) 5,249

----------------- -------------------- --------- ---------------- ---------------- ---------- --------

Changes in

equity for the

year ended 31

December

2014

Total

comprehensive

loss for the

year - - - - (200) (200)

Proceeds from

shares issued 10 2,052 - - - 2,062

At 31 December

2014 112 5,483 - 3,531 (2,105) 7,111

----------------- -------------------- --------- ---------------- ---------------- ---------- --------

Changes in

equity for the

year ended 31

December

2015

Total

comprehensive

loss for the

year - - - - (336) (336)

Issued in year 43 8,528 13 - - 8,584

At 31 December

2015 155 14,011 13 3,531 (2,351) 15,359

----------------- -------------------- --------- ---------------- ---------------- ---------- --------

Notes to the Financial Statements

1. General information

Venn Life Sciences Holdings Plc is a company incorporated in

England and Wales. The Company is a public limited company listed

on the AIM market of the London Stock Exchange. The address of the

registered office is 1 Berkeley Street, London, W1J 8DJ.

The principal activity of the Group is that of a Clinical

Research Organisation providing a suite of consulting and clinical

trial services to pharmaceutical, biotechnology and medical device

organisations. The Group has a presence in the UK, Ireland, France,

Netherlands and Germany.

The financial statements are presented in Euros, the currency of

the primary economic environment in which the Group's trading

companies operate. The Group comprises Venn Life Sciences Holdings

Plc and its subsidiary companies as set out in note 18.

The registered number of the Company is 07514939.

2. Segmental reporting

Management has determined the Group's operating segments based

on the monthly management reports presented to the Chief Operating

Decision Maker ('CODM'). The CODM is the Executive Directors and

the monthly management reports are used by the Group to make

strategic decisions and allocate resources.

The principal activity of the Group is that of a Clinical

Research Organisation (CRO) providing a suite of consulting and

clinical trial services to pharmaceutical, biotechnology and

medical device organisations. Prior to 2015, the CODM considered

the Groups operating segments to be the individual Countries of

operation. However, as the majority of the Group's contracts are

now larger, multi-country contracts, pulling resources from many

different locations, the CODM now considers this a single business

unit.

The Group also has an innovation division focussed on skin

technologies and continues to undertake developments in this arena.

2015 saw the re-launch and initial sales of Labskin and the CODM

consider this the second business unit.

Both business units have separate managers and report

performance to the CODM separately.

Currently the key operating performance measures used by the

CODM are Revenue and adjusted EBITDA (before exceptionals).

The segment information provided to the Board for the reportable

segments for the year ended 31 December 2015 is as follows:

2015 2015 2015 2014 2014 2014

Venn Innovenn Total Venn Innovenn Total

EUR'000 EUR'000 EUR'000 EUR'000 EUR'000 EUR'000

--------------------------- -------- --------- -------- -------- --------- --------

Income statement

External revenue 11,468 6 11,474 4,883 - 4,883

--------------------------- -------- --------- -------- -------- --------- --------

Adjusted EBITDA 834 (446) 388 (960) (573) (1,533)

Exceptional items (209) - (209) (47) - (47)

---------------------------

EBITDA 625 (446) 179 (1,007) (573) (1,580)

Depreciation (75) (28) (103) (46) (1) (47)

Amortisation (311) (50) (361) (135) (5) (140)

--------------------------- -------- --------- -------- -------- --------- --------

Operating profit/(loss) 239 (524) (285) (1,188) (579) (1,767)

Net finance costs (39) (3) (42) (62) - (62)

Retained profit/(loss)

before tax 200 (527) (327) (1,250) (579) (1,829)

--------------------------- -------- --------- -------- -------- --------- --------

Segment assets

Intangibles, Goodwill, 4,743 693 5,436 2,601 219 2,820

PPE 223 158 381 141 53 194

Investments 31 - 31 31 - 31

Trade and other debtors 5,455 128 5,583 2,078 51 2,129

Inter segment debtors 999 - 999 418 182 600

Cash 3,768 30 3,798 492 314 806

--------------------------- -------- --------- -------- -------- --------- --------

Total assets 15,220 1,009 16,228 5,761 819 6,580

--------------------------- -------- --------- -------- -------- --------- --------

Segment liabilities

Operating liabilities (4,737) (174) (4,911) (3,756) (30) (3,786)

