Stronger ties with Japanese

07 April 2004 - 6:53PM

UK Regulatory

RNS Number:4435X

Rio Tinto PLC

07 April 2004

Rio Tinto strengthens links with Japanese partners

Building on its strong relationship developed since becoming manager of the Robe

River Joint Venture (Robe) in 2000, Rio Tinto has reached agreement with its

Japanese partners on a number of iron ore and coking coal initiatives.

The initiatives include a contract to supply about 150 million tonnes of iron

ore to Nippon Steel over 20 years or more, an expansion study for the Hail Creek

coking coal mine, the transfer of a 47 per cent interest in the Beasley River

iron ore deposit, and various technical exchange programmes.

Chris Renwick, chief executive Rio Tinto Iron Ore, said, "Japan is a fundamental

market for Rio Tinto, and we are very pleased to enjoy such positive

relationships with our partners in that country. As well as adding significant

value through the physical synergies between the Hamersley Iron and Robe River

assets, we are deepening our relationship with our Japanese partners, especially

Nippon Steel, through broader business cooperation.

"This stronger relationship will underpin several new developments, including

the expansion of the Yandicoogina iron ore mine in Western Australia and a

proposed expansion of the Hail Creek coking coal mine in Queensland."

In early January 2004, Rio Tinto announced closer cooperation in the management

of Hamersley's and Robe's assets in the Pilbara region of Western Australia.

The new developments outlined below further strengthen Rio Tinto's relationship

with the Robe partners, to the benefit of all parties.

Long term contract for Yandi iron ore

Hamersley and Nippon Steel have reached agreement in principle for the supply of

some 150 million tonnes of Yandi iron ore under a long term contract of at least

20 years. Nippon Steel's annual uptake will be around seven million tonnes per

annum. Ore will be supplied at the annual reference price. The agreement is

expected to be signed later this year.

Hamersley is currently expanding the capacity of the Yandicoogina mine by 12

million tonnes to 36 million tonnes per annum at a cost of US$200 million.

Nippon Steel will purchase approximately 20 per cent of the output from the

expanded mine.

Hamersley has the flexibility to supply Yandi ore to Nippon Steel through the

Dampier port and, since October 2003, through Robe's Cape Lambert port.

Expansion of Hail Creek

In August 2003 Rio Tinto exported the first shipment of coal from the 5.5

million tonnes per annum Hail Creek metallurgical coal operation. The operation

was constructed at a cost of US$255 million and was commissioned in November

2003. As a result of strong response from customers for Hail Creek product in

traditional markets and China, Rio Tinto is studying an expansion of the mine.

The initial study is aimed at increasing capacity to eight million tonnes per

annum, with studies to further expand capacity also being considered. The study

to eight million tonnes per annum is expected to be completed in the next few

months.

Nippon Steel agreed to take an interest in the Hail Creek venture in 1999, but

did not participate in the initial development of the project. Nippon Steel has

now decided to take an interest, a move welcomed by the other Hail Creek joint

venture participants.

Under formal agreements now being finalised, Nippon Steel will take an eight per

cent interest in the total joint venture, with the other participants (Marubeni

Coal and Sumisho Coal Development) potentially increasing their combined share

by two per cent. Following completion of these transactions, Rio Tinto will

have an 82 per cent interest in Hail Creek.

Rio Tinto and Nippon Steel have signed a 15 year contract to supply up to 30

million tonnes of Hail Creek product, at a price to be agreed between the two

parties on an annual basis. This contract will significantly underpin the

expansion of the mine.

The expansion of Hail Creek and the change to the joint venture interests will

be subject to any necessary Government approvals.

Beasley River

Hamersley has agreed in principle to transfer a 47 per cent interest in the

Beasley River iron oredeposit to the Japanese participants in Robe for future

development. Beasley River, located near Tom Price in Western Australia, is an

inferred resource of approximately 400 million tonnes of pisolitic ore.

The geographical and geological characteristics of the Beasley River deposit

complement and enhance the pisolite resources available to the Robe participants

at Pannawonica and elsewhere in the Robe valley.

This preliminary agreement will be developed into a formal agreement, which is

expected to be signed later this year, and will be subject to any necessary

Government approvals.

Technical exchange

Rio Tinto Shipping and Nippon Steel are cooperating on a range of logistics

initiatives for delivery of iron ore andcoal. A joint team is investigating

options to improve vessel and port utilisation, aimed at reducing total supply

chain costs for both parties.

Rio Tinto and Nippon Steel have also agreed to increase cooperation to improve

utilisation of raw materials in the context of steel industry requirements.

Note to Editors:

Hamersley Iron is a wholly owned subsidiary of Rio Tinto and is one of the

world's leading producers of iron ore. Hamersley owns and operates six mines in

the Pilbara region of Western Australia.

Robe River is an unincorporated joint venture and is owned by Rio Tinto (53 per

cent), Mitsui Iron Ore Development (33 per cent), Nippon Steel Australia (10.5

per cent) and Sumitomo Metal Australia (3.5 per cent). Rio Tinto acquired its

share in the Robe River Joint Venture as part of the North acquisition in 2000.

Robe River operates two iron ore mines, which are also located in the Pilbara

region.

Hail Creek is a joint venture and is owned by Rio Tinto Coal Australia (92 per

cent), Marubeni Coal (5.33 per cent) and Sumisho Coal Development (2.67 per

cent). Hail Creek is an open cut coking coal mine located in Queensland and is

managed by Rio Tinto Coal Australia (formerly Pacific Coal) onbehalf of the

joint venture participants.

For further information, please contact:

LONDON AUSTRALIA

Media Relations Media Relations

Lisa Cullimore Ian Head

Office: +44 (0) 20 7753 2305 Office: +61 (0) 3 9283 3620

Mobile: +44 (0) 7730 418 385 Mobile: +61 (0) 408 360 101

Investor Relations Investor Relations

Peter Cunningham Dave Skinner

Office: +44 (0) 20 7753 2401 Office: +61 (0) 3 9283 3628

Mobile: +44 (0) 7711 596 570 Mobile: +61 (0) 408 335 309

Richard Brimelow Susie Creswell

Office: +44 (0) 20 7753 2326 Office: +61 (0) 3 9283 3639

Mobile: +44 (0) 7753 783 825 Mobile: +61 (0) 418 933 792

Website: www.riotinto.com

This information is provided by RNS

The company news service from the London Stock Exchange

END

STRGIGDSDUGGGSR

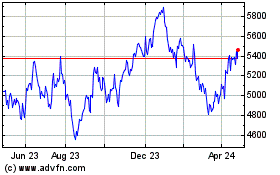

Rio Tinto (LSE:RIO)

Historical Stock Chart

From Oct 2024 to Nov 2024

Rio Tinto (LSE:RIO)

Historical Stock Chart

From Nov 2023 to Nov 2024