TIDMLWI

RNS Number : 1673Z

Lowland Investment Co PLC

24 May 2016

LOWLAND INVESTMENT COMPANY PLC

Unaudited Results for the Half Year Ended 31 March 2016

This announcement contains regulated information

Key Data for the six months to 31 March 2016

Net Asset Value

Total Return +3.8%

-------------------- ------

Benchmark Total

Return +3.5%

-------------------- ------

Growth in Dividend +10%

-------------------- ------

Dividend 22.0p

-------------------- ------

Financial Highlights

Half Year Half Year Year Ended

Ended Ended 30 Sept

31 Mar 2016 31 Mar 2015 2015

-------------------------- ------------- ------------- -----------

NAV Per Ordinary Share 1,333p 1,401p 1,318p

-------------------------- ------------- ------------- -----------

Share Price 1,290p 1,295p 1,287p

-------------------------- ------------- ------------- -----------

Market Capitalisation GBP349m GBP348m GBP346m

-------------------------- ------------- ------------- -----------

Dividend Per Share 22.0p 20.0p 41.0p

-------------------------- ------------- ------------- -----------

Ongoing Charge Including

Performance Fee 0.7% 0.8% 0.9%

-------------------------- ------------- ------------- -----------

Ongoing Charge Excluding

Performance Fee 0.6% 0.6% 0.6%

-------------------------- ------------- ------------- -----------

Dividend Yield(1) 3.3% 2.9% 3.2%

-------------------------- ------------- ------------- -----------

Gearing 16.7% 15.3% 16.8%

-------------------------- ------------- ------------- -----------

(1) Based on dividends paid in respect of the previous twelve

months

Total Return Performance (including dividends reinvested and

excluding transaction costs)

6 months 1 year 3 years 5 years 10 years

% % % % %

---------------- --------- ------- -------- -------- ---------

Net Asset

Value +3.8 -1.9 +22.5 +73.0 +104.3

---------------- --------- ------- -------- -------- ---------

Benchmark(1) +3.5 -3.9 +11.4 +31.9 +58.3

---------------- --------- ------- -------- -------- ---------

Share Price(2) +1.9 +2.7 +20.6 +81.9 +102.4

---------------- --------- ------- -------- -------- ---------

(1) FTSE All Share Index

(2) Using Mid-Market Price

Sources: Morningstar, Funddata, Datastream and Henderson.

Historical Record

Year to 30 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 As at

September 31 Mar 2016

------------------ ------ ------- ------ ------ ------ ------ ------- ------- ------- ------- -------------

Net Assets(1)

(GBPm) 222 276 178 174 204 214 266 347 362 355 360

------------------ ------ ------- ------ ------ ------ ------ ------- ------- ------- ------- -------------

Per Ordinary Share

----------------------------------------------------------------------------------------------------------------------

Net Asset Value 916p 1,044p 675p 657p 770p 811p 1,008p 1,307p 1,346p 1,318p 1,333p

------------------ ------ ------- ------ ------ ------ ------ ------- ------- ------- ------- -------------

Share Price 896p 1,091p 625p 610p 700p 763p 992p 1,325p 1,355p 1,287p 1,290p

------------------ ------ ------- ------ ------ ------ ------ ------- ------- ------- ------- -------------

Net Revenue 20.8p 27.9p 33.0p 22.7p 22.5p 28.8p 31.1p 36.7p 39.4p 46.4p 13.7p

------------------ ------ ------- ------ ------ ------ ------ ------- ------- ------- ------- -------------

Net

Dividends Paid 20.8p 23.5p 26.5p 26.5p 27.0p 28.0p 30.5p 34.0p 37.0p 41.0p 22.0p(2)

------------------ ------ ------- ------ ------ ------ ------ ------- ------- ------- ------- -------------

(1) Attributable to Ordinary Shares

(2) First Interim Dividend of 11.0p per Ordinary Share paid on

29 April 2016 and the Second Interim Dividend of 11.0p per Ordinary

Share that will be paid on 29 July 2016

Interim Management Report

Chairman's Statement

Review

Over the six months under review Lowland's total return and that

of our benchmark, the FTSE All Share Index (the 'Index'), were both

virtually unchanged with Lowland up 3.8% and the Index up 3.5%.

Over the longer term Lowland has outperformed the Index

handsomely.

Although in capital terms there has been little progress, it has

been a period of volatility. Some investors have worried that the

global economy may be slowing; others are worried that US interest

rates need to rise to counter the build-up of inflationary

pressures. They cannot both be right.

Meanwhile the companies we hold in the portfolio have made good

progress overall, as evidenced by their levels of cash

generation.

