TIDMIQAI

RNS Number : 5460J

IQ-AI Limited

17 August 2023

17 August 2023

IQ-AI Limited (the "Company" or the "Group")

Half Yearly Report for the Period Ended 30 June 2023

The Board of IQ-AI Ltd is pleased to announce the Company's half

yearly report for the period ended 30 June 2023.

For further information, please contact:

IQ-AI Limited

Trevor Brown/Vinod Kaushal/Brett

Skelly +44 (0)207 469 0930

Peterhouse Capital Limited

Lucy Williams/Heena Karani +44 (0)207 220 9797

Chief Executive's Statement

Financial Highlights

More than 45 different hospitals and healthcare systems are at

varying stages of evaluating our software, with more sites entering

the sales pipeline. This step-change in pre-sales activity is

approximately a seven-fold increase over previous periods and is

due, in large part, to the traction gained from our platform

partners including TeraRecon (Eureka) and Bayer (Calantic). These

partners have the medical expertise and marketing reach to sell our

technologies into large existing installed customer bases and have

ample sales and marketing resources to win clients.

It is a relatively easy up-sell for IB's partners' sales teams

to activate IB's technology on platforms already being used

clinically. The number of sites evaluating our software continues

to increase. Thus, we are optimistic about the revenue activity and

anticipate a step-change starting in the 2(nd) half of 2023.

Phase 1 clinical trial (IB003, gallium maltolate)

Primary Objectives of the Phase 1 clinic trial:

-- To determine the maximum-tolerated dose (MTD) and recommended

phase 2 dose (RP2D) of gallium maltolate (GaM)

-- To determine safety and tolerability of GaM

Secondary Objectives

-- To preliminarily identify signals of antitumoral activity of

GaM within the confines of a phase 1 study

-- To determine if GaM increases progression free survival (PFS)

and overall survival (OS) in patients with recurrent glioblastoma

multiforme (GBM)

The Phase 1 clinical trial being conducted at the Medical

College of Wisconsin (MCW, Milwaukee, WI) is generating steadily

increased attention, including recent exposure on TV, focussed on

the promising potential of addressing a drastically unmet clinical

need for patients.

On March 11, 2022, the trial was opened for enrolment of adult

patients with recurrent GBM, a devastating disease with a dismal

prognosis. The goal of the phase 1 trial is to determine the MTD of

GaM, the highest dose humans can take without serious side effects.

Over the past 18 months, the trial's dose escalation protocol has

been followed with encouraging results.

In response to how well patients are tolerating the agent and to

meet the goal of the phase 1, defining the MTD, the clinical team

is preparing an amendment to the original study protocol. The

amendment will expand the targeted enrolment from 24 to 36 subjects

and allow for continued dose escalation. The MTD determined in

Phase 1 will define the "recommended phase II dose" (RP2D) that

will be used in the Phase 2 trial. This amendment is the fastest

and most efficient way to satisfy the primary goal of the Phase

1.

Given the expanded target enrolment and assuming the strong

momentum in patient enrolment continues, it is anticipated that

Phase 1 will close in 2024. After enrolment closes, the last

patients enrolled will remain on the trial until all required study

data is collected. Analysing the data and documenting the phase 1

results is expected to be completed in the second half of 2024.

While the MTD is being determined in the final stages of Phase

1, the clinical team will complete the Phase 2 protocol. The Phase

2 trial is designed to evaluate preliminary evidence of efficacy.

Ideally, the Phase II trial will open for patient recruitment in

early 2025. This will be a multi-centre trial with a tentative

target enrolment of approximately 65 patients over a three-year

duration. The design of the Phase 2 study is currently being

defined. Factors such as the Phase 1 results and whether the study

will be a comparison to historical controls or if it will be

randomized (comparing patients with standard treatment alone

against those receiving standard treatment with GaM) will influence

the overall scope and cost.

The multi-site Phase 2 trial will require new funding which we

anticipate will come substantially from a partnership arrangement

with a large pharmaceutical company and grants, including those

from charitable foundations and other institutions. We anticipate

publishing frequent updates to our shareholders as developments

unfold.

We are evaluating an Early Access Program (EAP), also known as

Compassionate Use, to formally provide access to the agent to a

larger number of patients. The EAP would fall under the umbrella of

the existing Investigational New Drug (IND) application, and it is

not meant to supplant the Phase 2 trial. Instead, the data

collected in the EAP would be used to augment Phase 2 data in

support of regulatory approval. In addition, the EAP can be used to

better understand new variables, such as using the agent in

combination with other FDA approved treatments and to allow

patients who otherwise may not be eligible for the phase 2, due to

location or a disqualifying condition, to receive the drug. The FDA

allows for cost recovery in EAPs. As an unapproved agent, patients

would have to incur these costs.