Inter segment liabilities - (999) (999) (182) (418) (600)

--------------------------- -------- --------- -------- -------- --------- --------

(4,737) (1,173) (5,910) (3,938) (448) (4,386)

Borrowings (87) - (87) (392) - (392)

--------------------------- -------- --------- -------- -------- --------- --------

Total liabilities (4,824) (1,173) (5,997) (4,330) (448) (4,778)

--------------------------- -------- --------- -------- -------- --------- --------

3. Exceptional items

Included within Administrative expenses are exceptional items as

shown below:

2015 2014

EUR'000 EUR'000

------------------------------------------------------- -------- --------

Exceptional items includes:

- Transaction costs relating to business combinations

and acquisitions 209 47

Total exceptional items 209 47

-------------------------------------------------------- -------- --------

4. Finance income and costs

2015 2014

EUR'000 EUR'000

--------------------------------------------------- -------- --------

Interest expense:

- Bank borrowings 27 29

- Deferred consideration unwinding of discount - 17

- Interest on other loans 17 25

--------------------------------------------------- -------- --------

Finance costs 44 71

--------------------------------------------------- -------- --------

Finance income

- Interest income on cash and short-term deposits 2 9

--------------------------------------------------- -------- --------

Finance income 2 9

--------------------------------------------------- -------- --------

Net finance costs 42 62

--------------------------------------------------- -------- --------

5. Income tax expense

2015 2014

Group EUR'000 EUR'000

--------------------------------------------------- -------- --------

Current tax:

Current tax for the year - -

Tax refund (prior year) (65) -

--------------------------------------------------- -------- --------

Total current tax (credit)/charge (65) -

--------------------------------------------------- -------- --------

Deferred tax (note 24):

Origination and reversal of temporary differences (60) (20)

--------------------------------------------------- -------- --------

Total deferred tax (60) (20)

--------------------------------------------------- -------- --------

Income tax (credit)/charge (125) (20)

--------------------------------------------------- -------- --------

The tax on the Group's results before tax differs from the

theoretical amount that would arise using the standard tax rate

applicable to the profits of the consolidated entities as

follows:

2015 2014

EUR'000 EUR'000

---------------------------------------------------------------- -------- --------

Loss before tax (262) (1,829)

---------------------------------------------------------------- -------- --------

Tax calculated at domestic tax rates applicable to UK standard

rate of tax of 20% (2013 - 20%) (52) (366)

Tax effects of:

- Expenses not deductible for tax purposes 30 35

- Losses carried forward/(utilised) (38) 311

Tax (credit)/charge (60) (20)

---------------------------------------------------------------- -------- --------

There are no tax effects on the items in the statement of

comprehensive income.

6. Loss per share

(a) Basic

Basic loss per share is calculated by dividing the loss

attributable to equity holders of the Company by the weighted

average number of Ordinary Shares in issue during the year.

2015 2014

EUR'000 EUR'000

-------------------------------------- ----------- -----------

Profit/(loss) attributable to equity

holders of the Company 15 (1,533)

-------------------------------------- ----------- -----------

Weighted average number of Ordinary

Shares in issue 41,261,849 26,960,835

-------------------------------------- ----------- -----------

Basic profit/ (loss) per share 0.04c (6.0c)

-------------------------------------- ----------- -----------

(b) Diluted

Diluted earnings per share is calculated by adjusting the

weighted average number of Ordinary Shares outstanding to assume

conversion of all dilutive potential Ordinary Shares. No share

options or warrants outstanding at 31 December 2015 or 31 December

2014 were dilutive and all such potential ordinary shares are

therefore excluded from the weighted average number of ordinary

shares for the purposes of calculating diluted earnings per

share.