Dividend

Lowland's earnings per share in the six months under review was

13.7p which compares with 15.3p last year. The fall is the result

of lower special dividend income being received in the period. The

earnings per share excluding special dividends was 12.6p versus

12.1p. The Company paid a first interim dividend of 11.0p at the

end of April, and now declares a second interim of the same amount,

payable at the end of July. Interim dividends in respect of the

first half therefore amount to 22.0p, an increase of 10% over the

corresponding period last year. Barring unforeseen circumstances,

the Board's intention is to pay a total dividend for this year of

45.0p up from 41.0p last year, an increase of 9.8%. The dividend

has more than doubled over the last ten years.

Portfolio Activity

During the period, the Fund Manager made a number of purchases

in a diverse selection of companies. These include Legal &

General, Headlam and Ibstock. What these companies have in common

is excellence in their operational fields and reasonable

valuations. We would expect them to be increasing their dividends

from a starting yield that is higher than Lowland's cost of

borrowings, which immediately enhances the revenue account.

We have also purchased shares in certain companies which do not

currently pay dividends such as Standard Chartered. We believe that

radical management action by these companies will, over time,

result in a profits recovery and a return to the dividend list.

These companies have a very attractive potential dividend yield at

the price we have paid. We also increased our holding in Shell, as

it is likely, given the capacity cutbacks that the oil price will

rise at some stage. The reduction in the Shell's cost base,

combined with a higher oil price, will lead to a degree of margin

improvement that may pleasantly surprise investors.

These purchases were financed by reducing holdings in Hill &

Smith and Provident Financial, where the latter's valuation after

the share price appreciation more closely reflects the value of the

business. The takeover for cash of Amlin by Mitsui resulted in the

largest individual disposal during the period.

Investment Management Agreement

The Company has agreed a change to the terms of the Investment

Management Agreement with Henderson Investment Funds Limited, in

terms of which no performance fee will be paid if there has been a

decline in the Company's net asset value over the three year period

over which performance is measured. Previously performance fees

would have been paid if the Company outperformed its benchmark,

even if the net asset value declined in absolute terms. The change

reflects investors' concerns at performance fees being paid in

periods of absolute decline in net asset value.

Board Succession

In agreement with the Nominations Committee of the Board I have

decided to retire at the Annual General Meeting in January 2017. I

am delighted to report that the Board has approved the appointment

of Mr Robbie Robertson, as my successor. We have begun a process to

appoint another non-executive to the Board, with a view to the

appointee succeeding Mr Robertson as Chair of the Audit

Committee.

Outlook

The economy is growing at reasonable pace. The US economy is

expected to maintain its growth rate and Europe appears to be

returning to modest growth after stimulation by the European

Central Bank. This is a decent background for equity investment.

Growth is good, but subdued enough to delay interest rate

rises.

The benefits of the fall in the oil price to the headline annual

inflation rate will soon diminish. At the time of writing, the

uncertainties surrounding the Brexit vote are also a concern. We

are conscious that much of British industry is experiencing

challenging conditions but overall we remain comfortable with our

overweight positions in the Industrials sector. The UK companies we

hold in the portfolio are growing as a result of the

competitiveness of their products.

Good profit growth is leading to cash generation and pleasing

dividend progression. We retain a reasonable level of gearing,

which at the period end was 16.7%.

Peter Troughton CBE

Chairman

24 May 2016

Performance as at 31 March 2016

The tables below show the top five contributors to and the

bottom five detractors from the Company's total return

performance.

Top 5 Contributors to Total Return Performance

Company Sector Contribution %

------------------------- ------------------------ ---------------

Glencore Mining +0.8

Irish Continental Group Travel & Leisure +0.5

Anglo American Mining +0.5

RPC General Industrials +0.5

Hill & Smith Industrial Engineering +0.4

Bottom 5 Detractors to Total Return Performance

Company Sector Contribution %

---------------------- ------------------------ ---------------

Renold Industrial Engineering -1.0

Velocys Chemicals -0.4

St Modwen Properties Real Estate -0.4

Standard Chartered Banks -0.3

Interserve Support Services -0.3

% as at 31 March % as at 30 September

2016 2015

Sector Analysis Company Benchmark Company Benchmark

-------------------- --------- ---------- ---------- -----------

Industrials 26.4 10.7 28.4 10.1

Financials 25.3 23.9 27.0 26.3

Basic Materials 14.0 5.0 13.6 4.9

Consumer Services 11.3 12.9 10.3 12.9

Oil & Gas 7.4 10.6 5.8 10.4

Consumer Goods 5.2 17.6 5.5 16.3

Health Care 4.4 8.5 3.9 8.5

Utilities 2.4 4.0 2.4 3.9

Telecommunications 2.4 5.2 2.3 5.1

Technology 1.2 1.6 0.8 1.6

-------- -------- -------- --------

Total 100.0 100.0 100.0 100.0

===== ===== ===== =====

Related Party Transactions

During the first six months of the current financial year, no

transactions with related parties have taken place which has

materially affected the financial position or performance of the

Company during the period. Details of related party transactions

are contained in the Annual Report for the year ended 30 September

2015.