Assuming positive outcomes (preliminary evidence of efficacy)

during phase 2, i.e., indications of therapeutic efficacy the final

and last phase, phase 3, would be open for enrolment in early 2029.

Another three-year study duration is anticipated for this phase,

and the data of the Phase 3 would ultimately be used for regulatory

approval by the US FDA. While this timeline represents a typical

pathway for new drug approvals, we are hopeful for a possible

accelerated approval pathway.

In February 2023, following our application, the US FDA granted

Orphan Drug Designation (ODD) status to GaM for the treatment of

GBM and in June 2023, the FDA confirmed this status also applies to

paediatric populations. In the US, an orphan drug is defined as one

intended to treat, prevent, or diagnose rare diseases that affect

less than 200,000 persons annually. Designation of a drug as an

"orphan" has yielded medical breakthroughs that may not have

otherwise been achieved. This is due to the various incentives and

reduced fees that help companies offset the costs of development of

orphan drugs, not to mention seven years market exclusivity

post-approval.

While ODD is granted for GaM for the treatment of GBM, the

anti-tumour mechanism of GaM, which has been explained previously,

applies to other solid tumours. For example, in June 2023, two

abstracts were presented at the Society of Neuro Oncology (SNO)

Paediatric Conference in Washington, DC using oral GaM in that

demonstrated GaM's anti-tumor mechanism in paediatric atypical

teratoid rhabdoid tumor (ATRT) and glioblastoma multiforme (GBM).

Each pre-clinical study, led by Dr. Mona Al-Gizawiy, PhD from the

lab of Dr. Kathleen Schmainda at MCW, doubled median life

expectancy. Given the ODD status for paediatric GBM and the results

of these studies, we are considering a phase 1 study in children

and have initiated discussions with several sites who have

expressed a collaborative interest. In addition, paediatric brain

tumour research and development receive significant philanthropic

funding. Consortiums of non-profits exist that help fund clinical

trials for children, either partially or in their entirety. We have

already made connections and introduced our progress to one

organization. In turn, they identified several hospitals with whom

they have established relationships.

The ultimate objective of our program is to obtain regulatory

approval for a medicine that could offer a positive impact on the

length and quality of life for patients who otherwise have no other

options. As the trial process continues, our efforts to identify

and secure an accelerated regulatory approval pathway will also

continue. Pathways, such as Fast Track Designation and Paediatric

Rare Disease Priority Review Voucher (PRD-PRV), exist to expedite

the development, review, and approval of promising drugs that treat

diseases such as GBM and paediatric cancers.

Assuming the studies prove GaM to be safe and efficacious, a

submission to the FDA for regulatory approval will be prepared. If

granted, the Directors believe that the commercial impact would be

transformational for IQAI. In the interim, subject to positive

outcomes to the Phase 1 and Phase 2 trials, we expect that

potential discussions with pharma partners to become increasingly

productive.

Outlook

Our objective for the remainder of the year is to convert as

many of the 45 sites currently evaluating IB Software, to client

status though sales and to harness the momentum from the Phase 1

clinical trial to accelerate the planning for a Phase 2 trial.

Trevor Brown

Chief Executive

Results for the 2023 interim financial period

A summary of the key financial results is set out in the table

below:

30 June 2023

GBP

-------------------------------------------------- -------------

Revenue 282,652

-------------------------------------------------- -------------

Gross Profit 278,610

-------------------------------------------------- -------------

Operating expenses (573,772)

-------------------------------------------------- -------------

Finance costs (5,311)

-------------------------------------------------- -------------

Loss for the period from discontinued operations -

-------------------------------------------------- -------------

Loss for the period (300,473)

-------------------------------------------------- -------------

Interest

The net interest cost for the Group for the period was GBP5,311

(2022: GBP5,311).

Loss before tax

Loss before tax for the period was GBP300,473 (2022:

GBP330,584).

Taxation

Taxation charge was GBPnil for the period (2022: GBPnil).

Earnings per share

Basic and diluted earnings per share for the period were 0.16p

loss (2022: 0.18p loss).

Financial position

The Group's balance sheet as at 30 June 2023 can be summarised

as set out in the table below:

Net assets

GBP'm

GBP

----------------------------- -----------

Non-current assets 669,499

----------------------------- -----------

Net current liabilities -253,424

Net assets and total equity 416,075

----------------------------- -----------

Cash flow

Net cash outflow for the period was GBP223,779 (2022: GBP373,854

outflow).

