TIDMMUL

RNS Number : 1322V

Mulberry Group PLC

30 November 2023

Mulberry Group plc

Results for the twenty-six weeks ended 30 September 2023

Investments will power future growth

Mulberry Group plc (the "Group" or "Mulberry"), the British

sustainable luxury brand, announces unaudited results for the

twenty-six weeks ended 30 September 2023 (the "period").

THIERRY ANDRETTA, CHIEF EXECUTIVE OFFICER, COMMENTED:

"Against a challenging macro-economic backdrop, which is

impacting the entire luxury landscape, we have continued to invest

in our long-term future.

"Our strategy to transform our international businesses to a

direct-to-consumer model has enabled us to control the entire

customer experience in Sweden, Australia, New Zealand and Japan.

Our investments in the period in our digital systems, stores and

product will power future growth.

"As one of the most iconic British luxury brands, product

innovation remains at the heart of Mulberry. Our recent product

launches, the Islington, Pimlico and Lana have been well received

by customers, which is testament to our heritage, fresh designs and

modern craftsmanship.

"Looking ahead, we are well placed to capitalise on the

important festive trading period and expect the usual second half

weighting to trading.

"There is no doubt, however, that the macro-economic environment

has deteriorated, and this has had a knock-on effect on consumer

sentiment. At Mulberry we have ensured that we are prepared to

navigate this tricky environment, and we are confident in our

ability to continue to execute our strategy. I continue to believe

that offering VAT-free shopping in the UK would be one of the most

effective ways to encourage business growth in this country. The

fact this has not been reinstated is creating challenges for all

sectors; impacting not only the luxury players, but also

hospitality, travel and tourism. As we look ahead to the New Year,

I urge policy makers to collaborate with all industries campaigning

on this issue and reconsider implementing this to support

businesses across the UK."

Financial Highlights

-- Group revenue up 7% (8% CER(1) ) to GBP69.7m (2022: GBP64.9m)

o UK retail sales although impacted by the broader economic

environment, increased 6% to GBP36.2m (2022: GBP34.1m)

o International retail sales increased 34% (35% CER) to GBP23.5m

(2022: GBP17.5m), supported by our strategy to bring in-house

ownership of overseas stores including Sweden and Australia

o Revenue in the US increased by 38% (42% CER) due to increased

brand awareness

o Asia Pacific retail sales (including the first full period of

ownership of our Australian stores) increased by 13% (18% CER) to

GBP13.5m (2022: GBP11.9m). Underlying retail sales decreased by 7%

(3% CER) due to the challenging China macro-economic climate and

reduced footfall across the region

-- Gross margin of 69% (2022: 71%) was slightly below the prior period

-- Underlying loss before tax of GBP12.3m (2022: underlying loss

before tax GBP2.8m)(2) included GBP3.3m (2022: GBP0.8m) of Software

as a Service (SaaS) costs, the additional operational costs of our

new stores in Sweden and Australia, and additional important

investments for future growth in the Group

-- Reported loss before tax of GBP12.8m (2022: loss before tax GBP3.8m)

Operating Highlights

-- Digital sales represented 29% of total Group revenue in the

period (2022: 25%), demonstrating the continuing trend towards

omni-channel shopping in all regions

-- Our collaborations with Paul Smith, Axel Arigato and Stefan

Cooke drove further global awareness of the Mulberry brand

-- New stores opened in Italy, China and South Korea

-- Product innovation continued in the period with the launch of

new bag families including the Islington and the Retwist

-- Ongoing investment in projects to update the Group's legacy

systems and build on our omni-channel capabilities

Sustainability Highlights

-- Continued focus on embedding sustainability and circularity across the entire business

-- Mulberry Pre-Loved, our buy back and resale programme,

generated sales above the same period last year

-- 100% of leather (including all suede and nappa linings) for

Bags, Mini Bags and Small Leather Goods is sourced from tanneries

with an environmental accreditation. We continue to offset the

carbon emissions related to leather purchases

-- Lifetime Service Centre at The Rookery continues to restore more than 10,000 bags a year

Current Trading

-- The wider macro-economic environment and geo-political

climate continues to present some uncertainty, but we are well

positioned to navigate this given our beautifully crafted product,

made in our Somerset factories and sold at the best value price

point in the luxury market

-- Mulberry has a clear customer proposition and plan for growth

and we remain confident in our ability to navigate this uncertainty

and execute this strategy for the benefit of all our

stakeholders

-- Since period end, we launched two new bag families globally,

the Lana and the Pimlico which are performing well

-- Well prepared for the second half of the financial year,

which is weighted in trading given the important festive trading

period and further emphasised by our move from wholesale to

retail

FOR FURTHER DETAILS PLEASE CONTACT:

Mulberry

Charles Anderson Tel: +44 (0) 20 7605 6793

Headland (Public Relations)

Lucy Legh / Joanna clark Tel: +44 (0) 20 3805 4822

mulberry@headlandconsultancy.com

HOULIHAN LOKEY UK LIMITED (FINANCIAL ADVISER AND NOMAD)

Tim Richardson Tel: +44 (0) 20 7484 4040

Notes

1 Constant Exchange Rates

2 See note 2 for more details of alternative performance

measures and one off costs

OVERVIEW

Despite the current uncertain global economic climate, which

continues to dampen consumer confidence, Mulberry continues to

invest in its long-term future. Our strategic goals are clearly set

out in our strategic pillars - omni-channel distribution,

international development, constant innovation and sustainable

lifecycle - and will make us more efficient, more customer focused

and enable growth. Over the six months to 30 September 2023, we

made good progress towards all of them.

We invested in new lines, collaborations and extended ranges.

For example, collaborations with Swedish lifestyle label Axel

Arigato in April and Stefan Cooke in September introduced us to a

new generation of customers; and working with UK heritage brand

Paul Smith drove new customer sales. Further innovation came with

new bag ranges - the Islington and the Retwist. With two more

launched since period end - the Pimlico and the Lana.

