TIDMMWE

RNS Number : 8982T

MTI Wireless Edge Limited

20 November 2023

20 November 2023

MTI Wireless Edge Ltd

("MTI", the "Company" or the "Group")

Q3 2023 financial results

MTI Wireless Edge Ltd (AIM: MWE), the technology group focused

on comprehensive communication and radio frequency solutions across

multiple sectors, is pleased to announce its financial results for

the nine-month period ended 30 September 2023 (the "Period").

Financial highlights

-- Revenue for the Period of $33.7m (nine months to 30 September

2022: $34.8m). On a constant currency basis this represents an

increase of 1% over the same period last year

-- 6% improvement in profit before tax to $3.4m (nine months to

30 September 2022: $3.2m), helped by positive currency movements

and margin improvement

-- 9% improvement in earnings per share to 3.25 US cents ( nine

months to 30 September 2022 : 2.99 US cents)

-- Company remains virtually ungeared with net cash of $6.4m as

at 30 September 2023 (30 September 2022: $5.2m)

-- Final dividend anticipated to be declared alongside MTI's

full year results which will be announced during the first quarter

of 2024

Operational highlights

-- A stable performance with the Company remaining well placed

for the rest of the year and into 2024

-- Antenna division recorded good growth, driven by military and RFID sales

o Demand for military antennas globally is strong and is

expected by the Company to continue to grow

o India remains a key market for 5G sales, with recent wins

demonstrating the technical strength of the Company's 5G backhaul

solution

-- Mottech delivered a solid performance during the first nine months of the year

o Good contribution to the Group, helped by improved margins

following successful price increases and positive exchange rates

from the international businesses

o Israeli market remains firm, growing in NIS terms but, given

the NIS/US$ foreign exchange effects, remained flat in the year

o Growth coming through from France and Italy

o Pipeline for Q4 2023 looks promising to support a good end to

the year and start to 2024

-- MTI Summit affected by a slightly slower order rate, but its pipeline is positive

o The division has seen a slight slowdown in order rate which

has impacted sales in the period

o PSK continues to grow and returned to profitability in the

third quarter, although the first nine months of the year still

showed a minor loss, as it suffered from delays to key projects in

Q2

o Overall, MTI Summit remains well placed to deliver a good

result for the year and is likely to benefit from increased

government spend in Q4

Moni Borovitz, Chief Executive Officer of MTI Wireless Edge,

said:

"The business continues to perform well despite the tragic

events on 7 October 2023 and the subsequent war. Several of our

employees have been called up for military service and a number of

others that survived the terrible events have had to leave the

attacked area (where they lived) and are still not able to live a

normal life. This, together with the overall sadness and turmoil,

has had some effect in reducing the Company's labour resources. At

the same time, there is high motivation and solidarity in the

country as well as in the workplace, resembling to some extent the

beginning of the COVID era where people worked long hours and

adapted their working practices. As announced in July 2022 we are

engaged, in part of our business, in a service contract with the

Israeli Government and we are currently working very long hours

under this agreement, supporting the needs of the country and

compensating for the lost hours elsewhere. As a result, overall

demand for our services in Israel is largely unchanged. Our

internal infrastructure is unaffected and we continue to import and

export goods as normal. 40% of MTI's employees reside outside of

Israel where all the Company's international operations are running

and performing normally.

"The business is further supported by a strong balance sheet

with $6.4m in net cash at the end of September 2023. Q3 results

were impacted adversely by currency movements, especially the 9%

decrease in NIS against the US$ from the beginning of the year, at

the revenue level but those same currency changes had a positive

impact on profitability, resulting in an overall positive

performance for the first nine months of the year.

"Q4 has begun well with good opportunities visible in all

divisions of the Group, part of which is related to the increased

spending by the Israeli Government for services from both our

Antenna and MTI Summit divisions. I believe that the Company is

therefore well placed to weather the current challenges and, in the

absence of unforeseen geopolitical developments, to continue to

grow."