Consolidated Income Statement

For the six months ended 30 June 2023

Half year ended (Audited) Full year ended Half year

ended

30 Jun 2023 31 Dec 2022 30 Jun 2022

GBP GBP GBP

Continuing operations

Revenue 282,652 535,886 255,609

Cost of sales (4,042) (1,782) 2,457

---------------------------------------------------------- ---------------- -------------------------- ------------

Gross profit 278,610 534,104 258,066

Administrative expenses (573,777) (1,035,005) (583,346)

Other income 5 10 7

---------------------------------------------------------- ---------------- -------------------------- ------------

Operating loss (295,162) (500,891) (325,273)

Finance costs (5,311) (10,710) (5,311)

Loss before income tax (300,473) (511,601) (330,584)

Income tax - - -

Loss for the year from continuing operations (300,473) (511,601) (330,584)

Discontinued operations

Loss for the period from discontinued operations - - -

Loss for the year attributable to owners of the Company (300,473) (511,601) (330,584)

Earnings per share attributable to owners of the Company

From continuing operations:

Basic & diluted (pence per share) (0.16) (0.28) (0.18)

From discontinued operations:

Basic & diluted (pence per share) (0.00) (0.00) (0.00)

Total earnings per share (pence per share) (0.16) (0.28) (0.18)

Consolidated Statement of Comprehensive Income

For the six months ended 30 June 2023

Half year (Audited) Full year ended Half year

ended ended

30 Jun 2023 31 Dec 2022 30 Jun 2022

GBP GBP GBP

------------------------------------------------------------- ----------- ----------------------------- -----------

Loss for the period (300,473) (511,601) (330,584)

------------------------------------------------------------- ----------- ----------------------------- -----------

Other comprehensive income

------------------------------------------------------------- ----------- ----------------------------- -----------

Items that may be subsequently reclassified as profit or loss

Exchange differences on translation of foreign operations 3,241 (2,593) (16,956)

------------------------------------------------------------- ----------- ----------------------------- -----------

Total comprehensive loss for the year attributable to the

owners of the Company (297,232) (514,194) (347,540)

------------------------------------------------------------- ----------- ----------------------------- -----------

Total comprehensive loss for year arises from:

Continuing operations (297,232) (514,194) (347,540)

Discontinuing operations - - -

------------------------------------------------------------- ----------- ----------------------------- -----------

(297,232) (514,194) (347,540)

------------------------------------------------------------- ----------- ----------------------------- -----------

Consolidated Balance Sheet

As at 30 June 2023

(Audited)

30 Jun 2023 31 Dec 2022 30 Jun 2022

GBP GBP GBP

Non-current assets

------------------------------------------------------------------------ -------------- ------------- -------------

Property, plant and equipment 2,867 4,233 5,426

Goodwill 214,044 220,224 219,263

Intangible assets 452,588 531,866 591,111

------------------------------------------------------------------------ -------------- ------------- -------------

Total non-current assets 669,499 756,323 815,800

------------------------------------------------------------------------ -------------- ------------- -------------

Current assets

------------------------------------------------------------------------ -------------- ------------- -------------

Trade and other receivables 355,520 197,273 166,025

Cash 90,206 313,985 354,732

Assets classified as held for sale - - -

------------------------------------------------------------------------ -------------- ------------- -------------

Total current assets 445,727 511,258 520,757

Current liabilities

------------------------------------------------------------------------ -------------- ------------- -------------

Trade and other payables 699,151 560,508 514,959

Liabilities directly associated with assets classified as held for sale - - -

Total current liabilities 699,151 560,508 514,959

Net current assets/(liabilities) (253,424) (49,250) 5,798

------------------------------------------------------------------------ -------------- ------------- -------------

NET ASSETS 416,075 707,073 821,598

Equity

Share capital 1,826,214 1,826,214 1,826,214

Share premium 20,553,499 20,553,499 20,553,499

Capital redemption reserve 23,616 23,616 23,616

Merger reserve 160,000 160,000 160,000

Convertible loan note reserve 223,095 217,784 212,385

Share based payment reserve 81,696 81,696 71,808

Foreign currency reserve 25,228 21,064 (30,141)

Retained losses (22,477,273) (22,176,800) (21,995,783)

------------------------------------------------------------------------ -------------- ------------- -------------

Equity attributable to owners of the Company 416,075 707,073 821,598

TOTAL EQUITY 416,075 707,073 821,598

------------------------------------------------------------------------ -------------- ------------- -------------