Pop ups continue to allow us efficiently to reach new audiences,

with Leccio giving us invaluable insights into the Italian

market.

International sales represented 39% of total retail revenues,

supported by our strategy to bring in-house ownership of overseas

stores. This is the first full six-month period during which our

stores in Sweden and Australia have been fully owned; our stores in

New Zealand and Japan have been fully owned since June 2023. We

experienced strong growth in retail sales in the United States, up

38% (42% CER) as we continued to build brand awareness in this

market. In Asia Pacific overall retail sales increased by 13% (18%

CER) to GBP13.5m (2022: GBP11.9m), this period includes six months

of our newly acquired stores in Australia. Underlying retail sales

in Asia Pacific decreased by 7% principally due to the challenging

macro-economic climate in China and reduced footfall across the

region. We continue to develop our lifestyle range for the second

half of the financial year and expect lifestyle sales to continue

to grow throughout the remainder of the financial year.

Central to Mulberry's business model is sustainability and

circularity. Projects incorporating and promoting pre-loved

performed well, and we have made progress in lowering further our

already below-industry-average carbon footprint through our

hyper-local, hyper-transparent farm-to-finished-product model. We

expect validation of our science-based greenhouse gas emissions

reduction targets by the end of this financial year.

Group revenue increased by 7% (9% CER) over the period, with a

slight decline in the gross margin to 69% (2022: 71%). An

underlying loss before tax for the period of GBP12.3m (2022: loss

before tax of GBP2.8m) reflects the additional investments and

costs to support business growth, including SaaS costs and the

additional operational costs of our stores in Sweden and Australia.

We ended the period with net borrowings of GBP13.6m(1) (2022: net

borrowings GBP0.5m).

Much of this progress is thanks to the hard work and commitment

of our many colleagues around the world and I recognise and thank

them for their enduring efforts.

BOARD CHANGES

Appointment of additional Independent Non-Executive Director

On 7 September 2023, the Group appointed Ms Leslie Serrero as an

additional Independent Non-Executive Director. Ms Serrero will also

sit on the Audit Committee of the Board.

Ms Serrero has extensive experience of luxury brand leadership.

She has been International Managing Director of US luxury group

Casa Komos Brands Group since October 2022, having previously held

senior executive roles at Fendi France (2019-2022), Christian Dior

Couture (2012-2019) and Lacoste SA (2009-2012). Prior to this, Ms

Serrero was a project leader at Boston Consulting Group for six

years, advising companies in the retail, consumer and fashion

sectors on transformation and growth strategies.

CURRENT TRADING AND OUTLOOK

Since the period end, we have launched two new bag families

globally, the Lana and the Pimlico, which have both performed

well.

The wider macro-economic environment, including inflationary

pressures, continues to present some uncertainty, but we are well

positioned as the best value price point in the luxury market and

prepared for the second half of the financial year, which is

weighted in trading given the important festive trading period and

further emphasised by our move from wholesale to retail.

Mulberry has a clear customer proposition and plan for growth

and we remain confident in our ability to navigate this uncertainty

and execute this strategy for the benefit of all our

stakeholders.

Notes

1 Net borrowings comprises cash balances of GBP5.9m (2022:

GBP6.5m) less bank borrowings of GBP19.5m (2022: GBP7.0m), which

excludes related parties and non-controlling interest of GBP4.5m

(2022: GBP5.6m)

PROGRESS AGAINST OUR STRATEGY

With a rich heritage in leather craftmanship and a reputation

for innovation, we aim to build Mulberry as the British sustainable

global luxury brand through four strategic growth pillars.

Strategic pillar 1 - Omni-channel distribution

The period saw us invest in our ongoing digital transformation

to enhance our omni-channel distribution. Our new omni-hubs in

Glasgow, Bath and London's Regent Street take the majority of

omni-orders. They also optimise store space and are already making

order management more efficient. The payback is clear: digital

sales as a proportion of the Group revenue continued to rise - up

4% to 29% in the period. We launched the Mulberry Mindset strategy

in June to help staff provide memorable interactions for customers

and build authentic relationships.

Refurbishments and pop ups in London, Europe and Asia also

rewarded investment, helping us reach new audiences and lift

sales.

Strategic pillar 2 - International development

We continued to optimise our digital channels and global store

network, focusing on the US and Asia Pacific with their strong

growth opportunities, bringing more stores and concessions in-house

to better control pricing and distribution.

In the US, increasing brand awareness, helped to drive sales up

38% (42% CER). Asia Pacific retail sales, including the first full

period of ownership of our Australian stores, increased by 13% (18%

CER). Underlying retail sales decreased by 7% (3% CER) due to the

challenging China macro-economic climate and reduced footfall

across the region. Of note was our Chinese Valentine's Day event at

newly opened Nanjing Deji store with actress Zhu Zhu. This boosted

sales and brand awareness, with the Bayswater bag performing

particularly well.

In addition to Australia, the period saw the first full

six-month contribution of stores and concessions in Sweden; the New

Zealand store and stores and concessions in Japan became wholly

owned in May and June respectively.

In Europe, our six-month pop up in the luxury outlet Mall

Firenze, Leccio, is giving us valuable insight into the Italian

market and performing well.

Strategic pillar 3 - Constant innovation

Mulberry has a long tradition of innovation and collaboration as

it adapts to changing customer tastes and reaching new markets.

Further innovation came from new bag ranges - the Islington and the

Retwist - as well as new silhouettes for the Bayswater, Mini Lily

and North South Tote. Stand out performances came from Bayswater

Powder Rose and Pale Grey. With the Pimlico and the Lana ranges

launched since the period end, we expect bag sales to make up 79%

of our total by the end of the current financial year.

