Kenmare Resources Kenmare Resources : Announcement Of Plans For An Investment By State General Reserve Fund (SGRF), A Further...

07 December 2015 - 6:00PM

UK Regulatory

TIDMKMR

Kenmare Resources plc ("Kenmare" or "the Company")

7 December 2015

Announcement of plans for an investment by State General Reserve Fund

(SGRF), a further capital raising, and balance sheet restructuring

The Board of Kenmare today announces that it proposes to pursue a

capital raising and debt restructuring to materially deleverage the

balance sheet of the Company to provide a sustainable platform for

future operations, with an enhanced working capital position. Subject to

agreement with lenders, the plan is expected to result in gross

outstanding debt being substantially reduced and the satisfaction of the

requirement of lenders in relation to a material deleveraging

transaction.

The capital raising is expected to be conducted by means of a firm

placing and open offer. It is intended that there will be an opportunity

for existing shareholders to subscribe in the open offer on the same

terms as under the firm placing, failing which shares not subscribed for

will, it is anticipated, be issued to lenders as a partial equitisation

of the outstanding debt.

SGRF, a sovereign wealth fund of the Sultanate of Oman, has approved in

principle an investment of US$100 million in the firm placing via one of

its subsidiaries, subject to and conditional upon, inter alia, agreement

of a subscription agreement, agreement of arrangements with the Group's

project lenders on the Group's capital structure, procurement of

commitments from other shareholders in respect of an additional minimum

US$75 million capital, necessary Kenmare shareholder approvals, and

finalisation of a prospectus.

Following the withdrawal of the Iluka approach separately announced

today, and the related lifting of the restrictions on the Company which

applied during the offer period, the Company is seeking to engage in

negotiations with the lenders and key shareholders in relation to the

terms of the capital raising. The process of concluding these

negotiations and finalising related documentation is expected to take a

number of weeks. The Company remains in discussions with lenders in

respect of the required waivers to the April 2015 Amendment in the

context of planned further disbursements of the Super Senior facility.

Moma is a world-class asset that encompasses a large, long life ore

body. Total invested capital exceeds US$1.2 billion, with the mine

producing more than 7% of global TiO2 feedstock supply - being the

largest merchant producer of ilmenite globally. During 2015, Kenmare has

made material reductions to the sustainable costs of production in

response to the decline in market prices, while heavy mineral

concentrate and ilmenite achieved production records in Q3 2015.

Subject to agreeing a sustainable capital structure with lenders, the

Board believes Kenmare's business will be well supported during the

current low mineral sands pricing environment and will be well

positioned for all stakeholders to benefit from the expected recovery.

There remain a number of material matters that need to be agreed to

enable Kenmare to deliver the planned capital raising and there can be

no certainty at this time that they will be achieved. Kenmare welcomes

the indicated support from SGRF and appreciates the support of key

shareholders. Initial discussions between the lenders and Kenmare have

taken place and a term sheet has been shared with the lenders. Subject

to the support and co-operation of lenders and key shareholders, and

with the indicated support from SGRF, the Board of Kenmare looks forward

to progressing the capital raising. Furthermore, the Board remains

confident of the medium and long term fundamentals of the mineral sands

industry.

Further announcements will be made in due course. For further

information, please contact:

Kenmare Resources plc

Michael Carvill, Managing Director

Tel: +353 1 671 0411

Mob: + 353 87 674 0110

Tony McCluskey, Financial Director

Tel: +353 1 671 0411

Mob: + 353 87 674 0346

Jeremy Dibb, Corporate Development and Investor Relations Manager

Tel: +353 1 671 0411

Mob: + 353 87 943 0367

Murray Consultants

Joe Heron

Tel: +353 1 498 0300

Mob: +353 87 690 9735

Buchanan

Bobby Morse / Anna Michniewicz

Tel: +44 207 466 5000

This announcement is distributed by NASDAQ OMX Corporate Solutions on

behalf of NASDAQ OMX Corporate Solutions clients.

The issuer of this announcement warrants that they are solely

responsible for the content, accuracy and originality of the information

contained therein.

Source: Kenmare Resources via Globenewswire

HUG#1971648

http://www.kenmareresources.com/

(END) Dow Jones Newswires

December 07, 2015 02:00 ET (07:00 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

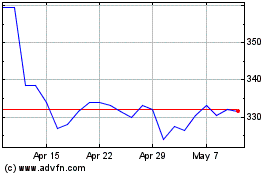

Kenmare Resources (LSE:KMR)

Historical Stock Chart

From Jun 2024 to Jul 2024

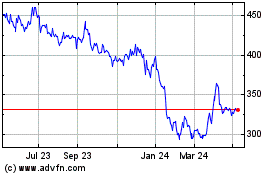

Kenmare Resources (LSE:KMR)

Historical Stock Chart

From Jul 2023 to Jul 2024