RNS Number:8503Z

Dart Group PLC

17 June 2004

For Immediate Release 17 June 2004

DART GROUP PLC

PRELIMINARY RESULTS FOR YEAR ENDED 31 MARCH 2004

Dart Group PLC, the aviation services and distribution group, announces its

preliminary results for the year ended 31 March 2004.

CHAIRMAN'S STATEMENT

I am pleased to report on the Group's trading for the year ended 31 March 2004.

Profit before tax, excluding goodwill amortisation, amounted to #9.0m (2003 -

#7.9m). Turnover was #228.2 m (2003 - #198.2m). Earnings per share before

the amortisation of goodwill were 17.91p (2003 - 15.78p). The Board is

recommending an unchanged final dividend of 4.26p, taking the total dividend for

the year to 6.11p (2003 - 6.11p). The dividend, if approved, will be payable on

20 August 2004 to shareholders on the register on 25 June 2004.

Capital expenditure amounted to #28.4m (2003 - #36.4m) and mainly related to the

expansion and upgrade of the Boeing 737-300 fleet.

Net borrowings at 31 March 2004 were #15.0m (2003 - #28.2m) which represents

gearing of 37% (2003 - 76%). The Group continues with its policy of matching

long-term US Dollar assets, namely Boeing 737-300 aircraft, with US Dollar

liabilities. Interest cover was 25.1 times (2003 - 8.5 times). The Group has

negligible exposure to rising fuel prices in the year to 31 March 2005 as its

fuel requirements are either substantially hedged or subject to pricing

adjustments with its contract customers.

The Group has continued to build its business-to-business services in both its

Aviation Services and Distribution Divisions. At the same time, considerable

energy is being put into the development of Jet2.com - our low cost scheduled

passenger airline business. The activities of the Group's two divisions are

more fully described in the Review of Operations that follows this statement.

Aviation Services

The Group now owns 14 Boeing 737-300 aircraft and is currently negotiating to

acquire further aircraft of the type for operation by Channel Express (Air

Services). Four of these are being converted to "Quick Change" (QC)

configuration which allows the aircraft to be transformed from a passenger

carrier to a containerised freighter in less than 40 minutes. By the autumn

these aircraft will be operating for Royal Mail at night whilst flying passenger

charters during the day.

Seven Boeing 737-300 passenger aircraft are operating Jet2.com (a trading name

of Channel Express) low cost services to 11 European business and leisure

destinations primarily from Yorkshire's Leeds Bradford International Airport.

The company expects to carry in excess of 1 million passengers on these services

during the coming financial year and to progressively add further aircraft to

this fleet.

The low cost airline market is competitive and no doubt there will be some fall

out amongst the less experienced carriers. However, we believe that with Channel

Express' low operating cost base and our careful aircraft acquisition policy,

Jet2.com should succeed in this market. Our immediate focus is to continue to

build our operations in the North of England.

The agreement to operate Boeing 737-300QCs at night for Royal Mail also gives

the long term stability needed to enable Channel Express to develop its daytime

passenger charter business. These modern jet aircraft are replacing smaller

turboprop aircraft that the company has operated for Royal Mail for many years

and will, we believe, provide an efficient and reliable air service to this

important customer.

Channel Express also operates four Airbus A300B4 "Eurofreighters" primarily on

behalf of express parcel companies, flying packages nightly from the UK, Ireland

and Italy to and from these customers' European hubs. Three Fokker F27s operate

on behalf of freight forwarders and newspaper publishers. This is a successful

business which we are always seeking to develop.

I am also delighted to report the continued growth of Benair Freight

International, the Group's freight forwarder. The company continues to make a

valuable contribution to the Group's operations and its progress is encouraging.