7. Intangible fixed assets

Group Customer Intellectual

relationships Trade secrets Goodwill Property Rights Workforce Total

EUR'000 EUR'000 EUR'000 EUR'000 EUR'000 EUR'000

---------------------- --------------------- -------------- --------- --------------------- ---------- ---------

Cost

At 1 January 2014 24 37 980 - - 1,041

Addition 420 - 180 224 - 824

Exchange differences 1 2 10 - - 13

On acquisition of

subsidiary

undertaking (note

34) 160 670 150 - 104 1,084

---------------------- --------------------- -------------- --------- --------------------- ---------- ---------

At 31 December 2014 605 709 1,320 224 104 2,962

---------------------- --------------------- -------------- --------- --------------------- ---------- ---------

Amortisation

At 1 January 2014 1 1 - - - 2

Charge for the year 94 32 - 5 9 140

---------------------- --------------------- -------------- --------- --------------------- ---------- ---------

At 31 December 2014 95 33 - 5 9 142

---------------------- --------------------- -------------- --------- --------------------- ---------- ---------

Net book value

At 31 December 2014 510 676 1,320 219 95 2,820

---------------------- --------------------- -------------- --------- --------------------- ---------- ---------

Cost

At 1 January 2015 605 709 1,320 224 104 2,962

Addition 525 525

Exchange differences 2 3 11 (9) 7

Adjustment (48) (48)

On acquisition of

subsidiary

undertaking (note

34) 1,032 117 1,345 2,494

At 31 December 2015 1,639 712 1,400 740 1,449 5,940

---------------------- --------------------- -------------- --------- --------------------- ---------- ---------

Amortisation

At 1 January 2015 95 33 - 5 9 142

Charge for the year 164 71 - 49 77 361

---------------------- --------------------- -------------- --------- --------------------- ---------- ---------

At 31 December 2015 259 104 - 54 86 503

---------------------- --------------------- -------------- --------- --------------------- ---------- ---------

Net book value

At 31 December 2015 1,380 608 1,400 686 1,363 5,437

---------------------- --------------------- -------------- --------- --------------------- ---------- ---------

No amortisation charge has been charged on the goodwill in the

income statement (2014 - EURnil).

On 16 October 2015 the Company acquired Kinesis Pharma B.V, a

Dutch pre-clinical/early clinical research organisation for initial

consideration of EUR3,324,137, satisfied through EUR1,846,620 cash

and the issue of 4,780,320 Ordinary shares of 0.01p each (Note 34).

A fair value exercise has been conducted on the Kinesis

acquisition.

On 13 January 2014 the Group completed the acquisition of trade

and certain business assets and liabilities of a German based CRO

for EUR600,000 satisfied through issue of 1,962,583 Ordinary shares

of 0.01p each. A fair value exercise was conducted on the

acquisition of the German based CRO.

On March 2014 the Group acquired intellectual property rights in

Labskin(TM) for EUR224,000 satisfied through issue of 864,706

Ordinary shares of 0.01p each.

Goodwill is allocated to the Group's cash-generating units

(CGU's) identified according to operating segment. An operating

segment-level summary of the goodwill allocation is presented

below.

2015 2014

EUR'000 EUR'000

---------- -------- --------

CRO 1,400 1,320

Innovenn - -

---------- -------- --------

Total 1,400 1,320

---------- -------- --------

Goodwill is tested for impairment at the balance sheet date. The

recoverable amount of goodwill at 31 December 2015 was assessed on

the basis of value in use. As this exceeded carrying value no

impairment loss was recognised.

The key assumptions in the calculation to assess value in use

are the future revenues and the ability to generate future cash

flows. The most recent financial results and forecast approved by

management for the next year were used followed by an extrapolation

of expected cash flows at a constant growth rate for a further four

years. The projected results were discounted at a rate which is a

prudent evaluation of the pre-tax rate that reflects current market

assessments of the time value of money and the risks specific to

the cash-generating units.

The key assumptions used for value in use calculations in 2015

were as follows:

%

-------------------------------------- ---

Longer-term growth rate (after 2015) 5

Discount rate 20

--------------------------------------- ---

The Group has been loss making for the last 4 years and in 2014

the Directors transformed the infrastructure and capabilities of

the Group in order to work as a Group in providing services to

clinical research and development markets as one unit rather than

separate units. This meant that the impairment review is prepared

on the group basis rather than a single unit basis. The Directors

have made significant estimates on future revenues and EBITDA

growth over the next three years based on the Group's budgeted

investment in recruiting key employees and marketing the

services.

The Directors have performed a sensitivity analysis to assess

the impact of downside risk of the key assumptions underpinning the

projected results of the Group. The projections and associated

headroom used for the group is sensitive to the EBITDA growth

assumptions that have been applied. A 50% reduction in EBITDA

growth; in the first five years of the management projections would

not result in any impairment at the group level.

The Company has no intangible assets.