Consolidated statement of changes in equity

For the six months ended 30 June 2023

Share Share Capital Merger Convertible Share Foreign Retained TOTAL

Capital premium redemption reserve loan note based currency losses EQUITY

reserve reserve payment reserve

reserve

GBP GBP GBP GBP GBP GBP GBP GBP GBP

-------------- --------- ---------- ---------- -------- ----------- -------- --------- ------------ ---------

Balance at 1

January 2022 1,825,076 20,547,343 23,616 160,000 207,024 71,808 20,973 (21,665,199) 1,190,691

-------------- --------- ---------- ---------- -------- ----------- -------- --------- ------------ ---------

Loss for the

year - - - - - - - (511,601) (511,601)

Exchange

differences

on

translation

of foreign

operations - - - - - - (2,593) - (2,593)

-------------- --------- ---------- ---------- -------- ----------- -------- --------- ------------ ---------

Total

comprehensive

loss for the

year - - - - - - (2,593) (511,601) (514,194)

-------------- --------- ---------- ---------- -------- ----------- -------- --------- ------------ ---------

Shares issued 1,138 6,156 - - - - - - 7,294

Cost of shares - - - - - - - - -

issued

Share based

payments - - - - - 9,888 - - 9,888

Movement in

the year - - - - 10,710 - 2,684 - 13,394

Balance at 31

December 2022 1,826,214 20,553,499 23,616 160,000 217,784 81,696 21,064 (22,176,800) 707,073

-------------- --------- ---------- ---------- -------- ----------- -------- --------- ------------ ---------

Loss for the

period - - - - - - - (300,473) (300,473)

Exchange

differences

on

translation

of foreign

operations - - - - - - 3,241 - 3,241

-------------- --------- ---------- ---------- -------- ----------- -------- --------- ------------ ---------

Total

comprehensive

loss for the

period - - - - - - 3,241 (300,473) (297,232)

-------------- --------- ---------- ---------- -------- ----------- -------- --------- ------------ ---------

Shares issued - - - - - - - - -

Share based - - - - - - - - -

payments

Movement in

the period - - - - 5,311 - 923 - 6,234

-------------- --------- ---------- ---------- -------- ----------- -------- --------- ------------ ---------

Balance at 30

June 2023 1,826,214 20,553,499 23,616 160,000 223,095 81,696 25,228 (22,477,274) 416,075

-------------- --------- ---------- ---------- -------- ----------- -------- --------- ------------ ---------

Consolidated Cash Flow Statement

For the six months ended 30 June 2023

Half year (Audited) Half year

ended Full year ended

30 Jun ended 30 Jun 2022

2023 31 Dec 2022

GBP GBP GBP

-------------------------------------- --------- ------------ -------------

Cash flows from operating activities:

Operating loss (300,473) (511,601) (330,584)

Adjustment for:

Depreciation and amortisation 53,790 140,609 69,704

Impairment of intangible assets - - -

Fees in exchange for shares - 7,293 7,293

Share based payment expense - 9,888 -

Foreign exchange loss 37,197 (80,207) (125,842)

Finance costs 5,311 10,710 5,311

Increase in receivables (158,247) (119,084) (87,836)

Increase/(Decrease) in payables 138,643 167,722 122,172

Net cash used in operating activities (223,779) (374,671) (339,782)

-------------------------------------- --------- ------------ -------------

Cash flows from investing activities

Purchase of equipment - (1,525) (2,129)

Purchase of intangible assets - (38,405) (31,943)

Net cash used in investing activities - (39,930) (34,072)

-------------------------------------- --------- ------------ -------------

Cash flows from financing activities

Shares issued - - -

Cost of shares issued - - -

Less shares issued arising from

convertible loan notes - - -

Convertible loan notes - - -

Unclaimed dividends - - -

Interest cost - - -

Net cash from financing activities - - -

-------------------------------------- --------- ------------ -------------

Net decrease in cash and cash

equivalents (223,779) (414,601) (373,854)

-------------------------------------- --------- ------------ -------------

Cash and cash equivalents brought

forward 313,985 728,586 728,586

Effects of exchange rate changes - - -

on cash and cash equivalents

-------------------------------------- --------- ------------ -------------

Cash and cash equivalents carried

forward 90,206 313,985 354,732

-------------------------------------- --------- ------------ -------------

Summary of significant accounting policies

IQ-AI Limited (the "Company") is a limited liability company

incorporated and domiciled in Jersey.

The financial statements are presented in pounds sterling (GBP)

since that is the currency of the primary environment in which the

Group and Company operates.