Collaborations in the period included Swedish minimalist Axel

Arigato, the heritage British designer Paul Smith and the

award-winning Stefan Cooke. The Stefan Cooke collaboration included

a pop-up during September's London Fashion Week and along with the

April Axel Arigato collaboration, successfully drove greater

awareness of Mulberry among younger generations. The Paul Smith

collaboration also introduced us to new customers. All led to

increased sales.

While bags and leather goods remain Mulberry's mainstay, we

continue to explore opportunities in lifestyle categories. During

the period we launched our lifestyle range and made further

investments to extend this range in the second half of the

year.

Strategic pillar 4 - Sustainable lifecycle

Our Made to Last manifesto with its Lifetime Service Centre and

the Mulberry Exchange for pre-loved bags set us apart and are

central in our strategy to be regenerative and circular across our

entire supply chain by 2030. This strategy feeds into everything we

do.

In April, our collaboration with Axel Arigato highlighted our

wear-forever ethos while in September, our capsule collaboration

with Stefan Cooke, focusing on pre-loved, was heralded by Vogue as

"a strong case for the coolest bag collaboration of the year". Both

brilliantly showcased our Mulberry Exchange platform, which ensures

every Mulberry bag can have multiple lives. The Stefan Cooke

collaboration contributed to the best-ever week for pre-loved on

Mulberry.com. We saw significant growth on the previous financial

year.

We remain carbon neutral across our UK operations and source

100% of our leather from environmentally accredited tanneries.

Ongoing efforts to establish a hyper-local, hyper-transparent

farm-to-finished-product model are further reducing our already

lower-than-industry average carbon footprint. Meanwhile, we offset

carbon emissions related to our leather purchases and business

flights and we expect validation of our science-based greenhouse

gas reduction targets by the end of this financial year.

Sustainable materials continue to play an important role in our

drive for Net Zero and this extends to our paper and packaging.

Since 2020, more than 3.2 million coffee cups have been turned into

Mulberry Green paper packaging and since 2011 all our cardboard and

paper are Forest Stewardship Council certified.

Respect for people as well as the planet is embedded in all we

do and we are proud to be a certified Living Wage employer and our

hybrid working policy helps cut emissions and costs associated with

commuting.

During the period we launched our Diversity, Equity and

Inclusion (DE&I) committee to drive progress across all

DE&I topics. To date, this includes partnering with Mentoring

Matters, Flourish in Diversity and The Outsiders Perspective.

In recognition of all our efforts, in May, we won Brand of the

Year at the Drapers Sustainable Fashion Awards, with the judges

citing our Made to Last Manifesto, our thriving apprenticeship

programme and our longstanding commitment to British

manufacturing.

FINANCIAL REVIEW

Group revenue and gross profit

Revenue analysis for the 26 weeks to 30 September 2023 compared

to the same period last year is as follows:

2023 2022

GBP'm GBP'm % change

Digital 20.3 16.3 +25%

Stores 39.4 35.3 +12%

Retail (omni-channel) 59.7 51.6 +16%

------ ------ ---------

Franchise and Wholesale 10.0 13.3 -25%

------ ------ ---------

Group Revenue 69.7 64.9 +7%

------ ------ ---------

Digital 12.8 10.8 +19%

Stores 23.4 23.3 0%

Omni-channel - UK 36.2 34.1 +6%

------ ------ ---------

Digital 2.9 2.7 +7%

Stores 10.6 9.2 +15%

Omni-channel - Asia

Pacific 13.5 11.9 +13%

------ ------ ---------

Digital 4.6 2.8 +64%

Stores 5.4 2.8 +93%

Omni-channel - Rest

of World 10.0 5.6 +79%

------ ------ ---------

Retail (omni-channel) 59.7 51.6 +16%

------ ------ ---------

Q1 Q2 H1 2023

Revenue % change Revenue % change Revenue % change

GBP'm GBP'm GBP'm

Digital 10.1 +19% 10.2 +31% 20.3 +25%

Stores 20.1 +15% 19.3 +8% 39.4 +12%

-------- --------- -------- --------- -------- ---------

Retail (omni-channel) 30.2 +16% 29.5 +15% 59.7 +16%

-------- --------- -------- --------- -------- ---------

Franchise and

Wholesale 7.0 -18% 3.0 -38% 10.0 -25%

-------- --------- -------- --------- -------- ---------

Group revenue 37.2 +8% 32.5 +7% 69.7 +7%

-------- --------- -------- --------- -------- ---------

Group revenue increased by 7% (8% CER) in the period, with

growth in both Q1 (+8%) and Q2 (+7%) on the prior period. Retail

omni-channel sales grew +16% in the period driven by our strategy

to transition some wholesale partners to full ownership or

concession agreements. UK total retail sales increased by 6%. Full

price sales in the UK increased by 4% to GBP27.9m (2022: GBP26.8m)

with the full price mix reducing slightly to 77% (2022: 79%). UK

store sales remained in line with prior period, however UK digital

sales were up 19% on the prior period, with average transaction

value increasing by 9% compared to the prior period and represented

35% of total UK retail sales (2022: 32%).

Asia Pacific retail revenue increased 13% (18% CER), which

includes the first full six-month period from the Australia retail

stores which were acquired in the second half of last year.

Excluding Australia, Asia Pacific retail revenue would have been

down 7% due to the challenging China macro-economic climate and

reduced footfall across all the markets.

Rest of World retail revenue, which includes Europe and the US,

increased 79% (73% CER) with GBP1.7m relating to the business in

Sweden which was acquired in September 2022. Revenue in the US also

increased by 38% (42% CER) due to increased brand awareness in the

market.

Franchise and wholesale sales decreased by 25%, with wholesale

arrangements in Sweden and Australia converted to retail following

the purchase of the business in the prior year.

