RNS No 5195c

JOHN DAVID SPORTS PLC

9 June 1999

JOHN DAVID SPORTS PLC

PRELIMINARY RESULTS FOR THE YEAR TO 31 MARCH 1999

John David Sports Plc, a leading specialist retailer of fashionable branded

sports and leisure wear, today announces its 1999 Preliminary Results.

Highlights:-

* Turnover increased by 33.4% to #142.61 million (1998: #106.88 million).

* Operating profit increased by 10.9% to #10.67 million (1998: #9.62

million).

* Pre tax profit increased by 5.8% to #9.85 million (1998: 9.31 million).

* Earnings per ordinary share increased by 3.2% to 14.20p (1998: 13.76p).

* Maintained final dividend (3.6p) 5.6p in total.

* 28 stores opened including 10 edge/out of town formats.

* Focused marketing campaigns including successful launch of the JD Gold

Card loyalty scheme.

* Continued like for like sales growth.

John Wardle, Chairman said: "We are now achieving a more positive

differentiation in the market and this is leading to a stronger trading

performance. Management are confident that the JD brand is firmly established

and recognised as the UK's leading specialist retailer of fashionable branded

sports and leisurewear."

Enquiries:

John Wardle, Chairman/Peter Cowgill, Finance Director

John David Sports Plc

Tel:0171 796 4133 (Hudson Sandler) on 9 June 1999,

01706 628000 (thereafter)

James Cracknell

Hudson Sandler

Tel: 0171 796 4133

CHAIRMAN'S STATEMENT

I am pleased to report that the company increased its pre-tax profit from

#9.31m to #9.85m for the year ended 31 March 1999, despite the difficult

retail conditions generally.

In particular, the trading performance from mid December onwards has been most

encouraging which supports my comments in the Interim Statement that the

company has successfully refined its merchandising and retail strategy.

The action that the management team has taken over the past 18 months to

achieve a consistent and strong offer better aligned to our distinct market

position is now yielding the benefits I anticipated. In particular we are now

achieving a stronger differentiation in the market through our innovative

partnership with leading brands.

RESULTS

Following a strong Christmas trading performance which resulted in a like for

like increase of 6.5% for the 5 week period ended 2 January 1999, positive

like for like sales continued up to 31 March 1999. As a consequence the

declines encountered pre December were recovered to the extent that a flat

like for like performance was achieved for the year in total. After adjusting

for the timing of Easter, like for like sales growth in the 3 months ended 31

March 1999 was in excess of 7%.

Gross profit margins for the year have increased from 45.2% to 45.5% despite

the influence of competitive pressures and the general background of high

street discounting.

Operating costs increased, mainly as a result of the additional store units in

operation. Inflationary increases in rent and rates were also encountered and

a further charge was incurred as a result of our decision to accelerate

depreciation on certain stores which had been designated for premature

closure.

Operating profits for the year increased by 10.9% from #9.62 million to #10.67

million and profit before taxation increased from #9.31 million to #9.85

million. Following an increase in the effective tax rate from 31.26% to 32.96%

(arising largely from accelerated depreciation), earnings per share has

increased by 3.2% from 13.76p to 14.20p.

DIVIDEND

The Board is recommending a maintained final dividend of 3.6p per ordinary

share subject to the approval of shareholders at the Annual General Meeting.

This combines with the Interim dividend of 2.0p (1998: 2.0p) per share to

provide a total dividend of 5.6p. This will be paid on 4 October 1999 to

shareholders on the register at close of business on 27 August 1999.

OPERATING REVIEW

During the year the company achieved its object of re-establishing several

major points of product and format differentiation. This emphasis had

featured most strongly during the development years of the company in

establishing the distinctive "JD" brand. It was felt that the rapid expansion

and market entry of other sportswear retailers had eroded certain areas of

difference. We are confident that the identity and image of JD Sports has

been restored as a result of appealing product, improved store display and

imaginative marketing initiatives. A consistent message of in-store formats

and marketing support is now evident. The product offering has been expanded

to include the JD Casual, JD Junior and JD Woman ranges, which have proved

successful.

Marketing developments include the JD Gold Card which was launched in November

1998 and has achieved an extremely encouraging response rate. This has

created a substantial customer database which will be used for future

merchandising and marketing initiatives.

We have established strategic partnerships with major brands and have

consequently enhanced our "JD Exclusives" range of footwear and apparel. We

have also stimulated the growth of certain desirable leisurewear brands.

These factors were the main reasons for the improvement in our trading

performance in the last four months.