Distribution

The Group's produce and horticulture distribution company, Fowler

Welch-Coolchain, based in Spalding, Lincolnshire, and Teynham, Kent, has had a

challenging year during which it has continued its restructuring in order to

reduce its operating costs. Unfortunately, the company was recently unsuccessful

in a re-tender by Sainsbury's for its UK primary produce and horticulture

distribution (from supplier to regional distribution centre). The loss of the

Sainsbury's business, which was carried out on a shared user basis, together

with pricing pressures in the Division's European and Channel Islands'

businesses will lower the Distribution Division's profits for the current year.

However, I am pleased to report that Fowler Welch-Coolchain's management is

enthusiastically working to replace the turnover, endeavouring to both increase

business with other existing customers and win new contracts.

The collection, sorting, storing and delivery of fresh produce and horticulture

remains an attractive, staple business and is important to the overall strength

of the Group. The resilience and experience of the Distribution Division's

management and operational teams gives us confidence that, despite these

difficulties, the longer term outlook for the division is encouraging and we

look forward to brighter days ahead.

Our Staff

Throughout the Group's operations, we are fortunate to have excellent teams of

hardworking and enthusiastic staff. The Group particularly prides itself on its

high standard of operations in demanding service businesses. Training and

health and safety are regarded as particularly important and we are fortunate to

have excellent support in both these areas from which we all benefit. I would

like to thank every member of our staff for their continuing contribution to the

Group's development and growth.

Outlook

As I stated last year, the business-to-business trading environment is very

price sensitive with each of our customers under their own profit pressures.

However, I believe that both the Aviation Services and Distribution Divisions,

with their increasingly competitive cost bases, are well placed to win new

business and improve profits.

I am pleased to report that current trading is in line with our budgets and that

I am cautiously optimistic for the year ahead.

Philip Meeson

Chairman 17 June 2004

For further information about Dart Group PLC and its subsidiary companies please

visit our website, www.dartgroup.co.uk

REVIEW OF OPERATIONS

Aviation Services

The Group has now taken delivery of 12 ex-Ansett Airlines of Australia Boeing

737-300 series passenger aircraft which have joined the two Boeing 737-300 Quick

Change (QC) aircraft previously purchased from Lufthansa. The ex-Ansett

aircraft were purchased at post-September 11, 2001 prices and should represent

excellent long-term investments.

Arrangements have been made with Israel Aircraft Industries (IAI) of Tel Aviv

for, initially, four of the ex-Ansett aircraft to be converted to freighter or

QC configuration. The Group holds options for a number of further conversions.

The remarkable QC concept allows the aircraft to be transformed from a very

smart passenger carrier to a containerised freighter in less than 40 minutes.

Two of these converted aircraft have now been re-delivered to us by IAI and have

joined our existing QC aircraft on nightly Royal Mail services.

The Royal Mail aircraft will be based at Stansted, Edinburgh, Belfast, Exeter

and Leeds Bradford airports allowing the company to build upon its already

successful daytime passenger programmes. The Stansted-based aircraft has a

well-established charter schedule whilst the two aircraft based in Edinburgh fly

on behalf of a Scottish airline. The Belfast and Leeds Bradford aircraft will

be flying Jet2.com services - the Belfast aircraft already operates services to

Prague. There is a growing demand from charterers for these attractive aircraft

and it is our belief that this is a good long-term business for the company.

The Boeing 737-300 is proving to be efficient and reliable and is able to meet

all current environmental legislation. The commonality of one type materially

improves aircrew and engineering efficiency and is certainly one of the keys to

delivering cost-effective and competitive services. We intend to expand the

Boeing 737 fleet to meet the demands of the freight and passenger contract

charter business and Jet2.com. We will take the opportunity to purchase where

pricing is attractive, or will lease aircraft from lessors if the costings work

for us.

Channel Express has, for some time, successfully operated four 45 tonne payload

Airbus A300B4 "Eurofreighters", two of which are owned by the Group, with two

leased in. These aircraft fly on behalf of two leading European overnight

express parcel delivery companies from Ireland, the UK and Italy to these

companies' hubs in Germany and Belgium. The two leased aircraft are contracted

by us from their owners on flexible terms to coincide with our commitments to

our customers. The aircraft currently meet existing noise regulations; however,

some airports are indicating that they will require operators to meet more

stringent noise standards, not yet generally in force, for night operations.