Principal Risks and Uncertainties

The principal risks and uncertainties associated with the

Company's business can be divided into various areas:

-- Investment and Strategy;

-- Market;

-- Financial;

-- Gearing;

-- Operational; and

-- Accounting, Legal and Regulatory.

Information on these risks is given in the Annual Report for the

year ended 30 September 2015. In the view of the Board these

principal risks and uncertainties are as applicable to the

remaining six months of the financial year as they were to the six

months under review.

Statement of Directors' Responsibilities

The Directors confirm that, to the best of their knowledge:

(a) the set of financial statements for the half year to 31

March 2016 has been prepared in accordance with "FRS 104 Interim

Financial Reporting";

(b) the Interim Management Report includes a fair review of the

information required by Disclosure and Transparency Rule 4.2.7R

(indication of important events during the first six months and

description of principal risks and uncertainties for the remaining

six months of the year); and

(c) the Interim Management Report includes a fair review of the

information required by the Disclosure and Transparency Rule 4.2.8R

(disclosure of related party transactions and changes therein).

For and on behalf of the Board

Peter Troughton CBE

Chairman

24 May 2016

Condensed Income Statement

(Unaudited) (Unaudited) (Audited)

Half-year ended Half-year ended Year-ended

31 March 2016 31 March 2015 30 September 2015

Revenue Capital Revenue Capital Revenue Capital

return return Total return return Total return return Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

---------------- ---------- --------- ---------- ---------- --------- ---------- ---------- ---------- ----------

Gains/(losses)

on investments

held at fair

value through

profit or loss - 6,086 6,086 - 16,831 16,831 - (8,387) (8,387)

Income from

investments 5,274 - 5,274 5,667 - 5,667 15,542 - 15,542

Other interest

receivable and

similar income 58 - 58 31 - 31 105 - 105

--------- -------- --------- --------- -------- --------- --------- --------- ---------

Gross revenue

and capital

gains/

(losses) 5,332 6,086 11,418 5,698 16,831 22,529 15,647 (8,387) 7,260

Management fee

and

performance

fee (note 2) (899) (253) (1,152) (913) (928) (1,841) (1,819) (908) (2,727)

Other

administrative

expenses (note

2) (240) - (240) (272) - (272) (484) - (484)

--------- -------- --------- --------- -------- --------- --------- --------- ---------

Net

return/(loss)

on ordinary

activities

before finance

charges and

taxation 4,193 5,833 10,026 4,513 15,903 20,416 13,344 (9,295) 4,049

Finance charges (439) - (439) (386) - (386) (806) - (806)

--------- -------- --------- --------- -------- --------- --------- --------- ---------

Net

return/(loss)

on ordinary

activities

before

taxation 3,754 5,833 9,587 4,127 15,903 20,030 12,538 (9,295) 3,243

Taxation on net

return on

ordinary

activities (51) - (51) (24) - (24) (48) - (48)

--------- -------- --------- --------- -------- --------- --------- --------- ---------

Net

return/(loss)

on ordinary

activities

after taxation 3,703 5,833 9,536 4,103 15,903 20,006 12,490 (9,295) 3,195

====== ====== ====== ====== ====== ====== ===== ====== =====

Return/(loss)

per ordinary

share - basic

and diluted

(note 4) 13.7p 21.7p 35.4p 15.3p 59.1p 74.4p 46.4p (34.6)p 11.8p

====== ====== ====== ====== ====== ====== ===== ====== ======

The total columns of this statement represent the Income

Statement of the Company, prepared in accordance with FRS 104. The

revenue and capital columns are supplementary to this and are

published under guidance from the Association of Investment

Companies.

The Company has no recognised gains or losses other than those

disclosed in the Income Statement and Statement of Changes in

Equity.

All items in the above statement derive from continuing

operations. No operations were acquired or discontinued during the

period.

The accompanying notes are an integral part of the condensed

financial statements.

