Kibo Mining Plc ("the Company") is a public limited company

incorporated in Ireland. The Group financial statements consolidate

those of the Company and its subsidiaries (together referred to as

the "Group"). The Company's shares are listed on the Alternative

Investment Market ("AIM") of the London Stock Exchange and from the

30 May 2011 the Alternative Exchange of the Johannesburg Stock

Exchange Limited (ALTX). The principal activities of the Company

and its subsidiaries are related to the exploration for and

development of gold and other minerals in Tanzania.

2. Statement of Compliance and basis of preparation

The Financial Statements are for the six months ended 31 March

2012. They do not include all the information required for full

annual financial statements and should be read in conjunction with

the audited consolidated financial statements of the Group for the

year ended 30 September 2011, which were prepared under

International Financial Reporting Standards ("IFRS") as adopted by

the European Union ("EU").

The financial information is prepared under the historical cost

convention and in accordance with the recognition and measurement

principles contained within IFRS as endorsed by the EU.

The comparative amounts in the Financial Statements include

extracts from the Company's consolidated financial statements for

the year ended 30 September 2011. These extracts do not constitute

statutory accounts in accordance with the Irish Companies Acts 1963

to 2009.

3. Loss per share

Basic earnings per share

The basic and weighted average number of ordinary shares used in

the calculation of basic earnings per share are as follows:

6 months 6 months 12 months

to to to

-------------------------------- ------------- ------------- --------------

31 March 31 March 30 September

-------------------------------- ------------- ------------- --------------

2012 2011 2011

-------------------------------- ------------- ------------- --------------

GBP GBP GBP

-------------------------------- ------------- ------------- --------------

Loss for the year attributable

to

-------------------------------- ------------- ------------- --------------

equity holders of the parent (243,038) (421,132) (3,691,561)

-------------------------------- ------------- ------------- --------------

Weighted average number of

-------------------------------- ------------- ------------- --------------

ordinary shares for the

-------------------------------- ------------- ------------- --------------

purposes of basic earnings

-------------------------------- ------------- ------------- --------------

per share 388,490,167 279,596,711 331,040,217

-------------------------------- ------------- ------------- --------------

Basic loss per ordinary share

(pence) 0.06 0.15 1.12

-------------------------------- ------------- ------------- --------------

4. Called up share capital and share premium

Authorised share capital of the company is 800,000,000 ordinary

shares of 0.01 euro each.

Details of issued capital are as follows:

Number

of

--------------------------------------- --------------- ------------ -----------

Shares

--------------------------------------- --------------- ------------ -----------

Ordinary Nominal Share

--------------------------------------- --------------- ------------ -----------

shares Value Premium

of

--------------------------------------- --------------- ------------ -----------

EUR0.01 GBP GBP

each

--------------------------------------- --------------- ------------ -----------

At 1 October 2010 253,925,874 2,132,295 3,533,115

--------------------------------------- --------------- ------------ -----------

Shares issued in period (net of

--------------------------------------- --------------- ------------ -----------

expenses) for cash 30,666,667 269,491 480,466

--------------------------------------- --------------- ------------ -----------

Shares issued in the period (net

of

--------------------------------------- --------------- ------------ -----------

expenses) for acquisition of Morogoro

--------------------------------------- --------------- ------------ -----------

Gold Limited 56,666,667 501,653 1,198,348

--------------------------------------- --------------- ------------ -----------

Balance at 31 March 2011 341,259,208 2,903,439 5,211,929

--------------------------------------- --------------- ------------ -----------

Shares issued in period (net of

--------------------------------------- --------------- ------------ -----------

expenses) for cash 36,370,303 328,459 675,398

--------------------------------------- --------------- ------------ -----------

Balance at 30 September 2011 377,629,511 3,231,898 5,887,327

--------------------------------------- --------------- ------------ -----------

Shares issued in period (net of

--------------------------------------- --------------- ------------ -----------

expenses) for cash 37,500,000 314,017 398,482

--------------------------------------- --------------- ------------ -----------

Balance at 31 March 2012 415,129,511 3,545,915 6,285,809

--------------------------------------- --------------- ------------ -----------

Enquiries

Louis Coetzee +27 (0)83 2606126 Kibo Mining Chief Executive

plc Officer

---------------- -------------------- ------------- ---------------------

Stuart Laing +61 8 9480 2506 RFC Ambrian Nominated Adviser

---------------- -------------------- ------------- ---------------------

Limited

---------------- -------------------- ------------- ---------------------

Andreas Lianos +27 (0)83 4408365 River Group Corporate Adviser

and

---------------- -------------------- ------------- ---------------------

Designated Adviser

---------------- -------------------- ------------- ---------------------

(AltX)

---------------- -------------------- ------------- ---------------------

Nick Bealer +44 (0)207 7109612 Cornhill Broker (Corporate

---------------- -------------------- ------------- ---------------------

Capital Ltd Broking)

---------------- -------------------- ------------- ---------------------

Matthew Johnson +44 (0)207 7968829 Northland Broker (Assistant

---------------- -------------------- ------------- ---------------------

Capital Director, Corporate

---------------- -------------------- ------------- ---------------------

Finance)

---------------- -------------------- ------------- ---------------------

Matt Beale +44 (0)7966 389196 Fortbridge Public Relations

---------------- -------------------- ------------- ---------------------

Review by Qualified Person

The information in this announcement that relates to mineral

resources is based on information from a NI 43-101 compliant

technical report with an effective date of 19 April 2012 authored

by CD van Niekerk, Pr.Sci.Nat. of Gemecs (Pty) Limited in South

Africa. CD van Niekerk has at least five years experience within

the sector which is relevant to the style of mineralisation and

type of deposit under consideration and to the activity which he is

undertaking to qualify as a qualified person under the AIM Rules.

CD van Niekerk consents to the inclusion in this announcement of

the matters based on his information in the form and context in

which it appears.

General Background & Strategy

Kibo is a public company registered in Ireland (company number

451931). Its registered office is Kibo Mining plc, Suite 3, One

Earlsfort Centre, Lower Hatch Street, Dublin 2, Ireland. Kibo was

established in early 2008 to explore and develop mineral deposits

in Tanzania, East Africa and was admitted to AIM on 27 April 2010

and AltX in South Africa on 30 May 2011.

The Board of Kibo is composed of experienced professionals

spanning mineral exploration, mine development, mining finance and

financial control of public companies. It is supported by well

trained and motivated Tanzanian staff that operates from Kibo's

exploration offices in Dar es Salaam and Mwanza.

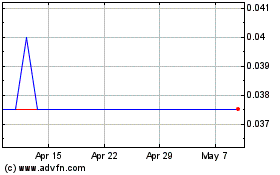

Kibo Energy (LSE:KIBO)

Historical Stock Chart

From Jun 2024 to Jul 2024

Kibo Energy (LSE:KIBO)

Historical Stock Chart

From Jul 2023 to Jul 2024