Jangada Mines PLC Further CAD$1m Received From ValOre (3463T)

14 November 2019 - 6:00PM

UK Regulatory

TIDMJAN

RNS Number : 3463T

Jangada Mines PLC

14 November 2019

Jangada Mines plc / EPIC: JAN.L / Market: AIM / Sector:

Mining

14 November 2019

Jangada Mines plc ('Jangada' or the 'Company')

Further CAD$1m Received From ValOre

Jangada Mines plc, a natural resources company, is pleased to

announce that it has received a further CAD$1m in cash from PBBM

Holdings Ltd., a wholly owned subsidiary of TSX-V listed company

ValOre Metals Corp. ('ValOre'), in relation to the disposal of the

Company's previously owned project, Pedra Branca Brasil Mineracao

Ltda ('Pedra Branca'), which was announced on 15 August 2019.

Under the terms of the binding share purchase agreement, Jangada

sold Pedra Branca to ValOre for a total consideration of 25,000,000

ValOre common shares and cash payments totalling CAD$3m, which are

payable in several tranches. ValOre has now paid the second cash

tranche of CAD$1m to Jangada, meaning a total of CAD$2m in cash and

22,000,000 ValOre common shares have been received by Jangada. A

final cash payment of CAD$1m is payable in three months from now,

as well as up to 3,000,000 ValOre common shares, payable in

six-monthly instalments of 500,000 shares each over the next three

years. The first instalment of 500,000 shares is due in

approximately three months from now.

Jangada currently has a circa 25 per cent interest in ValOre,

which is advancing, alongside its other projects, the development

of Pedra Branca; it recently published a Q4 Update Presentation on

its website, which highlights the value drivers and near term

expansion potential of Pedra Branca: https://bit.ly/34iapwE.

Jangada is using the cash received to date from the sale of

Pedra Branca to develop the Pitombeiras Vanadium Project in Ceara

State, Brazil ("the Project"), which has a JORC (2012) Exploration

Target of between 40 Mt to 60 Mt tonnes at 0.3% to 0.6% V2O5, 40%

to 55% Fe2O3 and 8% to 10% TiO2. On 4 November 2019, the Company

provided an update on its exploration programme at the Project

following the highly encouraging results obtained so far, which

highlighted the significant potential of this vanadium, titanium,

iron project. At the end of the planned exploration schedule and

along with the conclusions of the logistics study, the Company will

have substantial information to prepare a robust preliminary

economic assessment in Q1 2020.

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulations (EU) No. 596/2014 ("MAR").

ENDS

For further information please visit www.jangadamines.com or

contact:

Jangada Mines plc Brian McMaster (Chairman) Tel: +44 (0) 20

7317 6629

Strand Hanson Limited James Spinney Tel: +44 (0)20 7409

(Nominated & Financial Ritchie Balmer 3494

Adviser) Jack Botros

Brandon Hill Capital Jonathan Evans Tel: +44 (0)20 3463

(Broker) Oliver Stansfield 5000

St Brides Partners Isabel de Salis Tel: +44 (0)20 7236

Ltd David Penson 1177

(Financial PR)

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

MSCCKNDPCBDDQDD

(END) Dow Jones Newswires

November 14, 2019 02:00 ET (07:00 GMT)

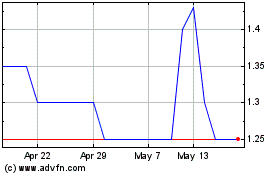

Jangada Mines (LSE:JAN)

Historical Stock Chart

From Jun 2024 to Jul 2024

Jangada Mines (LSE:JAN)

Historical Stock Chart

From Jul 2023 to Jul 2024