Other operating expenses

Other operating expenses increased by 21% to GBP58.9m (2022:

GBP48.6m) and underlying operating expenses increased by 9%. A

breakdown is given below:

2023 2022

GBP'm GBP'm % change

Underlying operating

expenses 51.6 47.2 +9%

SaaS Costs 3.3 0.8 +313%

Store Closure Charge/(Credit) 0.5 (0.2) -350%

New initiatives - Sweden

& Australia 3.5 0.8 +338%

------ ------ ---------

Operating expenses 58.9 48.6 +21%

------ ------ ---------

The underlying operating cost increase has been driven by

inflationary and real-living wage pay increases and we also

increased technology spend to GBP4.2m (2022: GBP3.3m) to support

the underlying costs associated with projects and systems

investments.

In light of the March 2021 IFRIC agenda decision to clarify the

treatment of Software as a Service (SaaS) costs, during the period

we expensed GBP3.3m (2022: GBP0.8m) of SaaS costs which would

previously have been capitalised, in line with the accounting for

configuration and customisation cost arrangements. We expect to

incur further SaaS costs in the second half.

The acquisition of our stores in Sweden and Australia have

increased costs during the period by GBP2.7m. The full year impact

of these new initiatives will be included in the current

period.

Loss before tax

The Group's underlying loss before tax was GBP12.3m (2022:

underlying loss before tax of GBP 2.8 m), included GBP3.3m (2022:

GBP0.8m) of SaaS costs and the additional operational costs of our

new stores in Sweden and Australia.

Reported loss before tax for the period was GBP12.8m (2022: loss

before tax of GBP3.8m) and includes a store closure charge of

GBP0.5m (2022: credit of GBP0.2m). The prior period included

GBP1.2m acquisition costs relating to the business in Australia and

Sweden.

2023 2022

GBP'm GBP'm

Underlying loss before

tax pre-SaaS costs (9.0) (2.0)

SaaS Costs (3.3) (0.8)

------- ------

Underlying loss before

tax (12.3) (2.8)

------- ------

Store Closure (Charge)/Credit (0.5) 0.2

Australia and Sweden acquisition

costs - (1.2)

------- ------

Reported loss before tax (12.8) (3.8)

------- ------

See note 2 below for further details of Alternative Performance

Measures.

Taxation

The Group reported a tax charge for the period of GBP0.6m (2022:

GBP0.3m.) The tax charge in the period is made up of GBP0.4m for

deferred tax, which is calculated by applying the forecast full

year effective tax rate to the Group results and GBP0.2m relating

to prior and current period current tax charges.

Balance Sheet

Net working capital, which comprises inventories, trade and

other receivables and trade and other payables decreased by GBP9.1m

to GBP34.6m at the period end (2022: GBP43.7m). This decrease was

driven by a reduction in inventories of GBP3.4m, as a result of

optimisation of inventory levels. We are managing stock levels in

light of the ongoing macro-economic uncertainty and cost

increases.

At the period end, other trade receivables had decreased by

GBP2.7m, principally due to wholesale customers being converted to

direct-to-customer models. The increase in other trade payables of

GBP3.0m is due to the timing of payments at the period end date and

recognising a liability for contributions towards the new lessee

rentals for the re-assigned Bond Street store.

Lease liabilities (current and non-current) reduced by GBP7.2m

to GBP53.0m (2022: GBP60.2m) due to the release of the lease

liability relating to the Bond Street store, which was re-assigned

at the beginning of the period and regular lease payments made in

the period.

Cash flow

The net decrease in cash and cash equivalents of GBP0.9m (2022:

decrease of GBP19.5m) included a GBP6.0m draw down of the Group's

revolving credit facility (RCF). Operating cash outflow for the

period was GBP3.9m (2022: GBP15.6m) driven by increased operating

expenses but partially offset by the improvement in working

capital.

During the period we continued to invest in capital expenditure

of GBP5.3m (2022: GBP5.2m) of which GBP2.9m (2022: GBP2.0m) related

to transformation projects and IT systems to support growth.

GBP0.8m (2022: GBP3.2m) has been spent in the period on new and

existing retail stores.

Borrowing facilities

The Group had bank borrowings relating to drawdowns under its

RCF of GBP13.0m at 30 September 2023 (2022: GBP7.0m). The

borrowings shown in the balance sheet also include loans from

minority shareholders in the Chinese and Japanese subsidiaries of

GBP4.5m (2022: GBP5.6m) and an overdraft of GBP6.5m (2022:

GBPnil).

The Group's net cash balance (cash and cash equivalents

including overdrafts) at 30 September 2023 was -GBP0.6m (2022:

GBP6.5m).

During the period the Group extended its secured RCF with HSBC

until September 2027, with unchanged banking covenants. The

covenants are tested quarterly on a "frozen GAAP" basis (excluding

the impact of IFRS 16 and SaaS costs) and contain a 12-month

rolling EBITDA target ratio and a maximum net debt target.

In addition, the Group has a GBP4.0m multi-currency overdraft

facility which is renewed annually.

Significant transactions in the period

Bond Street lease reassignment

On 3 April 2023 the Group assigned the lease on its Bond Street

store which closed in February 2023 and as a result disposed of the

right-of-use asset and released the remaining lease liabilities.

Additionally, the Group has incurred a charge for both the

contribution towards lease rentals of the new lessee and for a

financial guarantee covering the remaining period of the lease. The

net charge of GBP517,000 is included in the Income Statement (see

note 2).

Investment in Mulberry Japan Co. Limited

On 27 June 2023 the Group, via its subsidiary Mulberry Trading

Holding Company Limited acquired the 50% share capital owned by its

Joint Venture partner Onward Holding Co Limited, in Mulberry Japan

Co. Limited for 1 Yen. Following the acquisition, the Group now

owns 100% of Mulberry Japan Co. Limited (see note 7).

