NWF Group PLC Trading Update and Acquisition (5453K)

22 December 2022 - 6:00PM

UK Regulatory

TIDMNWF

RNS Number : 5453K

NWF Group PLC

22 December 2022

For release 7.00am Thursday 22 December 2022

NWF Group plc

NWF Group plc: Trading Update and Fuels acquisition

NWF Group plc ('NWF' the 'Company' or the 'Group'), the

specialist distributor of fuel, food and feed across the UK , today

provides a trading update for the six months ended 30 November 2022

(the "Period") and announces the acquisition of Sweetfuels

Limited.

Trading update

The Board is pleased to report that trading in the first half

has been strong. The Group's overall results for the Period were

ahead of the prior year, with all three divisions trading ahead of

the Board's expectations.

Fuels:

Performance in the Period has been delivered by strong margins

offsetting lower year-on-year volumes. Warmer than usual weather

over the Autumn months saw reduced consumption of heating oil, as

well as some deferral of purchases in response to the increased

cost. Oil prices have remained very volatile, with Brent Crude

starting the Period at $114 per barrel and ending at $83 per

barrel.

Food:

Trading has continued to be strong, with good storage capacity

utilisation and continued improvements in operating efficiency.

Demand from customers has been stable and service levels have

remained high.

Feeds:

Performance momentum has remained very encouraging. Whilst

volumes were a little lower than the prior year as a result of good

Autumn grazing conditions, farmers have been focused on optimising

feed rations to benefit from a very positive milk price in the

Period. Commodity prices remained volatile across the first half

and the business has been effective in passing through inflationary

cost increases.

Outlook

The Group has made a strong start to the current financial year,

with the seasonally more material winter months to come. As such

the Board's full year expectations are unchanged at this stage,

save for the anticipated contribution from the Sweetfuels

acquisition, as set out below.

The first half has built on the strong performance in the prior

year and we continue to have confidence in the Group's prospects.

We also continue to target strategic development opportunities

supported by our strong balance sheet and banking facilities.

Acquisition

NWF is pleased to announce the acquisition of Sweetfuels Limited

("Sweetfuels" or the "Acquisition") for a cash consideration of

GBP10.0 million on a debt and cash free basis.

Sweetfuels is a 20 million litre fuel distributor based in

Faringdon, Oxfordshire, supplying fuel to predominantly domestic

customers across the Cotswolds. The Acquisition further expands and

infills NWF's geographic coverage of its Fuels business within the

UK and is aligned to the Group's development strategy of

consolidating the highly fragmented fuels market whilst expanding

its existing geographical footprint. The acquisition is expected to

be immediately earnings enhancing to the Group.

The Group will implement its proven post-acquisition integration

plan, retaining the local brand and customer facing parts of the

business whilst centralising suppport services. In the 12 months to

31 August 2021, Sweetfuels generated EBITDA of GBP1.3 million,

profit before tax of GBP1.2 million and had net assets of GBP2.8

million.

The total consideration is GBP14.3 million which includes GBP4.3

million of adjustments for surplus cash and normalised working

capital. The net consideration is therefore GBP10.0 million which

will be funded from the Group's existing financial resources. The

Group reported net cash of GBP9.0m (excluding IFRS16 lease

liabilities) as at its financial year ended 31 May 2022, together

with substantial bank facilities to fund investment in its

development opportunities.

Richard Whiting, Chief Executive of NWF Group plc,

commented:

"We are delighted with our performance in the first half and to

announce the acquisition of Sweetfuels which adds a 26(th) depot to

our UK footprint in an attractive new geography for NWF. We have a

strong platform for continued growth as we leverage the benefits

from the further expansion of our growing network.

"The industry remains highly fragmented, with many small

operators, which provides us with further opportunities to

consolidate the market and increase our market share. Our pipeline

of acquisition prospects remains healthy and this remains a focus

for our development activity."

Information for investors, including analyst consensus

forecasts, can be found on the Group's website at

www.nwf.co.uk.

Richard Whiting, Chief Reg Hoare / Catherine

Executive Chapman Mike Bell / Ed Allsopp

Chris Belsham, Group Finance

Director

NWF Group plc MHP Peel Hunt LLP

(Nominated Adviser

and broker)

Tel: 01829 260 260 Tel: 020 3128 8339 Tel: 020 7418 8900

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCFESEDFEESESE

(END) Dow Jones Newswires

December 22, 2022 02:00 ET (07:00 GMT)

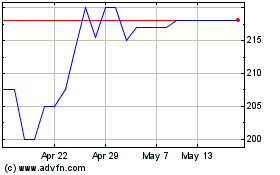

Nwf (LSE:NWF)

Historical Stock Chart

From Jun 2024 to Jul 2024

Nwf (LSE:NWF)

Historical Stock Chart

From Jul 2023 to Jul 2024