Condensed Statement of Changes in Equity

(Unaudited)

Half-year ended 31 March 2016

Called Share Capital Other

up share premium redemption capital Revenue

capital account reserve reserves reserve Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 October 2015 6,723 59,923 1,007 275,268 11,642 354,563

Net return on ordinary

activities after

taxation - - - 5,833 3,703 9,536

Third interim dividend

(10.0p) for

the year ended 30

September 2015 - - - - (2,689) (2,689)

Final dividend (11.0p)

for

the year ended 30

September 2015 - - - - (2,972) (2,972)

Issue of new ordinary

shares 32 1,693 - - - 1,725

------------ ------------ ----------- ----------- ----------- -----------

At 31 March 2016 6,755 61,616 1,007 281,101 9,684 360,163

======= ======= ======= ====== ======= =======

(Unaudited)

Half-year ended 31 March 2015

Called Share Capital Other

up share premium redemption capital Revenue

capital account reserve reserves reserve Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 October 2014 6,723 59,923 1,007 284,563 9,640 361,856

Net return on ordinary

activities after

taxation - - - 15,903 4,103 20,006

Third interim dividend

(9.0p) for

the year ended 30

September 2014 - - - - (2,420) (2,420)

Final dividend (10.0p)

for

the year ended 30

September 2014 - - - - (2,689) (2,689)

------------ ------------ ----------- ----------- ----------- -----------

At 31 March 2015 6,723 59,923 1,007 300,466 8,634 376,753

======= ======= ======= ======= ======= =======

(Audited)

Year-ended 30 September 2015

Called Share Capital Other

up share premium redemption capital Revenue

capital account reserve reserves reserve Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 October 2014 6,723 59,923 1,007 284,563 9,640 361,856

Net return on ordinary

activities after

taxation - - - (9,295) 12,490 3,195

Third interim dividend

(9.0p) for

the year ended 30

September 2014 - - - - (2,421) (2,421)

Final dividend (10.0p)

for

the year ended 30

September 2014 - - - - (2,689) (2,689)

First interim dividend

(10.0p) for the

year ended 30 September

2015 - - - - (2,689) (2,689)

Second interim dividend

(10.0p) for the

year ended 30 September

2015 - - - - (2,689) (2,689)

----------- ----------- ----------- ----------- ------------ -----------

At 30 September

2015 6,723 59,923 1,007 275,268 11,642 354,563

====== ====== ====== ====== ====== ======

The accompanying notes form an integral part of these financial

statements.

Condensed Statement of Financial Position

(Unaudited) (Unaudited) (Audited)

Half-year Half-year Year-ended

ended ended 30 September

31 March 31 March 2015

2016 2015 GBP'000

GBP'000 GBP'000

Fixed assets

Investments held at fair

value through profit or

loss (note 5) 420,312 434,480 414,132

----------- ----------- -----------

Current assets

Debtors 2,430 2,779 3,589

Cash at bank 1,432 1,286 669

----------- ----------- -----------

3,862 4,065 4,258

Creditors: amounts falling

due within one year (64,011) (61,792) (63,827)

----------- ----------- -----------

Net current liabilities (60,149) (57,727) (59,569)

----------- ----------- -----------

Net assets 360,163 376,753 354,563

====== ====== =======

Capital and reserves

Called up share capital 6,755 6,723 6,723

Share premium account 61,616 59,923 59,923

Capital redemption reserve 1,007 1,007 1,007

Other capital reserves 281,101 300,466 275,268

Revenue reserve 9,684 8,634 11,642

----------- ----------- -----------

Total shareholders' funds 360,163 376,753 354,563

====== ====== =======

Net asset value per ordinary

share - basic and diluted

(note 7) 1,333.0p 1,401.0p 1,318.4p

======= ======= =======

The accompanying notes form an integral part of these financial

statements.

Condensed Statement of Cash Flows

(Unaudited

(Unaudited) and restated*) (Audited

Half-year Half-year and restated*)

ended ended Year-ended

31 March 31 March 30 September

2016 2015 2015

GBP'000 GBP'000 GBP'000

-------------------------------- ------------ ---------------- ----------------

Cash flows from operating

activities

Net return on ordinary

activities before taxation 9,587 20,030 3,243

Add back: finance costs 439 386 806

(Less)/add: (gains)/losses

on investments held at

fair value through profit

or loss (6,086) (16,831) 8,387

Withholding tax on dividends

deducted at source (55) (24) (44)

Decrease/(increase) in

debtors (228) (710) 99

(Decrease)/increase in

creditors (99) 380 (160)

------------ ---------------- ----------------

Net cash inflow from operating

activities 3,558 3,231 12,331

Cash flows from investing

activities

Purchase of investments (29,701) (31,217) (68,100)

Sale of investments 30,992 23,247 53,569

------------ ---------------- ----------------

Net cash inflow/ (outflow)

from investing activities 1,291 (7,970) (14,531)

Cash flows from financing

activities

Equity dividends paid (net

of refund of unclaimed

distributions and reclaimed

distributions) (5,661) (5,109) (10,488)