CONSOLIDATED INCOME STATEMENT

26 WEEKSED 30 SEPTEMBER 2023

Note

Unaudited Unaudited Audited

26 weeks ended 26 weeks ended 52 weeks ended

30 September 2023 GBP'000 1 October 2022 1 April 2023

GBP'000 GBP'000

Revenue 69,743 64,920 159,129

Cost of sales (21,694) (18,954) (45,879)

Gross profit 48,049 45,966 113,250

Impairment charge relating to intangibles - - (2,366)

Impairment credit relating to property,

plant and equipment - - 850

Impairment credit relating to right-of-use

assets - - 12,949

Other operating expenses (58,884) (48,599) (108,485)

Other operating income 390 416 776

Operating (loss)/profit (10,445) (2,217) 16,974

Share of results of associates 19 36 52

Finance income 1 5 11

Finance expense (2,334) (1,574) (3,887)

(Loss)/profit before tax (12,759) (3,750) 13,150

Tax charge 4 (639) (279) (1,753)

(Loss)/profit for the period (13,398) (4,029) 11,397

Attributable to:

Equity holders of the parent (12,279) (2,715) 13,243

Non-controlling interests (1,119) (1,314) (1,846)

(Loss)/profit for the period (13,398) (4,029) 11,397

Basic (loss)/profit per share 5 (22.5p) (6.8p) 19.1p

Diluted (loss)/profit per share 5 (22.5p) (6.8p) 19.1p

All activities arise from continuing operations.

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

26 WEEKSED 30 SEPTEMBER 2023

Unaudited Unaudited Audited

26 weeks ended 26 weeks ended 52 weeks ended

30 September 2023 GBP'000 1 October 2022 1 April 2023

GBP'000 GBP'000

(Loss)/profit for the period (13,398) (4,029) 11,397

Items that may be reclassified subsequently to

profit or loss;

Exchange differences on translation of foreign

operations (845) 408 (483)

Total comprehensive (expense)/income for the

period (14,243) (3,621) 10,914

Attributable to:

Equity holders of the parent (13,166) (1,882) 12,888

Non-controlling interests (1,077) (1,739) (1,974)

Total comprehensive (expense)/income for the

period (14,243) (3,621) 10,914

CONSOLIDATED BALANCE SHEET

AT 30 SEPTEMBER 2023

Unaudited Unaudited Audited

30 September 2023 GBP'000 1 October 2022 1 April 2023

GBP'000 GBP'000

Non-current assets

Intangible assets 7,832 6,390 6,015

Property, plant and equipment 20,274 16,765 19,817

Right-of-use assets 43,649 30,453 57,520

Interests in associates 168 375 254

Deferred tax asset 212 1,871 622

72,135 55,854 84,228

Current assets

Inventories 45,320 48,726 48,250

Trade and other receivables 15,266 17,984 19,901

Current tax asset - 409 -

Cash and cash equivalents 5,852 6,544 6,872

66,438 73,663 75,023

Total assets 138,573 129,517 159,251

Current liabilities

Trade and other payables (25,971) (22,962) (28,143)

Current tax liabilities (331) - (182)

Lease liabilities (9,971) (11,199) (10,932)

Borrowings (23,883) (3,798) (11,562)

(60,156) (37,959) (50,819)

Net current assets 6,282 35,704 24,204

Non-current liabilities

Trade and other payables (2,191) - -

Lease liabilities (43,043) (49,021) (61,666)

Borrowings - (8,814) -

(45,234) (57,835) (61,666)

Total liabilities (105,390) (95,794) (112,485)

Net assets 33,183 33,723 46,766

Equity

Share capital 3,004 3,004 3,004

Share premium account 12,160 12,160 12,160

Own share reserve (854) (923) (896)

Capital redemption reserve 154 154 154

Foreign exchange reserve (170) 1,566 675

Retained earnings 25,176 23,968 38,110

Equity attributable to holders of the parent 39,470 39,929 53,207

Non-controlling interests (6,287) (6,206) (6,441)

Total equity 33,183 33,723 46,766

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

26 WEEKSED 30 SEPTEMBER 2023

Share Own Capital Foreign Non-controlling

Share premium share re-demption exchange Retained Total interest

capital account reserve reserve reserve earnings GBP'000 GBP'000 Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 equity

GBP'000

As at 2 April 2022 3,004 12,160 (1,269) 154 1,158 27,006 42,213 (4,467) 37,746

Loss for the period - - - - - (2,715) (2,715) (1,314) (4,029)

Other comprehensive

income for the

period - - - - 408 - 408 - 408

Total comprehensive

income/(expense) for

the period - - - - 408 (2,715) (2,307) (1,314) (3,621)

Charge for employee

share-based payments - - - - - 23 23 - 23

Own shares - - 346 - - - 346 - 346

Exercise of share

options - - - - - (346) (346) - (346)

Non-controlling

interest foreign

exchange - - - - - - - (425) (425)

As at 1 October 2022 3,004 12,160 (923) 154 1,566 23,968 39,929 (6,206) 33,723

Profit/(loss) for the

period - - - - - 15,958 15,958 (532) 15,426

Other comprehensive

expense for the

period - - - - (891) - (891) - (891)

Total comprehensive

(expense)/income for

the period - - - - (891) 15,958 15,067 (532) 14,535

Impairment of shares

in trust - - 27 - - (27) - - -

Dividends paid - - - - - (1,789) (1,789) - (1,789)

Non-controlling

interest foreign

exchange - - - - - - - 297 297

As at 1 April 2023 3,004 12,160 (896) 154 675 38,110 53,207 (6,441) 46,766

Loss for the period - - - - - (12,279) (12,279) (1,119) (13,398)

Other comprehensive

expense for the

period - - - - (845) - (845) - (845)

Total comprehensive

expense for the

period - - - - (845) (12,279) (13,124) (1,119) (14,243)

