Indus Gas Limited Debt Refinancing (0983H)

22 November 2022 - 12:45AM

UK Regulatory

TIDMINDI

RNS Number : 0983H

Indus Gas Limited

21 November 2022

Indus Gas Limited

("Indus" or the "Company")

Debt Refinancing

PROPOSED EXCHANGE OFFER FOR US$150,000,000 8%SENIOR UNSECURED

NOTES DUE DECEMBER 2022 (ISIN: XS1734080648 ) (THE "EXISTING

NOTES") OF ITS US$300,000,000 MULTICURRENCY MEDIUM TERM NOTE

PROGRAMME (THE "PROGRAMME")

The Board of Directors of Indus is pleased to announce that, as

part of the Company's continuing capital and liability management

initiatives to optimise its debt capital structure, it has today

commenced an invitation to the holders of the Notes (the

"Noteholders") to exchange any and all of the Existing Notes held

by the Eligible Holders (the "Exchange Offer"), subject to the

terms and conditions of the Exchange Offer Memorandum dated 21

November 2022 issued by the Company ("Exchange Offer

Memorandum").

Capitalised terms used in this announcement but not otherwise

defined shall have the meanings given to those in the Exchange

Offer Memorandum.

The Company is pleased to announce that it has mandated Phillip

Securities Pte. Ltd. as the Dealer Manager and Deutsche Bank AG,

Hong Kong Branch as the Tabulation and Exchange Agent.

The Company is offering to exchange any and all of the Existing

Notes held by the Eligible Holders for the exchange consideration

for each US$1,000 principal amount of the outstanding Existing

Notes that is validly tendered prior to the Exchange Expiration

Deadline (as defined below)and accepted for exchange (the "Exchange

Consideration") consisting of the following:

(a) US$1,000 in aggregate principal amount of the US$

denominated 8.00% Senior Unsecured Notes due 2027 (the "New

Notes");

(b) any Accrued Interest; and

(c) cash in lieu of any fractional amount of New Notes.

The Company will also conduct a concurrent offering to issue and

sell additional New Notes for up to US$25,000,000 (" Concurrent New

Money Issuance ") and together with the Exchange Offer, the New

Notes may aggregate up to US$175,000,000. Upon issuance, any

additional New Notes sold in the Concurrent New Money Issuance will

be on the same terms and form a single series with the

corresponding New Notes issued under the Exchange Offer.

The Exchange Offer will commence on 21 November 2022 and will

expire at 4.00 p.m. (Singapore time) on 28 November 2022, unless

extended or earlier terminated (such date and time, as may be

extended, the "Exchange Expiration Deadline") . The Company

anticipates that the Settlement Date will occur on or about 30

November 2022, unless the Exchange Offer is extended or earlier

terminated. The Company may, in its sole and absolute discretion,

extend the Exchange Expiration Deadline for any purpose. The

Company will notify the Noteholders of any such amendment or

extension as soon as is practicable after the relevant decision is

made by release of an announcement on the SGX-ST website.

Eligible Holders may accept the Exchange Offer prior to the

Exchange Expiration Deadline by submitting a valid electronic

instruction to the relevant Clearing System in accordance with the

requirements of the relevant Clearing System.

The Exchange Offer Memorandum will be made available on the

Company's website shortly for Eligible Holders of the Existing

Notes to read.

Further announcements will be made as a when appropriate.

Noteholders must read this announcement in conjunction with the

Exchange Offer Memorandum. The Exchange Offer Memorandum contains

important information which should be read carefully before any

decision is made with respect to the Exchange Offer. If any

Noteholder is in doubt as to the action it should take, it is

recommended to seek its own financial and legal advice, including

in respect of any tax consequences, immediately from its

stockbroker, bank manager, solicitor, accountant or other

independent financial adviser. Any individual or company whose

Notes are held on its behalf by a broker, dealer, bank, custodian,

trust company or other nominee must contact such entity if it

wishes to participate in the Exchange Offer. None of the Company,

the Subsidiary Guarantors, the Dealer Manager, the Tabulation and

Exchange Agent, and the Trustee makes any recommendation as to

whether or not or how Noteholders should participate in the

Exchange Offer.

For further information please contact:

Indus Gas Limited

+44 (0) 20 8133

Jonathan Keeling 3375

Strand Hanson Limited (Nominated and Financial

Adviser)

+44 (0) 20 7409

Ritchie Balmer, Rory Murphy 3494

Arden Partners plc (Broker)

+44 (0) 20 7614

Equity Sales: James Reed-Daunter 5900

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCFELFDFEESEDF

(END) Dow Jones Newswires

November 21, 2022 08:45 ET (13:45 GMT)

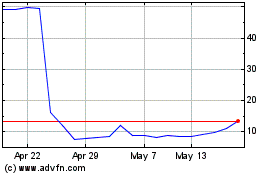

Indus Gas (LSE:INDI)

Historical Stock Chart

From Nov 2024 to Dec 2024

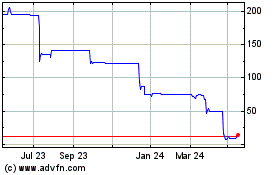

Indus Gas (LSE:INDI)

Historical Stock Chart

From Dec 2023 to Dec 2024