The principal accounting policies applied in the preparation of

these financial statements are set out below. These policies have

been consistently applied to all the years presented, unless

otherwise stated.

Basis of preparation

These financial statements have been prepared and approved by

the Directors in accordance with International Financial Reporting

Standards (IFRS) and IFRIC interpretations (IFRS IC) as adopted by

the European Union.

The financial statements have been prepared under the historical

cost convention, as modified for the assets held for sale measured

at fair value less costs to sell.

The preparation of financial statements in conformity with IFRS

requires the use of certain critical accounting estimates. It also

requires management to exercise its judgement in the process of

applying the accounting policies. The areas involving a higher

degree of judgement or complexity, or areas where assumptions and

estimates are significant to the financial statements, are

disclosed under the heading 'Critical accounting estimates and

judgements' below.

Going concern

The Group's business activities, together with the factors

likely to affect its future development, performance and position

are set out in the Chief Executive Officer's Statement.

The current economic conditions continue to create uncertainty,

particularly over (a) the level of demand for the group's products;

and (b) the availability of finance for the foreseeable future. The

group's forecasts and projections, taking account of reasonably

possible changes in trading performance, show that additional

funding will be required either via an issue of equity or through

the issuance of convertible loan notes. The Directors are

reasonably confident that funds will be forthcoming if and when

they are required. The Chief Executive Officer has provided a

letter of financial support to the Group to make sufficient funds

available, if required, to ensure the Group can meet its

obligations over the going concern period.

Taking in to account the comments above, the Directors have, at

the time of approving the financial statements, a reasonable

expectation that the Company and the Group have adequate resources

to continue in operational existence for the foreseeable future.

Therefore, they continue to adopt the going concern basis of

accounting in preparing the financial statements

New standards, amendments and interpretations adopted by the

Group and Company

The following IFRS or IFRIC interpretations were effective for

the first time for the financial year beginning 1 January 2022.

Their adoption has not had any material impact on the disclosures

or on the amounts reported in these financial statements:

Standards /interpretations Application

--------------------------- ------------------------------------------------

IAS 1 & IAS 8 amendments Definition of Material

IFRS 3 amendments Business Combinations

IFRS 16 Amendments to provide lessees with an exemption

from assessing whether a COVID-19 related

rent concession is a lease modification

New standards, amendments and interpretations not yet

adopted

Standards /interpretations Application

--------------------------- -----------------------------------------------------

IAS 1 amendments Presentation of Financial Statements: Classification

of Liabilities as Current or Non-Current.

Effective: Annual periods beginning on

or after 1 January 2023

IFRS 3 amendments Business Combinations - Reference to the

Conceptual Framework.

Effective: Annual periods beginning on

or after 1 January 2022

IFRS 7, IFRS 9, Amendments regarding replacement issues

IFRS 16 in the contract of IBOR reform.

Effective: Annual periods beginning on

or after 1 January 2021

IFRS 16 Amended by Covid-19 Related Rent Concessions

beyond 30 June 2021 (amendment to IFRS

16)

Effective: Annual periods beginning on

or after 1 April 2021

IAS 1 amendments Presentation of Financial Statements: Classification

of Liabilities as Current or Non-Current.

Effective: Annual periods beginning on

or after 1 January 2023

There are no IFRS's or IFRIC interpretations that are not yet

effective that would be expected to have a material impact on the

Company or Group.

Basis of consolidation

The Group financial statements consolidate the financial

statements of the Company and all its subsidiaries ("the Group").

Subsidiaries include all entities over which the Group is exposed,

or has rights, to variable returns from its involvement with the

investee and has the ability to affect those returns through its

power over the investee. The existence and effect of potential

voting rights that are currently exercisable or convertible are

considered when assessing whether the Group controls another

entity. Subsidiaries are consolidated from the date on which

control commences until the date that control ceases. Intra-group

balances and any unrealised gains and losses on income or expenses

arising from intra-group transactions, are eliminated in preparing

the consolidated financial statements.

The acquisition method of accounting is used to account for

business combinations. The cost of an acquisition is measured as

the fair value of the assets given, equity instruments issued, and

liabilities incurred or assumed at the date of exchange, and the

equity interests issued. Identifiable assets acquired, and

liabilities and contingent liabilities assumed in a business

combination are measured initially at their fair value at the

acquisition date. Acquisition related costs are expensed as

incurred. Where necessary, amounts reported by subsidiaries have

been adjusted to conform with the Group's accounting policies.

Investments in subsidiaries

Investments in subsidiaries are held at cost less any

impairment.