Charge for employee

share-based payments - - - - - 7 7 - 7

Impairment of shares

in trust - - 42 - - (42) - - -

Adjustment arising

from investment by

non-controlling

interests (see note

7) - - - - - - - 611 611

Adjustment arising

from acquisition of

non-controlling

interests (see note

7) - - - - - (620) (620) 620 -

Non-controlling

interest foreign

exchange - - - - - - - 42 42

As at 30 September

2023 3,004 12,160 (854) 154 (170) 25,176 39,470 (6,287) 33,183

CONSOLIDATED CASH FLOW STATEMENT

26 WEEKSED 30 SEPTEMBER 2023

Unaudited Unaudited Audited

26 weeks ended 26 weeks ended 52 weeks ended

30 September 2023 GBP'000 1 October 2022 1 April 2023

GBP'000 GBP'000

Operating (loss)/profit for the period (10,445) (2,217) 16,974

Adjustments for:

Depreciation and impairment of property, plant

and equipment 2,451 1,922 3,487

Depreciation and impairment of right-of-use

assets 4,517 3,577 (5,021)

Amortisation and impairment of intangible assets 921 835 4,041

Gain on lease modifications and lease disposals (5,484) (243) (441)

(Profit)/loss on sale of property, plant and

equipment - (2) 96

Business combination gain - - (304)

Share-based payments expense 7 23 23

Operating cash (outflows)/inflows before

movements in working capital (8,033) 3,895 18,855

Decrease/(increase) in inventories 3,063 (11,960) (9,722)

Decrease/(increase) in receivables 4,673 (2,057) (3,974)

(Decrease)/increase in payables (1,229) (1,073) 2,001

Cash (used)/generated by operations (1,526) (11,195) 7,160

Income taxes paid (71) (2,790) (2,427)

Interest paid (2,334) (1,582) (3,899)

Net cash(outflow)/inflow from operating

activities (3,931) (15,567) 834

Investing activities:

Interest received 1 5 15

Acquisition of businesses (see note 8) (238) - (3,182)

Purchases of property, plant and equipment (3,057) (4,030) (7,129)

Proceeds from disposal of property, plant and

equipment - 2 2

Acquisition of intangible fixed assets (2,219) (1,179) (3,919)

Dividend received from associate - - 40

Net cash used in investing activities (5,513) (5,202) (14,173)

Financing activities:

(Repayment)/increase in loans from

non-controlling interests (744) 94 246

Investment from non-controlling interest (see 611 - -

note 7)

New borrowings 13,309 7,000 6,100

Dividends paid - - (1,789)

Principal elements of lease payments (4,629) (5,840) (10,261)

Net cash generated/(used) in financing activities 8,547 1,254 (5,704)

Net decrease in cash and cash equivalents (897) (19,515) (19,043)

Cash and cash equivalents at beginning of period 6,872 25,669 25,669

Effect of foreign exchange rate changes (123) 390 246

Cash and cash equivalents at end of period 5,852 6,544 6,872

Notes to the condensed financiAL statements

26 WEEKSED 30 SEPTEMBER 2023

1. GENERAL INFORMATION

Mulberry Group plc is a company incorporated in the United

Kingdom under the Companies Act 2006. The half year results and

condensed consolidated financial statements for the 26 weeks ended

30 September 2023 (the interim financial statements) comprise the

results for the Company and its subsidiaries (together referred to

as the Group) and the Group's interest in associates. The interim

financial statements for the 26 weeks ended 30 September 2023 have

not been reviewed or audited.

The information for the 52 weeks ended 1 April 2023 does not

constitute statutory accounts as defined in section 434 of the

Companies Act 2006. The statutory accounts for that period were

approved by the Board of Directors on 27 June 2023 and have been

filed with the Registrar of Companies. The auditor's report on

those statutory accounts was not qualified, did not include a

reference to any matters to which the Auditor drew attention by way

of emphasis without qualifying the report and did not contain

statements under section 498(2) (3) of the Companies Act 2006.

2. ACCOUNTING POLICIES AND BASIS OF PREPARATION

The accounting policies and methods of computation followed in

the interim financial statements are consistent with those

published in the Group's Annual Report and Financial Statements for

the 52 weeks ended 1 April 2023.

These condensed consolidated interim financial statements for

the 26 weeks ended 30 September 2023 have been prepared in

accordance with IAS 34 'Interim Financial Reporting' as adopted by

the European Union. This report should be read in conjunction with

the Group's financial statements for the 52 weeks ended 1 April

2023, which have been prepared in accordance with UK-adopted

International Financial Reporting Standards in conformity with the

requirements of the Companies Act 2006.

The Annual Report and Financial Statements are available from

the Group's website (www.mulberry.com) or from the Company

Secretary at the Company's registered office, The Rookery,

Chilcompton, Bath, England, BA3 4EH.

CRITICAL ACCOUNTING JUDGEMENTS AND KEY SOURCES OF ESTIMATION

UNCERTAINTY

Preparation of the condensed consolidated interim financial

statements requires the Directors to make certain estimates and

judgements that affect the measurement of reported revenues,

expenses, assets and liabilities.

The critical accounting judgements and key sources of estimation

uncertainty applied in the preparation of the condensed

consolidated interim financial statements are consistent with those

described on pages 91-92 of the Group's Annual Report and Financial

Statements for the 52 weeks ended 1 April 2023.

PRINCIPAL RISKS AND UNCERTAINTIES

The management of the business and the execution of the Group's

growth strategies are subject to a number of risks and

uncertainties that could adversely affect the Group's future

development. The principal risks and uncertainties for the Group

and the key mitigating actions used to address them are consistent

with those outlined on pages 42-47 of the Group's Annual Report and

Financial Statements for the 52 weeks ended 1 April 2023.

ALTERNATIVE PERFORMANCE MEASURES

In reporting financial information, the Group presents an APMs,

which is not defined or specified under the requirements of IFRS.

The Group believes that these APMs, which are not considered to be

a substitute for, or superior to, IFRS measures, provide

stakeholders with additional helpful information on the performance

of the business. These APMs are consistent with how the business

performance is planned and reported within the internal management

reporting to the Board of Directors. Some of these measures are

also used for the purpose of setting remuneration targets.