For further information please contact:

MTI Wireless Edge Ltd +972 3 900 8900

Moni Borovitz, CEO http://www.mtiwirelessedge.com

Allenby Capital Limited (Nomad and Joint

Broker) +44 20 3328 5656

Nick Naylor/Alex Brearley/Piers Shimwell

(Corporate Finance)

Guy McDougall/Amrit Nahal (Sales and

Corporate Broking)

Shore Capital (Joint Broker)

Toby Gibbs/ Rachel Goldstein (Corporate

Advisory)

Fiona Conroy (Corporate Broking) +44 20 7408 4090

Novella (Financial PR)

Tim Robertson/Safia Colebrook +44 20 3151 7008

About MTI Wireless Edge Ltd. ("MTI")

Headquartered in Israel, MTI is a technology group focused on

comprehensive communication and radio frequency solutions across

multiple sectors through three core divisions:

Antenna division

MTI is internationally recognised as a producer of commercial

off-the-Shelf and custom-developed antenna solutions in a broad

frequency range of HF to 170 GHz for commercial, RFID and military

applications. MTI continuously invests in ground breaking

technologies, explores new frequencies, and devises innovative

solutions which empower our wireless communication customers with

cutting-edge off-the-shelf and custom-made antennas.

We are at the forefront of technology and innovation, being the

first to introduce Dual Band parabolic antennas, E Band Automatic

Beam Steering antennas, E Band FCC compliant flat antennas, and

more.

MTI supplies directional and omnidirectional antennas for

outdoor and indoor deployments, including smart antennas for 5G

backhaul, Broadband access, public safety, RFID, base station and

terminals for the utility market.

Military applications include a wide range of broadband,

tactical and specialized communication antennas, antenna systems

and DF arrays installed on numerous airborne, ground and naval,

including submarine, platforms worldwide.

Water Control & Management division

Via its subsidiary, Mottech Water Solutions Ltd ("Mottech"), MTI

provides high-end remote control and monitoring solutions for water

and irrigation applications based on Motorola's IRRInet

state-of-the-art control, monitoring and communication

technologies.

As Motorola's global prime-distributor Mottech serves its

customers worldwide through its international subsidiaries and a

global network of local distributors and representatives. With over

25 years of experience in providing customers with irrigation

remote control and management, Mottech's solutions ensure constant,

reliable and accurate water usage, increase crops quality and yield

while reducing operational and maintenance costs providing fast ROI

while helping sustain the environment. Mottech's activities are

focused in the market segments of agriculture, water distribution,

municipal and commercial landscape as well as wastewater and

storm-water reuse.

Distribution & Professional Consulting Services division

Via its subsidiary, MTI Summit Electronics Ltd., MTI offers

consulting, representation and marketing services to foreign

companies in the field of RF and Microwave solutions and

applications including engineering services (including design and

integration) in the field of aerostat systems and the ongoing

operation of Platform subsystems, SIGINT, RADAR, communication and

observation systems which is performed by the Company. It also

specializes in the development, manufacture and integration of

communication systems and advanced monitoring and control systems

for the Government and defence industry market.

MTI WIRELESS EDGE LTD.

(An Israeli Corporation)

INTERIM CONSOLIDATED STATEMENTS OF

COMPREHENSIVE INCOME

Year ended

Nine month period ended December

September 30, 31,

-------------------------- ----------

2023 2022 2022

------------ ------------ ----------

U.S. $ in thousands

(Except per share data)

--------------------------------------

Unaudited

--------------------------

Revenues 33,724 34,783 46,270

Cost of sales 22,815 23,927 31,680

------------ ------------ ----------

Gross profit 10,909 10,856 14,590

Research and development expenses 794 789 1,077

Distribution expenses 2,814 2,855 3,924

General and administrative expenses 3,757 3,719 4,998

Loss (profit) from sale of property,

plant and equipment (8) 8 1

------------ ------------ ----------

Profit from operations 3,552 3,485 4,592

Finance expenses 245 350 385

Finance income (116) (108) (110)

------------ ------------ ----------

Profit before income tax 3,423 3,243 4,317

Tax expenses 569 505 468

------------ ------------ ----------

Profit 2,854 2,738 3,849

------------ ------------ ----------

Other comprehensive income (loss)

net of tax:

Items that will not be reclassified

to profit or loss:

Re-measurement of defined benefit

plans - - 127

------------ ------------ ----------

Items that may be reclassified to

profit or loss:

Adjustment arising from translation

of financial statements of foreign

operations (288) (365) (422)