Proceeds from issue of

ordinary shares 1,725 - -

Net loans drawn down 270 9,794 12,408

Interest paid (430) (431) (809)

------------ ---------------- ----------------

Net cash (outflow)/inflow

from financing activities (4,096) 4,254 1,111

Net increase/(decrease)

in cash and cash equivalent 753 (485) (1,089)

Cash and cash equivalents

at start of year 669 1,756 1,756

Effect of foreign exchange

rates 10 15 2

------------ ---------------- ----------------

Cash and cash equivalents

at end of year 1,432 1,286 669

------------ ---------------- ----------------

Comprising:

Cash at bank 1,432 1,286 669

--------- --------- ------

1,432 1,286 669

===== ==== ===

*See Note 1

The accompanying notes are an integral part of the financial

statements.

Notes to the Financial Statements

The half-year financial statements cover the period from 1

October 2015 to 31 March 2016 and have not been audited or reviewed

by the Company's auditor.

1. Accounting policies - basis of preparation

The condensed set of financial statements has

been prepared in accordance with FRS 104, Interim

Financial Reporting, issued in March 2015, the

revised reporting standard for half-year reporting

that was issued following the introduction of

FRS 102, the Financial Reporting Standard applicable

in the UK and Republic of Ireland, which is effective

for periods commencing on or after 1 January

2015. The Statement of Recommended Practice for

"Financial Statements of Investment Trust Companies

and Venture Capital Trusts", in accordance with

which the Company's financial statements are

also prepared, was reissued by the Association

of Investment Companies in November 2014 to comply

with the revised reporting standards. The Company

has early adopted the amendments to FRS 102 in

respect to fair value hierarchy disclosures as

published in March 2016.

Following the application of the revised reporting

standards, there have been no significant changes

to the accounting policies set out in the Company's

Annual Report for the year ended 30 September

2015.

The condensed financial statements for the year

ended 30 September 2015 and the six months ended

31 March 2015 have been restated where necessary

to comply with the new standards and disclosure

requirements.

There has been no impact on the Company's Income

Statement, Statement of Financial Position (previously

called the Balance Sheet) or Statement of Changes

in Equity (previously called the Reconciliation

of Movements in Shareholders' Funds) for periods

previously reported. The Cash Flow Statement

previously reported has been restated to comply

with the new disclosure requirements of the revised

reporting standard. The condensed set of financial

statements has been neither audited nor reviewed

by the Company's auditors.

2. Expenses

All expenses with the exception of the performance

fee are charged wholly to revenue. Expenses which

are incidental to the purchase or sale of an

investment are included in the cost or deducted

from the proceeds of sale of the investment.

A provision of GBP253,000 (31 March 2015: GBP928,000;

30 September 2015: actual GBP908,000) has been

made for a performance fee based on the Company's

performance relative to the FTSE All-Share Index

(the benchmark) over the thirty months to 31

March 2016. The actual performance fee payable

will be calculated based on the actual relative

performance for the thirty-six months to 30 September

2016 and will be equal to 15% of any outperformance

(on a total return basis) of the FTSE All-Share

Index by more than 10% (the "hurdle rate"). The

total of the management and performance fees

are capped at 0.75% of average net chargeable

assets for the year. The provision, which is

the maximum that could be charged under the cap

arrangements, has been charged to the capital

return column of the income statement whereas

the management fee is charged to the revenue

return column.

3. Management and performance fees

The Company has agreed a change to the terms

of the Investment Management Agreement with Henderson

Investment Funds Limited with effect from 24

May 2016 in terms of which no performance fee

will be paid if there has been a decline in the

Company's net asset value over the three year

period over which performance is measured.

4. Return per ordinary share - basic and diluted

(Unaudited) (Unaudited)

Half year Half year (Audited)

ended ended Year ended

31 March 31 March 30 September

2016 2015 2015

GBP'000 GBP'000 GBP'000

-------------------------------- -------------- ------------- ----------------

The return per ordinary

share is based on

the following figures:

Net revenue return 3,703 4,103 12,490

Net capital return/(loss) 5,833 15,903 (9,295)

---------- ---------- ----------

Net total return 9,536 20,006 3,195

====== ====== ======

Weighted average

number of ordinary

shares in issue for

each period 26,965,491 26,892,427 26,892,427

Revenue return per

ordinary share 13.7p 15.3p 46.4p

Capital return per

ordinary share 21.7p 59.1p (34.6)p

---------- ---------- ----------

Total return per

ordinary share 35.4p 74.4p 11.8p

====== ====== ======

The Company does not have any dilutive securities;

therefore basic and diluted returns per share

are the same.