During the year 28 new stores were opened and 5 stores were closed. Of the 5

store closures 2 represented relocations and a further 2 were stores which had

remained open in towns where 2 JD stores were operating. The increase of 23

stores represented additional retail space of 121,000 sq ft resulting in a

total of 386,000 sq ft. Included therein are 17 edge/out of town stores

occupying 113,000 sq ft.

BALANCE SHEET AND FINANCIAL RESOURCES

Shareholders' funds at the balance sheet date have increased from #26.85

million to #30.85 million, as a result of the retained profit of #4.00

million. Total expenditure on fixed assets in the year amounted to #10.45

million, of which #9.05 million related to stores. Net borrowings at 31

March 1999 were #9.62 million (1998: #5.19m). Gearing amounted to 31.2%

(1998: 19.3%).

CURRENT TRADING

For the 10 week period since the year end total sales have increased by 25%

ahead of the similar period in the previous year and this includes an

underlying increase in like for like sales of 2%. This growth is against a

comparative background of good weather and World Cup influences which

prevailed during the same period last year.

A flagship store was opened in the Bluewater Park development on 16 March 1999

and this represented a significant investment by the company. We are pleased

to report that trading from this store has been most successful. No further

stores have been opened since the year end.

PROSPECTS

We have seen encouraging evidence that our refined merchandising and retail

strategy has successfully differentiated JD Sports from its competitors in

what remains a competitive market place.

As previously announced, store openings during the current year will be

significantly lower than in recent years and critical selection criteria will

continue to apply. Focus will be placed on enhancing the consistent in store

format of King of Trainers, JD Woman, JD Junior, JD Casuals and JD Exclusives

which will continue to be exploited as specific offers of distinction. Brand

partnerships will be further developed with progressive emphasis on the

exclusive ranges. Initial customer reaction has been extremely positive and

all offerings will be supported by strong, consistent and targeted marketing

campaigns. The market knowledge available from the JD Gold Card scheme will be

relevant and exploited via the quarterly JD Catalogue.

We are now achieving a more positive differentiation in the market which is

strengthening the JD brand and leading to an improved trading performance.

The Directors are confident that JD is now firmly established and recognised

as the UK's leading specialist retailer of fashionable branded sports and

leisurewear.

John Wardle

Chairman

9 June 1999

Profit and loss account

for the year ended 31 March 1999

1999 1998

#000 #000

-----------------------------------------------------------------

Turnover 142,607 106,878

Cost of sales (77,674) (58,544)

-----------------------------------------------------------------

Gross profit 64,933 48,334

Distribution costs (48,846) (34,224)

Administrative expenses (5,440) (4,521)

Other operating income 23 27

-----------------------------------------------------------------

Operating profit 10,670 9,616

Loss on sale of tangible fixed assets (212) (165)

-----------------------------------------------------------------

Profit on ordinary activities before

interest 10,458 9,451

Interest receivable 164 417

Interest payable and similar charges (771) (555)

-----------------------------------------------------------------

Profit on ordinary activities before

taxation 9,851 9,313

Tax on profit on ordinary activities (3,247) (2,912)

-----------------------------------------------------------------

Profit for the financial year 6,604 6,401

Dividends paid and proposed (2,605) (1,591)

-----------------------------------------------------------------

Retained profit for the financial year 3,999 4,810

-----------------------------------------------------------------

Earnings per ordinary share 14.20p 13.76p

Diluted earnings per ordinary share 14.20p 13.76p

-----------------------------------------------------------------

All amounts shown for both years relate to continuing operations.

The company has no recognised gains or losses during the current and previous

years other than the results reported above. The results above also represent

the historical cost profit.

Balance sheet

as at 31 March 1999

1999 1998

#000 #000 #000 #000

---------------------------------------------------------

Fixed assets

Tangible assets 28,796 23,734

---------------------------------------------------------

Current assets

Stocks 26,312 21,555

Debtors 4,609 4,407

Cash at bank and in hand 337 2,882

---------------------------------------------------------

31,258 28,844

Creditors: amounts falling

due within one year (21,668) (19,458)

---------------------------------------------------------

Net current assets 9,590 9,386

---------------------------------------------------------

Total assets less current

liabilities 38,386 33,120

Creditors: amounts falling

due after more than one year (5,712) (4,844)

Provisions for liabilities

and charges (1,824) (1,425)