To achieve these, Channel Express has been working with the aircraft's

manufacturer, Airbus Industrie, and the engine manufacturer, General Electric

Aircraft Engines, to improve the aircraft's performance in this respect. The

outcome of this will be important to the company and should be known in the

fourth quarter of this year.

Channel Express also operates Fokker F27 freighter aircraft on behalf of Royal

Mail, newspaper publishers and on the company's scheduled services to the

Channel Islands. The Royal Mail requirement for containerised jet aircraft and

increased competition on freight services to the Channel Islands has led to the

retirement of two Fokker F27s during the year. The remaining aircraft provide

a valuable return to the company and it is hoped that they will continue in

service for a considerable time to come.

Channel Express, trading as Jet2.com, commenced low cost scheduled services to

Amsterdam from Leeds Bradford International Airport, Yorkshire, in February

2003. Services were increased that summer to include Alicante, Barcelona,

Malaga, Milan, Nice, Palma, Prague, and, in the winter, Geneva for skiing.

Reduced frequencies were operated during the winter with services to Milan

discontinued. Belfast, Faro, Murcia and Venice have been added this year with

all destinations being served daily or twice daily except Faro and Venice which

are served four times per week. On 29 April 2004, a service to Prague from

Belfast commenced using the Belfast-based Boeing 737 QC aircraft.

Jet2.com aims to give a comfortable, friendly service at the lowest possible

price with seating allocated at check in. The market is competitive with low

cost services also currently offered from Newcastle, Teesside, Manchester,

Liverpool and East Midlands all of which are within reach of our customers in

the North of England. Additionally, from 2005, low cost services will be

available from the former Finningley Air Force base near Doncaster. Faced with

this competitive market place, it is important that we make every effort to give

our customers a really low cost, friendly service from their convenient local

airport. Sales are supported by large-scale price led promotions via the

company's website, on local radio and poster sites, and in regional and national

press.

Jet2.com achieved a satisfactory load factor for the year to 31 March 2004 and

made a positive contribution to Channel Express after all costs and expenses.

Currently, 94% of the company's bookings are made via its website - please view

this at www.jet2.com.

The Group intends to build on this successful start to low cost services from

Leeds Bradford by increasing frequencies and destinations from that airport and

thereby consolidating Jet2.com's position in the North of England.

Through its Parts Trading division, Channel Express also supplies aircraft parts

both for its own operations and to other operators. Previously focusing on the

Airbus A300, the introduction of the Boeing 737-300 has given Parts Trading new

opportunities to support the type and it has played an invaluable role in the

aircraft's successful introduction into service.

Benair Freight International, the Group's freight forwarder, has offices located

at London Heathrow, Manchester, East Midlands, Newcastle and Singapore airports

together with a worldwide agency partner network. Benair, with its expertise in

air, sea and road freight, had a successful year with record sales and profits.

Progress was made in both the general freight and ornamental fish importing

and distribution businesses and in increasing its USA business with the

appointment of a dynamic new agent, with offices throughout the USA. It is also

encouraging to note the growth in the company's aircraft spare parts logistics

business where Benair has an increasing number of aviation customers.

Distribution

The temperature-controlled distribution market continues to grow with the

volumes of produce, horticulture, chilled foods and beverages expected to

increase faster than frozen foods for the foreseeable future.

The Group's temperature-controlled distribution business, Fowler

Welch-Coolchain, was formed by the merger of Fowler Welch, based in Spalding in

Lincolnshire, and Coolchain, based in Teynham and Paddock Wood in Kent. The

Lincolnshire region is largely a produce growing area within which several

leading chilled prepared foods suppliers, who are customers of the company, are

also based, whilst Kent is, of course, traditionally the centre of the country's

fruit growing and packing industry. Today, both are also focal points for the

importation, storage, packing and distribution of produce and fruit.