Investments held at fair value through profit

5. of loss

The table below analyses fair value measurements

for investments held at fair value through profit

or loss. These fair value measurements are categorised

into different levels in the fair value hierarchy

based on the valuation techniques used and are

defined as follows under FRS 102:

Level 1: valued using quoted prices in active

markets for identical assets

Level 2: valued by reference to valuation techniques

using observable inputs other than quoted prices

included in Level 1

Level 3: valued by reference to valuation techniques

using inputs that are not based on observable

market date

Investments held at fair Level Level Level Total

value through profit or 1 2 3 GBP'000

loss at 31 March 2016 GBP'000 GBP'000 GBP'000

(unaudited)

-------------------------- --------- --------- --------- ---------

Investments 418,133 - 2,179 420,312

Investments held at fair Level Level Level Total

value through profit or 1 2 3 GBP'000

loss at 31 March 2015 GBP'000 GBP'000 GBP'000

(unaudited)

-------------------------- --------- --------- --------- ---------

Investments 433,634 - 846 434,480

Investments held at fair Level Level Level Total

value through profit or 1 2 3 GBP'000

loss at 30 September 2015 GBP'000 GBP'000 GBP'000

(audited)

---------------------------- --------- --------- --------- ---------

Investments 411,953 - 2,179 414,132

The investments were previously reported as Level

1 or Level 3 investments under the FRS 29 fair

value hierarchy and those same investments continue

to be classified as Level 1 or Level 3 investments

following the adoption of FRS 102 and the amendments

to the fair value hierarchy issued in March 2016.

There have been no transfers between levels of

the fair value hierarchy during the period.

The valuation techniques used by the Company

are explained in the accounting policies note

in the Company's Annual Report for the year ended

30 September 2015 and are equally applicable

under both FRS 29 and FRS 102.

Transaction costs

Purchase transaction costs for the half year

ended 31 March 2016 were GBP139,000 (half year

ended 31 March 2015: GBP156,000; year ended 30

September 2015: GBP336,000). Sale transaction

costs for the half year ended 31 March 2016 were

GBP28,000 (half year ended 31 March 2015: GBP19,000;

year ended 30 September 2015: GBP43,000). These

6 comprise mainly stamp duty and commission.

Net asset value per ordinary share - basic and

7. diluted

The net asset value per ordinary share is based

on the net assets attributable to the ordinary

shares of GBP360,163,000 (31 March 2015: GBP376,753,000;

30 September 2015: GBP354,563,000) and on 27,018,565

ordinary shares (31 March 2015: 26,892,427; 30

September 2015: 26,892,427) being the number

of ordinary shares in issue at the end of each

period.

8. Dividend

On 29 April 2016, a first interim dividend of

11.0p per Ordinary Share was paid in respect

of the year ended 30 September 2016. A second

interim dividend of 11.0p per Ordinary Share

has been declared and will be paid on 29 July

2016 to shareholders on the register of members

at the close of business on 1 July 2016. The

ex-dividend date is 30 June 2016. Based on the

number of shares in issue on 24 May 2016 of 27,018,565,

the cost of the dividend will be GBP2,972,000.

9. Going concern

Having reassessed the principal risks and uncertainties

the Directors believe that it is appropriate

to adopt the going concern basis in preparing

the financial statements.

10. Comparative Information

The financial information contained in this half-year

report does not constitute statutory accounts

as defined in section 434 of the Companies Act

2006. The figures and financial information for

the year ended 30 September 2015 are extracted

from the latest published accounts, restated

where necessary to comply with FRS 102 and FRS

104 as explained in note 1, and do not constitute

the statutory accounts for that year. Those accounts

have been delivered to the Registrar of Companies

and included the report of the independent auditors,

which was unqualified and did not include a statement

under either section 498(2) or 498(3) of the

Companies Act 2006.

11. Manager

Henderson Investment Funds Limited ('HIFL') is

appointed to act as the Company's Alternative

Investment Fund Manager. HIFL delegates investment

management services to Henderson Global Investors

Limited. References to Henderson within these

results refer to the services provided by both

entities.

12. General information

Company Objective

The Company aims to give shareholders a higher

than average return with growth of both capital

and income over the medium to long term, through

a broad spread of predominantly UK Companies.

The Company measures its performance against

the FTSE All-Share Index Total Return.

Company Status

The Company is a UK domiciled investment trust

company.

The London Stock Exchange Daily Official List

SEDOL number is 0536806 and ISIN number is GB0005368062.

The London Stock Exchange (EPIC) Code is LWI.

The Global Intermediary Identification Number

(GIIN) is 2KBHLK.99999.SL.826.