------------ ------------ ----------

Total other comprehensive income

(loss) (288) (365) (295)

------------ ------------ ----------

Total comprehensive income 2,566 2,373 3,554

============ ============ ==========

Profit attributable to:

Owners of the parent 2,868 2,643 3,721

Non-controlling interests (14) 95 128

------------ ------------ ----------

2,854 2,738 3,849

============ ============ ==========

Total comprehensive income attributable

to:

Owners of the parent 2,580 2,278 3,426

Non-controlling interests (14) 95 128

------------ ------------ ----------

2,566 2,373 3,554

============ ============ ==========

Earnings per share (dollars)

Basic and Diluted (dollars per share) 0.0325 0.0299 0.0421

============ ============ ==========

Weighted average number of shares

outstanding

Basic and Diluted 88,332,198 88,494,239 88,444,356

============ ============ ==========

The accompanying notes form an integral part of the financial

statements.

MTI WIRELESS EDGE LTD.

(An Israeli Corporation)

INTERIM CONSOLIDATED STATEMENTS OF

CHANGES IN EQUITY

For the nine month period ended September 30, 2023

(Unaudited):

Attributable to owners of the parent

----------------------------------------------------------------

Total

attributable

Additional to owners

Share paid-in Translation Retained of the Non-controlling

capital capital differences earnings parent interest Total equity

------------ ---------- ------------ ---------- ------------ --------------- ------------

U.S. $ in thousands

------------

Balance at January

1, 2023 209 23,078 (250) 3,775 26,812 1,226 28,038

Changes during the

nine month period

ended September 30,

2023:

Comprehensive

income

Profit for the

period - - - 2,868 2,868 (14) 2,854

Other

comprehensive

income

Translation

differences - - (288) - (288) - (288)

------------ ---------- ------------ ---------- ------------ --------------- ------------

Total

comprehensive

income for the

period - - (288) 2,868 2,580 (14) 2,566

Acquisition and

disposal of

treasury

shares * (27) - - (27) - (27)

Dividend - - - (2,656) (2,656) - (2,656)

Acquisition of a

non-controlling

interest

in subsidiary - - - - - (45) (45)

------------ ---------- ------------ ---------- ------------ --------------- ------------

Balance at

September

30, 2023 209 23,051 (538) 3,987 26,709 1,167 27,876

============ ========== ============ ========== ============ =============== ============

(*) Less than US$ 1 thousand

The accompanying notes form an integral part of the financial

statements.

MTI WIRELESS EDGE LTD.

(An Israeli Corporation)

INTERIM CONSOLIDATED STATEMENTS OF

CHANGES IN EQUITY (CONT.)

For the nine month period ended September 30, 2022

(Unaudited):

Attributable to owners of the parent

------------------------------------------------------------------

Total

Additional attributable

paid-in Translation Retained to owners Non-controlling

Share capital capital differences earnings of the parent interest Total equity

------------- ---------- ------------ ---------- ------------- --------------- ------------

U.S. $ in thousands

------------

Balance at

January 1, 2022 209 23,126 172 2,406 25,913 1,098 27,011

Changes during

the nine-month

period

ended September

30, 2022:

Comprehensive

income

Profit for the

period - - - 2,643 2,643 95 2,738

Other

comprehensive

income

Translation

differences - - (365) - (365) - (365)

------------- ---------- ------------ ---------- ------------- --------------- ------------

Total

comprehensive

income for

the

period - - (365) 2,643 2,278 95 2,373

Acquisition

and disposal

of treasury

shares - (87) - - (87) - (87)

Dividend - - - (2,479) (2,479) - (2,479)

------------- ---------- ------------ ---------- ------------- --------------- ------------

Balance at

September

30, 2022 209 23,039 (193) 2,570 25,625 1,193 26,818

============= ========== ============ ========== ============= =============== ============

The accompanying notes form an integral part of the financial

statements.

MTI WIRELESS EDGE LTD.

(An Israeli Corporation)

INTERIM CONSOLIDATED STATEMENTS OF

CHANGES IN EQUITY (CONT.)