Goodwill

Goodwill on acquisition of subsidiaries represents the excess of

the cost of acquisition over the fair value of the Group's share of

the identifiable net assets and contingent liabilities acquired.

Identifiable assets are those which can be sold separately, or

which arise from legal rights regardless of whether those rights

are separable. Goodwill on acquisition of subsidiaries is included

in intangible assets. Goodwill is not amortised but is tested

annually, or when trigger events occur, for impairment and is

carried at cost less accumulated impairment losses.

Segment reporting

An operating segment is a component of the Group that engages in

business activity from which it may earn revenues and incur

expenses, including revenues and expenses that relate to

transactions with and of the Group's other components. All

operating segments' operating results, for which discrete financial

information is available, are reviewed regularly by the Group's

Board to make decisions about resources to be allocated to the

segment and assess its performance. As a result of the acquisition

during the year, the Group reports on a two-segment basis - holding

company expenses and medical software.

Foreign Currency Translation

Foreign currency transactions are translated into the functional

currency using the exchange rates prevailing at the dates of the

transactions. Foreign exchange gains and losses resulting from the

settlement of such transactions and from the translation at

year-end exchange rates of monetary assets and liabilities

denominated in foreign currencies are recognised in the income

statement. Foreign exchange gains and losses are presented in the

income statement within 'finance income or costs.'

The results and financial position of Group entities that have a

functional currency different from the presentation currency are

translated into the presentation currency as follows:

-- assets and liabilities for each Statement of Financial

Position presented are translated at the closing rate at the date

of that Statement of Financial Position;

-- income and expenses for each Income Statement presented are

translated at average exchange rates (unless this average is not a

reasonable approximation of the cumulative effect of the rates

prevailing on the transaction dates, in which case income and

expenses are translated at the rate on the dates of the

transactions); and

-- all resulting exchange differences are recognised in other comprehensive income.

Goodwill and fair value adjustments arising on the acquisition

of a foreign entity are treated as assets and liabilities of the

foreign entity and translated at the closing rate. Exchange

differences arising are recognised in other comprehensive

income.

Intangible Assets - Intellectual property and internally

generated software

Separately acquired intellectual property is shown at historic

cost. Intellectual property acquired in a business combination is

recognised at fair value at the acquisition date. Amortisation is

calculated using the straight-line method over the estimated useful

life of up to 5 years.

Development costs that are directly attributable to the design

and testing of identifiable and unique software products controlled

by the Group are recognised as intangible assets when the following

criteria are met:

-- it is technically feasible to complete the software product

so that it will be available for use;

-- management intends to complete the software product and use or sell it;

-- there is an ability to use or sell the software product;

-- it can be demonstrated how the software product will generate

probable future economic benefits;

-- adequate technical, financial and other resources to complete

the development and use or sell the software product are available;

and

-- the expenditure attributable to the software product during

its development can be reliably measured.

Directly attributable costs that are capitalised as part of the

software product include the software development employee costs

and an appropriate portion of relevant overheads.

Other development expenditure that does not meet these criteria

is recognised as an expense as incurred.

Development costs previously recognised as an expense are not

recognised as an asset in a subsequent period.

Software development costs recognised as assets are amortised

over their estimated useful lives, which do not exceed 5 years.

Amortisation commences when regulatory approval is obtained, and

the product is commercially available.

Impairment of Non-Financial Assets

Intangible assets that have an indefinite useful life or

intangible assets not ready to use are not subject to amortisation

and are tested annually for impairment. Assets that are subject to

amortisation are reviewed for impairment whenever events or changes

in circumstances indicate that the carrying amount may not be

recoverable. An impairment loss is recognised for the amount by

which the asset's carrying amount exceeds its recoverable amount.

The recoverable amount is the higher of an asset's fair value less

costs of disposal and value in use. For the purposes of assessing

impairment, assets are grouped at the lowest levels for which there

are largely independent cash inflows (cash-generating units). Prior

impairments of non-financial assets (other than goodwill) are

reviewed for possible reversal at each reporting date.

Financial instruments

Financial assets and financial liabilities are recognised in the

Group's balance sheet when the Group becomes a party to the

contractual provisions of the instrument.

Financial assets

The Group classifies its financial assets in the following

categories financial assets as "at fair value through profit and

loss" and "loans and receivables". The classification depends on

the nature and purpose of the financial assets and is determined at

the time of initial recognition. Management determines the

classification of its financial assets at initial recognition.

Loans and receivables

Trade receivables are amounts due from customers for merchandise

sold or services performed in the ordinary course of business.