The Legal Entity Identifier Number (LEI) is 2138008RHG5363FEHV19

Directors

The Directors of the Company are Peter Troughton

(Chairman), Duncan Budge, Kevin Carter, Robert

Robertson and Karl Sternberg.

Corporate Secretary

Henderson Secretarial Services Limited, represented

by Hannah Blackmore ACIS.

Registered Office

201 Bishopsgate, London EC2M 3AE. Registered

number 670489.

Website

Details of the Company's share price and net

asset value, together with general information

about the Company, monthly factsheets and data,

copies of announcements, reports and details

of general meetings can be found at www.lowlandinvestment.com.

13. Half Year report

The Half Year report will be available in typed

format on the Company's website or from the Company's

Registered Office, 201 Bishopsgate, London EC2M

3AE. An update extracted from the Company's Half

Year report will be posted to shareholders in

early June 2016 and will be available on the

Company's website thereafter.

Portfolio Information

as at 31 March 2016

Market

Value % of

Company Sector GBP'000 Portfolio

-------------------------- ------------------------------- --------- ------------

Royal Dutch

Shell Oil & Gas Producers 17,361 4.1

Hiscox Non-Life Insurance 12,029 2.9

Senior Aerospace & Defence 11,405 2.7

Phoenix Life Insurance 10,991 2.6

Scapa(1) Chemicals 8,600 2.1

Irish Continental(2) Travel & Leisure 8,564 2.0

HSBC Banks 8,136 1.9

BP Oil & Gas Producers 7,703 1.8

GKN Automobiles & Parts 7,336 1.8

Hill & Smith Industrial Engineering 7,237 1.7

10 Largest 99,362 23.6

----------------------------------------------------------- --------- ------------

Legal & General Life Insurance 7,056 1.7

Glencore Mining 6,956 1.7

Anglo American Mining 6,901 1.6

DS Smith General Industrials 6,120 1.5

Croda Chemicals 6,078 1.5

Standard Chartered Banks 6,043 1.4

Provident

Financial Financial Services 5,930 1.4

Rio Tinto Mining 5,866 1.4

RELX Media 5,823 1.4

Low & Bonar Construction & Materials 5,568 1.3

20 Largest 161,703 38.5

----------------------------------------------------------- --------- ------------

Novae Non-Life Insurance 5,460 1.3

Castings Industrial Engineering 5,411 1.3

RPC General Industrials 5,317 1.3

International

Personal Finance Financial Services 5,313 1.2

Pharmaceuticals &

GlaxoSmithKline Biotechnology 5,295 1.2

Elementis Chemicals 5,267 1.2

Canfor Pulp(2) Forestry & Paper 5,121 1.2

Rolls-Royce Aerospace & Defence 4,944 1.2

Marshalls Construction & Materials 4,913 1.2

Johnson Service(1) Support Services 4,908 1.2

-------------------------- ------------------------------- --------- ------------

30 Largest 213,652 50.8

----------------------------------------------------------- --------- ------------

Avon Rubber Aerospace & Defence 4,827 1.2

Household Goods &

Headlam Home Construction 4,782 1.1

Health Care Equipment

Consort Medical & Services 4,737 1.1

Convivilaity

Retail(1) Food & Drug Retailers 4,734 1.1

Vodafone Mobile Telecommunications 4,575 1.1

Carclo Chemicals 4,567 1.1

Pharmaceuticals &

4D Pharma(1) Biotechnology 4,464 1.1

Park(1) Financial Services 4,233 1.0

Clarkson Industrial Transportation 4,137 1.0

BAE Systems Aerospace & Defence 4,072 1.0

-------------------------- ------------------------------- --------- ------------

40 Largest 258,780 61.6

----------------------------------------------------------- --------- ------------

Marstons Travel & Leisure 3,990 1.0

Technology Hardware

Infineon Technologies(2) & Equipment 3,964 0.9

National Grid Gas, Water & Multiutilities 3,949 0.9

Inmarsat Mobile Telecommunications 3,938 0.9

CRH(2) Construction & Materials 3,932 0.9

Greencore(2) Food Producers 3,750 0.9

IP Group Financial Services 3,696 0.9

Interserve Support Services 3,687 0.9

Aviva Life Insurance 3,649 0.9

Centrica Gas, Water & Multiutilities 3,643 0.9

-------------------------- ------------------------------- --------- ------------

50 Largest 296,978 70.7

----------------------------------------------------------- --------- ------------