For the year ended December 31, 2022 :

Attributable to owners of the parent

----------------------------------------------------------------

Total

attributable

Additional to owners

paid-in Translation Retained of the Non-controlling

Share capital capital differences earnings parent interests Total equity

------------- ---------- ------------ --------- ------------ --------------- ------------

U.S. $ in thousands

-----------------------------------------------------------------------------------------------

Balance as at January

1, 2022 209 23,126 172 2,406 25,913 1,098 27,011

Changes during 2022:

Comprehensive

income

Profit for the

year - - - 3,721 3,721 128 3,849

Other

comprehensive

income

Re measurements on

defined benefit

plans - - - 127 127 - 127

Translation

differences - - (422) - (422) - (422)

------------- ---------- ------------ --------- ------------ --------------- ------------

Total

comprehensive

income (loss) for

the

year - - (422) 3,848 3,426 128 3,554

Dividend - - - (2,479) (2,479) - (2,479)

Acquisition and

disposal of

treasury shares - (48) - - (48) - (48)

------------- ---------- ------------ --------- ------------ --------------- ------------

Balance as at

December 31,

2022 209 23,078 (250) 3,775 26,812 1,226 28,038

============= ========== ============ ========= ============ =============== ============

The accompanying notes form an integral part of the financial

statements.

MTI WIRELESS EDGE LTD.

(An Israeli Corporation)

INTERIM CONSOLIDATED STATEMENTS OF

FINANCIAL POSITION

30.09.2023 30.09.2022 31.12.2022

---------- ---------- ----------

U.S. $ in thousands

----------------------------------

Unaudited

----------------------

ASSETS

CURRENT ASSETS:

Cash and cash equivalents 6,655 5,280 8,279

Trade and other receivables 11,697 13,798 11,035

Unbilled revenue 4,407 2,760 2,204

Current tax receivables 409 444 549

Inventories 7,365 6,745 7,757

---------- ---------- ----------

30,533 29,027 29,824

---------- ---------- ----------

NON-CURRENT ASSETS:

Long term prepaid expenses 39 40 39

Property, plant and equipment 4,987 5,801 5,573

Deferred tax assets 1,072 1,113 1,163

Intangible assets 3,739 3,928 3,858

---------- ---------- ----------

9,837 10,882 10,633

---------- ---------- ----------

Total assets 40,370 39,909 40,457

========== ========== ==========

The accompanying notes form an integral part of the financial

statements.

MTI WIRELESS EDGE LTD.

(An Israeli Corporation)

INTERIM CONSOLIDATED STATEMENTS OF

F INANCIAL P OSITION

30.09.2023 30.09.2022 31.12.2022

---------- ---------- ----------

U.S. $ In thousands

-----------------------------------

Unaudited

----------------------

LIABILITIES AND EQUITY

CURRENT LIABILITIES:

Current maturities and short term bank

credit and loans 198 17 43

Trade payables 5,684 6,080 5,739

Other accounts payable 3,817 3,827 3,627

Current tax payables 422 439 425

---------- ---------- -----------

10,121 10,363 9,834

---------- ---------- -----------

NON- CURRENT LIABILITIES:

Liability to purchase shares of subsidiary 1,432 1,432 1,432

Lease liabilities 150 401 303

Loans from banks, net of current maturities 52 37 98

Employee benefits, net 739 858 752

---------- ---------- -----------

2,373 2,728 2,585

---------- ---------- -----------

Total liabilities 12,494 13,091 12,419

---------- ---------- -----------

EQUITY

Equity attributable to owners of the parent

Share capital 209 209 209

Additional paid-in capital 23,051 23,039 23,078

Translation differences (538) (193) (250)

Retained earnings 3,987 2,570 3,775

---------- ---------- -----------

26,709 25,625 26,812

Non-controlling interest 1,167 1,193 1,226

---------- ---------- -----------

Total equity 27,876 26,818 28,038

---------- ---------- -----------

Total equity and liabilities 40,370 39,909 40,457

========== ========== ===========

November 19, 2023

------------------------- ----------------- -------------- ------------------------

Date of approval Moshe Borovitz Elhanan Zeira Zvi Borovitz

of financial statements Chief Executive Controller Non-executive Chairman

Officer of the Board

The accompanying notes form an integral part of the financial

statements.