8. Cash used in operations

Group Group Company Company

2015 2014 2015 2014

EUR'000 EUR'000 EUR'000 EUR'000

--------------------------------- --------- -------- -------- --------

Loss before income tax (327) (1,829) (336) (200)

Adjustments for:

- Depreciation and amortisation 464 187 - -

- Foreign currency translation

of net assets (204) (22) (164) 11

- Exceptional Item 209 47 209 -

- Net finance costs 42 62 - 26

Changes in working capital

- Trade and other receivables (3,463) (892) (4,689) (1,394)

- Trade and other payables 1,004 1,453 243 486

--------------------------------- --------- -------- -------- --------

Net cash used in operations (2,275) (994) (4,737) (1,071)

--------------------------------- --------- -------- -------- --------

Exceptional Item

2014 Group comparative has been restated to disclose exceptional

items and Foreign exchange separately

9. Business combinations

Acquisition of Kinesis Pharma B.V.

On 16 October 2015 the Company acquired 100% of Kinesis Pharma

B.V, a Dutch pre-clinical and early clinical research organisation,

and Kinesis Singapore (100% subsidiary). The final terms of the

initial consideration for the acquisition, following the adjustment

mechanism set out in the sale and purchase agreement, plus the

crystallised contingent consideration from the 2015 performance is

EUR3,083,746. The Company has performed a fair value exercise of

the remaining contingent consideration, reflecting the time value

of money and the likelihood of this consideration

crystallising.

The goodwill of EUR117,000 arising from the acquisition is

attributable to the expected future profitability of the acquired

business and synergies expected to arrive from the incorporation of

the business within the Group.

The following table summarises the consideration paid and the

amounts of the assets acquired and liabilities assumed at the

acquisition date.

EUR'000

---------------------------------------------------------------------------- --------

Fair value consideration at 16 October 2016

Cash 1,847

Share issue (4,780,320 Ordinary shares of 0.01p each) 1,477

---------------------------------------------------------------------------- --------

Initial consideration (note 17) 3,324

Adjustment to consideration and crystallised 2015 contingent consideration (240)

Total fair value consideration 3,084

---------------------------------------------------------------------------- --------

Recognised amounts of identifiable assets acquired and liabilities assumed

Cash and cash equivalents 1

Property, plant and equipment (note 16) 72

Investment in Subsidiary 76

Customer relations - included in intangibles (note 17) 1,032

Workforce - included in intangibles (note 17) 1,345

Trade and other receivables 2,005

Trade and other payables (896)

Borrowings (184)

Tax (484)

Total identifiable net assets 2,967

---------------------------------------------------------------------------- --------

Goodwill 117

---------------------------------------------------------------------------- --------

The revenue included in the consolidated statement of

comprehensive income since 16 October 2015 contributed by Kinesis

Pharma B.V. was EUR1.4m. Kinesis Pharma B.V. also contributed a

profit of EUR103,000 over the same period. Had Kinesis Pharma B.V.

been consolidated from 1 January 2015, the consolidated statement

of comprehensive income, would show approximately revenue of

EUR16.4m and EUR0.4m profit before tax.

10. Post balance sheet events

The following events have taken place since the year end:

(a) On 8 January 2016, Non-Executive Chairman David Evans, aged

55, resigned his position on the Board in line with his personal

commitment to reduce the number of Non-Executive Chairman roles

undertaken.

11. Annual Report & Accounts

Copies of the audited Annual Report & Accounts for the year

ended 31 December 2015 will be posted to shareholders shortly and

may also be obtained from the Company's head office at 19 Railway

Road, Dalkey, Dublin, Ireland.

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR UKSKRNWAVRAR

(END) Dow Jones Newswires

May 10, 2016 02:00 ET (06:00 GMT)

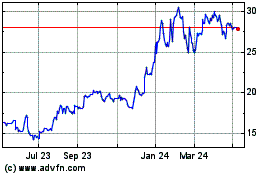

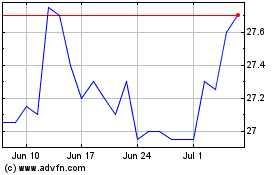

Hvivo (LSE:HVO)

Historical Stock Chart

From Jun 2024 to Jul 2024

Hvivo (LSE:HVO)

Historical Stock Chart

From Jul 2023 to Jul 2024