AGM Statement

15 July 2004 - 11:00PM

UK Regulatory

RNS Number:8824A

John David Group (The) PLC

15 July 2004

15 July 2004

THE JOHN DAVID GROUP PLC

AGM TRADING UPDATE

At the AGM being held at 1pm today, The John David Group PLC (the "Group"), a

leading retailer of fashionable branded sportswear and fashion apparel, will

provide the following trading update to shareholders:

On 11 May 2004 in the Preliminary Announcement of the Group's results for the

year ended 31 January 2004, we reported overall like for like sales growth of

0.9% for the thirteen weeks ended 1 May 2004 and also that the growth in the

core Sports Fascia was 2.5%. We are pleased to say that this trend has continued

with the respective figures for the twenty three weeks ended 10 July 2004 being

0.9% and 2.6%.

Overall margins have continued to be on plan despite the impact of clearance

activity in the Fashion Fascias which continue to trade disappointingly as a

result of stock buying decisions made in 2003. We are focussed on addressing the

long term profitability of the Fashion Fascias (which represent less than 10% of

the Group's turnover) but this requires short term pain as stocks are cleansed.

Our continued stronger performance in the Sports Fascias means that the Group's

performance is in line with current market expectations and stocks are being

maintained below last year's levels.

During the twenty three weeks ended 10 July 2004 we have opened 6 stores and

closed 12 stores including four clearance stores with negligible change in

overall selling space. We do not expect new store openings to be more than 12 in

the current year but we are continuing to dispose of poor performing stores

wherever it is economically beneficial for us to do so.

Last week we announced that John Wardle, one of our founding shareholders and a

non-executive Director, had sold an 11.5% stake in the Company to a subsidiary

of Pentland Group plc ("Pentland"), who are a supplier to the Group. The Board

believes that this is a strategic investment and Pentland is not in any way

influencing the Group's procurement policy and no discussions have taken place

over Board representation. We are continuing to seek to recruit a senior

independent non-executive director and expect to make a further update on this

no later than the announcement of our Interim Results in early October. We also

intend to announce the conclusions of the Board's Strategic Review at this time.

In summary, there is still a lot to do but our turnaround plan is progressing.

The continuing elimination of poor performing stores and the rationalisation of

Fashion stocks remain fundamental to the Board's plan. The Christmas trading

period will as always be crucial to the final result for the year but we believe

that the foundations are in place for a more successful trading future.

Enquiries:

The John David Group Plc Tel: 0161 767 1000

Peter Cowgill, Executive Chairman

Barry Bown, Chief Executive

Brian Small, Finance Director

Hogarth Partnership Limited Tel: 020 7357 9477

Andrew Jaques

Tom Leatherbarrow

This information is provided by RNS

The company news service from the London Stock Exchange

END

AGMEAAXSFAPLEFE

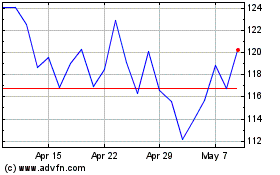

Jd Sports Fashion (LSE:JD.)

Historical Stock Chart

From Jun 2024 to Jul 2024

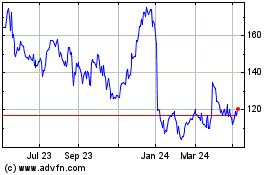

Jd Sports Fashion (LSE:JD.)

Historical Stock Chart

From Jul 2023 to Jul 2024