INTERIM CONSOLIDATED STATEMENTS OF

CASH FLOWS

Nine month period Year ended

ended December

September 30, 31,

-------------------- ----------

2023 2022 2022

--------- --------- -----------

U.S. $ in thousands

---------------------------------

Unaudited

--------------------

Cash Flows from Operating Activities:

Profit for the period 2,854 2,378 3,849

Adjustments for:

Depreciation and amortization 956 1,090 1,466

Loss (Gain) from sale of property, plant

and equipment (6) - (1)

Finance (income) expenses, net (86) (95) (82)

Tax expenses 569 505 468

Changes in operating assets and liabilities:

Decrease (increase) in inventories 258 (35) (951)

Decrease (increase) in trade receivables (830) (2,607) (63)

Decrease (increase) in other accounts receivables (191) (440) (1,134)

Decrease (increase) in unbilled revenues (2,129) 34 590

Increase (decrease) in trade and other

accounts payables 517 172 572

Increase (decrease) in employee benefits,

net (13) (114) (93)

--------- --------- -----------

Cash from operations 1,899 1,248 4,621

Interest received 46 - -

Interest paid (23) (41) (52)

Income tax paid (344) (848) (978)

--------- --------- -----------

Net cash provided by operating activities 1,578 359 3,591

--------- --------- -----------

The accompanying notes form an integral part of the financial

statements.

INTERIM CONSOLIDATED STATEMENTS OF

CASH FLOWS (cont.)

Nine month period Year ended

ended December

September 30, 31,

---------------------- -----------------

2023 2022 2022

---------- ---------- -----------------

U.S. $ in thousands

-----------------------------------------

Unaudited

----------------------

Cash Flows From Investing Activities:

Proceeds from sale of property, plant

and equipment 39 - 15

Acquisition of subsidiary, net of cash

acquired - (1,427) (1,427)

Net cash from sale of previously consolidated

subsidiaries - (2,785) (2,785)

Purchase of property, plant and equipment (229) (421) (552)

---------- ---------- -----------------

Net cash used in investing activities (190) (4,633) (4,749)

---------- ---------- -----------------

Cash Flows From Financing Activities:

Dividend (2,656) (2,479) (2,479)

Payments of lease liabilities (328) (429) (560)

Treasury shares acquired (362) (87) (118)

Short-term loans and credit line received

from banks 136 34 -

Treasury shares sold 335 - 70

Acquisition of the non-controlling

interest in subsidiary (45) - -

Repayment of long-term loans from banks (10) (7) 118

---------- ---------- -----------------

Net cash used in financing activities (2,930) (2,968) (2,969)

---------- ---------- -----------------

(Decrease)/Increase in cash and cash

equivalents during the period (1,542) (7,242) (4,127)

Cash and cash equivalents at the beginning

of the period 8,279 12,567 12,567

Exchange differences on balances of

cash and cash equivalents (82) (45) (161)

---------- ---------- -----------------

Cash and cash equivalents at the end

of the period 6,655 5,280 8,279

========== ========== =================

The accompanying notes form an integral part of the financial

statements.

MTI WIRELESS EDGE LTD.

(An Israeli Corporation)

NOTES TO INTERIM CONSOLIDATED FINANCIAL STATEMENTS

Note 1 - General:

Corporate information:

M.T.I Wireless Edge Ltd. (hereafter - the "Company", or

collectively with its subsidiaries, the "Group") is an Israeli

corporation. The Company was incorporated under the Companies Act

in Israel on December 30, 1998 and commenced operations on July 1,

2000. Since March 2006, the Company's shares have been traded on

the AIM market of the London Stock Exchange.

The formal address of the Company is 11 Hamelacha Street, Afek

industrial Park, Rosh-Ha'Ayin, Israel.

The Company and its subsidiaries are engaged in the following

areas:

- Development, design, manufacture and marketing of antennas for

the military and civilian sectors.

- A leading provider of remote control solutions for water and

irrigation applications based on Motorola's IRRInet state of the

art control, monitoring and communication technologies.

- Providing consulting, representation and marketing services to

foreign companies in the field of RF (radio frequency) and

Microwave, including engineering services in the field of aerostat

systems and system engineering services.

- Development, manufacture and integration of communication

systems and advanced monitoring and control systems for the

Government and defence industry market.