Fowler Welch-Coolchain is well positioned to serve these markets. The company

has extensive temperature-controlled facilities at both Spalding and Teynham, a

large fleet of modern distribution vehicles and an experienced workforce.

During the 1990s, the supermarkets progressively took control of their logistics

supply chains from their suppliers in order to gain economies of scale and

greater distribution efficiency. Consequently, whilst in the early 1980s up to

20 companies might tender for supermarket distribution contracts - today,

following a period of consolidation in the temperature-controlled distribution

industry, this has reduced to three or four. Fowler Welch-Coolchain's main

customers have been Tesco, Sainsbury's and Safeway. We hope that the

acquisition of Safeway by Morrisons earlier this year will offer Fowler

Welch-Coolchain new opportunities with this highly successful retailer whose

business has, thereby, dramatically expanded.

Fowler Welch-Coolchain's services are operated on a shared user basis with

common collections from suppliers and common use of its facilities, thereby

providing a cost-effective UK distribution service to the supermarkets' regional

distribution centres and sometimes direct to store.

Needless to say, there are continual pricing pressures when working for these

competitive customers, although volumes handled have also progressively

increased. Service levels are demanding, with peaks at Easter, during the

summer months, when the consumption of salads and fruit is at its highest, and

pre-Christmas. Servicing such peaks is, of course, challenging and expensive,

particularly at Christmas. Consequently, the control of costs has been and

continues to be a major challenge to the company, whilst delivering promised

standards throughout the year. During the past financial year, Fowler

Welch-Coolchain has increased its business with Tesco, entered into formal

contracts with Safeway for produce distribution in the UK and to the Channel

Islands and has been in a continuous dialogue about the level of and terms under

which future business with Sainsbury's would be undertaken.

Unfortunately, having recently been awarded considerable extra Sainsbury's

business in the Cambridgeshire area, this customer re-tendered its national

produce and horticulture distribution and Fowler Welch-Coolchain was

unsuccessful in retaining it. Regrettably, therefore, our business with

Sainsbury's for the distribution of their produce and horticulture products will

cease on 3 July 2004.

Fowler Welch-Coolchain has also seen increasing competition in its European

division which resulted in the loss of a major customer. However, this has

largely been offset in volume terms by the gain of significant business from

American Airlines. This leading airline has contracted Fowler Welch-Coolchain

to transport large volumes of produce and horticulture from Holland to its main

hubs at London's Heathrow and Gatwick airports from where it is flown to the USA

for onward distribution. We are very pleased to be working with American

Airlines and hope to grow our business with them and other leading importers of

produce in the years ahead.

The distribution of imported fresh produce is likely to be of increasing

importance to the company as its supermarket customers progressively source from

abroad, either direct from growers or via co-operatives. Considerable

opportunities exist for Fowler Welch-Coolchain to build upon the volumes of

produce and fruit that it transports direct from the major growing areas in

mainland Europe. This European capability, together with the company's

strategically positioned UK storage facilities and distribution network, offers

real opportunities for growth in this sector.

Fowler Welch-Coolchain has taken the opportunity to expand its services from UK

deep water ports with the haulage of containers of produce to supermarket

suppliers, who import, process and package produce and fruit. This is seen as

an important area for growth for the company. An office has recently been opened

at the Port of Bristol to service its increasing number of inbound fruit ships.

The company also recently renewed its contract to distribute Canary Islands

fresh produce imported through the port of Southampton. This represents a

considerable volume of business between October and May.

Channel Express (CI) provides air and sea services to and from Guernsey and

Jersey. The traditional Channel Islands industries of flower and produce

growing are in decline and, consequently, volumes in these sectors are reducing.

However, they are being replaced by increasing amounts of horticultural

products, health foods and other goods exported as a result of the Islands'

vibrant mail order business. It is also encouraging to report that Channel

Express (CI) is working closely with its sister company, Benair, to provide a

one stop shop for the import and export of international freight to and from the

Islands.