---------------------------------------------------------

Net assets 30,850 26,851

---------------------------------------------------------

Capital and reserves

Called up share capital 2,325 2,325

Share premium account 8,634 8,634

Profit and loss account 19,891 15,892

---------------------------------------------------------

Equity shareholders' funds 30,850 26,851

---------------------------------------------------------

Cash flow statement

for the year ended 31 March 1999

1999 1998

#000 #000

----------------------------------------------------------------------

Net cash inflow from operating activities 9,652 10,211

Returns on investments and servicing

of finance (607) (138)

Taxation (2,088) (3,051)

Capital expenditure (9,799) (10,735)

Equity dividends paid (1,592) (2,605)

----------------------------------------------------------------------

Net cash outflow before financing (4,434) (6,318)

----------------------------------------------------------------------

Financing 1,889 1,557

----------------------------------------------------------------------

Decrease in cash in the year ( 2,545) (4,761)

----------------------------------------------------------------------

Reconciliation of net cash flow to movement in net debt

for the year ended 31 March 1999

1999 1998

#000 #000

----------------------------------------------------------------------

Decrease in cash in the year (2,545) (4,761)

Cash inflow from movement in debt and

lease financing (1,889) (1,557)

New finance leases and similar hire

purchase contracts - (127)

----------------------------------------------------------------------

Movement in net debt in the year (4,434) (6,445)

Net (debt)/funds at start of year (5,186) 1,259

----------------------------------------------------------------------

Net debt at end of year (9,620) (5,186)

----------------------------------------------------------------------

Earnings per ordinary share

Earnings per ordinary share represents the post-tax profit for the financial

year #6,604,000 (1998: #6,401,000) divided by the weighted average number of

ordinary shares in issue of 46,508,772 (1998: 46,508,772).

There is no difference between the basic earnings per ordinary share and the

diluted earnings per ordinary share for either year.

Reconciliation of movements in shareholders' funds

1999 1998

#000 #000

---------------------------------------------------------------------

Profit for the financial year 6,604 6,401

Dividends (2,605) (1,591)

---------------------------------------------------------------------

Net movement in shareholders' funds 3,999 4,810

Shareholders' funds at beginning of year 26,851 22,041

---------------------------------------------------------------------

Shareholders' funds at end of year 30,850 26,851

Reconciliation of operating profit to net cash inflow from operating

activities

1999 1998

#000 #000

---------------------------------------------------------------------

Operating profit 10,670 9,616

Depreciation charge 4,525 2,612

Increase in stocks (4,757) (5,025)

Increase in debtors (366) (1,453)

(Decrease)/increase in creditors (420) 4,461

---------------------------------------------------------------------

Net cash inflow from operating activities 9,652 10,211

---------------------------------------------------------------------

Notes

1.These figures are abridged versions of JD's full accounts for the years

ended 31 March 1998 and 1999 and do not constitute the Company's statutory

accounts within the meaning of Section 240 of the Companies Act 1985. The

Company's auditors have audited the statutory accounts for the Company and

have issued an unqualified audit report thereon within the meaning of

Section 235 of the Companies Act 1985 and have not made any statement under

Section 237 (2) or (3) of the Companies Act 1985 for the year concerned.

Statutory accounts for the year ended 31 March 1998 have been delivered to

the Registrar of Companies. Statutory accounts for the year ended 31 March

1999 will be delivered to the Registrar of Companies following the Annual

General Meeting.

2.Final dividends for the year ended 31 March 1998 were waived in respect of

28,152,980 ordinary shares (amounting to #1,015,000).

3.Included within profit on ordinary activities before taxation is income of

#762,000 gained from the disposal of a lease which has offset an accelerated

depreciation of #735,000 following the revision of the useful economic lives

of certain stores.

4.Copies of the full accounts will be sent to shareholders in due course.

Additional copies will be available from John David Sports Plc, Unit P14

Parklands, Heywood Distribution Park, Pilsworth Road, Heywood, Lancs, OL10

2TT.

END

FR FPMMBLLJMTTL

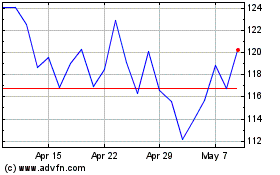

Jd Sports Fashion (LSE:JD.)

Historical Stock Chart

From Jun 2024 to Jul 2024

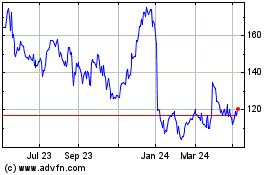

Jd Sports Fashion (LSE:JD.)

Historical Stock Chart

From Jul 2023 to Jul 2024