Note 2 - Significant Accounting Policies:

The interim consolidated financial statements have been prepared

in accordance with generally accepted accounting principles for the

preparation of financial statements for interim periods, as

prescribed in International Accounting Standard No. 34 ("Interim

Financial Reporting").

The interim consolidated financial information set out above

does not constitute full year-end accounts within the meaning of

Israeli Companies Law . It has been prepared on the going concern

basis in accordance with the recognition and measurement criteria

of the International Financial Reporting Standards (IFRS). The

financial information for the financial year ended December 31,

2022 was approved by the board on March 12, 2023. The report of the

auditors on those financial statements was unqualified.

The interim consolidated financial statements as of September

30, 2023 have not been audited.

The interim consolidated financial information should be read in

conjunction with the annual financial statements as of December 31,

2022 and for the year then ended and with the notes thereto. The

significant accounting policies applied in the annual financial

statements of the Company as of December 31, 2022 are applied

consistently in these interim consolidated financial

statements.

Note 3 - REVENUES:

Year ended

Nine month period ended December

September 30, 31,

------------------------- ------------------

2023 2022 2022

------------ ----------- ------------

U.S. $ in thousands

-----------------------------------------------

Unaudited

-------------------------

Revenues arise from:

Sale of goods* 23,630 26,573 34,618

Rendering of services** 5,189 5,603 8,334

Projects** 4 ,905 2,607 3,318

------------ ----------- ------------

33,724 34,783 46,270

============ =========== ============

(*) at the point in time

(**) over time

Note 4 - operating SEGMENTS:

The following tables present revenue and profit information

regarding the Group's operating segments for the nine month period

ended September 30, 2023 and 2022 respectively and for the year

ended December 31, 2022.

Nine month period ended September 30, 2023 (Unaudited):

Distribution

Water & Consultation Adjustment

Antennas Solutions Services & Elimination Total

--------- ----------- ---------------- --------------- -------

U.S. $ in thousands

Revenues

External 8,917 13,006 11,801 - 33,274

Internal - - 201 (201) -

--------- ----------- ---------------- --------------- -------

Total 8,917 13,006 12,002 (201) 33,724

Segment profit (loss) 560 1,457 1,230 305 3,552

========= =========== ================ =============== =======

Finance expense (income),

net 129

Tax expenses 569

-------

Profit 2,854

=======

September 30, 2023 (Unaudited):

Distribution

Water & Consultation Adjustment

Antennas Solutions Services & Elimination Total

-------- ---------- --------------- -------------- --------

U.S. $ in thousands

Segment assets 15,136 11,263 11,532 - 37,931

======== ========== =============== ============== ========

Unallocated assets 2,439

========

Segment liabilities 3,834 3,707 4,460 - 12,001

======== ========== =============== ============== ========

Unallocated liabilities 493

========

Note 4 - operating SEGMENTS (CONT.):

Nine month period ended September 30, 2022 (Unaudited):

Distribution

Water & Consultation Adjustment

Antennas Solutions Services & Elimination Total

--------- ----------- ---------------- --------------- -------

U.S. $ in thousands

Revenues

External 8,627 13,743 12,413 - 34,783

Internal - - 252 (252) -

--------- ----------- ---------------- --------------- -------

Total 8,627 13,743 12,665 (252) 34,783

Segment profit 254 1,282 1,814 135 3,485

========= =========== ================ =============== =======

Finance expense, net 242

Tax expenses 505

-------

Profit 2,738

=======

September 30, 2022 (Unaudited):

Distribution

Water & Consultation Adjustment

Antennas Solutions Services & Elimination Total

-------- ---------- --------------- -------------- --------

U.S. $ in thousands

Segment assets 14,923 11,805 10,650 - 37,378

======== ========== =============== ============== ========

Unallocated assets 2,531

========

Segment liabilities 3,070 4,316 4,762 - 12,147

======== ========== =============== ============== ========

Unallocated liabilities 944

========

Year ended December 31, 2022

Water Distribution Adjustment

Antennas Solutions & Consultation & Elimination Total

--------- ----------- ---------------- --------------- -------

U.S. $ in thousands

------------------------------------------------------------------

Revenues

External 11,627 18,196 16,447 - 46,270

Inter-segment - - 215 (215) -

--------- ----------- ---------------- --------------- -------

Total 11,627 18,196 16,662 (215) 46,270

========= =========== ================ =============== =======

Segment profit 337 1,838 2,321 96 4,592

========= =========== ================ =============== =======

Finance expense, net 275

Tax expenses 468

-------

Profit 3,849

=======

Note 4 - operating SEGMENTS (CONT.):