The Group makes certain adjustments to the statutory profit or

loss measures in order to derive the APMs. Adjusting items are

those items which, in the opinion of the Directors, should be

excluded in order to provide a consistent and comparable view of

the performance of the Group's ongoing business. Generally, this

will include those items that are largely one-off and material in

nature as well as income or expenses relating to acquisitions or

disposals of businesses or other transactions of a similar nature.

Treatment as an adjusting item provides stakeholders with

additional useful information to assess the year-on-year trading

performance of the Group.

A reconciliation of reported (loss)/profit before tax to

underlying (loss)/profit before tax is set out below:

Unaudited Unaudited Audited

26 weeks ended 26 weeks ended 52 weeks ended

30 September 2023 GBP'000 1 October 2022 1 April 2023

GBP'000 GBP'000

Reconciliation to underlying (loss)/profit before

tax

(Loss)/profit before tax (12,759) (3,750) 13,150

Store closure charge/(credit) 517 (210) (205)

Impairment credit related to property, plant and

equipment - - (850)

Impairment credit related to right-of-use assets - - (12,949)

Impairment charge for intangible assets - - 2,366

Australia acquisition costs - 933 806

Sweden acquisition costs - 193 193

Underlying (loss)/profit before tax - non-GAAP

measure (12,242) (2,834) 2,511

Underlying basic (loss)/profit per share (21.8p) (5.3p) 5.8p

Underlying diluted (loss)/profit per share (21.8p) (5.3p) 5.8p

Store closure charge

During the period no stores (2022: 2 stores) were closed although the lease on a store that

had been closed in February 2023 was assigned on 3 April 2023. The charge on disposal comprises

the release to the income statement of lease and other liabilities of GBP17,735,000 (2022:

GBP210,000), the write-off of right-of-use assets of GBP11,777,000 (2022: GBPnil), a charge

of lease exit costs of GBP150,000 (2022: GBPnil), a contribution of GBP5,205,000 (2022 : GBPnil)

towards the new lessee rentals and a charge of GBP1,120,000 (2022 : GBPnil) being the financial

guarantee for the remaining lease rentals.

Australian acquisition costs

During the previous period the Group took over the running of five stores in Australia and

incurred a write-off of debtors of GBP933,000.

Sweden acquisition costs

During the previous period the Group took over the running of three stores in Sweden previously

owned by the Swedish franchisee and incurred costs of GBP193,000.

3. GOING CONCERN

In determining whether the Group's accounts can be prepared on a

going concern basis, the Directors considered the Group's business

activities and cash requirements together with factors likely to

affect its performance and financial position. The Group had cash

and cash equivalents (net of overdrafts) of -GBP0.6 million (2022:

GBP6.5 million) at 30 September 2023 and had drawn down GBP13.0

million (2022: GBP7.0 million) on its revolving credit facility.

The Directors have also reviewed the 12-month forecasts including

their resilience in the face of possible downside scenarios.

Based on the assessment outlined above, the Directors have a

reasonable expectation that the Group has access to adequate

resources to enable it to continue to operate as a going concern

for the foreseeable future. For these reasons, the Directors

consider it appropriate for the Group to continue to adopt the

going concern basis of accounting in preparing the Interim Report

and financial statements.

4. TAXATION

The tax charge relates to deferred tax which is calculated by

applying the forecast full year effective tax rate to the interim

(loss)/profit and calculating the deferred tax balance for the

period.

5. EARNINGS PER SHARE ('EPS')

Unaudited Unaudited Audited

26 weeks ended 26 weeks ended 52 weeks ended

30 September 2023 GBP'000 1 October 2022 1 April 2023

GBP'000 GBP'000

Basic (loss)/profit per share (22.5p) (6.8p) 19.1p

Diluted (loss)/profit per share (22.5p) (6.8p) 19.1p

Underlying basic (loss)/profit per share (21.8p) (5.3p) 5.8p

Underlying diluted (loss)/profit per share (21.8p) (5.3p) 5.8p

Earnings per share is calculated based on the following

data:

Unaudited Unaudited Audited

26 weeks ended 26 weeks ended 52 weeks ended

30 September 2023 GBP'000 1 October 2022 1 April 2023

GBP'000 GBP'000

(Loss)/profit for the period for basic and

diluted earnings per share (13,398) (4,029) 11,397

Adjusting items:

Store closure charge/(credit)* 388 (206) (203)

Reversal of impairment charge related to

property, plant and equipment* - - (650)

Reversal of impairment charge related to

right-of-use assets* - - (10,342)

Impairment charge for intangible assets - 2,366

Australia acquisition costs* - 193 728

Sweden acquisition costs - 855 193

Underlying (loss)/profit for the period for basic

and diluted earnings per share (13,010) (3,187) 3,489

*These items are included net of tax

Unaudited Unaudited Audited

26 weeks ended 26 weeks ended 52 weeks ended

30 September 2023 GBP'000 1 October 2022 1 April 2023

GBP'000 GBP'000

Weighted average number of ordinary shares for

the purpose of basic EPS 59.7 59.6 59.6

Effect of dilutive potential ordinary shares: - - -

share options

Weighted average number of ordinary shares for

the purpose of diluted EPS 59.7 59.6 59.6

The weighted average number of ordinary shares in issue during

the period excludes those held by the Employee Share Trust.

6. BUSINESS AND GEOGRAPHICAL SEGMENTS

IFRS 8 requires operating segments to be identified on the basis

of internal reports about components of the Group that are

regularly reviewed by the Chief Operating Decision Maker ("CODM"),

defined as the Board of Directors, to allocate resources to the

segments and to assess their performance. Inter-segment pricing is

determined on an arm's length basis. The Group also presents

analysis by geographical destination and product categories.

a) Business segment

The Group continues to extend its omni-channel network in order

to support the Group's global growth ambitions. Mulberry has thus

become increasingly reliant on individual market-level

profitability metrics to enable them to make timely market-centric

decisions that are operational and investment in nature. It is

therefore appropriate for the segmental analysis disclosures to be

a regional view of segments (being UK, Asia Pacific and Other

International) to reflect the current business operations and the

way the business internally reports and the information that the

CODM reviews and makes strategic decisions based on its financial

results.