Trade receivables are held with the objective of collecting the

contractual cash flows. If collection is expected in one year or

less (or in the normal operating cycle of the business if longer),

they are classified as current assets. If not, they are presented

as non-current assets.

Trade receivables are recognised initially at fair value, and

subsequently measured at amortised cost using the effective

interest method, less provision for impairment. The Group applies

the IFRS 9 simplified approach to measuring expected credit losses

which uses a lifetime expected loss allowance for all trade

receivables and contract assets.

Due to the short-term nature of the other current receivables,

their carrying amount is considered to be the same as their fair

value.

A financial asset is assessed at each reporting date to

determine whether there is any evidence that it is impaired. A

financial asset is considered impaired if objective evidence

indicates that one or more events have had a negative effect on the

estimated future cash flows of that asset. Individual significant

financial assets are tested for impairment on an individual basis.

The remaining financial assets are assessed collectively in groups

that share similar credit risk characteristics. All impairment

losses are recognised in the consolidated income statement.

Cash and cash equivalents

Cash and cash equivalents include cash in hand, deposits held at

call with banks and other short-term highly liquid investments with

maturities of three months or less. In the consolidated Statement

of Financial Position, bank overdrafts are shown within borrowings

in current liabilities.

Financial liabilities and equity instruments issued by the

group

Financial liabilities and equity instruments are classified

according to the substance of the contractual arrangements entered

into. An equity instrument is any contract that evidences a

residual interest in the assets of the Group after deducting all of

its liabilities. Equity instruments issued by the Group are

recorded at the proceeds received, net of direct issued costs.

Non-Current Assets (or Disposal Groups) Held-for-Sale and

discontinued operations

Non-current assets (or disposal groups) are classified as assets

held for sale when their carrying amount is to be recovered

principally through a sale transaction and a sale is considered

highly probable. They are stated at the lower of carrying amount

and fair value less costs to sell. A discontinued operation is a

component of the Group that is classified as held for sale and that

represents a separate line of business or geographical area of

operations. The results of discontinued operations are presented

separately in the Consolidated Income Statement.

Convertible loan notes

The convertible loan note ("CLN") is a compound financial

instrument that can be converted to share capital at the option of

the holder. As the CLN, and the accrued interest, can only be

repaid by the issue of shares, it has been recognised in equity

only, with no liability component. Interest is accounted for on an

accruals basis and charged to the Consolidated Income Statement and

added to the carrying amount of the equity component of the

CLN.

Trade and other payables

Trade payables are obligations to pay for goods or services that

have been acquired in the ordinary course of business from

suppliers. Accounts payable are classified as current liabilities

if payment is due within one year or less (or in the normal

operating cycle of the business if longer). If not, they are

presented as non-current liabilities.

Trade and other payables are recognised initially at fair value,

and subsequently measured at amortised cost using the effective

interest method. The carrying amounts of trade and other payables

are considered to be the same as their fair values.

Share capital

Ordinary shares

Ordinary shares are classified as equity. Incremental costs

directly attributable to the issue of ordinary shares and share

options are recognised as a deduction from equity, net of any tax

effects, from the proceeds.

Share-Based Payments

The Company operates an equity-settled, share-based compensation

plan, under which the entity receives services from employees as

consideration for equity instruments (options) of the Company. The

fair value of the employee services received in exchange for the

grant of the options is recognised as an expense. The total amount

to be expensed is determined by reference to the fair value of the

options granted:

-- including any market performance conditions (for example, an entity's share price);

-- excluding the impact of any service and non-market

performance vesting conditions (for example, profitability or sales

growth targets, or remaining an employee of the entity over a

specified time period); and

-- including the impact of any non-vesting conditions (for

example, the requirement for employees to save or holding shares

for a specific period of time).

At the end of each reporting period, the group revises its

estimates of the number of options that are expected to vest based

on the non-market vesting conditions and service conditions. It

recognises the impact of the revision to original estimates, if

any, in the income statement, with a corresponding adjustment to

equity.

In addition, in some circumstances employees may provide

services in advance of the grant date and therefore the grant date

fair value is estimated for the purposes of recognising the expense

during the period between service commencement period and grant

date.

When the options are exercised, the company issues new shares.

The proceeds received net of any directly attributable transaction

costs are credited to share capital (nominal value) and share

premium.

The grant by the Company of options over its equity instruments

to the employees of subsidiary undertakings in the Group is treated

as a capital contribution. The fair value of employee services

received, measured by reference to the grant date fair value, is

recognised over the vesting period as an increase in investment in

subsidiary undertakings, with a corresponding credit to equity in

the parent entity accounts.

