Petaling Tin Berhd - Interim Results

24 July 1998 - 9:40PM

UK Regulatory

RNS No 7662q

PETALING TIN BERHAD

24th July 1998

Half yearly report on consolidated results for the six months ended 30/04/98.

The figures have hot been audited.

GROUP COMPANY

30-Apr-98 30-Apr97 30-Apr-98 30-Apr-97

MINING RESULTS

Output of tin concentrates (tonnes) - 19 (100%) - 19

Sale of tin concentrates (tonnes) - - - -

Average price per tonne of tin

metal (RM) - 10,450 (100%) - 10,450

Average net price received

per tonne of tin concentrates(RM) - - - -

RM'000 RM'000 CHANGE RM'000 RM'000

1(a) TURNOVER 384 - - - -

(b) Investment and other

income excluding Extraordinary Items 226 279 (19%) 141 224

2(a) Consolidated Operating Loss before

Income Tax, Minority Interest and

Extraordinary items and

after interest on (11,513) (3,943) (192%) (12,084) (3,864)

Borrowings, Depreciation and Amortisation

(see note (i) and (ii) below)

(b) Income derived from Associated Company - - - - -

(c) Less Income Tax

(d) (i) Consolidated Operating Loss

before deducting (11,513) (3,943) (192%) (12,084) (3,864)

Minority Interests

(ii) Less Minority Interests - - - - -

(e) CONSOLIDATED OPERATING LOSS

ATTRIBUTABLE TO MEMBERS OF THE COMPANY (11.513) (3,943) (192%) (12,084) (3,864)

(f) (i) Extraordinary Items - - - -

(ii) Less Minority Interests - - - -

(iii) Extraordinary Items attributable

to Members Of the Company - - - -

(g) Consolidated Operating Loss

& Extraordinary

Items attributable to Members

of the Company (11,513) (3,943) (192%) (12,084) (3,864)

Note (i) Interest on Borrowings, including

interest on Bank Overdrafts,

Charged as an expense 465 - 34 -

(ii) Depreciation including

Amortisation 940 989 40 986

3 The Group has ceased its tin mining operation and hence, no sales of tin ore

were made. However, PTB Clay Products Sdn Bhd, a wholly-owned subsidiary,

commenced operations of its bricks manufacturing plant on 28 February 1998.

The substantial increase in losses compared to the corresponding period in the

previous year are due mainly to:

i) provisions for amount owing from an associate company:

ii) write off of stocks and pre-stripping expenditure incurred on mining in view

of the cessation of tin mining operations.

4 Loss in sen per share based on 2(e)

after deducting there from provisions

for preference dividends, if any. 57 20 60 19

5 There was no deferred tax and adjustments for under or over provisions in

respect of prior years

6 There was no pre -acquisition profits.

7 There was no sale of investments and properties.

8 There was no rights or any issues of stock since the previous dividend was

paid.

9 Following requests and indications from the relevant land and district office

and lessor of the mining land for the surrender of mining leases held, the

Company has made preparations during the period concerned to cease its tin

mining operations and related activities. While the surrender of the said

leases is still pending, the Company is pursuing negotiations with the

relevant parties for compensation.

10 No decision regarding dividend has been made.

END

IR SEDFSLUAUFEW

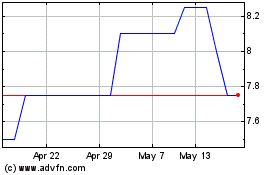

Petards (LSE:PEG)

Historical Stock Chart

From Jun 2024 to Jul 2024

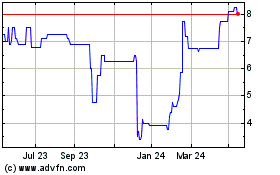

Petards (LSE:PEG)

Historical Stock Chart

From Jul 2023 to Jul 2024