The principal activities are as follows:

-- The accounting policies of the reportable segment are the

same as described in the Group's financial statements. Information

regarding the results of the reportable segment is included below.

Performance for the segment is assessed based on operating

profit/(loss).

-- The Group designs, manufactures and manages the Mulberry

brand for the segment and therefore the finance income and expense

are not attributable to the reportable segments.

GROUP INCOME STATEMENT

26 WEEKSED 30 SEPTEMBER 2023

Other International

UK Asia Pacific GBP'000 Eliminations GBP'000 Total

GBP'000 GBP'000 GBP'000

Revenue

Omni-channel 56,616 13,474 10,006 (20,402) 59,694

Wholesale 1,026 2,077 6,946 10,049

Total revenue 57,642 15,551 16,952 (20,402) 69,743

Segment (loss)/profit (6,454) (4,591) 2,395 (8,650)

Central costs (1,278)

Store closure charge (517)

Operating loss (10,445)

Share of results of

associates 19

Finance income 1

Finance expense (2,334)

Loss before tax (12,759)

Other International

UK Asia Pacific GBP'000 Central Total

GBP'000 GBP'000 GBP'000 GBP'000

Segment capital

expenditure 4,572 956 116 - 5,644

Segment depreciation and

amortisation 4,431 1,918 708 832 7,889

Segment assets 94,392 23,657 13,226 7,086 138,361

Segment liabilities 68,232 15,135 12,693 9,330 105,390

26 WEEKSED 1 OCTOBER 2022

Other International

UK Asia Pacific GBP'000 Eliminations GBP'000 Total

GBP'000 GBP'000 GBP'000

Revenue

Omni-channel 72,280 11,826 5,120 (37,665) 51,561

Wholesale 2,182 3,141 8,036 13,359

Total revenue 74,462 14,967 13,156 (37,665) 64,920

Segment profit/(loss) 665 (1,969) 1,703 399

Central costs (1,700)

Store closure credit 210

Australia acquisition

costs (933)

Sweden acquisition costs (193)

Operating loss (2,217)

Share of results of

associates 36

Finance income 5

Finance expense (1,574)

Profit before tax (3,750)

Other International

UK Asia Pacific GBP'000 Central Total

GBP'000 GBP'000 GBP'000 GBP'000

Segment capital

expenditure 2,786 614 1,429 29 4,858

Segment depreciation and

amortisation 3,955 926 457 996 6,334

Segment assets 84,413 20,994 14,132 8,107 127,646

Segment liabilities 62,229 8,617 14,341 10,607 95,794

52 WEEKSED 1 APRIL 2023

Other International

UK Asia Pacific GBP'000 Eliminations GBP'000 Total

GBP'000 GBP'000 GBP'000

Revenue

Omni-channel 171,615 27,234 13,073 (77,677) 134,245

Wholesale 4,918 4,254 15,712 24,884

Total revenue 176,533 31,488 28,785 (77,677) 159,129

Segment profit/(loss) 533 (1,222) 12,398 11,709

Central costs (5,374)

Store closure credit 205

Impairment credit related

to property, plant and

equipment 850

Impairment credit related

to right-of-use assets 12,949

Impairment charge related

to intangible asset (2,366)

Australia acquisition

costs (806)

Sweden acquisition costs (193)

Operating profit 16,974

Share of results of

associates 52

Finance income 11

Finance expense (3,887)

Profit before tax 13,150

Other International

UK Asia Pacific GBP'000 Central Total

GBP'000 GBP'000 GBP'000 GBP'000

Segment capital

expenditure 7,866 1,101 1,731 138 10,836

Segment depreciation and

amortisation net of

impairment (6,142) 4,942 1,747 1,960 2,507

Segment assets 108,065 27,812 14,539 8,213 158,629

Segment liabilities 72,006 16,312 13,877 10,290 112,485

For the purposes of monitoring segment performance and

allocating resources between segments, the Chief Operating Decision

Maker, which is deemed to be the Board, monitors the tangible,

intangible and financial assets. All assets are allocated to the

reportable segment.

(b) Product categories

Leather accessories account for around 90% of the Group's

revenues, of which bags represent over 70% of revenues. Other

important product categories include small leather goods, shoes,

soft accessories and women's ready-to-wear. Net asset information

is not allocated by product category.

7. INVESTMENT IN MULBERRY JAPAN CO. LIMITED

During the period the Group, via its subsidiary Mulberry Trading

Holding Company Limited and its Joint Venture partner Onward

Holding Co Limited, invested additional share capital of GBP661,000

each into Mulberry Japan Co. Limited the proceeds of which were

used to repay trading loans to both parties. Following this

investment on 27 June 2023 the Group acquired the 50% share capital

owned by Onward Holding Co Limited for a purchase price of 1 Yen

and, following the acquisition, the Group now owns 100% of Mulberry

Japan Co. Limited.

8. ACQUISTION OF NEW ZEALAND STORE

On 12 May 2023 the Group acquired one store previously operated

by our New Zealand franchisee. The Group paid GBP238,000 to

purchase the assets from the franchisee. The store is being

operated by a branch of Mulberry Company (Australia) Pty

Limited.

9. EVENTS AFTER THE REPORTING PERIOD

There are no events to report after the reporting period.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR VKLFLXFLZFBV

(END) Dow Jones Newswires

November 30, 2023 02:00 ET (07:00 GMT)

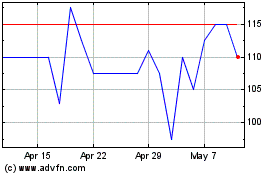

Mulberry (LSE:MUL)

Historical Stock Chart

From Oct 2024 to Nov 2024

Mulberry (LSE:MUL)

Historical Stock Chart

From Nov 2023 to Nov 2024