For further information contact:

Dart Group PLC Tel: 01202 597676

Philip Meeson,

Group Chairman and Chief Executive Mobile: 07785 258666

Mike Forder,

Group Finance Director Mobile: 07721 865850

Group Profit And Loss Account

for the year ended 31 March 2004

Notes 2004 2003

#'000 #'000

Turnover

Continuing operations 1 228,200 198,176

Net Operating Expenses

Continuing operations, excluding goodwill amortisation (219,195) (189,354)

Goodwill amortisation (497) (497)

Total continuing operations (219,692) (189,851)

Operating Profit

Continuing operations, excluding goodwill amortisation 9,005 8,822

Goodwill amortisation (497) (497)

Total continuing operations 8,508 8,325

Profit on disposal of fixed assets (continuing operations) 365 82

Net interest payable (353) (989)

Profit on ordinary activities before taxation 8,520 7,418

Taxation (2,868) (2,499)

Profit on ordinary activities after taxation 5,652 4,919

Dividends (2,099) (2,094)

Retained profit for the year 3,553 2,825

Earnings per share

- basic 4 16.46p 14.33p

- basic, excluding the amortisation of goodwill 4 17.91p 15.78p

- diluted 4 16.43p 14.27p

Statement of Total Recognised Gains and Losses

2004 2003

#'000 #'000

Profit on ordinary activities after taxation 5,652 4,919

Exchange (loss)/gain on foreign equity investment (63) 8

5,589 4,927

Balance Sheets

at 31 March 2004

Group Company

2004 2003 2004 2003

Note #'000 #'000 #'000 #'000

Fixed assets

Intangible assets 7,780 8,277 - -

Tangible assets 75,264 73,484 78,915 66,264

Investments - - 20,671 18,279

83,044 81,761 99,586 84,543

Current assets

Stock 2,216 2,452 - -

Debtors 31,221 31,043 3,731 5,783

Cash at bank and in hand 13,362 6,940 3,004 3

46,799 40,435 6,735 5,786

Current liabilities

Creditors: amounts falling due

within one year (55,793) (48,496) (61,021) (42,082)

Net current liabilities (8,994) (8,061) (54,286) (36,296)

Total assets less current liabilities 74,050 73,700 45,300 48,247

Creditors: amounts falling due after

more than one year (25,093) (30,444) (24,943) (30,364)

Provision for liabilities and charges (8,293) (6,112) (8,145) (5,778)

(33,386) (36,556) (33,088) (36,142)

Net assets 40,664 37,144 12,212 12,105

Capital and reserves

Called up share capital 1,718 1,716 1,718 1,716

Share premium account 7,702 7,674 7,702 7,674

Profit and loss account 31,244 27,754 2,792 2,715

Shareholders' funds - equity interests 2 40,664 37,144 12,212 12,105

Group Cash Flow Statement

for the year ended 31 March 2004

2004 2003

Note #'000 #'000

Net cash inflow from operating activities 3 36,111 33,713

Returns on investment and servicing of finance (551) (989)

Taxation (506) (2,283)

Capital expenditure and financial investment (26,019) (36,209)

Equity dividends paid (2,099) (2,094)

Cash inflow/(outflow) before financing 6,936 (7,862)

Financing (2,471) 13,734

Increase in cash in the year 4,465 5,872

Reconciliation of net cash flow to movement in net debt

Note 2004 2003

#'000 #'000

Increase in cash in the year 4,465 5,872

Cash outflow/(inflow) from decrease/(increase) in net debt in

the year 2,501 (13,719)

Change in net debt resulting from cash flows 6,966 (7,847)

Exchange differences 6,169 2,183

Net debt at 1 April (28,167) (22,503)

Net debt at 31 March (15,032) (28,167)

1. Turnover

2004 2003

#'000 #'000

Distribution 112,076 119,154

Aviation Services 116,124 79,022

228,200 198,176

Turnover arising within:

The United Kingdom and the Channel Islands 222,804 192,072

Mainland Europe 4,368 5,077

The Far East 1,028 1,027

228,200 198,176

Turnover to third parties by destination is not materially different to that by

source and relates to continuing activities.