St Modwen

Properties Real Estate 3,604 0.8

Balfour Beatty Construction & Materials 3,583 0.8

Chesnara Life Insurance 3,370 0.8

Churchill Household Goods &

China(1) Home Construction 3,344 0.8

Mondi Forestry & Paper 3,340 0.8

Renold Industrial Engineering 3,326 0.8

Daily Mail

& General

Trust Media 3,308 0.8

Barclays Banks 3,300 0.8

Epwin(1) Construction & Materials 3,289 0.8

Prudential Life Insurance 3,253 0.8

-------------------------- ------------------------------- --------- ------------

60 Largest 330,695 78.7

----------------------------------------------------------- --------- ------------

Mucklow Real Estate 3,185 0.8

Shoe Zone(1) General Retailers 3,157 0.8

McColl's Retail Food & Drug Retailers 3,133 0.7

IMI Industrial Engineering 3,129 0.7

Tesco Food & Drug Retailers 3,069 0.7

Standard Life Life Insurance 2,914 0.7

Ibstock Construction & Materials 2,822 0.7

Herald Investment Equity Investment

Trust Instruments 2,796 0.7

Morgan Advanced Electronic & Electrical

Materials Equipment 2,726 0.6

H&T Group(1) Financial Services 2,592 0.6

-------------------------- ------------------------------- --------- ------------

70 Largest 360,218 85.7

----------------------------------------------------------- --------- ------------

FBD(2) Non-Life Insurance 2,557 0.6

Findel General Retailers 2,534 0.6

Weir Industrial Engineering 2,493 0.6

Segro Real Estate 2,462 0.6

Quarto Media 2,420 0.6

Pearson Media 2,406 0.6

BHP Billiton Mining 2,348 0.6

Gibson Energy(2) Oil & Gas Producers 2,252 0.5

Electronic & Electrical

TT Electronics Equipment 2,235 0.5

Stobart Industrial Transportation 2,100 0.5

-------------------------- ------------------------------- --------- ------------

80 Largest 384,025 91.4

----------------------------------------------------------- --------- ------------

Pharmaceuticals &

Horizon Discovery(1) Biotechnology 2,090 0.5

Pennon Gas, Water & Multiutilities 2,028 0.5

Revolymer(1) Chemicals 1,980 0.5

Oil Equipment Services

Cape & Distribution 1,911 0.4

Palace Capital(1) Real Estate 1,859 0.4

Somero Enterprises

(1,2) Industrial Engineering 1,850 0.4

Manx Telecom(1) Fixed Line Telecommunications 1,767 0.4

Pharmaceuticals &

AstraZeneca Biotechnology 1,717 0.4

Shanks Support Services 1,660 0.4

Carr's Group Food Producers 1,560 0.4

-------------------------- ------------------------------- --------- ------------

90 Largest 402,446 95.7

----------------------------------------------------------- --------- ------------

Carillion Support Services 1,471 0.4

Topps Tiles General Retailers 1,470 0.3

Babcock International Support Services 1,424 0.3

Oxford Sciences Pharmaceuticals &

Innovation Biotechnology 1,333 0.3

Velocys(1) Chemicals 1,302 0.3

DFS Furniture General Retailers 1,193 0.3

Wireless Media 891 0.2

Airea(1) Personal Goods 846 0.2

Software & Computer

Fidessa Services 706 0.2

Elecosoft(1) Construction & Materials 662 0.2

-------------------------- ------------------------------- --------- ------------

100 Largest 413,744 98.4

----------------------------------------------------------- --------- ------------

(1) AIM Stocks

(2) Overseas Quoted Stocks (Canada, Germany and Ireland)

For further information please contact:

James Henderson

Fund Manager, Tel: 020 7818 4370

Laura Foll

Deputy Fund Manager, Tel: 020 7818 6364

James de Sausmarez

Director and Head of Investment Trusts, Henderson Global

Investors, Tel: 020 7818 3349

Sarah Gibbons-Cook

Investor Relations and PR Manager, Henderson Global Investors,

Tel: 020 7818 3198

Neither the contents of the Company's website nor the contents

of any website accessible from hyperlinks on the Company's website

(or any other website) is incorporated into, or forms part of, this

announcement.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR AKQDPNBKDPPB

(END) Dow Jones Newswires

May 24, 2016 09:56 ET (13:56 GMT)

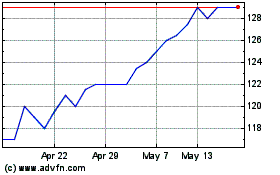

Lowland Investment (LSE:LWI)

Historical Stock Chart

From Jun 2024 to Jul 2024

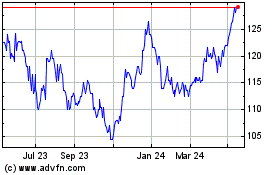

Lowland Investment (LSE:LWI)

Historical Stock Chart

From Jul 2023 to Jul 2024