Norman Broadbent PLC Trading Update (9178R)

11 July 2022 - 4:00PM

UK Regulatory

TIDMNBB

RNS Number : 9178R

Norman Broadbent PLC

11 July 2022

Norman Broadbent plc

("Norman Broadbent", the "Company" or the "Group")

Trading Update

Norman Broadbent (AIM: NBB), a leading London quoted Executive

Search and Interim Management firm offering a diversified portfolio

of integrated Leadership Acquisition & Advisory Services, is

pleased to provide the following trading update for the 6 months

ended 30 June 2022 ("H1 2022").

Financial highlights

Net Fee Income H1 2022 H1 2021 % Change

GBP'000 GBP'000

---------- ---------- ---------

Executive Search 2,581 1,995 29%

---------- ---------- ---------

Interim Management 715 752 -

---------- ---------- ---------

--------- ---------

---------- ---------- ---------

Group Total 3,296 2,747 20%

---------- ---------- ---------

-- Following on from a strong Q4 2021, net fee income ("NFI") in

H1 2022 increased by 20% to GBP3.3m (H1 2021: GBP2.7m) driven by

growth in Executive Search NFI.

-- Executive Search NFI grown by 29% to GBP2.6m (H1 2021:

GBP2.0m) through culture change, increased focus on senior mandates

and improved brand positioning across core sectors.

-- Interim Management NFI slightly down year on year ("YOY") at

GBP0.7m, however, an operational focus to grow the Company's book

of long-term contractors versus purely fixed term contracts has

seen a considerable increase in contractor numbers and recurring

income from these long term contractors, providing additional H2

2022 NFI visibility of GBP0.2m.

-- Average new search fee value increased by 30% YOY.

-- Average NFI per fee earner up 40% YOY.

-- 50% growth in number of fee earners since start of 2022.

-- Days Sales Outstanding (DSO) reduced to 45 days as of 30 June

2022 (versus 66 days year-end 2021).

-- New office openings scheduled in Scotland for H2 2022 to

leverage industrial, financial services, retail / consumer, digital

/ technology and interim management practices across the UK.

Experienced executive search leaders already recruited in Scotland

to drive this market expansion.

-- EBITDA for H1 2022 is expected to be in the range GBP40k to

GBP60k, making progress to pre-covid earnings, but on a reshaped

business built for growth. The Group will publish its unaudited

interim results for the half year ended 30 June 2022 in mid-August

2022.

Kevin Davidson , Group CEO of Norman Broadbent plc, said:

"We are delighted with the progress the entire business has made

and that this is quickly translating into improved financial

performance whilst we continue to invest heavily in growth and

business transformation.

It is encouraging to see that our immediate focus on

re-establishing Norman Broadbent's position at the forefront of

executive and board search, along with rebuilding the interim

runner book, are both bearing fruit. We have grown our team across

multiple core sectors over the past 9 months, especially

industrial, digital / technology and retail / consumer. Our

Research and Insights team has also continued to expand, and all

new appointments have established themselves quickly, adding to the

evolving culture of the business and its future prospects.

With continued headcount growth, new office openings scheduled

for H2 and a continued focus on higher value search and long-term

recurring interim contractor income, I am confident in the

trajectory the business is now on. There will clearly be some

macro-economic headwinds in the coming months but with a relentless

focus on quality, client satisfaction and culture we believe we can

continue to build the business whilst generating sustainable

profits in the years ahead."

For further information, please contact:

Norman Broadbent plc

Kevin Davidson / Peter Searle / Steve

Smith 020 7484 0000

WH Ireland Limited

Jessica Cave / Darshan Patel 020 7220 1666

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTQVLFBLDLZBBX

(END) Dow Jones Newswires

July 11, 2022 02:00 ET (06:00 GMT)

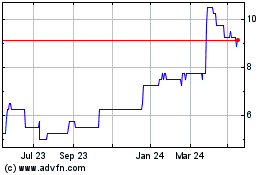

Norman Broadbent (LSE:NBB)

Historical Stock Chart

From Dec 2024 to Jan 2025

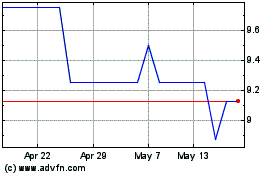

Norman Broadbent (LSE:NBB)

Historical Stock Chart

From Jan 2024 to Jan 2025