December 31, 2022:

Water Distribution Adjustment

Antennas Solutions & Consultation & Elimination Total

-------- ---------- --------------- -------------- --------

U.S. $ in thousands

---------------------------------------------------------------

Segment assets 14,848 11,834 11,272 - 37,954

======== ========== =============== ============== ========

Unallocated assets 2,503

========

Segment liabilities 2,627 3,881 5,098 - 11,606

======== ========== =============== ============== ========

Unallocated liabilities 813

========

Note 5 - SIGNIFICANT EVENTS:

A. On March 12, 2023, the Board of directors declared a cash

dividend of 3.0 US cents per share, representing approximately

$2,656,000, in total. This dividend was paid on April 6, 2023 to

shareholders on the register at the close of trading on March 24,

2023 (ex-dividend on March 23, 2023).

B. On 24 January, 2019, the Company announced a share repurchase

program to conduct market purchases of ordinary shares of par value

0.01 Israeli Shekels each ("Ordinary Shares") in the Company up to

a maximum value of GBP150,000 (the "Programme"). Thereafter, the

board of directors of the Company and the board of directors of MTI

Engineering decided to continue with the Programme for several

further periods. On 14 March, 2023, the Company announced that it

would extend the Programme until 31 March, 2024, with the Programme

having an increased maximum value of up to GBP200,000 and with the

Programme being managed by Shore Capital Stockbrokers Limited

pursuant to the terms as announced. As at 30 September 2023 and as

at 19 November 2023, 200,000 and 350,000 Ordinary Shares,

respectively, were held in treasury under the Programme.

C. On 14 March, 2023 at the Company's annual general meeting,

Mr. Michael Yehezkel Karo was elected as an independent

non-executive director.

D. On 11 July, 2023 the Company acquired minority holdings in

Ginat for an insignificant amount and now holds 100% of the

company.

E. On 19 July, 2023 the Company completed the registration of

its fully owned subsidiary, MTI Wireless Communication India

Private Limited, in India in order to support local demand in the

market.

Note 6 - SUBSEQUENT EVENTS:

A. On 7 October, 2023 Israel was attacked by the Hamas terror

organization leading to war. The war has led to a slowdown in the

Israeli economy and if war continues for a prolonged period then it

may begin to impact the Company. The wide usage of military reserve

personnel, adverse foreign currency exchange rates and restrictions

on access to certain areas in Israel are risks which may affect the

Company from a prolonged period of war. As of the date of this

report, and to the best of the Company's knowledge, the war has not

had a significant effect on it. The Company continues to review the

effects of the war on its trading as it believes that if the war

continues for a long period of time then the overall Israeli

economy will be effected, and factors including the lack of

available manpower, interest rates and foreign currency exchange

rates may have an impact on its trading.

B. On 19 November, 2023 the remuneration committee and the board

of directors approved an option plan for the Company's shares

("Option Plan").

The Option Plan includes the authority to issue 2,000,000

options (2.2% of the Company's issued share capital on fully

diluted basis) with the following terms:

1. Each option can be exercised into one ordinary share of the

Company at a price of 40p being 25% above the share price at the

date preceding this announcement and 17% above the average share

price in the last 30 days.

2. The vesting of the options will be 50% after two years, 25%

after three years and 25% after four years with expiration after

six years from issuance.

3. The economic value of the options based on a Black-Scholes

calculation is US$259,000 for the total 2 million options approved

by the board of directors.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

QRTNKOBPFBDDADD

(END) Dow Jones Newswires

November 20, 2023 02:00 ET (07:00 GMT)

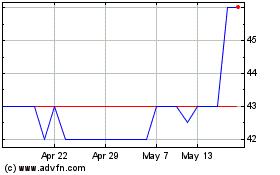

Mti Wireless Edge (LSE:MWE)

Historical Stock Chart

From Apr 2024 to May 2024

Mti Wireless Edge (LSE:MWE)

Historical Stock Chart

From May 2023 to May 2024