Analyses of profit before taxation and net assets between the different segments

of the Group are not given as, in the opinion of the directors, such analyses

would be seriously prejudicial to the commercial interests of the Group.

2. Reconciliation of movements in shareholders' funds

Group Company

2004 2003 2004 2003

#'000 #'000 #'000 #'000

Profit for the year 5,652 4,919 2,179 2,357

Dividends (2,099) (2,094) (2,099) (2,094)

3,553 2,825 80 263

Currency translation differences (63) 8 (3) 5

Issue of shares under share option schemes 30 15 30 15

Net addition to

shareholders' funds 3,520 2,848 107 283

Opening shareholders' funds 37,144 34,296 12,105 11,822

Closing shareholders' funds 40,664 37,144 12,212 12,105

3. Reconciliation of operating profit to net cash flow from operating

activities

2004 2003

#'000 #'000

Operating Profit 8,508 8,325

Depreciation 18,759 15,341

Amortisation of goodwill 497 497

Decrease in stock 236 55

(Increase) in debtors (309) (1,164)

Increase in creditors 8,480 10,651

Exchange differences (60) 8

Net cash inflow from operating activities 36,111 33,713

4. Earnings per share

The calculation of basic earnings per share is based on earnings

for the year ended 31 March 2004 of #5,652,000 (2003 - #4,919,000) and on

34,344,692 shares (2003 - 34,323,441) being the weighted average number of

shares in issue for the year.

The calculation of basic earnings per share, excluding the

amortisation of goodwill, is based on earnings of #6,149,000, as calculated

below, for the year ended 31 March 2004 (2003 - #5,416,000) and on

34,344,692 shares (2003 - 34,323,441) being the weighted average number of

shares in issue for the year.

2004 2003

#'000 #'000

Profit on ordinary activities after taxation 5,652 4,919

Amortisation of goodwill 497 497

6,149 5,416

The diluted earnings per share is based on earnings for the year ended 31 March

2004 of #5,652,000 (2003 - #4,919,000) and on 34,403,760 ordinary shares (2003 -

34,464,530) calculated as follows:

2004 2003

000's 000's

Basic weighted average number of shares 34,345 34,323

Dilutive potential ordinary share:

Employee share options 59 142

34,404 34,465

5. The financial information for the years ended 31 March 2003 and

2004 does not constitute statutory accounts, as defined in Section 240 of

the Companies Act 1985, but is based on the statutory accounts for the

years then ended. Statutory accounts for the year ended 31 March 2003, on

which the auditors issued an unqualified opinion pursuant to Section 235 of

the Companies Act 1985, have been filed with the Registrar of Companies.

Statutory accounts for the year ended 31 March 2004, on which the auditors

issued an unqualified opinion pursuant to Section 235 of the Companies Act

1985, will be filed with the Registrar of Companies in due course.

6. The proposed final dividend of 4.26 pence per share will, if

approved, be payable on 20 August 2004 to shareholders on the Company's

register at the close of business on 25 June 2004.

7. The 2004 Annual Report and Accounts (together with the Auditors

Report) will be posted to shareholders on 12 July 2004. The Annual General

Meeting will be held on 5 August 2004.

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR ZGGMVRVVGDZM

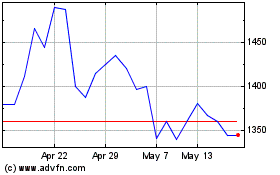

Jet2 (LSE:JET2)

Historical Stock Chart

From Jun 2024 to Jul 2024

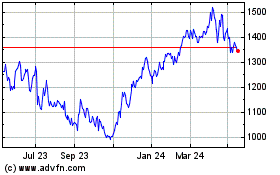

Jet2 (LSE:JET2)

Historical Stock Chart

From Jul 2023 to Jul 2024