The social security contributions payable in connection with the

grant of the share options is considered an integral part of the

grant itself, and the charge will be treated as a cash-settled

transaction.

Revenue recognition

The group derives revenue from the transfer of goods and

services at a point in time and over time. Revenue from external

customers arise on the sales of software licences, including

associated maintenance, and consultancy services.

Revenue from licence sales is measured at the agreed transaction

price at a point in time. A receivable is recognised when access to

the software is granted, since this is the point in time that the

consideration is unconditional because only the passage of time is

required before the payment is due. Support and maintenance

services are provided on the product supplied; this is deemed to be

a separately identifiable product and is recognised over time.

Revenue from consulting services are recognised in the accounting

period in which the services are rendered.

Taxation

The Company is registered in Jersey, Channel Islands and is

taxed at the Jersey Company standard rate of 0%. However, the

Company's subsidiaries are situated in jurisdictions where taxation

may become applicable to local operations.

The major components of income tax on profit or loss include

current and deferred tax.

The tax currently payable is based on the taxable profit for the

period using the tax rates that have been enacted or substantially

enacted by the balance sheet date. Taxable profit differs from the

net profit as reported in the income statement because it excludes

items of income or expense that are taxable or deductible in other

years and it further excludes items that are never taxable or

deductible.

Deferred tax is provided in full, using the liability method, on

temporary differences arising between the tax bases of assets and

liabilities and their carrying amounts in the Group financial

statements. Deferred tax is determined using tax rates that have

been enacted or substantially enacted at the balance sheet date and

are expected to apply when the related deferred income tax asset is

realised of the deferred tax liability is settled.

Deferred tax assets are only recognised to the extent that it is

probable that future taxable profit will be available against which

the asset can be utilised. Deferred tax is charged or credited in

the income statement, except when it relates to items charged or

credited to equity, in which case the deferred tax is also dealt

with in equity.

Critical accounting estimates and judgements

Estimates and judgements are continually evaluated and are based

on historical experience and other factors, including expectations

of future events that are believed to be reasonable under the

circumstances.

Critical Accounting Estimates and Assumptions

The Group makes estimates and assumptions concerning the future.

The resulting accounting estimates will, by definition, seldom

equal the related actual results. The estimates and assumptions

that have a significant risk of causing a material adjustment to

the carrying amounts of assets and liabilities within the next

financial year are discussed below.

Fair value measurement

Management uses valuation techniques to determine the fair value

of assets held for sale. This involves developing estimates and

assumptions consistent with how market participants would price the

instrument. Management bases its assumptions on best observable

data available as far as possible. Estimated fair values may vary

from the actual prices that would be achieved in an arm's length

transaction at the reporting date.

Critical judgments in applying the entity's accounting

policies

The following are the critical judgements that the Directors

have made in the process of applying the Group's accounting

policies and that have the most significant effect on the amounts

recognised in the financial statements.

Capitalisation of internally developed software

Distinguishing the research and development phases of the

software suites and determining whether the recognition

requirements for the capitalisation of development costs are met

requires judgement. After capitalisation, management monitors

whether the recognition requirements continue to be met and whether

there are any indicators that capitalised costs may be

impaired.

Earnings per share

Basic and diluted

Earnings per share is calculated by dividing the loss

attributable to the equity holders of the Company by the weighted

average number of Ordinary shares in issue during the period,

excluding Ordinary shares purchased by the Company and held as

treasury shares.

Half year Audited Half year

ended Full year ended ended

30 Jun 2023 31 Dec 2022 30 Jun 2022

------------------------------------------ ----------- ---------------- -----------

Loss attributable to equity

holders of the Company (GBP) (300,473) (511,601) (330,584)

Loss from discontinued operation - -

attributable to equity holders

of the parent (GBP)

Weighted average number of

shares in issue (number) 182,621,390 182,609,544 182,595,616

Loss per share (pence)

-From continuing operations (0.16) (0.28) (0.18)

-From discontinued operations (0.00) (0.00) (0.00)

------------------------------------------ ----------- ---------------- -----------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR EALPKFLNDEFA

(END) Dow Jones Newswires

August 17, 2023 02:00 ET (06:00 GMT)

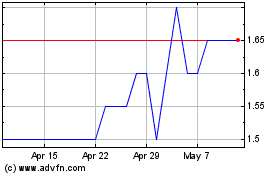

Iq-ai (LSE:IQAI)

Historical Stock Chart

From Mar 2025 to Apr 2025

Iq-ai (LSE:IQAI)

Historical Stock Chart

From Apr 2024 to Apr 2025